The big news this week came from the Federal Reserve. In an 8-1 vote, the Fed’s policymakers decided to raise their benchmark interest rate by a quarter percentage point, the first increase since 2018. Additionally, they announced their plan to raise rates at all six remaining meetings this year, hoping to bring down the fastest inflation our economy has seen in four decades.

This was all expected. The surprising news, however, came from the Fed’s updated “dot plot,” which kind of reminds me of those Dippin’ Dots I used to buy at the water park as a kid.

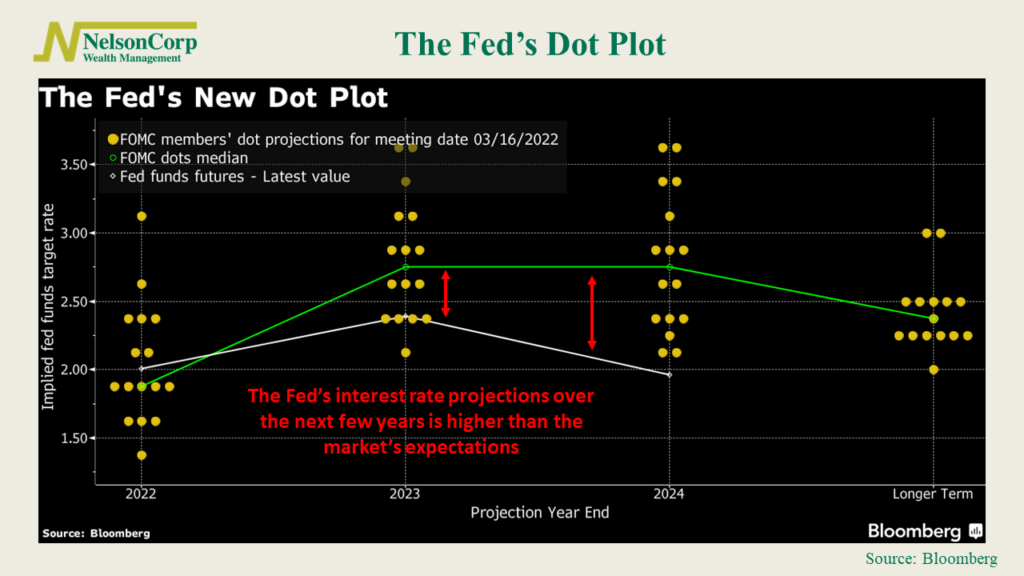

Shown on the chart above, each tiny yellow dot represents a fed official and where they think the fed funds rate will be at the end of the next three years (plus a longer run estimate), should the economy evolve as expected.

The green line represents the median fed official’s estimate for each year, whereas the white line represents the market’s expectations, according to fed funds futures.

According to the dot plot, most fed officials think rates will reach a range of at least 1.75% to 2% by the end of this year. This is in line with market expectations.

However, expectations diverge over the following two years. By the end of 2023, the Fed thinks rates will be at least 2.75% and stay there until 2024. By contrast, the market expects rates only to reach a high of between 2.25% and 2.5% by 2023 and then fall back to under 2% by 2024.

The stock market wasn’t exactly sure what to make of this at first. Stocks initially sold off on what looked like a more hawkish Fed. However, after hearing how optimistic Fed Chair Jerome Powell was about the economy, the stock market reversed course and headed higher.

Over in the bond market, short-term rates continued to surge, but longer-term rates were more subdued, a sign that bond investors are less optimistic about future economic growth.

The worry, of course, is that the Fed’s rate increases will hit the economy harder than expected.

So, the question going forward is: Will the Fed be able to orchestrate a so-called “soft landing,” in which it brings down economic activity by raising rates just enough to curb surging prices while keeping the job market and the economy expanding?

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.