OVERVIEW

Last week proved to be a strong one for U.S. financial markets. The S&P 500 climbed 1.74%, the Dow advanced 2.15%, and the Nasdaq rose 1.65%, while small caps saw a modest gain of 0.92%.

International markets also performed well, with developed markets jumping 3.16% and emerging markets increasing by 1.86%. Meanwhile, the U.S. dollar softened by approximately 1.75% against major global currencies.

In the bond market, moderate gains were observed as the 10-year Treasury yield settled around 4.63%. Long-term Treasuries edged up slightly by 0.04%, while short-term Treasuries saw a modest increase of 0.08%.

Commodities, however, faced challenges, declining 0.26% overall, driven by a 3.5% drop in oil prices. On a brighter note, real estate posted gains of 1.18% to close out the week.

KEY CONSIDERATIONS

Owner of a Lonely Trend – The stock market has had a nice recovery in recent weeks. But the evidence suggests it’s increasingly marching to its own beat.

A couple of key indicators explain what I mean.

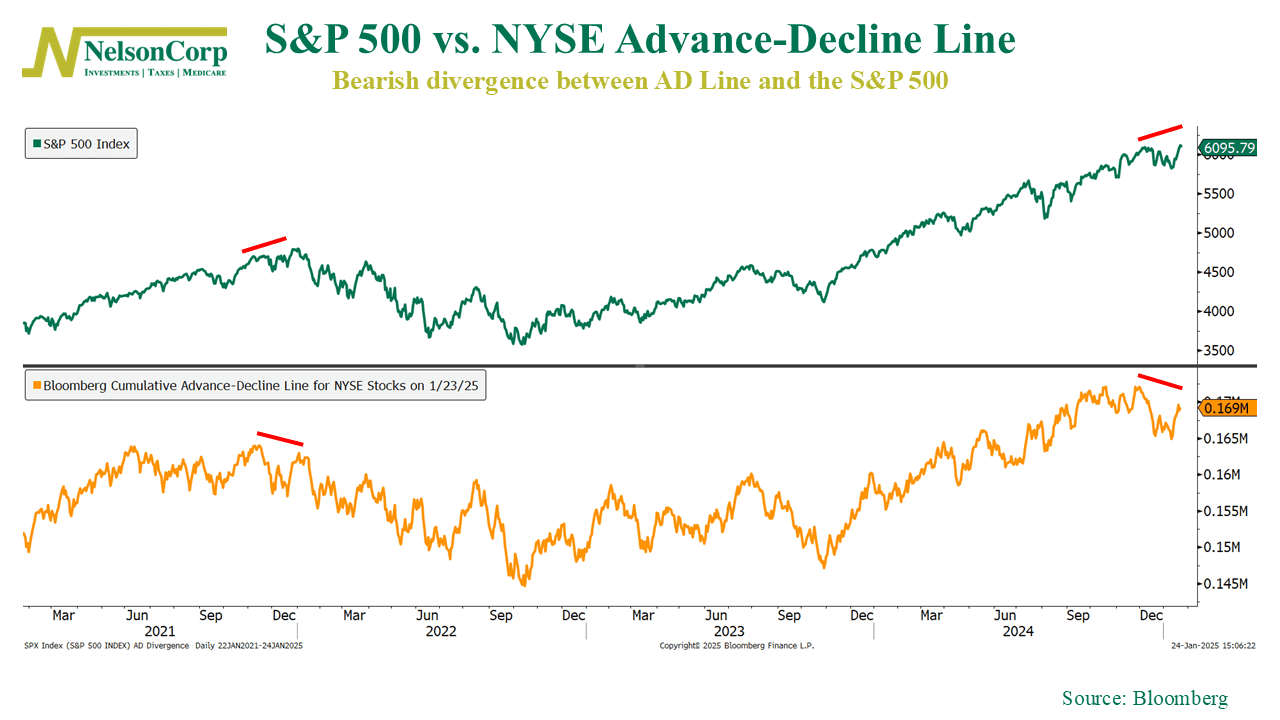

First up the Advance-Decline Line, shown below. This tracks how many stocks are rising versus falling. Normally, when the S&P 500 hits new highs, the AD Line should follow suit, showing that most stocks are pulling their weight. But that’s not happening. While the S&P 500 keeps climbing, the AD Line is turning down.

In other words, fewer stocks are driving the rally, which isn’t a great sign. It’s like a three-legged stool—you can sit on it, but you wouldn’t want to lean too far.

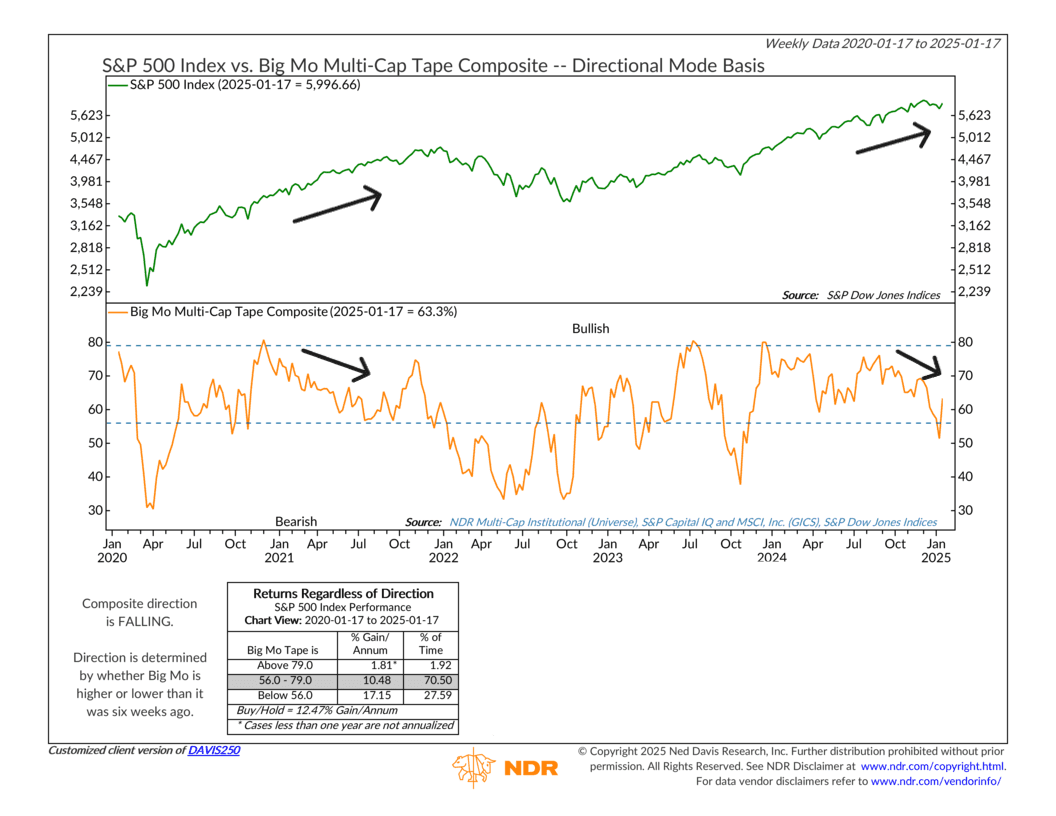

Then there’s Big Mo, a momentum indicator for the broader market. It’s been slipping lately, falling below levels that typically separate bullish from bearish trends.

But here’s the kicker: the S&P 500 hasn’t noticed. It’s still hanging near its highs. We call this a bearish divergence. When momentum fades while prices rise, it usually means the rally’s running on fumes, kind of like what happened back in 2021, before the major selloff in 2022.

So, what does this mean for investors? It’s not time to panic, but it is time to pay attention. Divergences like these are like an early warning light on your dashboard. The engine might not quit right away, but you know something’s off.

The market’s still moving higher, but it’s feeling more like a solo act. To see our underlying indicators improve, we’d need stronger breadth and momentum.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.