If you thought tariffs were a relic of early American economic policy, think again.

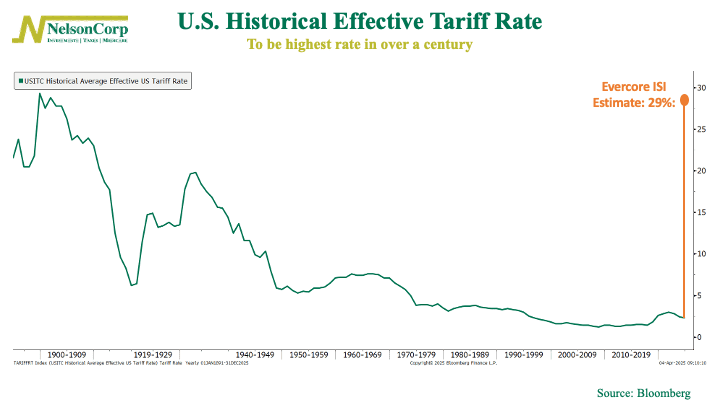

Under President Trump’s proposed “Liberation Day” policy, the U.S. is set to see its effective tariff rate hit 29%, the highest level in over a century. That’s according to an estimate from Evercore ISI, shown in the chart below, which tracks customs duty revenue as a percentage of goods imports.

For context, today’s spike would rival tariff levels from the Smoot-Hawley era and even some of the early 1800s peaks—back when tariffs were a primary source of government revenue.

Markets didn’t take kindly to the prospect of these sweeping reciprocal tariffs, especially when layered on top of a new 10% “baseline” rate. As many market commentators put it, “The tariffs were definitely worse than we had anticipated.”

Fortunately, under our Risk Aware Investment process, we don’t need to chase headlines or overreact to sudden policy shifts. Our models assess the market environment ahead of time and guide us in adjusting risk exposure. They’ve been recommending caution since December and continue to support a defensive stance as policy uncertainty ramps up.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.