Interest rates matter for stock prices. This is something you hear all the time in the financial ecosystem. But not all interest rates are created equal. So, for this week’s featured indicator, we focus on a very short-term type of interest rate—called a T-Bill yield—that is particularly important for stocks.

A T-Bill (Treasury Bill) is a short-term U.S. government debt obligation that the U.S. Treasury Department issues with a maturity of one year or less.

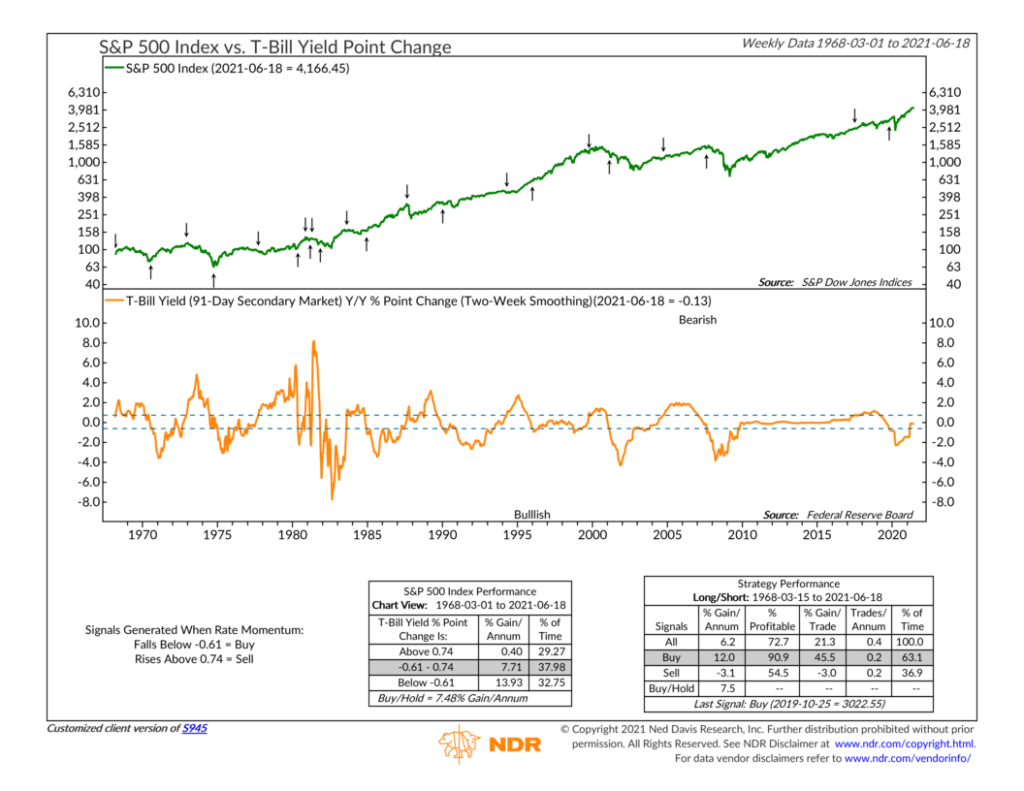

In this case, we’re looking at 3-month (91-day) T-Bills. Our indicator is formed by taking the year-to-year percentage point change in the 3-month T-Bill yield (smoothed by two weeks to dampen volatility). This is shown in the bottom clip of the chart above. The top clip shows the performance of the S&P 500 stock index.

As the performance boxes and signals show, when this measure has gotten above 0.74 in the past, it has been a warning that the interest rate environment has become treacherous for stocks. On the other hand, when it has fallen below -0.61, that’s typically been a good buying opportunity.

Why is this the case? Because, like real estate, gold, bonds, and other types of financial assets, T-Bills compete with stocks for investor dollars. And for income-seeking investors, T-Bill yields compete with the dividend yields on stocks. When lower-risk T-Bill yields are rising, it decreases the relative appeal of the riskier dividends that stocks provide, so stocks tend to get repriced downwards.

More so, since the Federal Reserve controls short-term interest rates in America, an increase in T-Bill yields can be a sign of tighter Fed policy. When the Fed is tightening, it’s raising interest rates and draining liquidity out of the system. This is usually bad for the stock market.

The general takeaway, then, is that if short-term interest rates are falling sharply, it’s probably a good time for investors to take risks in the stock market. However, if those same rates are rising at a rapid pace, it might be time to chill out a bit and wait for a better buying opportunity.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.