We’re starting to see fewer and fewer S&P 500 sectors sustain long-term uptrends—and that could spell trouble for the broader stock market.

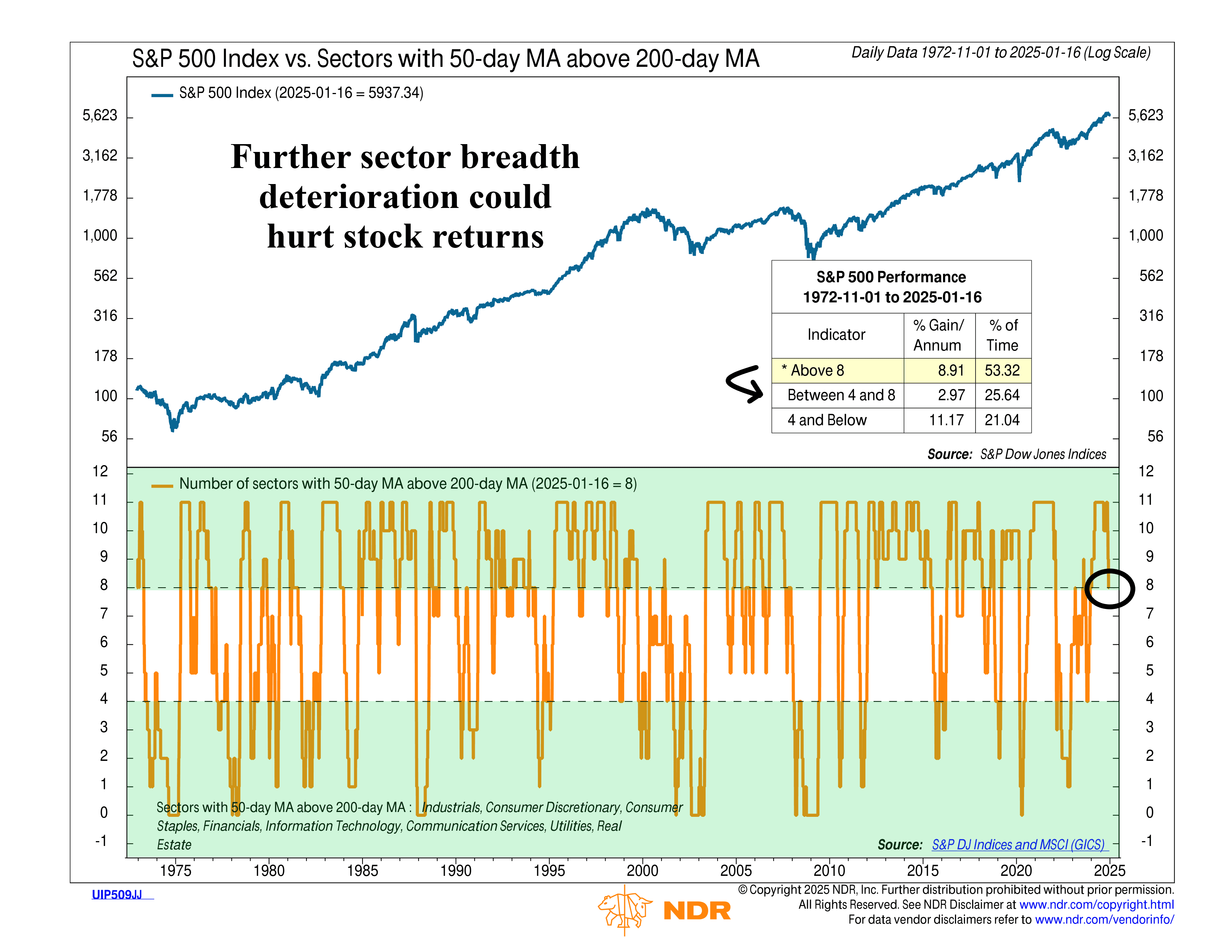

This week’s chart tracks the number of S&P 500 sectors (there are 11 total) with a 50-day moving average above their 200-day moving average. In other words, it measures the number of sectors in technically-defined “uptrends.”

Not long ago, as shown by the orange line, all 11 sectors were in uptrends. We spotlighted this indicator last year when it hit that level, and it was a big reason why the overall stock market did so well. It makes sense. When more sectors are doing well, the overall market tends to do well, too.

This year, however, we’ve seen the number of sectors in uptrends dip to 8—a roughly 30% deterioration. Historically, the S&P 500 performs best when sector strength is either very strong or very weak—essentially “all or nothing.” But when the number of sectors in uptrends falls into the middle range (4 to 8 sectors), the market tends to struggle, barely managing to hold its ground.

The takeaway? We’re not quite in the danger zone yet, but the market is inching closer to it. While stocks could still perform well here, it’s a good time to stay cautious and avoid complacency.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.