OVERVIEW

The U.S. stock market made a strong recovery last week. The S&P 500 climbed 2.91%, the Dow jumped 3.69%, and the Nasdaq rose 2.45%.

Global markets followed suit, with developed markets gaining 2.75% and emerging markets up 2.98%. Meanwhile, the U.S. dollar slipped slightly, declining by 0.13%.

Bonds saw broad price increases as interest rates eased. The 10-year Treasury yield fell to 4.63%, down from 4.77% earlier in the week, driving U.S. bond prices up roughly 1.1%.

Commodities had moderate gains, rising about 0.68%. Gold led the way with a 2.59% increase, followed by a 1.67% rise in corn prices. Real estate also had a standout performance, surging 3.5% for the week.

KEY CONSIDERATIONS

Chinks in the Armor – The stock market enjoyed a nice bump last week, bringing the S&P 500 within 1.5% of its all-time highs.

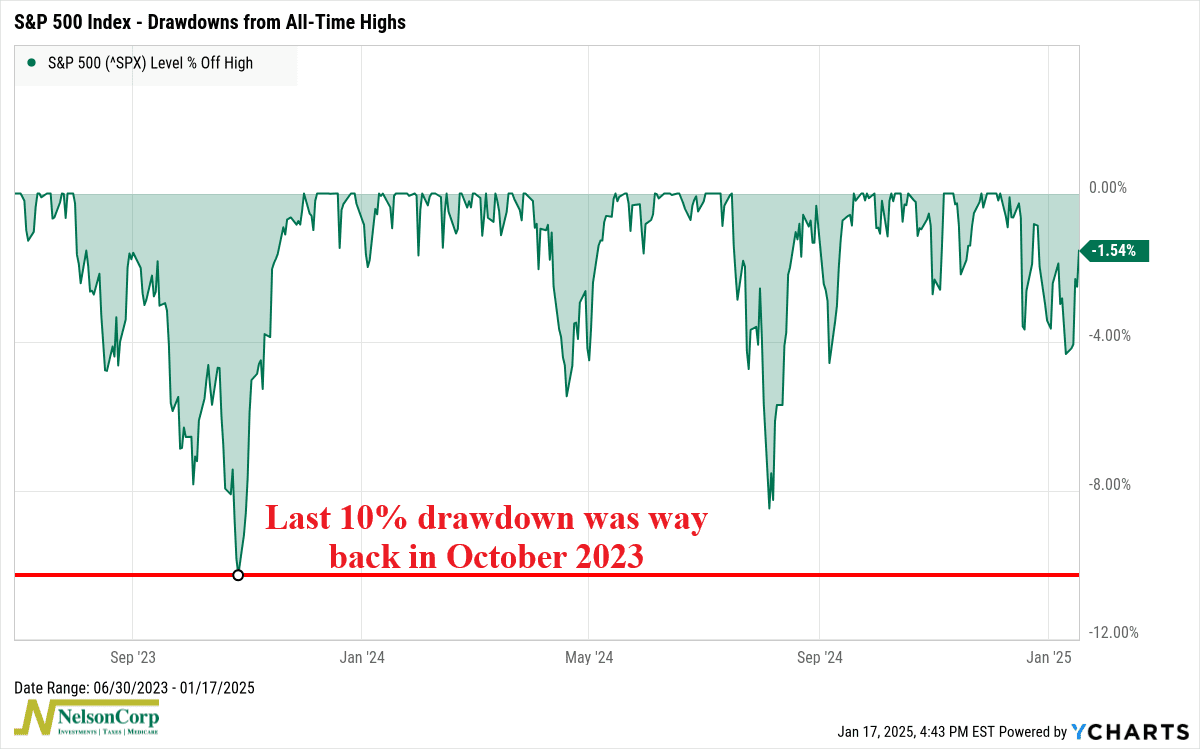

This got me thinking—when was the last time the S&P 500 actually experienced a full-on correction (a decline of 10% or more from its peak)? After checking the drawdown chart below, I found that it’s been well over a year.

That’s right. The last correction happened nearly two Halloweens ago. Talk about a strong bull market!

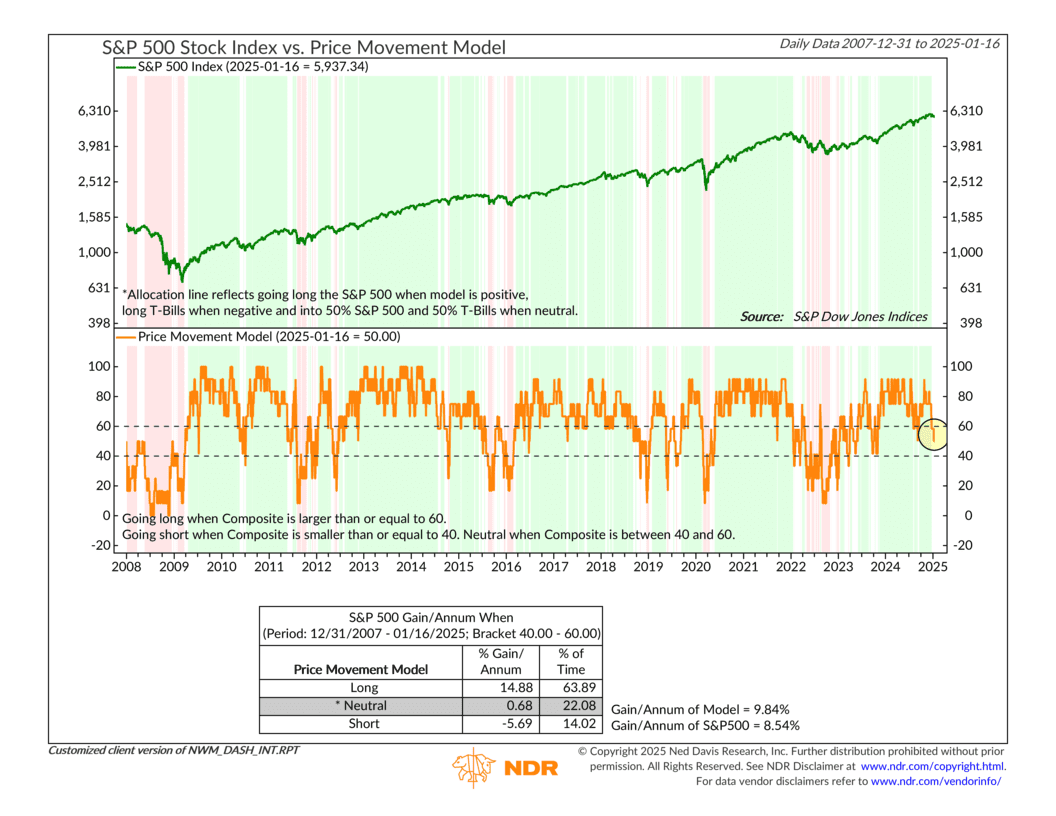

However, cracks are beginning to appear in this otherwise powerful rally. For instance, our Price Movement Model is now showing its weakest readings since October 2023. Aside from a single day last September, the model hasn’t consistently been this low since the fall sell-off of 2023.

In other words, the market’s underlying price action has significantly weakened in recent weeks, putting pressure on both the overall market and our model.

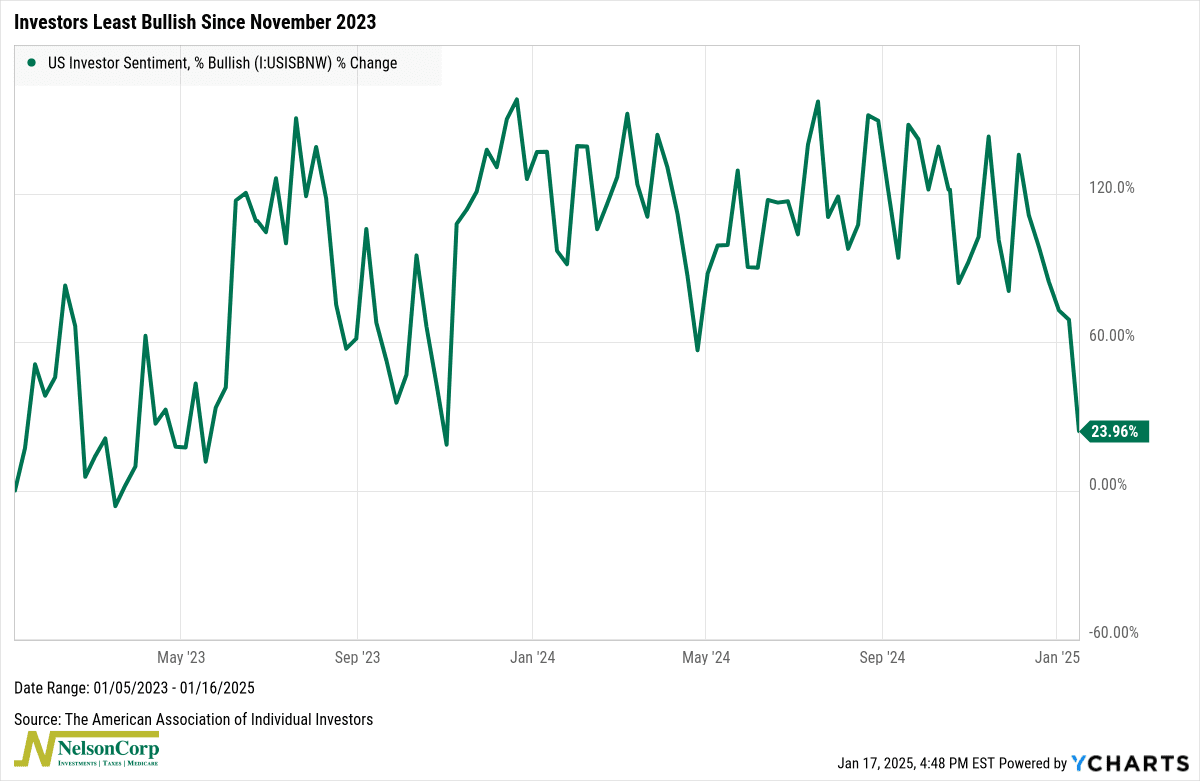

What might help relieve this pressure? Well, a shift in investor sentiment could be key. Last week, the AAII Sentiment Survey showed that only about 25% of participants were bullish on the stock market—the lowest level since, you guessed it, just after October 2023.

This drop in sentiment could set the stage for stronger returns ahead, as washouts like this often pave the way for market recoveries.

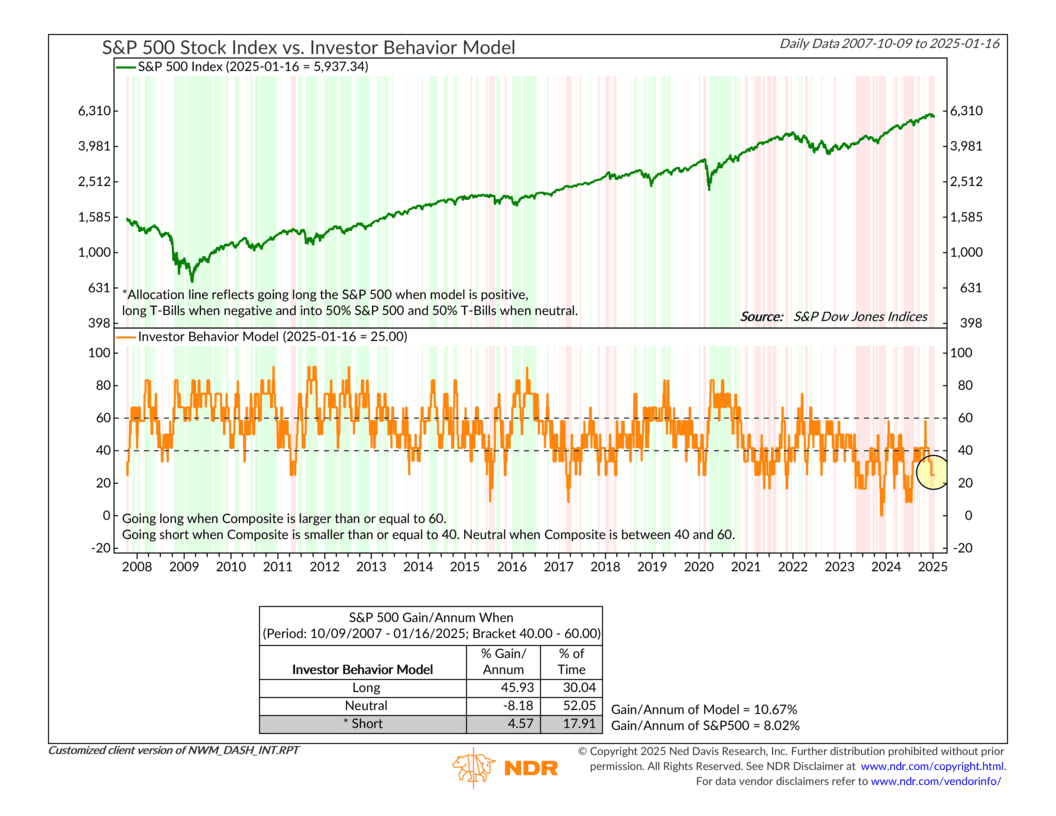

However, for that to happen, we’d need our Investor Behavior Model—which combines things like sentiment, valuations, and volatility—to improve. Right now, as the chart below shows, it’s stuck in negative territory. This suggests that sentiment and valuations aren’t quite supportive enough for a rally, especially without stronger price action as a tailwind.

So, where does that leave us? Well, the market has shown remarkable resilience over the past year, but the underlying weakness in price action and sentiment cannot be ignored. If sentiment improves and our models turn positive, there’s potential for the bull market to regain its strength. Until then, caution is warranted.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.