OVERVIEW

The major U.S. stock indices managed to finish the holiday-shortened week in positive territory despite some end-of-week turbulence. The S&P 500 climbed 0.67%, the Dow added 0.35%, and the Nasdaq advanced 0.76%, though small caps slipped slightly, down 0.02%.

International markets performed well, with developed markets up 1.76% and emerging markets gaining roughly 1%. The U.S. dollar took a significant hit, dropping about 4% for the week.

In the bond market, rising yields pressured prices as the 10-year Treasury yield spiked to 4.6%. Long-term Treasuries declined about 1.4%, while intermediate-term Treasuries fell 0.35%.

Commodities saw modest gains, up 0.66% overall. Oil rose 1%, and corn increased 1.7%, but gold slipped 0.5%. Meanwhile, real estate ended the week down 0.65%.

KEY CONSIDERATIONS

Grincy Vibes – The stock market has been feeling the heat in recent weeks. While it’s not quite a “Grinch stole Wall Street” scenario, the shift has been enough to grab our attention.

So, what’s behind this latest “risk-off” sentiment among investors?

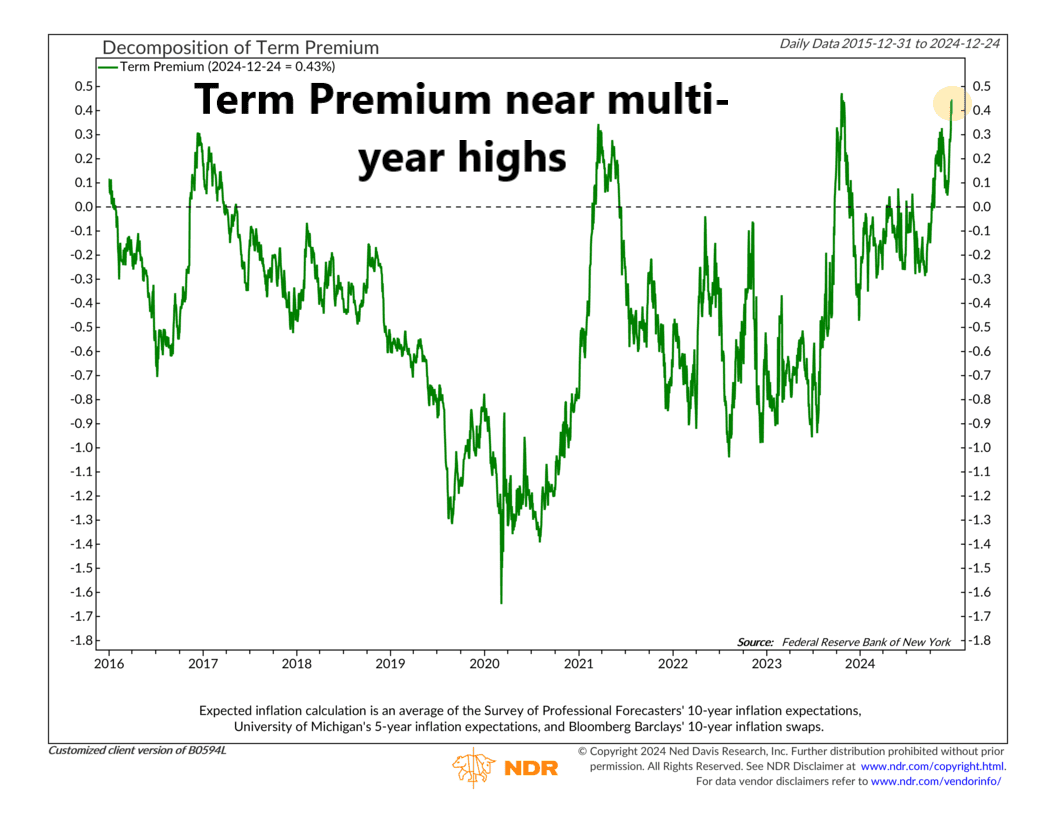

One factor, as our Chart of the Week highlights, is the rising Treasury Term Premium (see below). In simple terms, this means even ultra-safe assets like U.S. government bonds are seeing increased risk aversion. Investors are growing cautious, and that’s never a good sign for confidence.

Why the sudden nerves? Federal Reserve Chair Jerome Powell’s recent press conference might hold the answer. He described the most recent rate cut as a “closer call” than previous decisions and didn’t rule out a potential rate hike next year. That remark sent ripples through the markets.

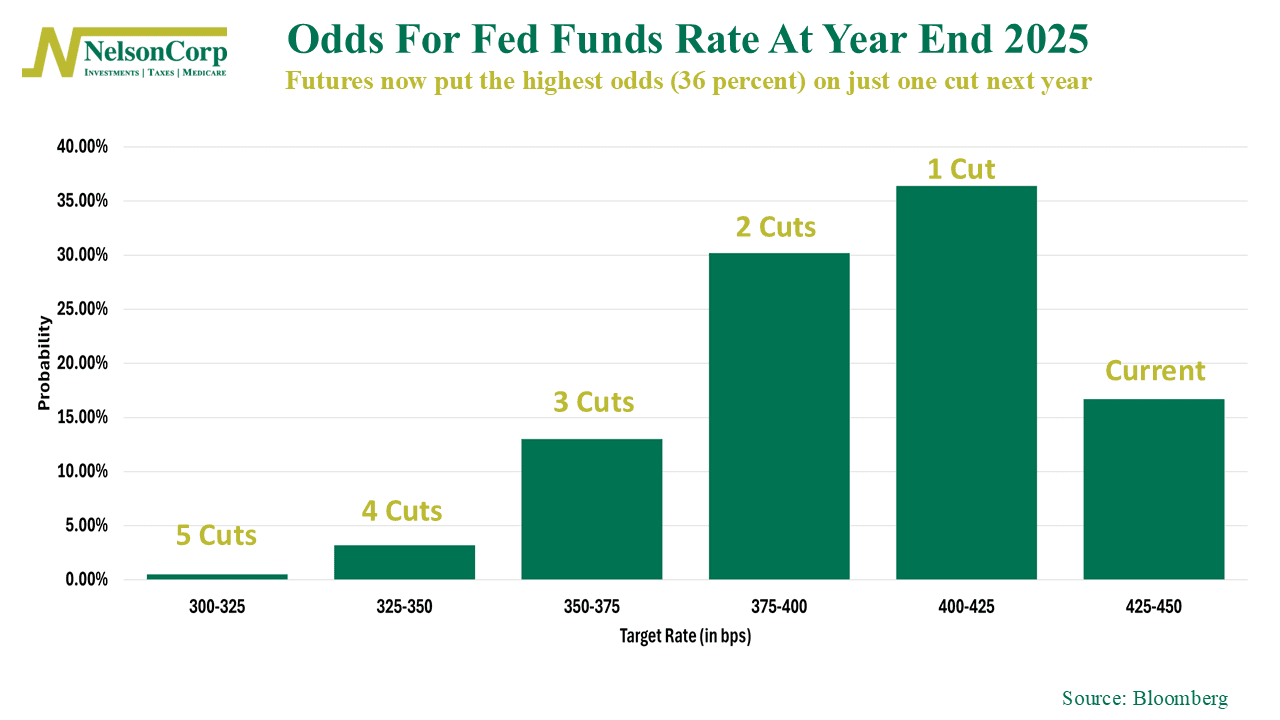

As the chart below shows, Fed Funds futures quickly recalibrated. The market now sees just one rate cut happening next year. Even the odds of no cut rose from 9% to 17%. However, it’s worth noting that the chances of a rate hike—instead of a cut—are still a flat zero.

The key takeaway? Fed Funds futures suggest there’s a solid 72% chance we’ll get one rate cut in the first half of 2025, but that might be all we see for the year. Investors remain cautious about penciling in further cuts for the latter half of the year, thanks to lingering uncertainties over inflation and the economic policies of the incoming administration. This aligns with Powell’s comments and gives us a clear picture of today’s market expectations.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.