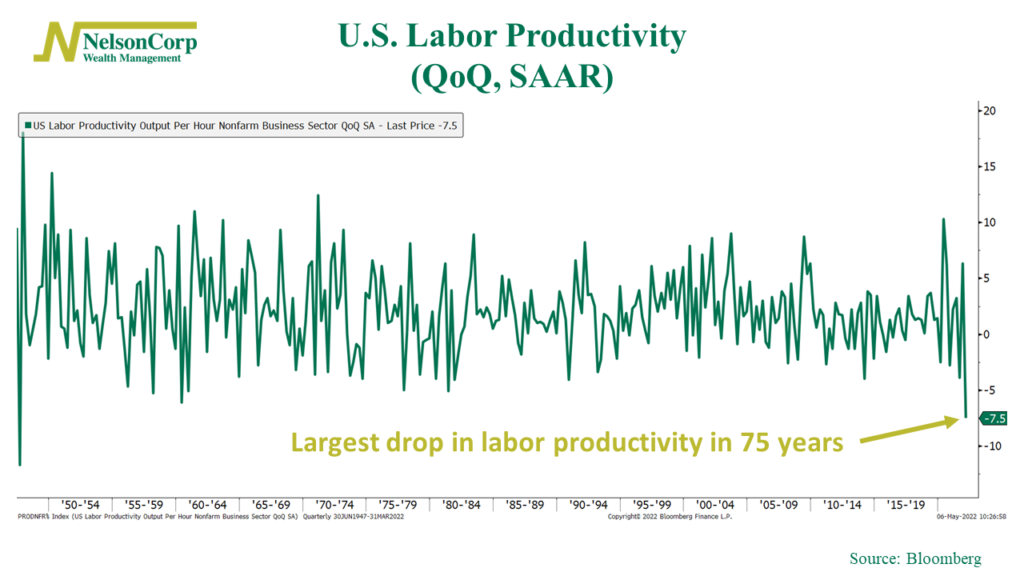

U.S. workers got a lot less productive in the first quarter of this year. According to the latest figures from the Labor Department, nonfarm business employee output per hour—or simply labor productivity—dropped by a 7.5% annual rate from the previous quarter, the fastest decline since 1947.

This is worrisome because productivity is one of the primary drivers of economic growth. When workers are more efficient at producing goods and services, society’s living standards go up. But the recent drop in productivity is particularly troubling because it also resulted in the fastest year-over-year increase in unit labor costs since 1982.

As our Indicator Insights blog post highlighted this week, unit labor costs go up when labor productivity goes down. This is because unit labor costs are calculated as wages per hour divided by output per hour. To rehash the example used in the piece, if a worker can make 10 widgets per hour for $10 an hour, unit labor costs equal $1. However, if the worker is less productive and can only produce 9 widgets per hour for the same $10 an hour wage, then unit labor costs increase to roughly $1.11. And as the indicator pointed out, rapidly rising unit labor costs hurt stock market returns.

Additionally, both the drop in labor productivity and the increase in unit labor costs will reinforce the pressure on the Federal Reserve to hike rates in the face of fast-rising prices and wages. And as we’ve witnessed so far this year, an aggressive Fed and rising interest rates can result in a painful repricing of risk assets.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.