This week we look at one of the oldest indicators on Wall Street: Dow Theory. Initially developed by Charles H. Dow—the founder of Dow Jones & Company, Inc.—more than 100 years ago, the theory is based on the idea that both the Dow Jones Industrial Average and the Dow Jones Transportation Average should, over time, move in tandem and thus “confirm” when the environment is bullish for stocks.

In a nutshell, this is because transportation companies are responsible for the movement of goods across the country. When they are doing well, it’s a signal that the overall economy is set to thrive. Back in Charles Dow’s days, the Dow Transports consisted mostly of railroads, as they were the dominant mode of transportation then. Today, however, along with railroads, the index also includes airlines, trucking, delivery services, and logistics companies.

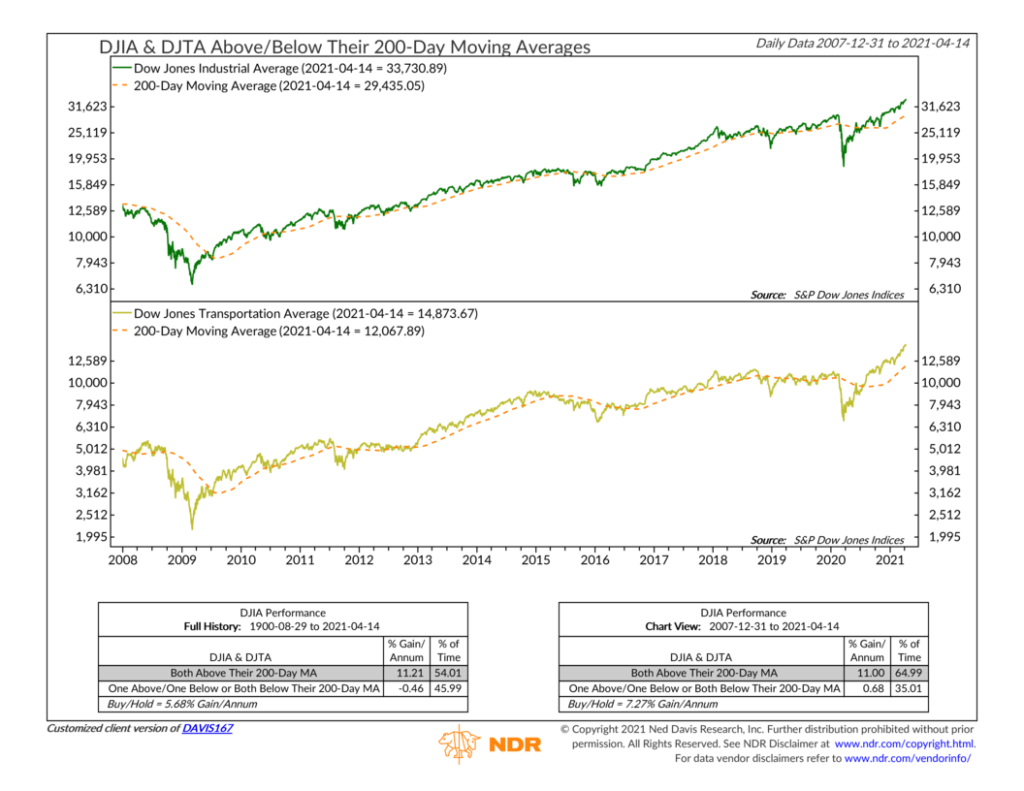

We find that the best way to make Dow Theory objective is to simply see if both the Dow Industrials and Dow Transports are trading above their average 200-day price. If they are, then that’s a confirmation of a bullish trend.

The chart above shows the Dow Industrials (green line) and the Dow Transports (gold line) with their respective 200-day moving averages (orange dotted lines) for the past 13 years since the Great Financial Crisis of 2007-2008. The performance box on the bottom right shows the average annualized return during that period for the Dow Jones Industrial Average (the market) when both of the Dow Averages were above their average 200-day price, and when one or both of the Dow Averages were below their average 200-day price. The performance box on the bottom left shows these same statistics, but for the whole history of the indicator, going back to 1900.

Both periods confirm that when the Dow Averages were both above their respective 200-day average price and thus showing confirmation, the market had above-average gains. But when one or both Dow Averages were below their average 200-day price, overall market returns were essentially flat. This is pretty compelling evidence for the power of the Dow Theory, especially after all these years!

Plus, it’s useful. This type of indicator allows us to keep our finger on the pulse of the market, so to speak. And when used in conjunction with other price-based indicators, it gives us a good feel for the overall strength of the current trend in stock prices.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.