Global stocks are having a rough week. After a strong start to the year, markets have stumbled—hard. The selling pressure has been widespread, and it’s hitting many of the biggest names that have been propping things up. It’s starting to feel like a building where the upper floors looked sturdy, but the foundation was quietly starting to crack. Now, those cracks are widening.

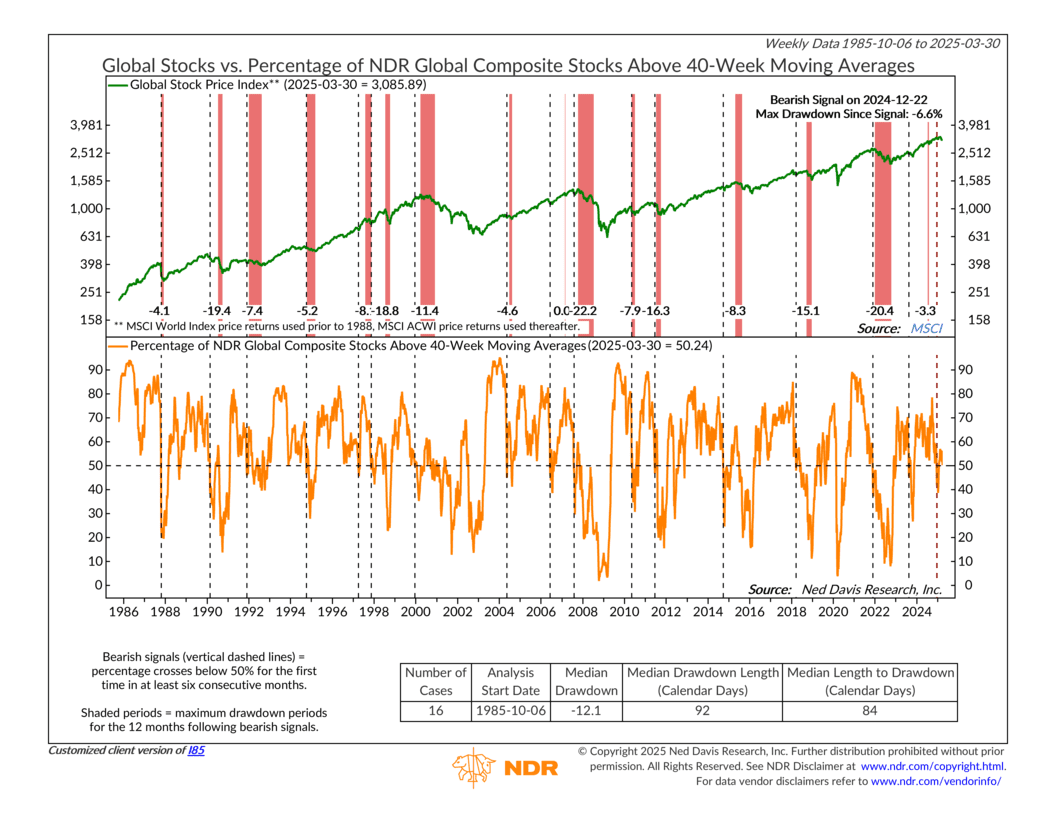

Which brings us to this week’s indicator, which takes a global view of market “breadth,” or how many stocks are participating in the trend. It tracks the percentage of stocks in the NDR Global Composite Index that are trading above their 40-week moving averages. Think of this as a long-term trend line. It helps identify which stocks are still in an uptrend.

Here’s the key point: when this percentage falls below 50% for the first time in six months, it has historically signaled trouble. And that’s exactly what has happened recently.

On December 22, 2024, the indicator triggered a bearish signal—marking the 16th time this setup has occurred since 1985. Past signals have often been followed by weak returns. The median drawdown after these signals has been -12.1%, with the worst of the damage typically hitting within the first three months.

And right on cue, global stocks are starting to crack. The MSCI Global Index is down sharply this week and likely to finish lower after the latest update. The drawdown since the signal already sits at -6.6%, and momentum appears to be heading in the wrong direction.

Is this a prediction? No. But it is a pattern—and it’s worth paying attention to.

When fewer stocks are holding above their long-term trendlines, it usually means the market’s strength is coming from just a handful of names. That kind of narrow leadership can leave the broader market more exposed to downside shocks—whether it’s earnings, economic data, or geopolitics. That certainly feels like what is happening now, given the rout in the so-called “Mag 7” names.

So, the bottom line? Breadth tells us about the health behind the headlines. And this week, that health check is flashing red.

The next few weeks will be important. If market participation doesn’t rebound soon, history suggests the current pullback may still have room to run. Just like any building, the broader market needs a solid base. Right now, that foundation is looking a little too thin.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.