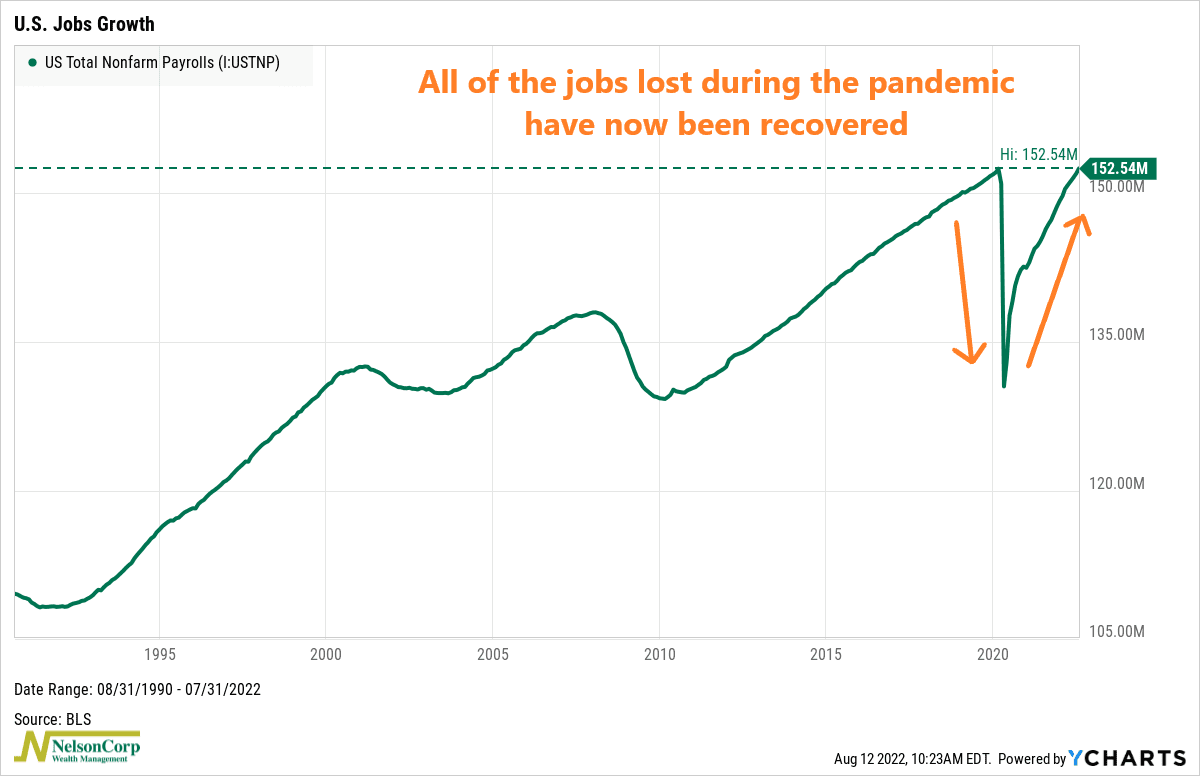

This week’s chart looks at job growth in the U.S. economy. Last month, we found out that U.S. employers added 528,000 new jobs. This was significant because it means the economy has now recovered all of the roughly 22 million jobs it lost in the early stages of the pandemic.

As you can see on the chart, in April 2020, the economy shed 20 million jobs. However, over the last 27 months, the U.S. economy has seen the number of people employed grow by an average of 800,000 a month. That’s quite the run—and this recovery in jobs has been much faster than the one coming out of the Great Financial Crisis of 2008.

What does this mean for investors? Well, it could make it harder for the Federal Reserve to dial back the pace of rate increases in the coming months, as a strong labor market is at odds with expectations of an economic slowdown. And higher rates tend to weigh on the valuations of things like stocks.

But the key for the Fed will be if it can achieve a so-called “soft landing,” where it manages to bring down inflation without a major increase in unemployment. The stock market would welcome that scenario.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.