OVERVIEW

U.S. stocks continued their ascent into record territory last week. The S&P 500 rose 1.37%, and the Dow gained 1.18%, the fourth straight week of gains for the two U.S. stock indices. The tech-heavy Nasdaq put in its third straight weekly gain, up 1.1%.

Growth stocks led the rally, gaining about 1.7%, and mid-cap stocks led in the size category, rising about 1.9%.

Foreign equity markets had a good week, with developed country stocks gaining 1.63% and emerging markets rising 1.38%.

The U.S. 10-year Treasury yield fell to 1.59% from 1.67% a week earlier, which was the largest one-week decline since last June. Bond prices across the board rose as a result.

Real estate registered gains of 2.5% for the week, and commodities rose nearly 3% on the back of firmer oil and gold prices.

The U.S. dollar weakened, falling 0.64% for the week.

KEY CONSIDERATIONS

The Hype is Real – We got hit with a flood of economic data last week, all of which looked quite impressive.

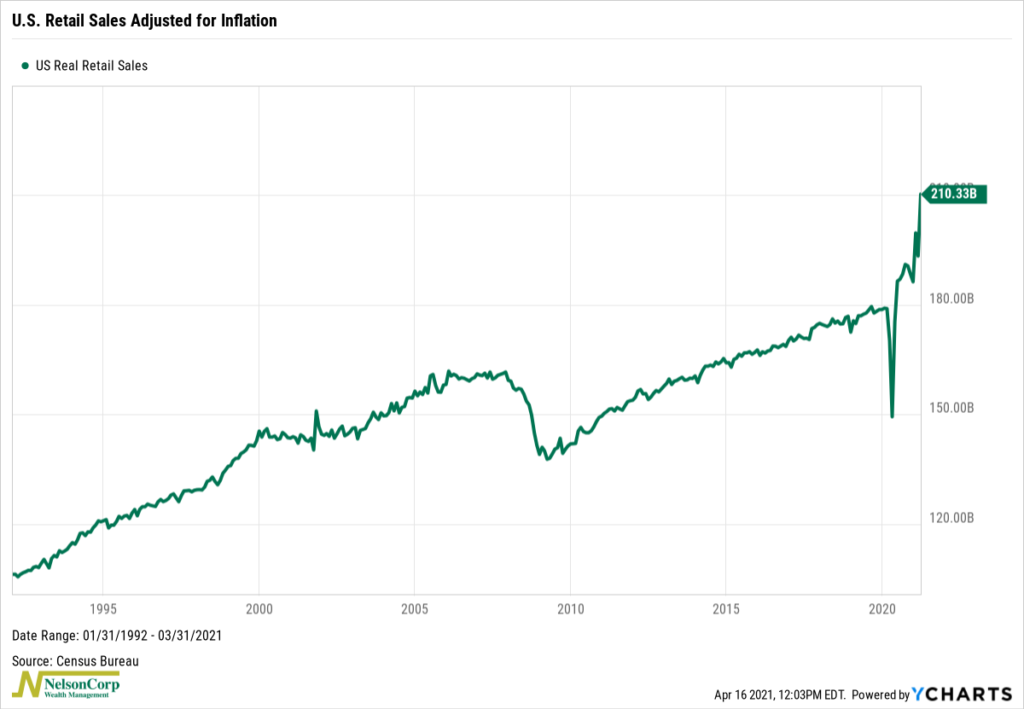

For one, consumer spending surged and has rebounded remarkably since the covid-induced shutdown last year. U.S. real (inflation-adjusted) retail sales jumped to $201.33 billion in March from $170.16 billion one year ago, a change of 8.76% from the prior month and 23.61% from a year ago. Not only is spending far above its pre-crisis trend, but the time it took to recover was far shorter than the previous recession (5 months versus the 40 months it took after the Financial Crisis in 2008).

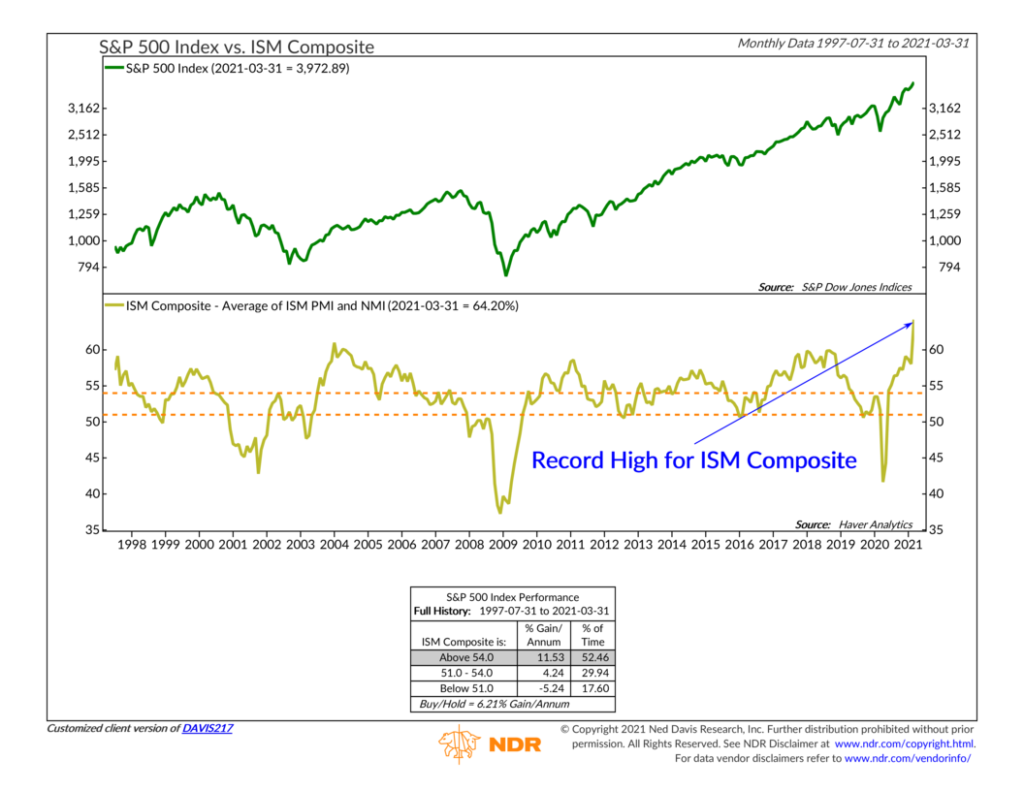

So that’s the consumer. But we also see tremendous growth in the manufacturing and service-related areas of the economy. The ISM Composite, which is an average of the ISM Purchasing Manager’s Index (PMI) and the ISM Non-Manufacturing Index (NMI), rose to a record reading of 64.2% last month.

Historically, as the chart above shows, readings this high in the ISM Composite has corresponded to S&P 500 stock market index returns of nearly 12% per year, on average, versus a historical buy and hold gain of around 6.2%.

So, the economic machine is rolling along. But how does all this good news affect our stock market risk models going forward?

The short answer: positively. Our composite of economic indicators is already moderately bullish. The positive economic data mentioned above confirms what analysts expect to be a surge in corporate earnings growth this year. If earnings grow as anticipated, it will likely improve our economic composite further.

Interest rates, if they continue to rise, could be one area that could weigh down the economic composite. Currently, however, the weight of the evidence is mostly neutral on that front. And although we saw CPI inflation jump recently, our composite of inflation indicators is already in a negative zone, so that won’t affect the overall model much.

As for the rest of the model, the other two major pillars of risk that we monitor are at odds.

While the composite of price movement indicators is approximately 75% bullish, the composite of investor sentiment indicators is only 25% bullish. It might seem that the net reading between the two would then be 50%, but since we place double the weight on the price movement of the market itself, it actually equates to a net reading of about 60%.

Coincidentally, this is the same reading of the economic composite we talked about above.

Therefore, the overall composite reading of our primary stock market risk model is hovering around 60%, or what we’d call moderately bullish.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.