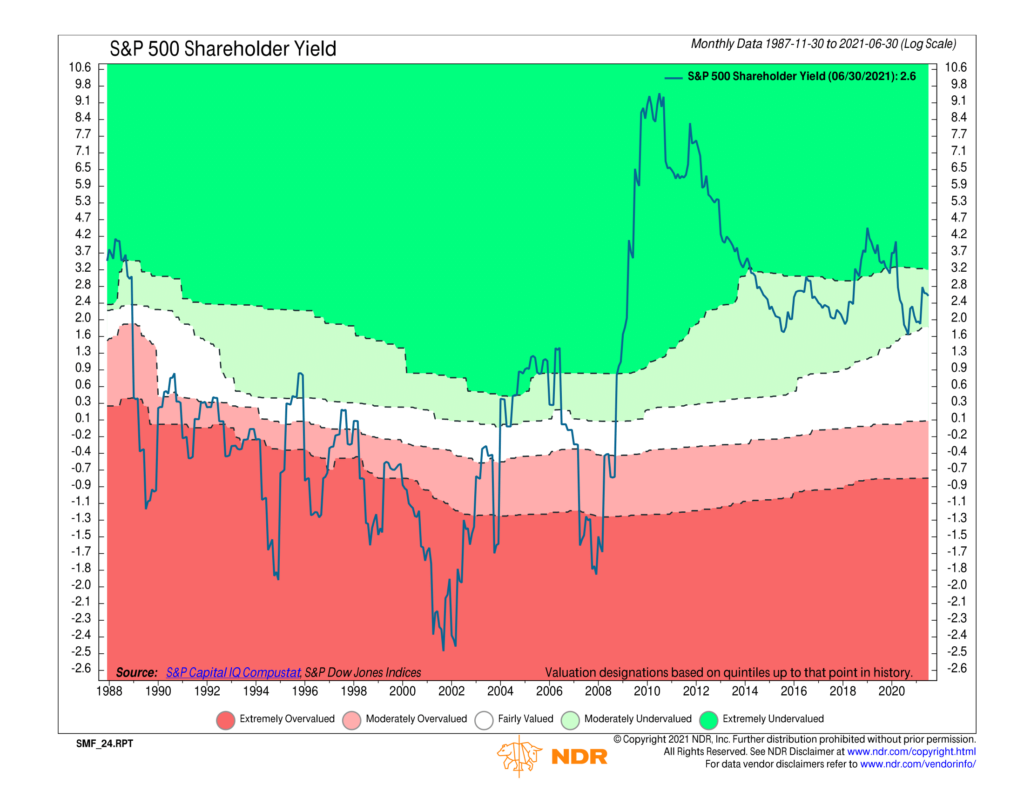

A lot of the valuation metrics out there today paint a picture of a grossly overvalued stock market. Many of these metrics compare stock prices to things like earnings or sales. However, some valuation metrics—like shareholder yield—suggest that stock prices aren’t quite as overvalued as some other metrics would imply.

In the chart above, we show the shareholder yield of the S&P 500 going back to 1987. The shareholder yield can be thought of as a measure of how much money a company is sending back to shareholders through a combination of dividends, share repurchases, and net debt reduction.

Dividends are straightforward. This is the cash the company sends to investors every quarter. Share repurchases (or buybacks) are less direct but achieve the same goal in a more tax-efficient manner (capital gains versus dividend income).

The combination can be powerful. When a company is buying back stock, it decreases the overall number of shares. With dividends also increasing, investors suddenly own a larger and larger portion of the company and get paid more for it. Add in the net amount that the company reduces its debt by, and you end up with a baseline rate of return for the stock.

Currently, the shareholder yield of the S&P 500 index is about 2.6%. This is comprised of the dividend yield of 1.3%, the net repurchase yield of 0.9%, and the net debt reduction yield of 0.4%. The dividend yield has been falling for decades. Net repurchases, however, have offset this some in recent times. And although net repurchases dropped a lot this past year, companies also decreased their overall debt loads by a significant amount.

So, overall, the stock market appears moderately undervalued according to the shareholder yield indicator. This provides an interesting counterpoint to the other valuation metrics that indicate an extremely overvalued market.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.