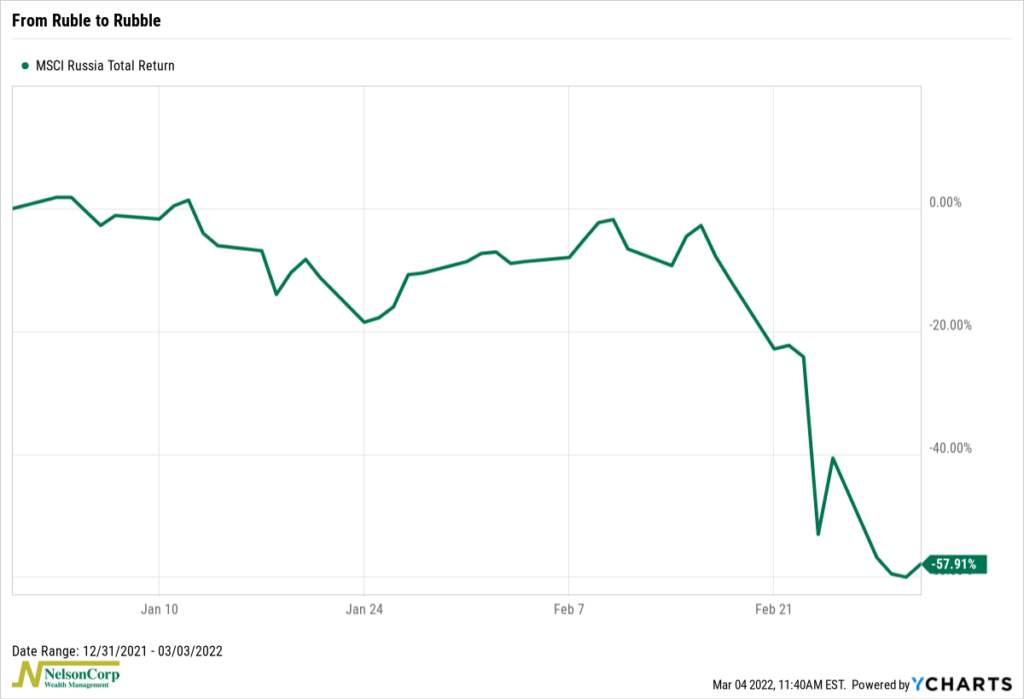

For this week’s Chart of the Week, we show the return of the MSCI Russia Index, a broad gauge of the Russian stock market. Due to crippling sanctions from the western world, the Russian stock market is now effectively uninvestable and illiquid. As you can see from the chart, it’s down roughly 58% this year.

This highlights an issue that most people don’t consider when investing in foreign stocks: currency risk. Russia’s local currency, the ruble, has collapsed by roughly 30% against the U.S. dollar since Russia invaded Ukraine on February 24th.

When we look at the performance of a foreign stock market index, like the MSCI Russia index, we see the returns from the perspective of a U.S. investor. Here’s how I think about it. When a U.S. investor wants to buy Russian stocks, they essentially have to swap their dollars for rubles to buy the Russian shares. Then when they sell the Russian stocks, they must swap the rubles back for U.S. dollars. If the ruble declined relative to the dollar while they were invested, it hurt the overall return of the U.S. investor.

And that’s what happened this past week. The massive devaluation of Russia’s currency relative to the U.S. dollar accounted for a large chunk of the index’s 58% decline. Sure, this is an extreme example, as most investors probably have very little exposure to the Russian stock market. But, it highlights the reality that when U.S. investors buy foreign stocks, they are also making an implicit bet against the U.S. dollar.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.