The stock market needs money to thrive. OK, maybe that’s an obvious statement. But what I mean is that the economy’s money supply needs to grow at a rate consistent with stock prices. When it doesn’t, returns often suffer.

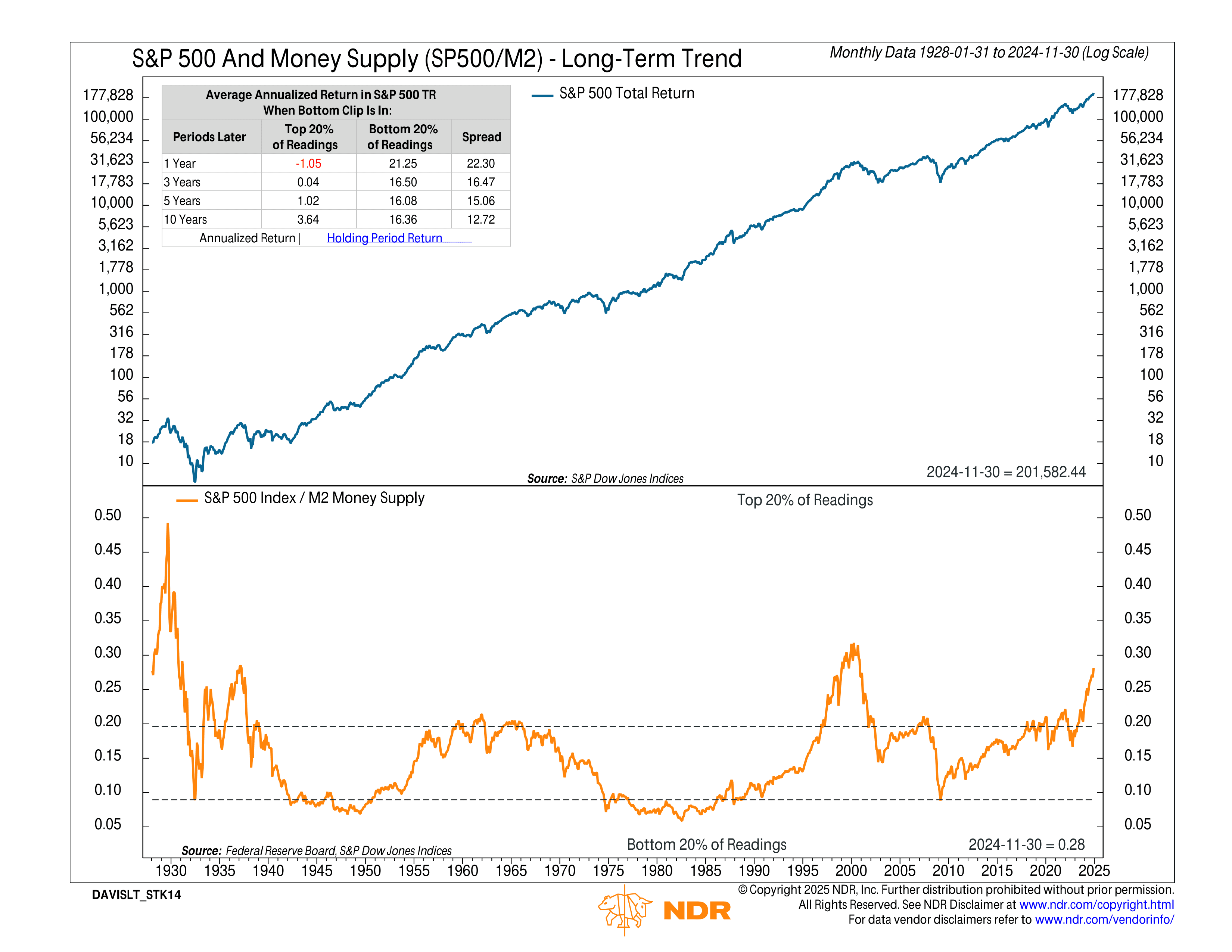

This week’s indicator explains why. At its core, it gives us a unique view of stock market valuations. It uses the M2 money supply as a benchmark and tracks the ratio of the S&P 500 Index to M2 (shown in orange) over nearly a century. A high ratio signals the stock market is “expensive” relative to the money circulating in the economy, while low readings suggest the market is “cheap.”

The historical returns following extremes in this ratio are highlighted in the table on the top left. The “Top 20% of Readings” reflects overvalued conditions, while the “Bottom 20%” represents undervalued ones.

The spread in annualized returns between these groups aligns with what we’d expect. Extremely low readings (suggesting undervaluation) tend to be followed by significantly higher S&P 500 returns versus periods following extremely high readings.

So, where are we now? Well, as of November 2024, the S&P 500/M2 ratio sits at 0.28, well above the historic lows seen in the 1940s and 1980s. While it’s not at extreme highs, it’s worth noting that we’re trending higher, aligning with what some might call a more “pricey” market. Historically, the ratio was only higher in 2000 and 1929/1937.

Does this relatively high ratio spell doom for future returns? Not necessarily. But it is a cautionary signal. It reminds us to temper expectations and perhaps lean toward a more selective or defensive approach in portfolio strategies.

In other words, over the past two years, money supply growth has slowed sharply as central banks tightened policies. That slowdown, paired with a strong stock market rebound, has pushed this ratio higher.

This is important to understand because while valuation measures like this don’t predict short-term moves, they do help provide us with a valuable framework for setting realistic long-term expectations.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.