It’s weird. Given a relatively strong economy and stock market, you would think consumer confidence would be running hot right now.

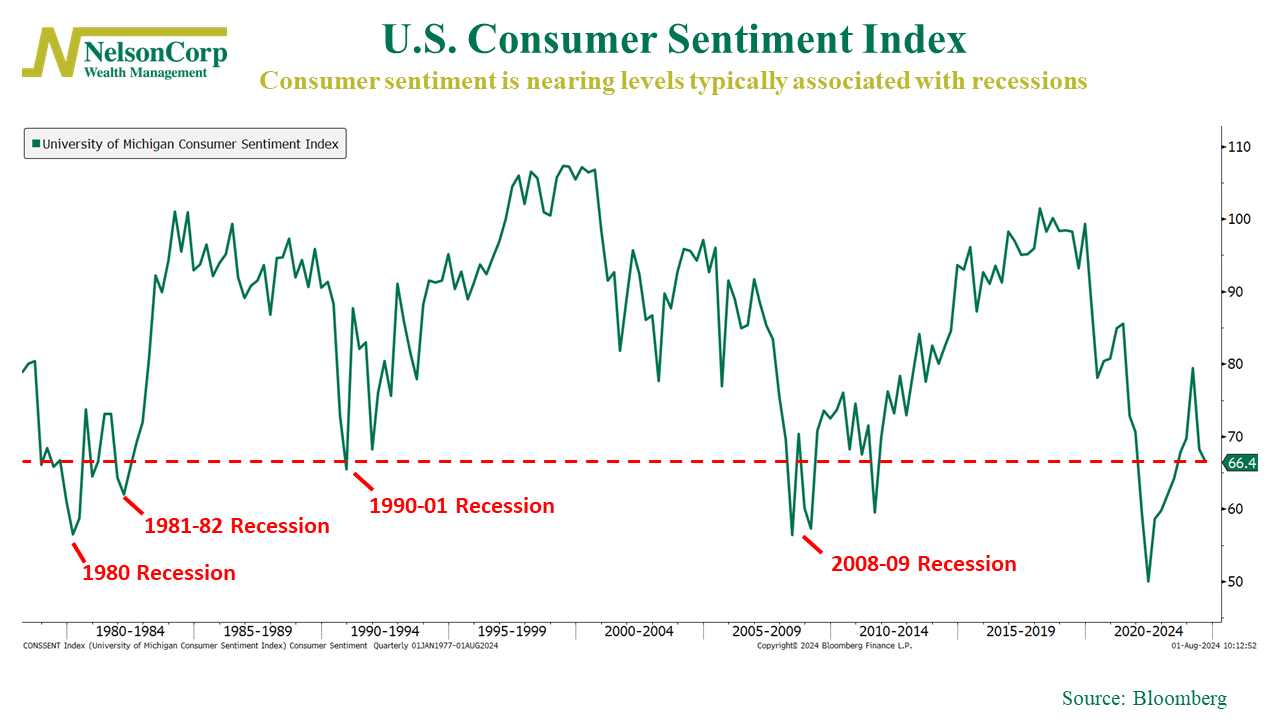

But that’s not the case. As our featured chart above shows, the University of Michigan Consumer Sentiment Index fell to its lowest level of the year last month.

What’s even weirder is that consumer sentiment is hovering around levels we’ve typically seen only during bear markets or recessions.

So, what gives?

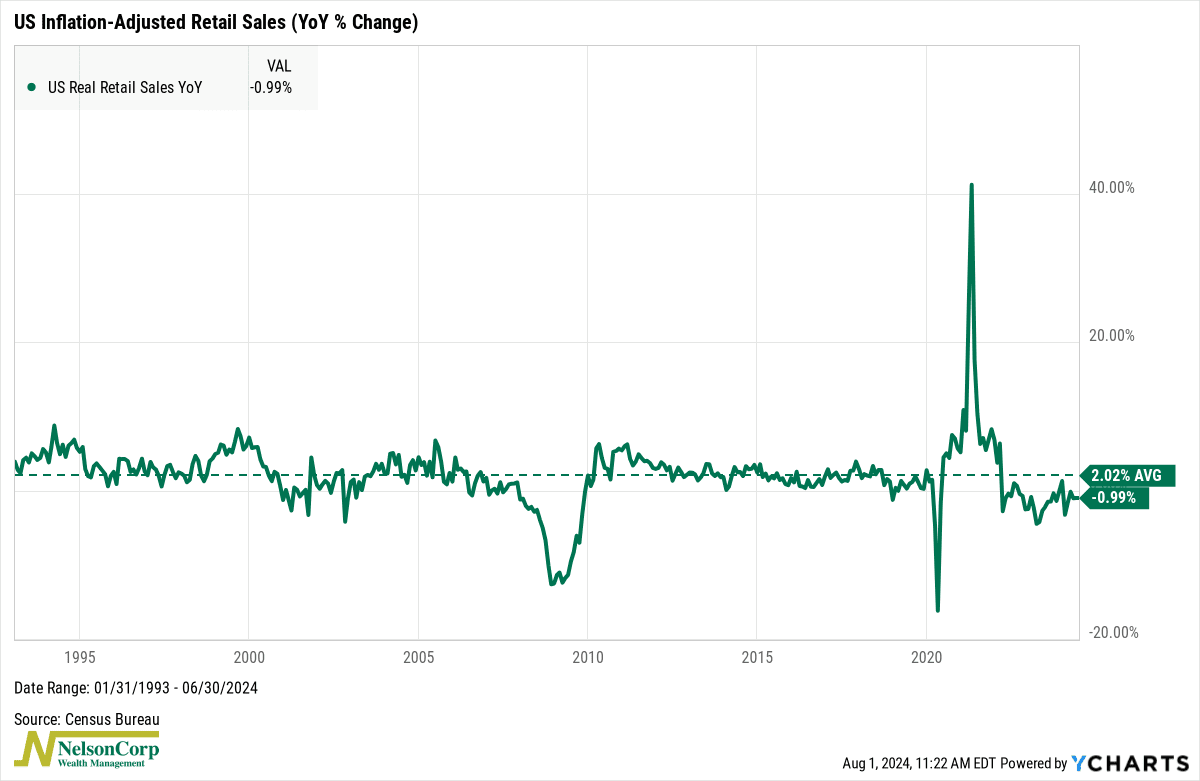

Well, there are a few potential explanations. For one, high prices continue to be a big complaint. Although the rate of inflation has eased, overall price levels remain high. This has certainly impacted real (inflation-adjusted) consumer spending, shown below.

But another explanation is that confidence is typically a result of predictability—and the last four years have been anything but. The Pandemic Crisis, high inflation, aggressive Fed monetary policy, stock market volatility (especially in 2022), and now political uncertainty have all combined to make for a poor “vibe.”

The good news, however, is that history shows that, as long as the U.S. avoids a recession, consumer sentiment eventually recovers.

That could be the case now. It will likely take at least a year or more for sentiment to rise back to the long-run average, but if it does, it will help consumer spending in the years ahead.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.