So here we are. This is the part of a market cycle when we start having conversations that look a little something like this:

Client: “I’ve been mulling this over, and I think I am comfortable taking on more risk. Maybe I should own more stocks”

Us: “I see. You know, based on our conversations about this previously, we concluded that you had a moderate risk tolerance and we thought a balanced mix of stocks and bonds seemed like the right approach.”

Client: “I know, but I think more stocks makes sense now.”

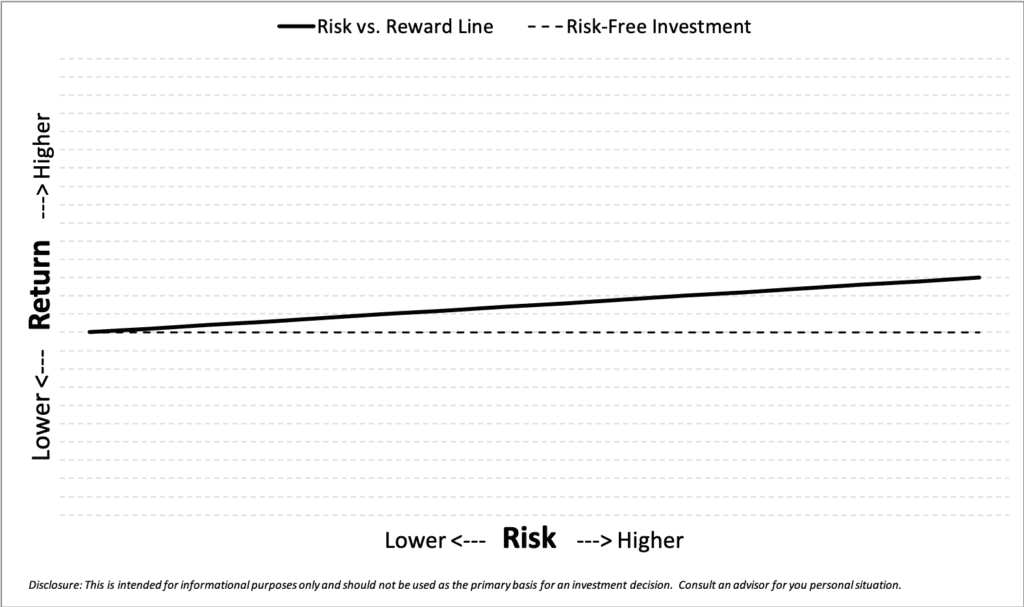

Now, sometimes this is a perfectly rational thing. Some clients can and should take more investment risk to accomplish their goals. But in probably more than half of these conversations people are not telling us they want more risk (it does seem like a weird thing to want more of, doesn’t it?). What they are saying is they want higher returns. We are 9 years into a bull market where US stock have gained nearly 15% per year. For those who own balanced portfolios, it can be difficult to look at that and not be tempted to move safe assets like bonds and cash into the higher returning stocks. However, there is a truism in the investing world, and that is that risk is risky. It can be easy to picture risk as something like this:

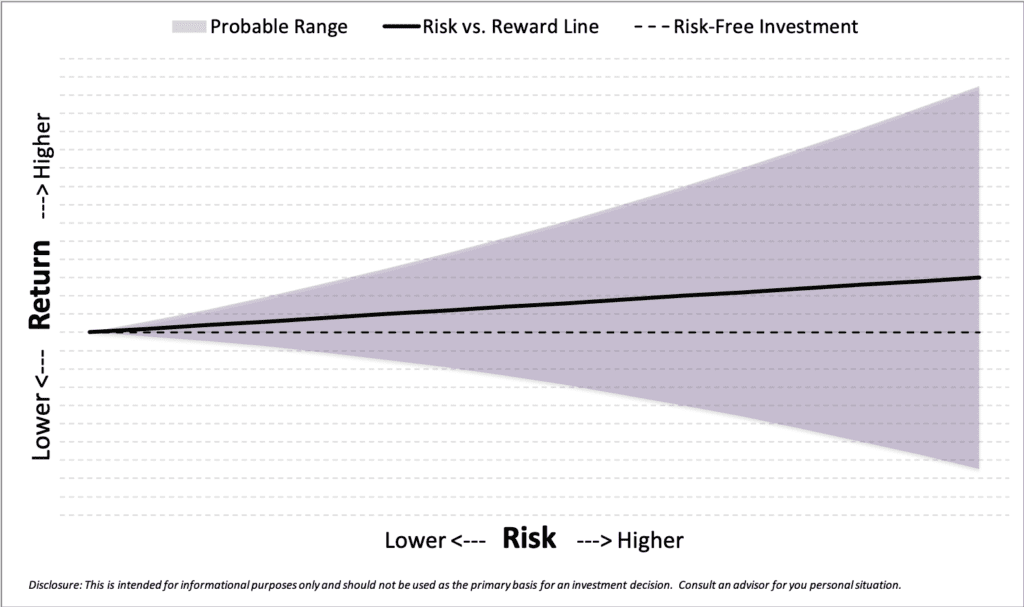

What this line shows is the risk to reward relationship. The further right you move along the line, the more risk that is being taken. The upward slope of the line shows that as risk increases, so does the return. This is how we have come to think about risk. When you hear people say, “If you want to make more money, you have to take more risk,” it is this relationship that they are referring to. However, this does not tell the whole story. The best way I have heard investment risk described comes from Professor Elroy Dimson of London’s University of Cambridge Judge Business School. He said, “Risk means more things can happen than will happen.” This comment does a wonderful job of capturing the inherent uncertainty of investing. So with that in mind, rather than the linear, upwardly sloping line we see in figure 1, we should really view it along with its accompanying uncertainty such as in figure 2.

This shows that while the upwardly sloping black line shows the general risk to reward relationship (you could think of this as the average of risk to reward), the range of outcomes increases as more risk is taken. This range is what individuals should focus on, not the simple line. The failure of many to do this is why I feel the need to remind people that risk is risky.

At the end of the day, risk is something of an arbitrary concept, but it does manifest itself in very real ways. For example, risks in US stocks include the prospect that businesses continue to grow their earnings, the amount investors pay to own the stocks, external factors such as inflation which reduce how valuable the stocks earnings are, as well as many other risks. These risks are not static. Most of these risks are higher the later in a cycle we get. So for those contemplating more risk, be sure to consider the concept shown in figure 2 and consider what that range of outcomes might look like from our current starting point.