This week’s featured indicator is all about following the leader, just like the popular children’s game. But instead of a 4-year-old, we’ll be keeping an eye on the financial sector of the stock market.

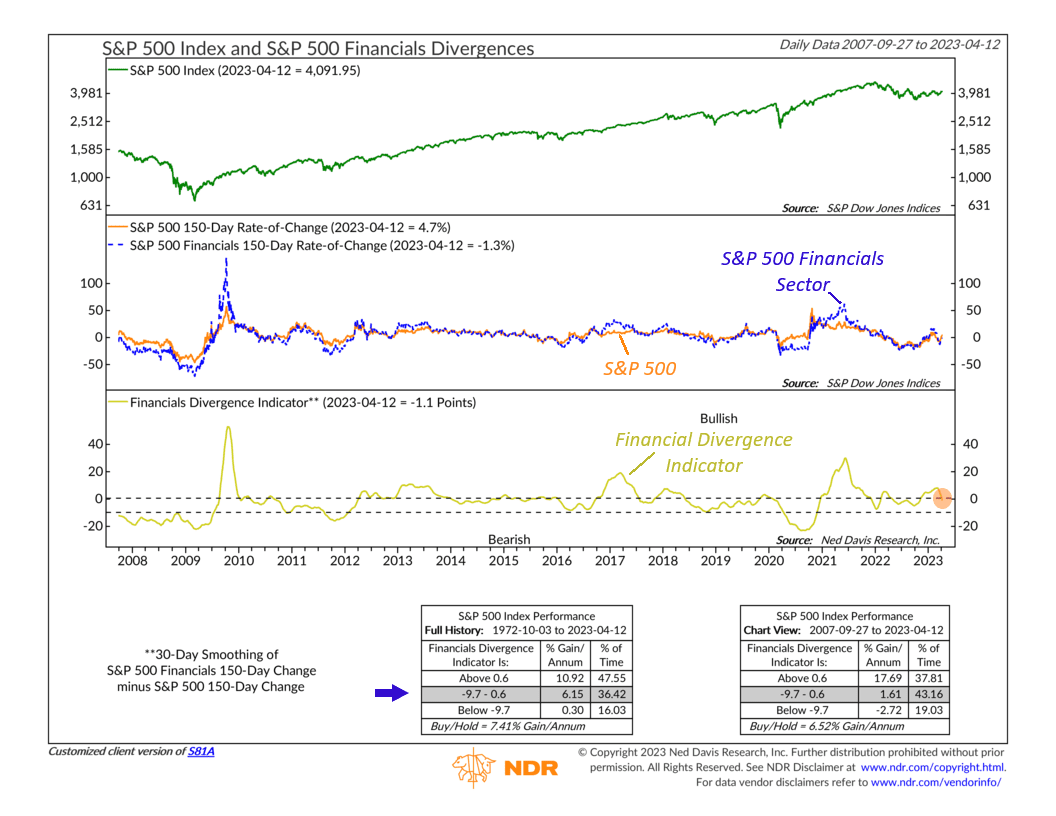

Why? Because historically, the broader stock market tends to follow the financial sector’s lead. It’s like a leading indicator for the overall market. But just like a 4-year-old can be unpredictable, the stock market can be quite volatile too. So, to smooth things out, we use a 150-day rate of change calculation for both the S&P 500 index and the S&P 500’s financial sector, shown in the middle clip of the chart above.

To construct our indicator, we subtract the 150-day rate of change of the S&P 500 from the 150-day rate of change of the financial sector and then smooth it by 30-days, shown as the gold line on the bottom clip of the chart. If the line is rising, it means the financial sector is outperforming the broader stock market. But if it’s falling, it indicates an underperforming financial sector.

True to form, the S&P 500 has performed the best when that line has been rising, especially when it’s above the upper bracket, known as the bullish zone. The S&P 500 has gained nearly 11% per year, on average, during those times. But when the line falls into the middle (neutral) zone, the S&P 500’s returns drop to around 6%, and if it dips further into the lower bearish zone, the S&P 500’s returns are only barely positive.

Looking at recent history, we see that the indicator experienced a significant uptrend in the latter part of last year, aligning with a robust rally in the overall stock market. However, in the aftermath of the recent banking crisis, the financial sector has encountered challenges, resulting in the indicator dipping into the neutral zone from its previous position in the upper bullish zone. The future trajectory of the indicator is likely to have significant implications for the broader stock market, making it a critical factor to watch closely.

So, the bottom line is this: it’s crucial to keep a keen eye on the financial sector and take note of significant divergences from the broader market. In the children’s game, if you fail to follow or mimic the leader, you’re out. The goal here is to avoid a similar fate for your investments.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.