There’s this amusing scene in the 2000 movie Boiler Room where Ben Affleck’s character boasts about his wealth to a room full of interns. He proudly mentions his luxurious car, beautiful house, and most importantly, he says, “I am liquid.” By “liquid,” he means that his assets can easily be converted into cash or that he has a significant amount of cash readily available.

In other words, liquidity is valuable, not just for individuals but also for the stock market.

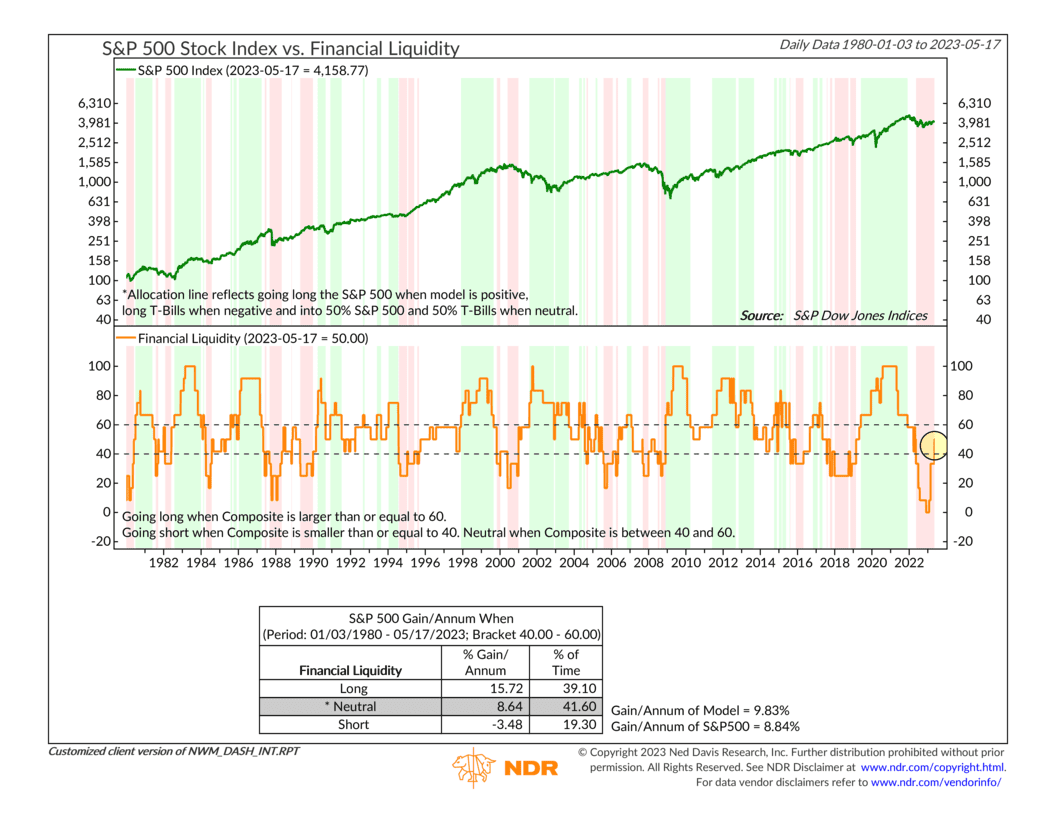

This week’s featured indicator, displayed above, does a great job of measuring financial liquidity and its impact on the stock market. It’s a composite of six distinct liquidity indicators, each measuring different aspects of liquidity, such as money supply growth, the relationship between money supply and the real economy, the strength of the U.S. dollar, and banking liquidity, among others. By combining these indicators, the composite offers a comprehensive view of overall liquidity.

The orange line on the bottom section of the chart represents the composite reading, which is simply a combination of the six liquidity indicators. A reading of 100 would mean that all six indicators are bullish, whereas a reading of 0 means they are all bearish. Historically, going back to 1980, when at least 60% of the indicators are bullish, the S&P 500 has returned about 15.7% per year, on average. In contrast, when 40% or fewer of the indicators are bullish, the S&P 500 has experienced an average annual return of about -3.5%.

Examining the far-right side of the chart, we can see that the indicator dipped significantly negative last year, reaching a reading of 0% at one point. This reflected the Federal Reserve’s aggressive actions in tightening financial conditions to combat inflation, which led to struggles in the stock market.

However, there is potentially good news for this year, as the indicator recently climbed to 50, a neutral reading. Despite challenges faced by regional banks, overall financial conditions have remained relatively stable. It seems that the Federal Reserve is nearing the end of its rate-hiking period, the U.S. dollar is weakening, and banks have ample reserves deposited with the Fed.

The next crucial development would be witnessing growth in the money supply again, which would drive the composite indicator higher into bullish territory. Until then, however, the current neutral reading implies average market gains.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.