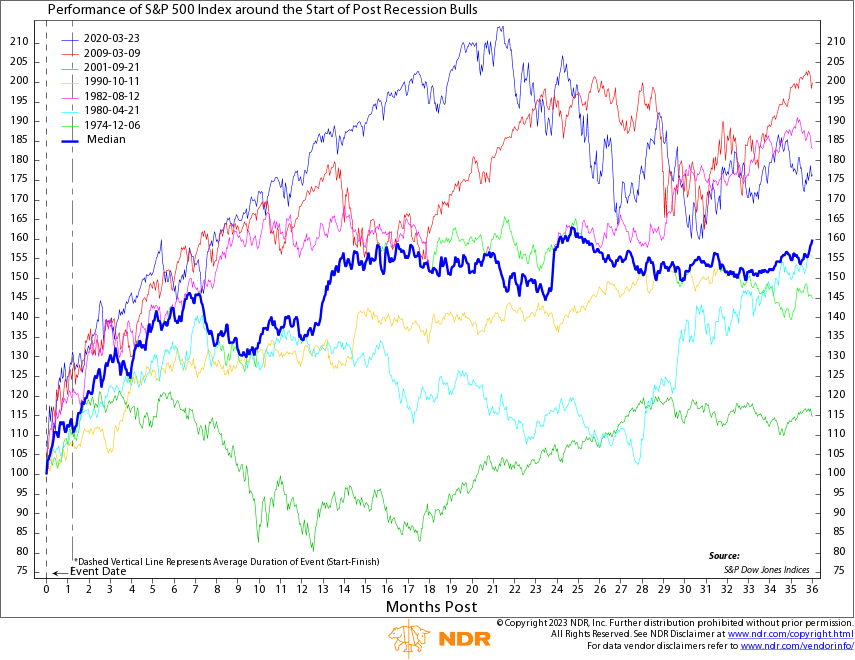

The topic of a potential recession, that dreaded “R” word, has been the subject of much discussion lately. Yet, our highlighted chart this week provides some hopeful news, indicating that bull markets generally exhibit strong performance following economic recessions.

Our research shows that since the mid-1970s, seven bull markets have commenced following an economic recession. The median return of the S&P 500 stock index 12 months after the start of a recession is around 39%, and approximately 58% after 36 months. The chart displays the average return represented by the dark blue line, with the other colored lines representing the individual post-recession bull markets.

Upon closer examination, we observe that in one instance, in 2001, the S&P 500 was still down after one year following a recession. Nevertheless, it had gained about 16% after three years. In contrast, in other cases, such as 2009 and 1982, the S&P 500 saw significant surges of approximately 100% and 83%, respectively. These returns were quite impressive.

The bottom line is that while the possibility of a recession may cause concern among investors, the data suggests that post-recession bull markets have historically performed quite well. Although there have been some exceptions, overall, post-recession bull markets have yielded impressive returns, which may provide some comfort to investors during uncertain economic times.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.