You don’t need a government report to know prices are still high—just check your grocery bill. But the latest CPI data confirms what you’re likely feeling: inflation isn’t going away quietly.

The latest data out this week showed that over the past three months, headline prices have been rising at an annualized 4.5%, well above the Fed’s 2% target.

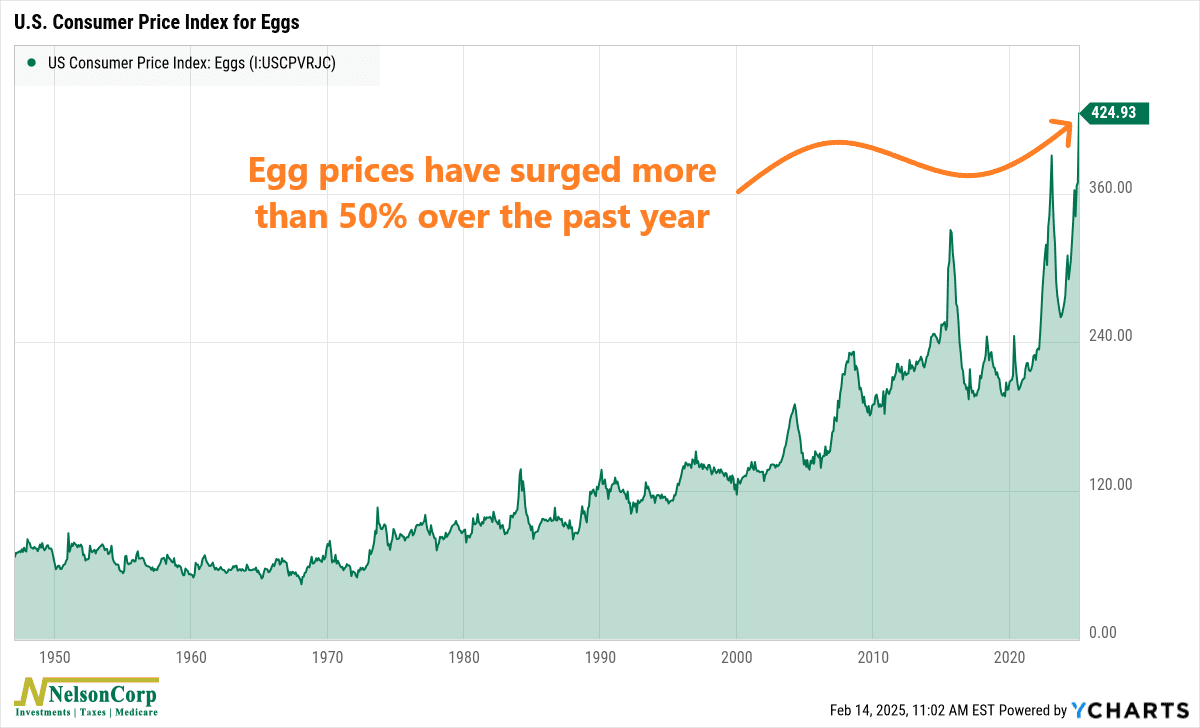

Egg prices, in particular, have taken off. As our featured chart this week shows, a fresh bird flu outbreak has pushed prices up 15.2% in just four weeks—the biggest jump in nearly a decade. Over the past year, egg prices have climbed 53%—yikes!

For the Fed, this makes the inflation fight trickier. While progress has been made, price pressures in certain areas are proving stubborn. That could mean rate cuts take longer than markets expect.

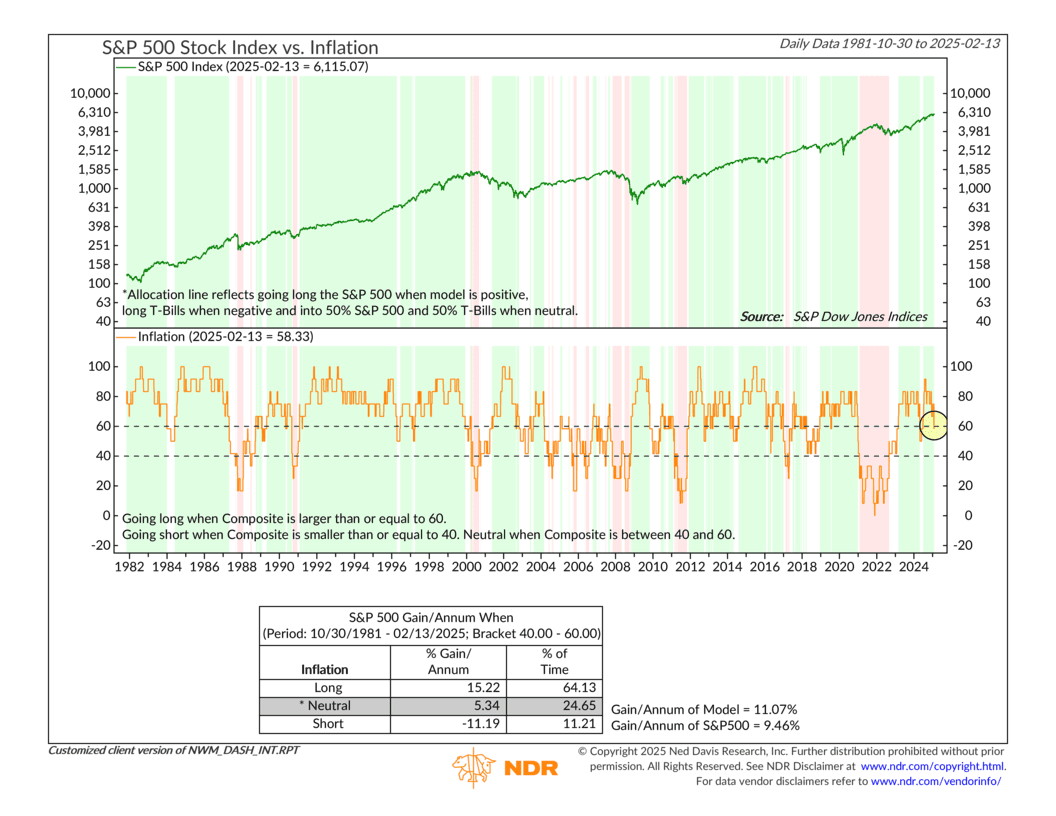

How does this impact stocks? Well, our Inflation Model recently slipped into neutral territory.

Stocks can still do OK here, but if the model falls into negative territory—like it did in 2022—it could be trouble for the overall stock market. This will be something to keep an eye on throughout the remainder of the year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.