OVERVIEW

U.S. stocks finished in the green last week. The S&P 500 rose 1.45%, the Dow gained 1.27%, and the Nasdaq increased 1.4%. Small caps outperformed, surging over 3%.

Over in foreign markets, developed countries did well, rising 2.72%. Emerging markets grew by a smaller 0.64%. The U.S. dollar weakened around 1.6%.

Overall, the bond market had a good week, with the Bloomberg Agg Index rising around 0.6%. The U.S. 10-year rate settled at around 3.8%.

Commodities also did well overall, rising around 0.8%. While oil dipped 1%, gold increased 0.33%. And finally, real estate capped off a strong week, gaining roughly 3.78%.

KEY CONSIDERATIONS

Strength in Numbers – The stock market had a positive week, with several indicators pointing to a broadening rally and continued strength in the current bull market.

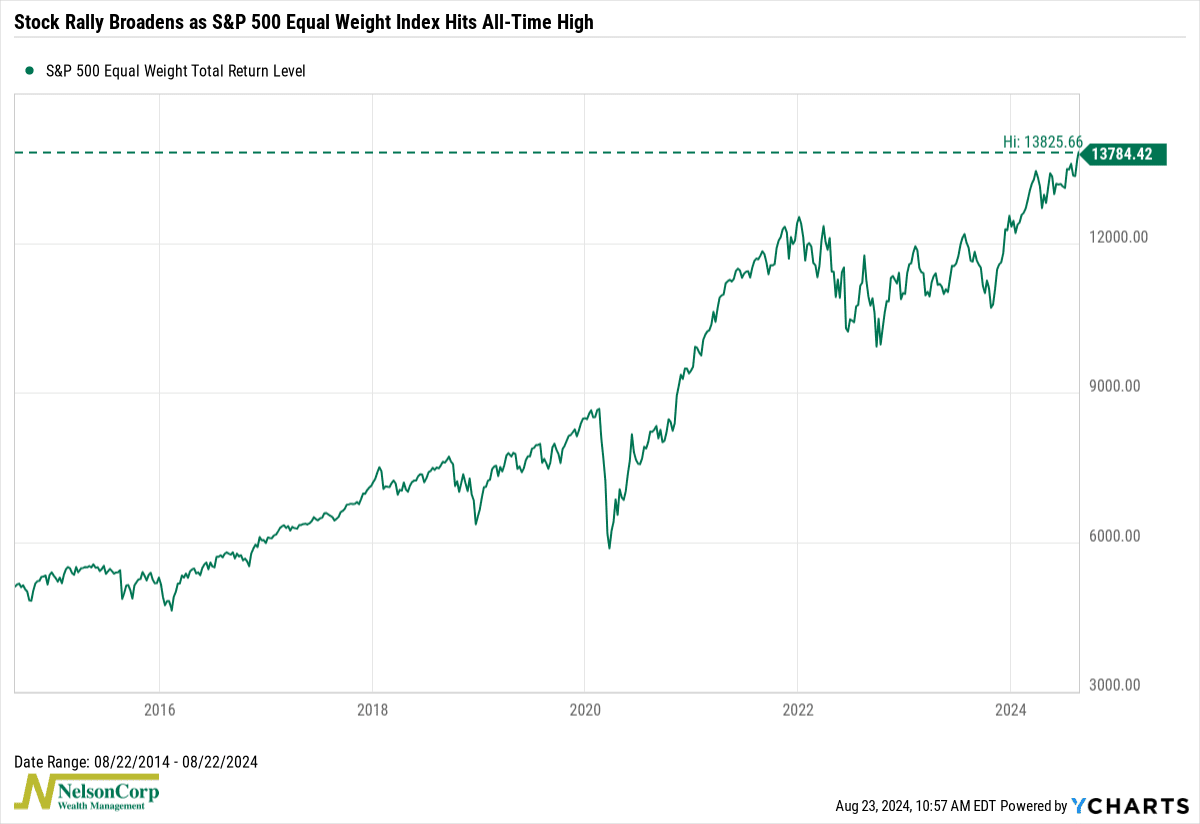

First up, let’s talk about participation. The S&P 500 Equal Weight Index (shown below) recently hit a new all-time high, signaling that more stocks are joining the party.

This is significant because a broad-based rally is more sustainable. When more sectors and stocks are contributing to gains, it reflects a healthier market environment.

Here’s why that matters: in the past, when the S&P 500 Equal Weight Index has hit new highs, it’s often been a precursor to further gains in the broader market. This increased participation is a sign of growing investor confidence across different sectors, which bodes well for the market’s resilience moving forward.

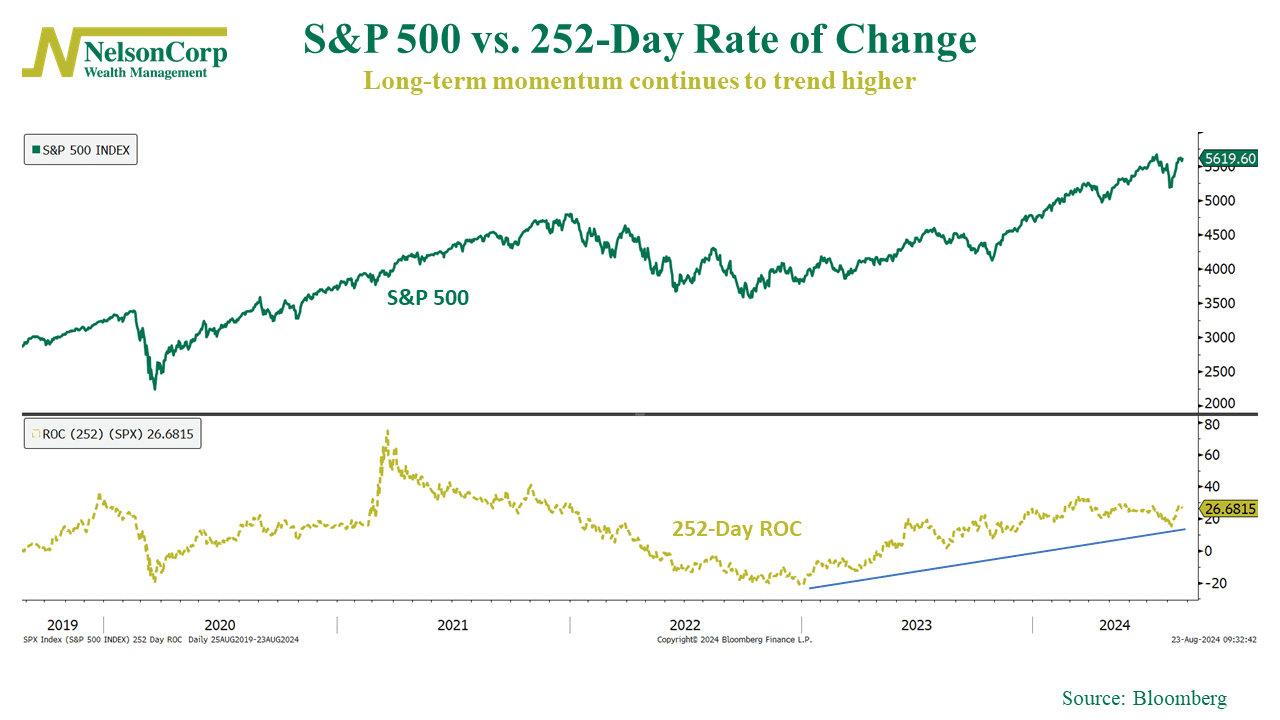

Next up, let’s look at the long-term momentum of the S&P 500. The 252-day rate of change is holding up well, showing that the market’s long-term trend remains intact.

Historically, when this rate of change is strong, it has coincided with prolonged periods of positive market performance. It’s a reminder that despite short-term volatility, the market’s long-term trajectory remains on solid footing.

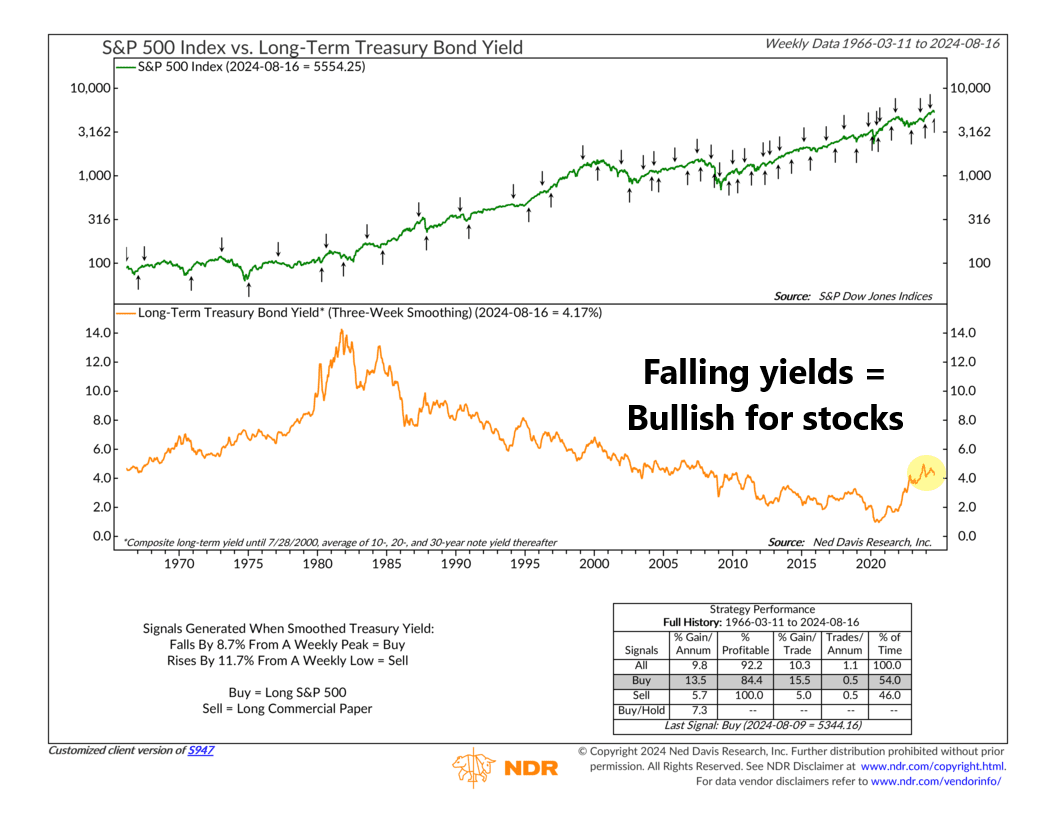

Lastly, we can’t ignore what’s happening in the bond market. Long-term bond yields have been falling recently, and that’s typically a bullish signal for stocks.

Lower yields make equities more attractive by reducing the discount rate applied to future earnings, which can lead to higher valuations. So, chalk that up as another check in the bulls’ favor.

The bottom line? The indicators we’re watching this week paint a positive picture for the stock market. The broadening rally, strong long-term momentum, and favorable bond market conditions all suggest that the bull market has room to run.

Of course, as always, things can change quickly. So, we’ll keep a close eye on the data to see how these trends evolve.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.