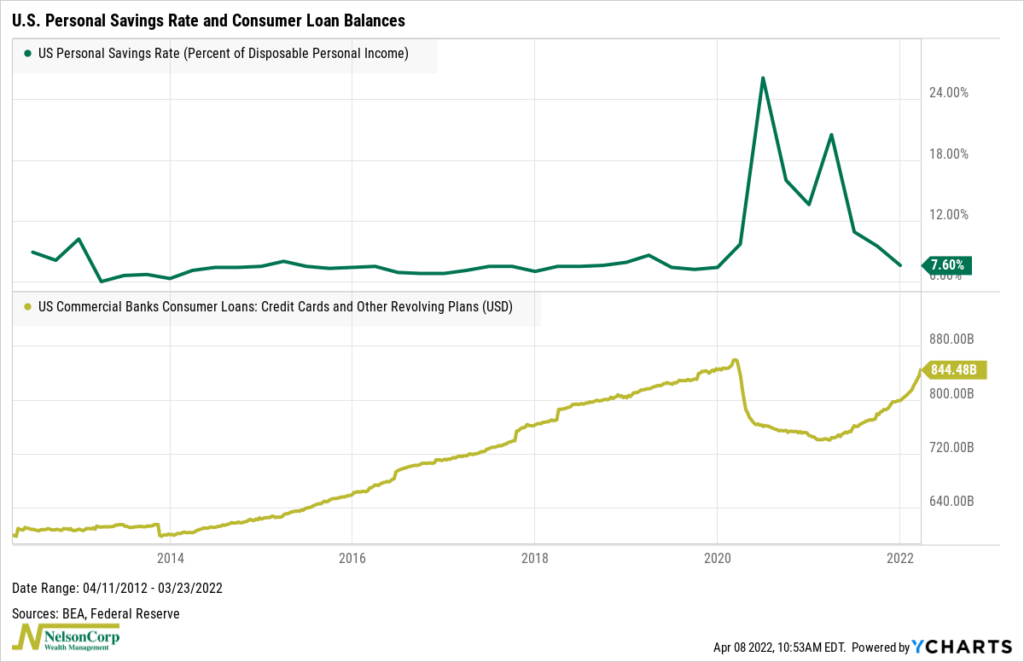

One of the weird things about the 2020 recession was that household balance sheets in the U.S. actually improved quite a bit. Not only did the personal savings rate skyrocket, but credit card debt plummeted as well.

A combination of fiscal and monetary support from the government and a drop in overall demand from consumers was the primary reason for this.

But, as our chart of the week above shows, this era is coming to an end. The government is no longer providing much stimulus to consumers, while consumer demand has come roaring back as people are ready to spend down their savings.

The personal savings rate (green line, top clip) is back to 7.6%, in line with the historical average before the pandemic. Additionally, consumer loan debt (gold line, bottom clip) is nearly back to pre-pandemic levels.

It’s interesting to see how the double peaks in the savings rate corresponded to the multiple rounds of stimulus checks that have gone out to consumers over the past two years. You can also see that after the last round of checks went out last year, the savings rate plummeted, and consumer loan debt (i.e., credit card debt) started rising again.

So essentially, we are back to where we started before the pandemic. And it appears that consumer spending habits are more or less back to normal.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.