Last year on this blog, we highlighted how a surge in interest rates had led to an environment in which stocks were poorly valued based on profitability measures like Return on Equity (ROE), which measures how much a company earns for each dollar of equity capital invested.

This year, however, the script has been flipped. Our featured indicator above shows that recent changes in both ROE and interest rates have created an environment in which stocks look attractive once again.

Here’s how.

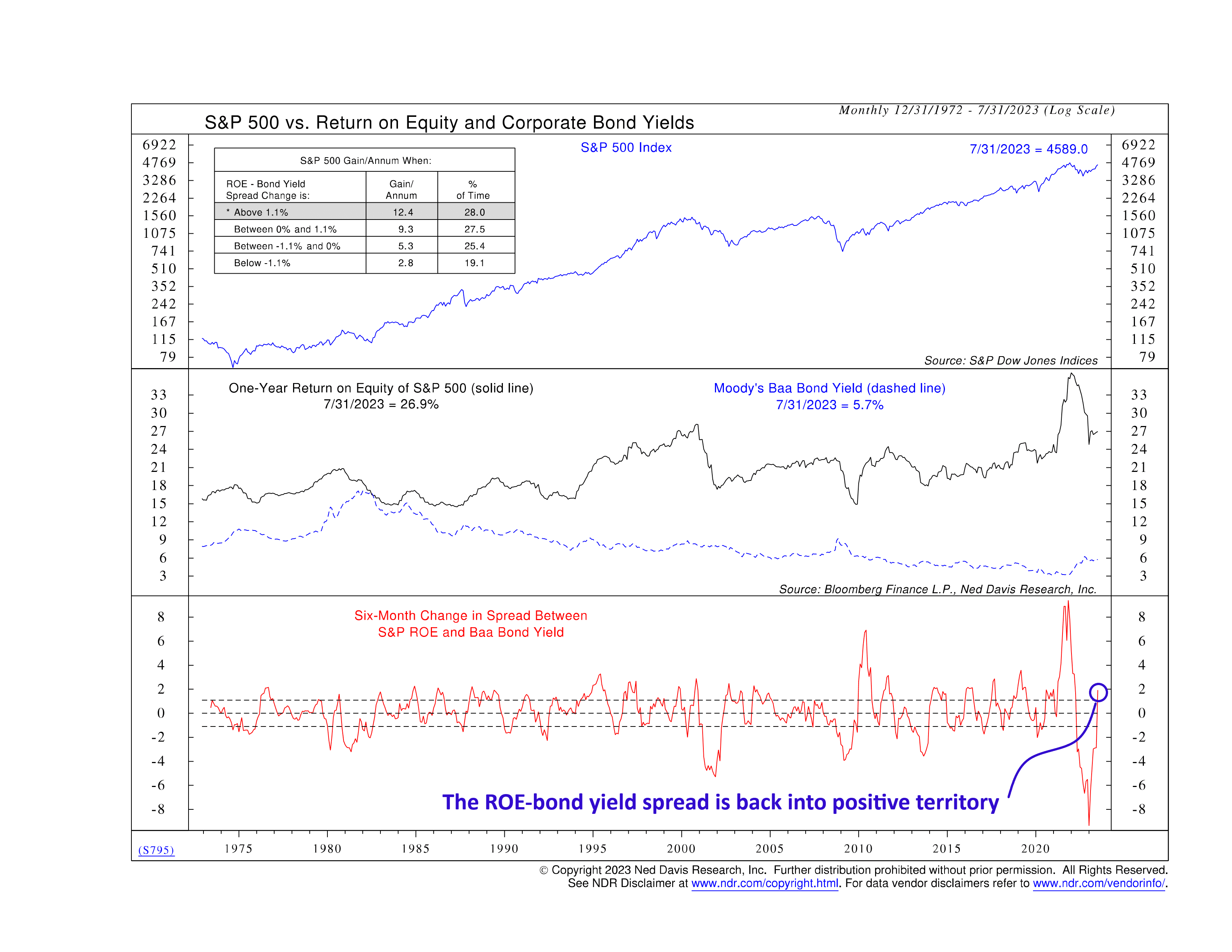

In the middle clip of the chart above, we show two measures: the one-year Return on Equity (ROE) of the S&P 500 (black line) and the Moody’s Baa Bond yield (blue dashed line). To get our indicator (red line, bottom clip), we subtract the bond yield from the ROE to get a spread between the two and then take the 6-month change of that spread.

From there, the interpretation is pretty straightforward. The faster the change in the spread, the faster ROE is increasing relative to interest rates on comparable corporate debt. This produces a favorable environment for stock market returns.

Indeed, as you can see, after dropping into deeply negative territory last year, the indicator has returned to positive territory. So positive, in fact, that it’s in the upper (most bullish) zone, where the S&P 500 (blue line, top clip) has historically returned about 12.4% per year, on average.

In other words, now that bond yields have started to cool, measures of corporate profitability—which have also stopped falling—are looking more attractive.

Why? Because, as investors, we only care about the “real” profits that companies can generate, meaning earnings over and above inflation. And since bonds incorporate inflation expectations into rates, we can compare them to measures like ROE to determine just how profitable companies are.

The takeaway? Corporate profitability measures like ROE have held up well in recent months while comparable bond yields have cooled off, and that means stocks will likely attract more investor attention and perhaps better returns going forward.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.