OVERVIEW

It was a mixed week for U.S. stocks. While the Nasdaq gained 1.41%, the S&P 500 remained roughly flat with a 0.03% gain, and the Dow fell 2.33%.

Growth stocks rose around 0.9%, whereas value stocks declined 1.44%. Small-cap stocks also fell around 1.35%.

Foreign stocks were in the red, too. Developed country markets dropped 0.94%, and emerging markets declined about 1.5%.

The bond market dipped as the 10-year Treasury’s rate rose to 4.47%. Overall, the bond market dropped about 0.2%.

There was no reprieve in real assets, either. Real estate plummeted 3.6%, and commodities dropped 0.7%. This was mainly due to a 3.42% fall in gold prices and a 2.1% decrease in the price of oil.

The U.S. dollar, however, rose about 0.35%.

KEY CONSIDERATIONS

When Trend Extend – The stock market loves to trend.

By that, I mean that once it picks up momentum in a direction, it likes to continue in that direction regardless of external events.

Sure, the market might wiggle around in the near term, but over a long enough time period, there is a general bias in the trend.

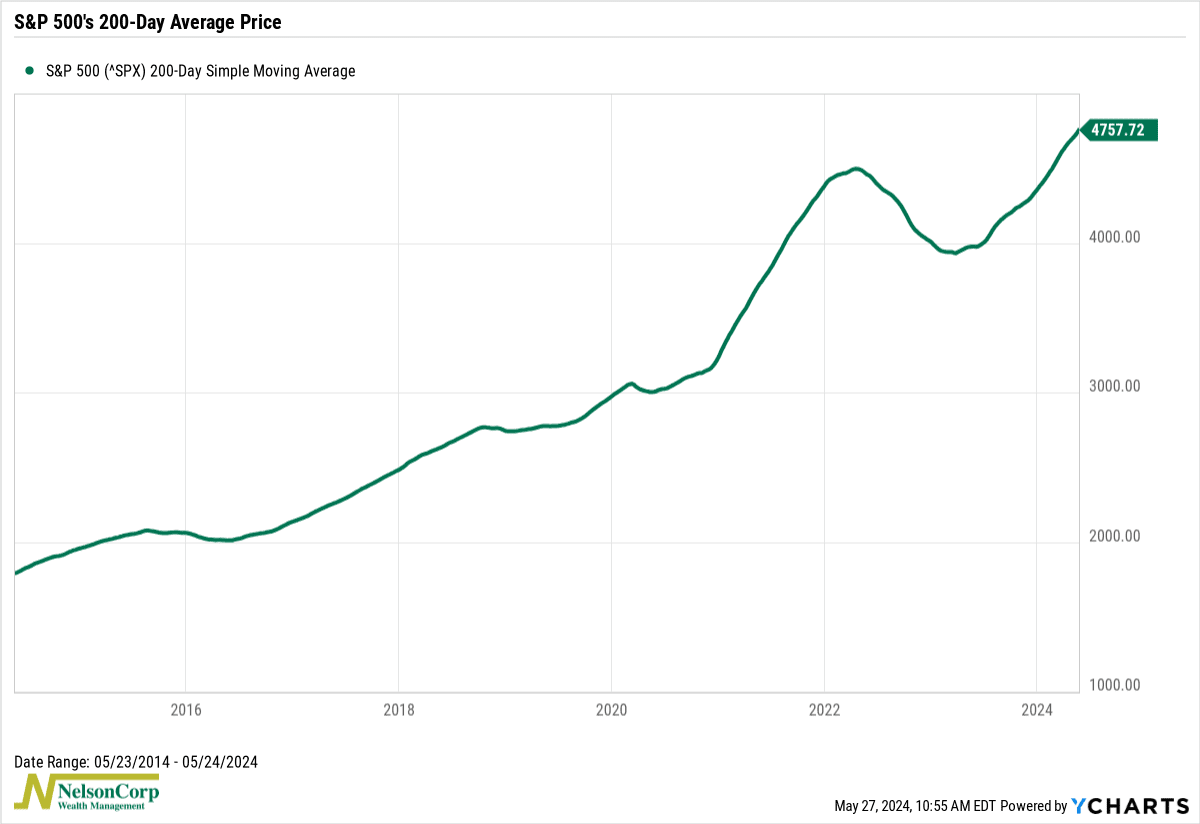

A popular way to measure this trend is to look at the average 200-day price. This equates to about 9 ½ months of trading, so it’s a good proxy for the long-term trend. If you recalculate this average price every day, you get something that looks like this:

When this line is rising, it means the stock market’s average 200-day price is improving. This tends to be very good for stocks.

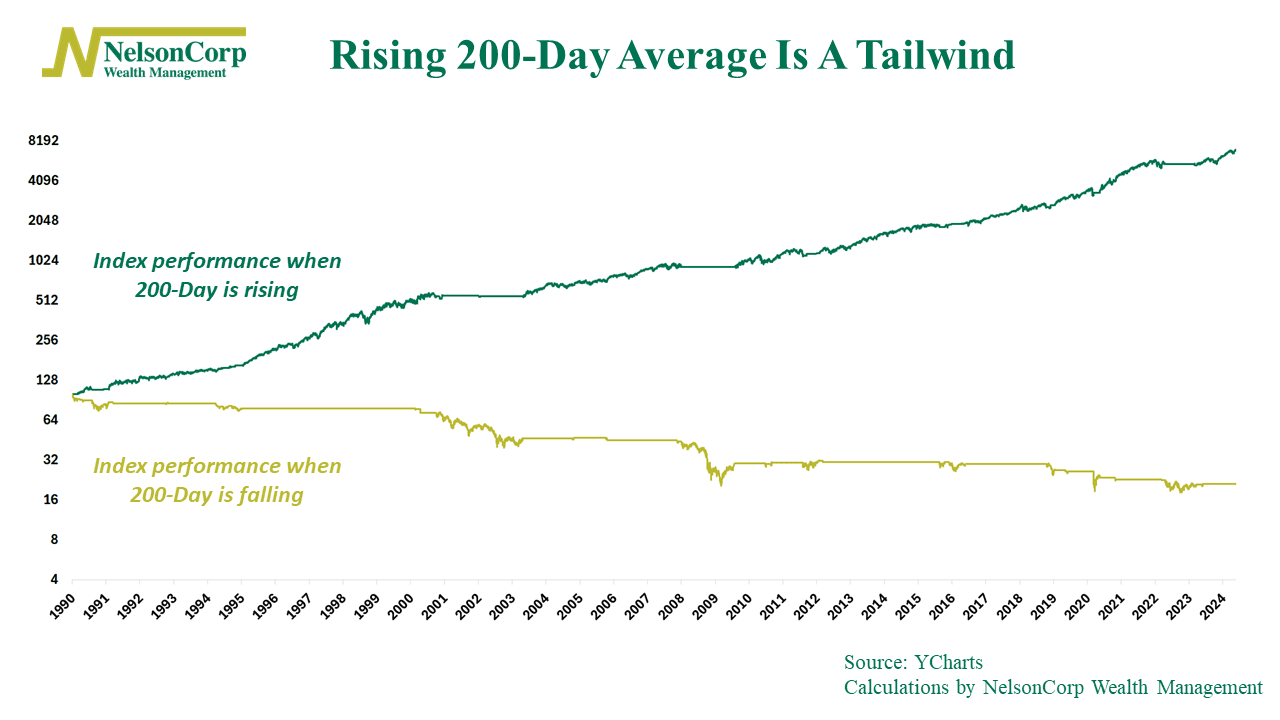

In fact, as the chart below shows, the S&P 500 Index has done significantly better when its 200-day average price has been rising versus when it has been falling.

That’s a pretty striking difference. To put some numbers on it, we find that since 1990, when the S&P 500’s 200-day average price is rising, the index rises at a 13.11% annualized pace. That compares to a -4.42% annualized rate when the 200-day average price is falling.

That’s it. That’s the basic idea in a nutshell. When the long-term trend is improving—the 200-day is rising—you get above-average returns. But when the long-term trend is deteriorating—the 200-day is falling—you get below-average returns (negative returns, in fact).

Of course, external factors can (and do) still affect the market. But at the end of the day, the trend sets the tone.

It’s like a current in a vast ocean, shaping the fate of every ship that sails upon it.

And right now, that current is trending in a favorable direction.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.