The Balance of Risk

OVERVIEW Markets pulled back modestly over the week, with most U.S. equity indexes finishing slightly lower. Large-cap stocks were under mild pressure, as the S&P 500 fell 0.35% and the Dow Jones Industrial Average declined 0.53%. The NASDAQ was essentially...

Financial Focus – January 21st, 2026

Tax season is right around the corner, and there are several changes this year that could catch people off guard. We talk through what’s new, what to watch for, and a few simple steps that could save you time, stress, and money.

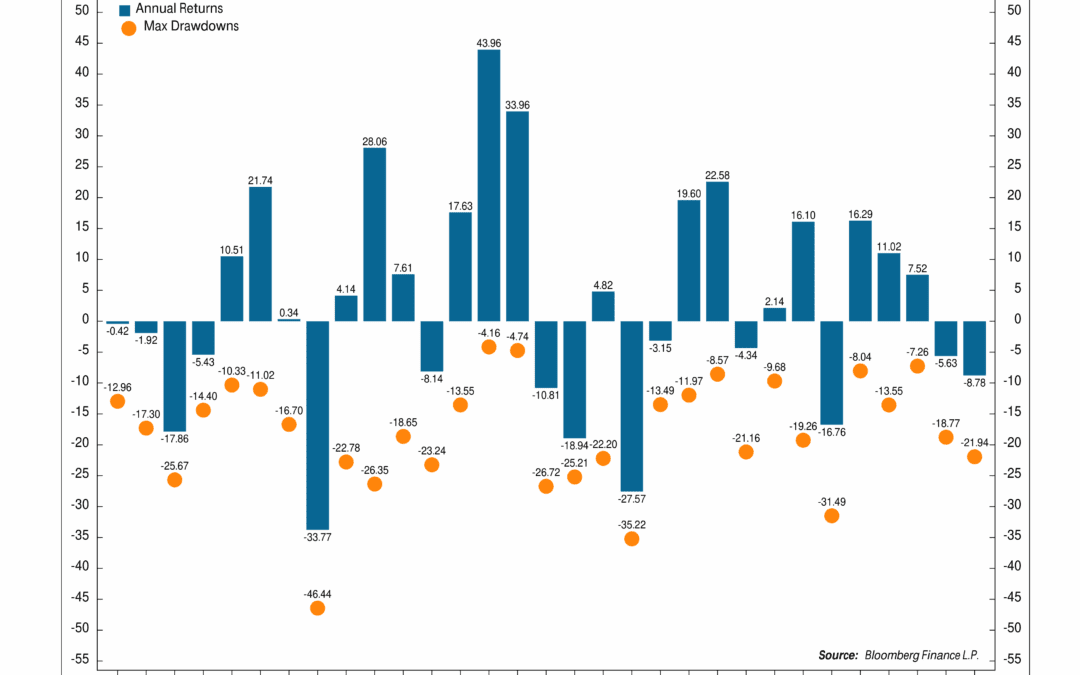

Midterm Mania

This week’s chart looks at how the Dow Jones Industrial Average has typically behaved during midterm election years. There have been 31 midterm elections since 1902. Each blue bar on the chart represents the annual return for that midterm year, while the orange...

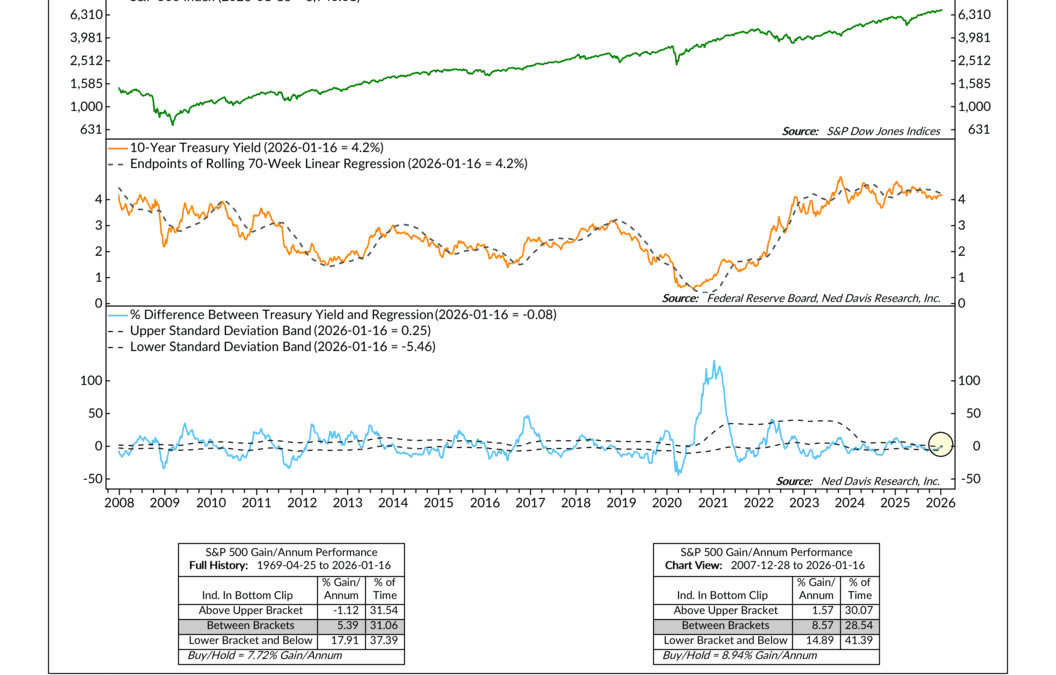

The Discount Rate

Interest rates are important for the stock market. In a technical sense, they’re what we call the “discount rate.” This is the rate at which the future cash flows generated by the companies in the stock market get discounted back to the present. Because of how...

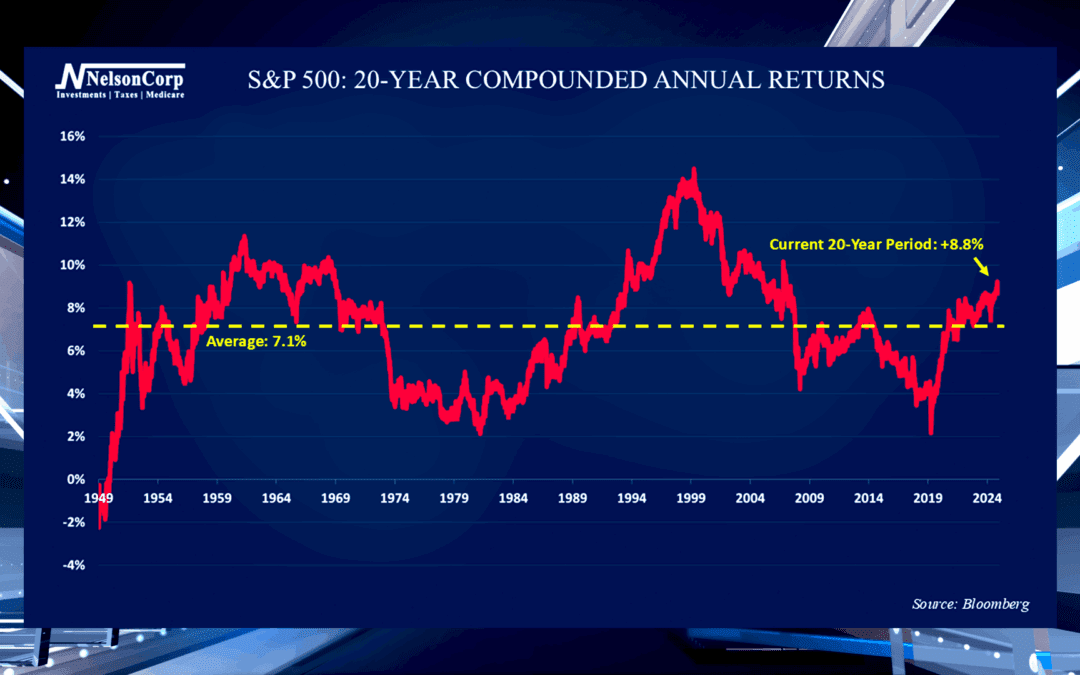

Long-Term Cycles

When investors evaluate long-term stock market returns, it is helpful to look through the lens of rolling 20-year periods. Nate Kreinbrink shares the history of S&P 500’s returns and where the index stands now.

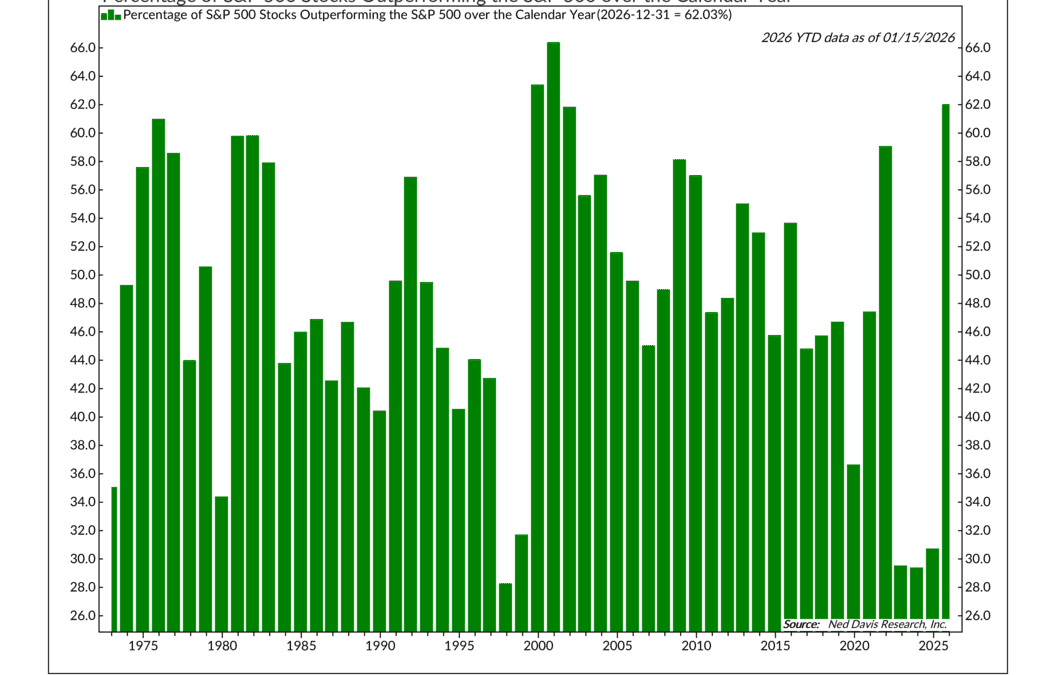

Deep Bench

OVERVIEW Markets pulled back modestly during the week, with mixed results across major asset classes. Large-cap U.S. equities were under mild pressure, as the S&P 500 declined 0.38% and the NASDAQ fell 0.66%. The Dow Jones Industrial Average slipped 0.29%,...

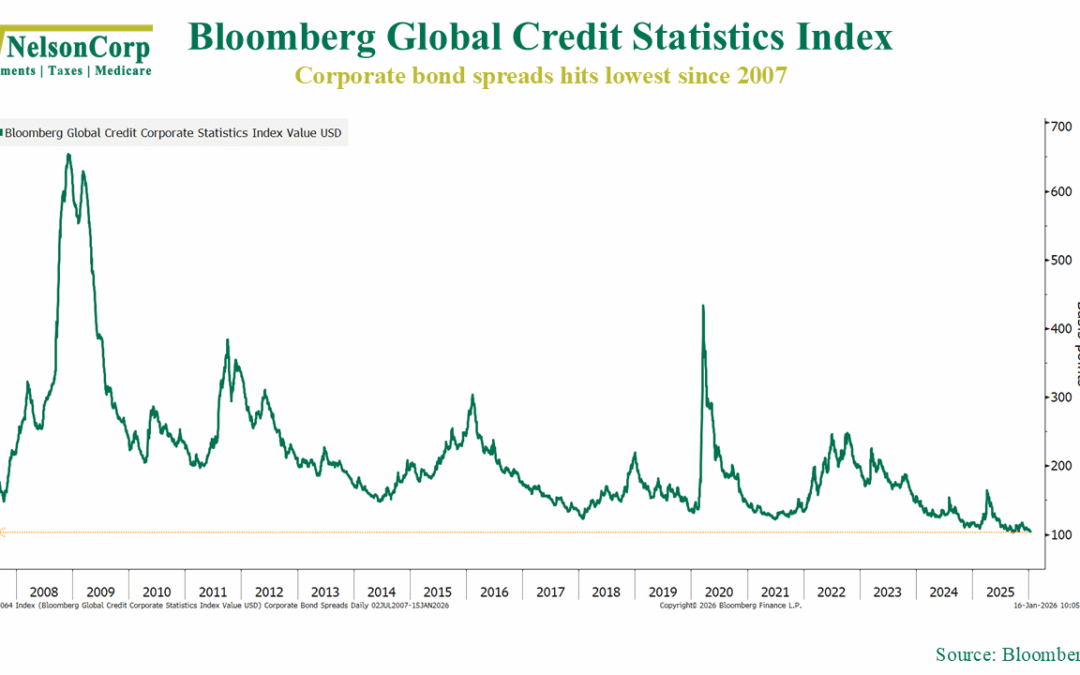

Confident Credit

How do we know when investors are gearing up to embrace risk? We look at credit spreads, the featured metric in this week’s chart shown above. What are credit spreads? Simply put, they are the extra interest investors earn for lending money to companies instead...

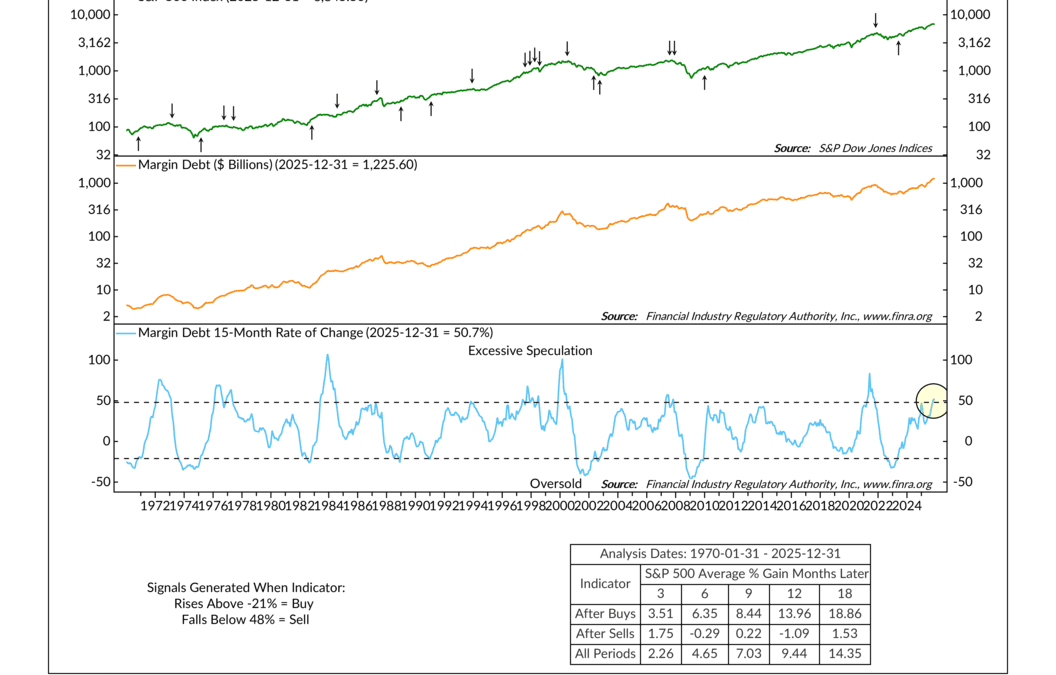

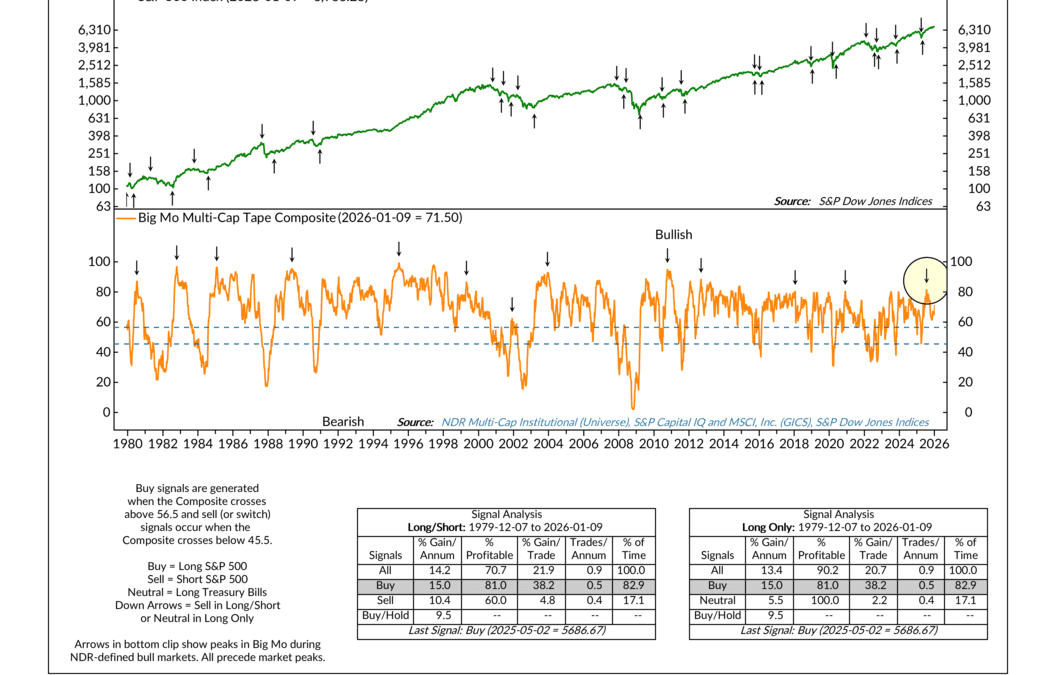

Peak Momentum

Momentum can be an interesting thing to measure in markets. Due to the nature of how momentum is calculated (a rate of change), it often tends to fade before prices actually peak. Think of it like a homemade rocket. The speed at which it’s rising slows down...

Financial Focus – January 14th, 2026

Tax season is officially underway, and there are a few important shifts to keep in mind this year. Nate Kreinbrink and Andy Fergurson break down what documents to look for, common mistakes to avoid, and how to stay ahead of deadlines.

Parking Spot, Not The Destination

Last week we discussed money market funds and why cash tools have been so popular lately. David Nelson elaborates more on real cash yields and explains why cash tools provide short-term stability but are not ideal for long-term investing.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.