OVERVIEW

The major U.S. stock indices gained more than three percent last week.

Small-cap and value stocks did better than the larger growth-oriented companies for a change, but they are still vastly underperforming year-to-date.

International stocks continued to underperform the United States, with developed country stocks gaining 2.94 percent, and emerging market stocks gaining just 0.45 percent.

U.S. government bond prices fell as the yield on the 10-Year Treasury Note ticked higher.

Investment and high-yield bonds, however, gained roughly 1.5 and 2.6 percent, respectively.

Real estate also had a big week, gaining nearly 7 percent.

Although gold and corn prices fell, commodities as a whole ended the week positive due to the continued rally in oil prices; WTI crude oil is now over $30/bbl.

The U.S. dollar fell about 0.7 percent to end the week.

KEY CONSIDERATIONS

Margin Pressure – The business of banking can be summarized in one sentence: borrow short and lend long. In other words, banks take in deposits that are generally short term in nature (think checkings, savings, CDs, etc.) and lend for longer periods (e.g., a 30-year home mortgage).

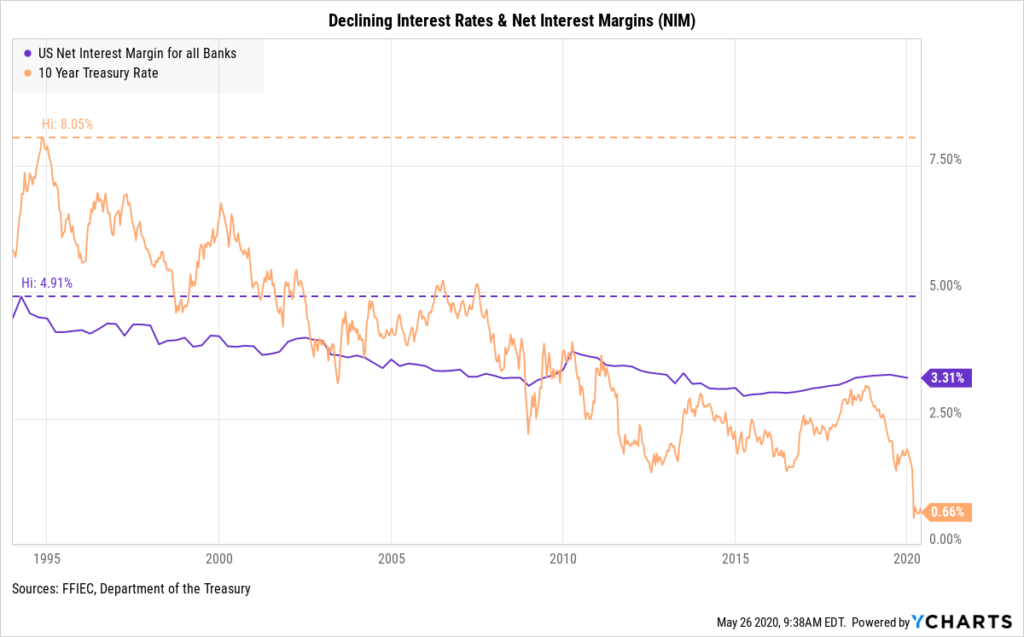

To determine just how efficient banks are at “borrowing short and lending long,” the industry calculates a profitability ratio called the net interest margin (NIM). In essence, the NIM measures the spread between how much a bank earns in interest and how much it pays in interest and then divides that figure by the bank’s average earning assets to get a profitability ratio, or margin ratio. A higher number is better because it means a bank is making profitable investments and funding them efficiently.

Since 1994, the average NIM for U.S. banks has been declining. The primary culprit has been the persistent decline in interest rates over this period. In 1994, the U.S. 10-year government bond yielded as much as 8.05 percent, and the average NIM for U.S. banks was as high as 4.91 percent. Today, the rate on the 10-year government bond has fallen to below 0.7 percent, and even before the corona-crisis struck, the average NIM was a meager 3.31 percent.

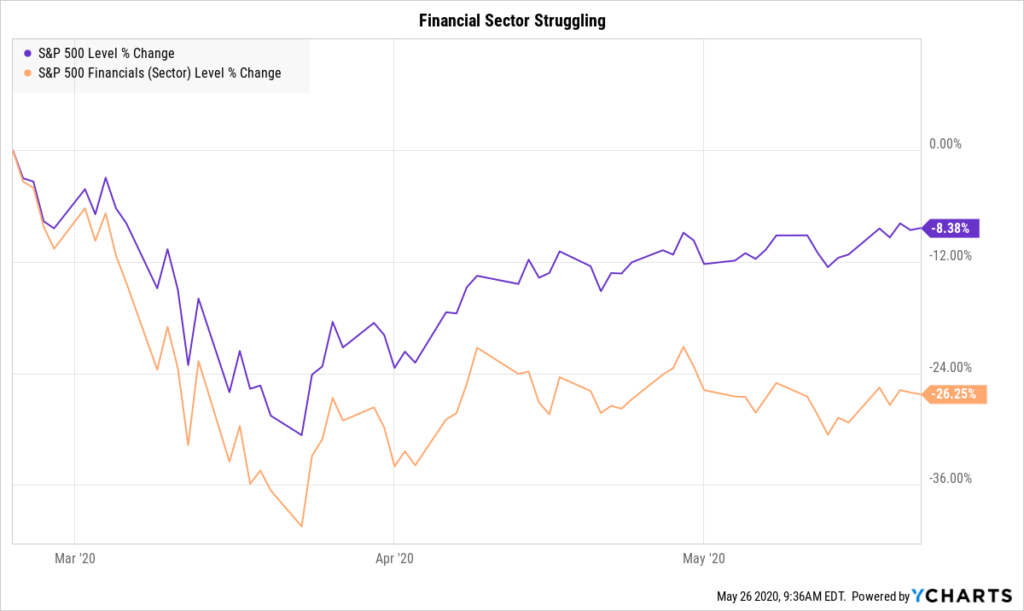

The financial sector has been struggling since the stock market sold off earlier this year. While the S&P 500 index is down about eight percent over the past three months, the financial sector is down roughly 26 percent. And the ultra-low interest rates set by central banks to fight the pandemic, while good for borrowers, could be a headwind to banks and their net interest margins well after the pandemic has faded.

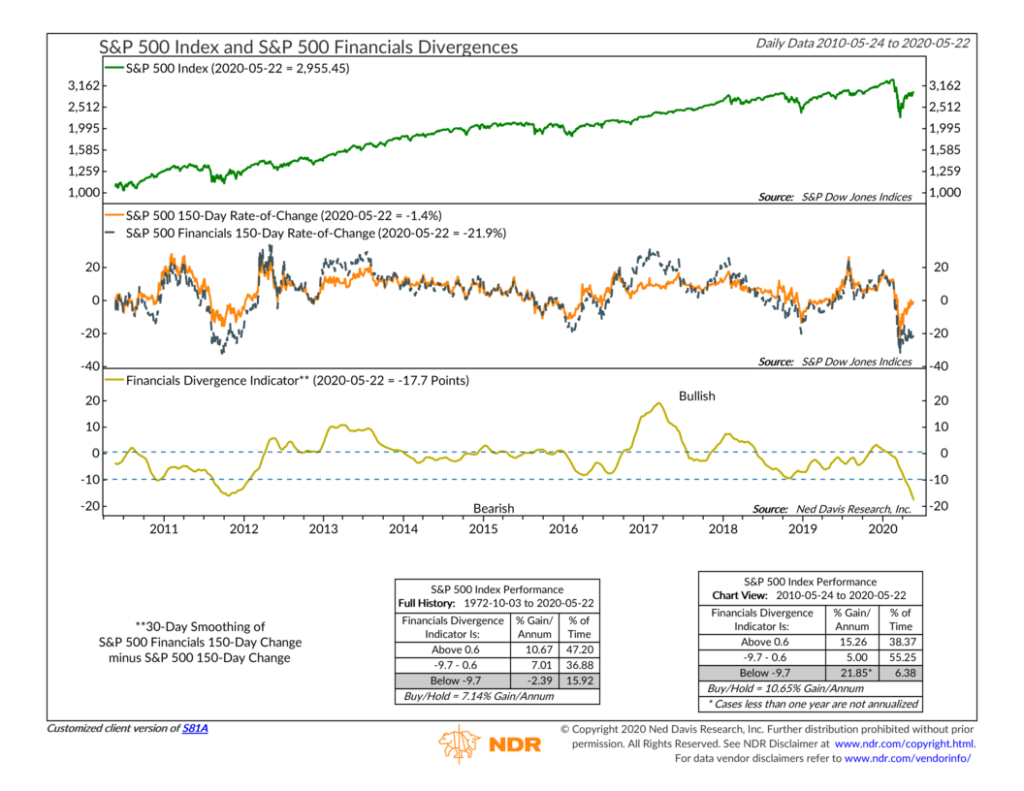

This is a concern for stock market investors because the financial sector tends to lead the broader stock market. Historical analysis shows that when the financial sector is underperforming the broader market over the past 150 days by roughly ten percentage points or more, the stock market performs below average, on average, going forward.

Therefore, a rebound in the financial sector’s relative performance would be a sign of decreased risk to the downside for the broader stock market. The forecasted compression in the net interest margins of banks, however, makes this less likely.

Once again, the big will probably get bigger. Jamie Dimon, the head of one of the world’s strongest, most profitable big banks, said his bank could comfortably withstand an extreme downturn in GDP coupled with high unemployment, and still emerge in a strong capital position.

However, most of the smaller community banks — and many regionals — earn more than half of their income from interest. They are likely to suffer the most in this crisis.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.