This week’s featured indicator highlights a concept known as the stock market’s rolling drawdown. The rolling drawdown—or trailing loss—is a measure used to assess the maximum loss an investment has experienced over time.

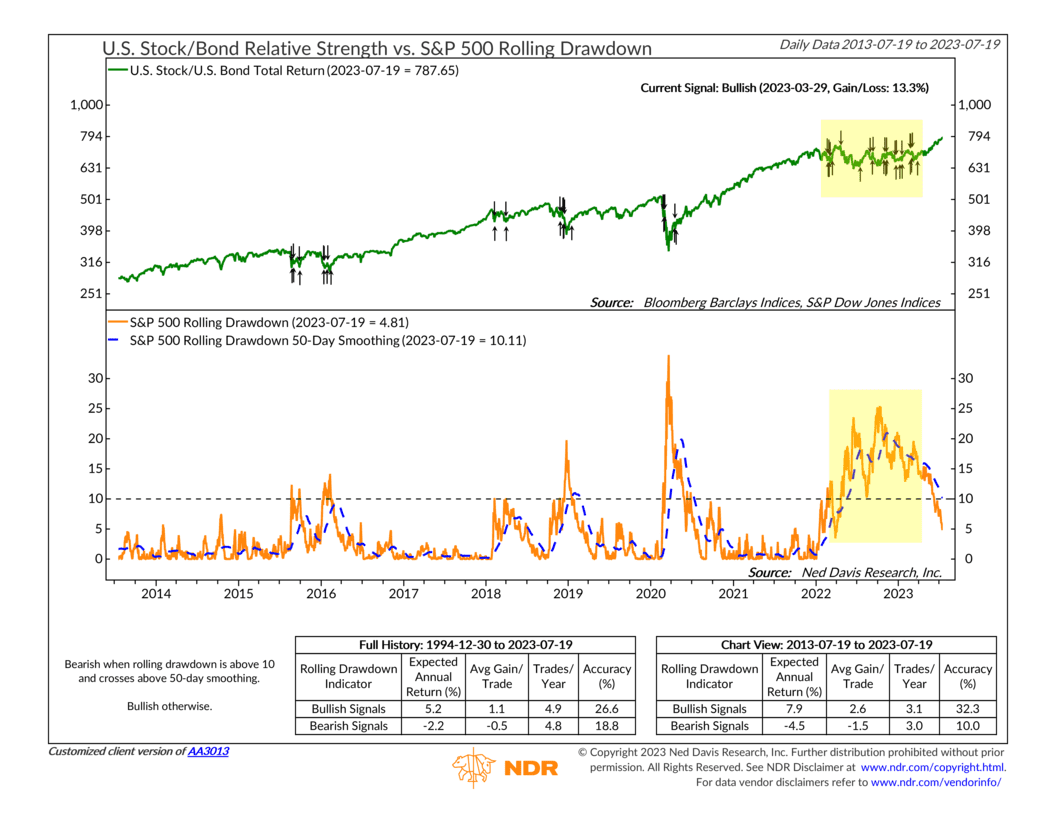

In this case, we’re looking at the maximum loss of the S&P 500 index. The orange line represents the rolling drawdown of the index, and the blue dashed line represents the 50-day moving average of the rolling drawdown.

The rules of the indicator say that when the rolling drawdown of the S&P 500 is greater than 10% (above the black dashed line) and crosses above the 50-day moving average, it triggers a bearish (negative) signal for the stock/bond ratio (green line, top clip). Conversely, the signal is bullish (positive) for the stock/bond ratio in all other cases.

In simple terms, when the market is more than 10% off its highs and still declining compared to its recent price history, it’s an unfavorable time to own stocks relative to bonds. However, once the drawdown improves significantly relative to recent price history—or falls below 10%—it generally becomes a favorable time to favor stocks over bonds.

For example, near the beginning of 2022, the S&P 500’s rolling drawdown rose above 10%, generating a cluster of buy and sell signals for roughly a year. This indicated significant volatility in stocks and bonds, with both asset classes performing poorly.

However, earlier this year, the S&P 500’s rolling drawdown rapidly declined and now stands below 5%. This suggests that stocks have finally broken out and are poised to outperform bonds in the market.

The bottom line? In general, the stock market tends to go up most of the time, which is why you see this indicator stay positive for long stretches of time. But occasionally, the market goes down—sometimes by a lot—and this type of indicator can help navigate those tricky situations in a quantitative, objective way.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.