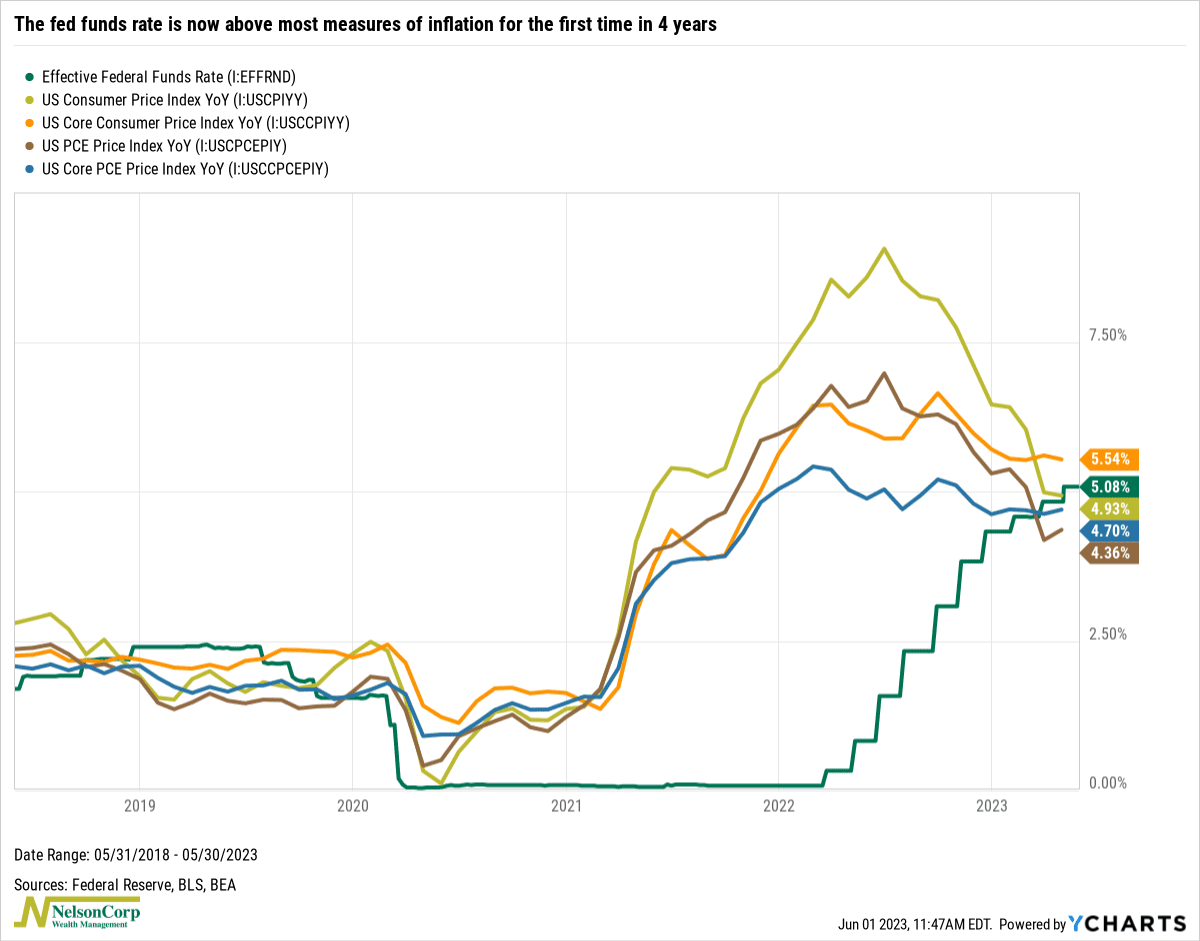

Inflation has been a thorn in the side of investors for a while now. But the good news is that we recently hit a major milestone in the fight against inflation.

As our featured chart of the week above shows, the fed funds rate—the rate controlled by the Federal Reserve—is now above most measures of inflation for the first time since 2019. This is significant because it’s a sign that the Fed’s rate-hiking cycle is likely coming to an end. In fact, the Fed has explicitly stated that it will adopt a “wait-and-see” approach going forward to assess the effectiveness of its efforts in curbing inflation.

Historically, rate cuts tend to follow after the Fed has stopped hiking rates. Sure enough, the market is currently placing a high percentage chance that we will see rate cuts before the end of the year.

Whether that’s good or bad ultimately depends on the reason for the rate cuts. If rates are being cut because economic activity is slowing considerably, then the cuts might not be enough to stem declines in risk assets. Ultimately, investors should closely monitor the interplay of the three major forces influencing the market—the Fed’s actions, sentiment, and price movements—to get a comprehensive understanding of the risks they face.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.