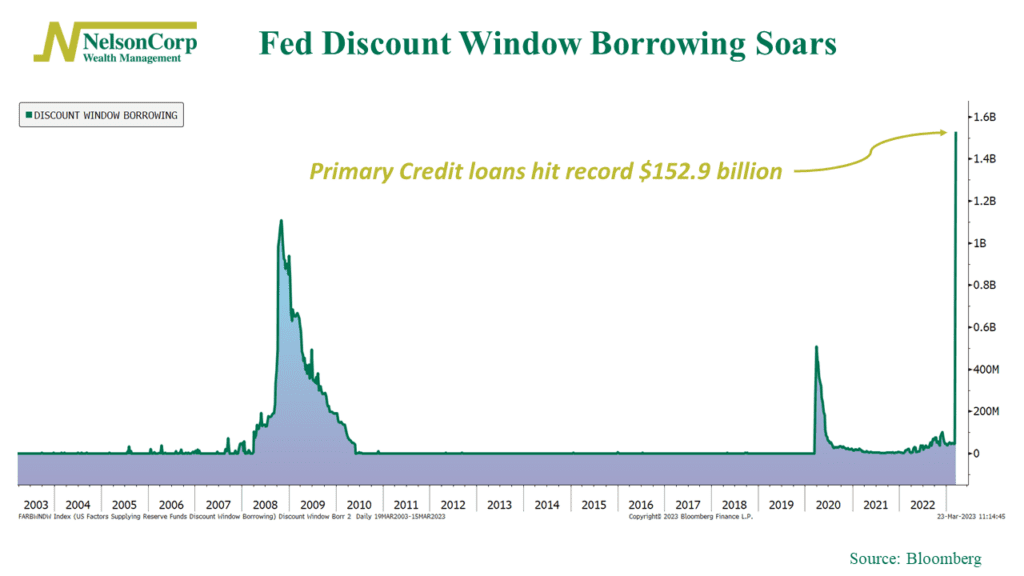

There’s been a lot of stress in the banking system lately. So much so that recent data published by the Fed showed that a record $152.9 billion was borrowed from the Fed’s discount window last week, surpassing the $111 billion reached during the 2008 financial crisis.

The discount window allows commercial banks to get short-term loans from the Fed to help with liquidity needs. They do this as a last resort if they are unable to secure funds from other banks in the fed funds markets.

As you can see, banks generally only turn to the discount window in times of financial stress, such as the 2008 financial crisis—and briefly during the pandemic. They are doing it today to shore up funding as customers have pulled their unsecured deposits out of some banks by the billions (i.e., a good ole bank run).

While this is admittedly a bit scary, the good news is that the financial problems banks face today lend themselves to straightforward solutions—such as using the Fed’s discount window and other lending facilities. Unlike 2008—when the issue was toxic subprime mortgages, hard-to-value assets, and a run on shadow banks—the problem assets held by banks this time around are safe and boring Treasury bonds issued by the U.S. government. To be sure, they’ve lost value on a mark-to-market basis due to higher interest rates, which is a problem if banks are forced to sell them to match depositor outflows. But there are no real credit issues here, and the losses are generally transparent and easy to manage—at least compared to 2008.

The bottom line? The record amount of discount window borrowing from the Fed is eyebrow-raising. But it’s a sign that the Fed—as the lender of last resort—is doing what it can to stem the bleeding and keep the problem from spreading further.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.