It was a wild week in financial markets. A lot of crazy stuff happened. While I could point to several noteworthy charts—like the sharp decline in Japanese stocks or the fleeting reversal of the inverted yield curve—one chart stood out above the rest: weekly jobless claims.

In normal times, weekly jobless claims don’t get much attention. But these aren’t normal times. After the worrisome jobs report last Friday, markets were on edge, looking for any hint, however small, that the economy would be ok. Jobless claims delivered.

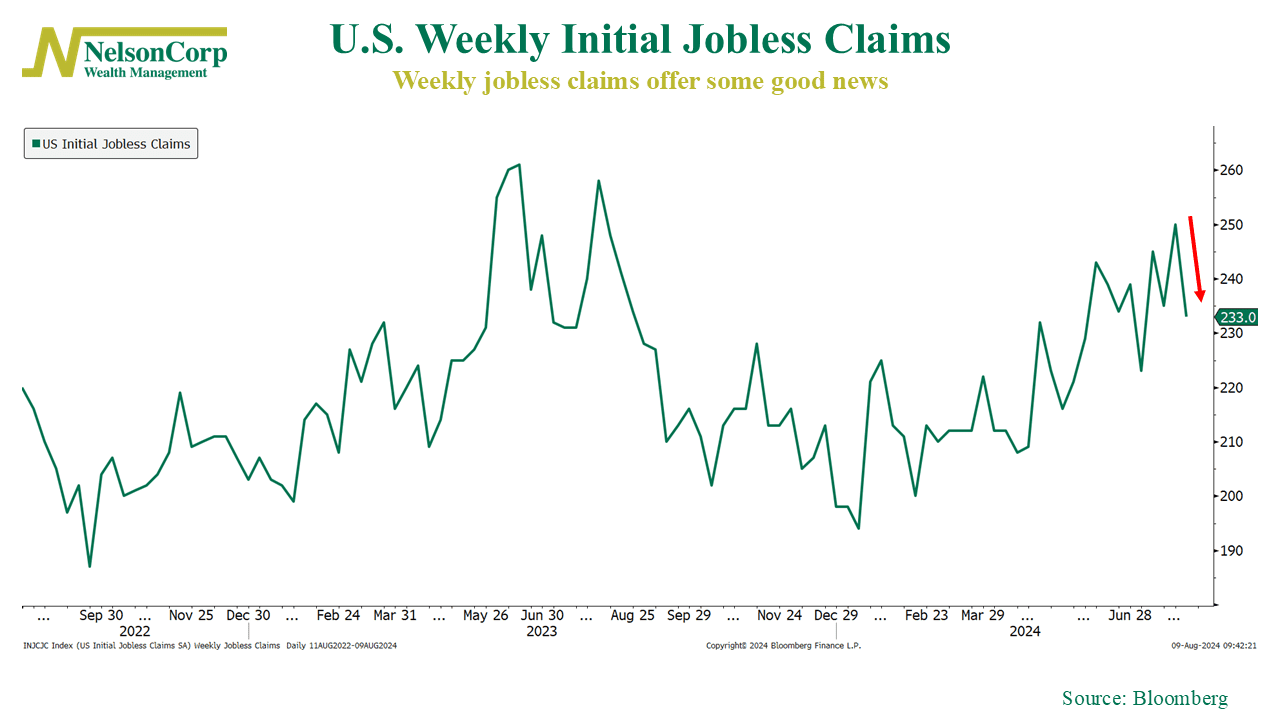

As you can see on the chart above, weekly jobless claims fell to 233,000 last week. This was a nice drop from the 250,000 claims the week before.

Ok, sure, it wasn’t that big of a move. But it was important because it helped soothe markets. After the data, interest rates jumped, and stocks rallied. It also reinforced the other better-than-expected data we got earlier in the week showing that the service sector of the economy was once again back in expansionary mode.

Will all this keep stocks afloat? It’s hard to say. Our risk models suggest markets are likely to stay choppy for the time being. We might not be out of the woods yet. But if the incoming economic data continues to show strength, it could provide some crucial support for the stock market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.