Last April, we talked about the real earnings yield indicator and how a continued fall in inflation could eventually bring the indicator into positive (bullish) territory. This week I want to give an update on how things are going.

But first, here’s a quick recap of how we define the real earnings yield.

The stock market’s earnings yield—or, in this case, the S&P 500 index—is the average corporate earnings or profits divided by the index’s current price. The higher the earnings yield, the “better valued” the market is. And to get the real (inflation-adjusted) earnings yield, we simply subtract the annualized inflation rate from the earnings yield.

In other words, the real earnings yield is a valuation technique that allows investors to value the stock market based on real earnings instead of those potentially artificially inflated by rising prices.

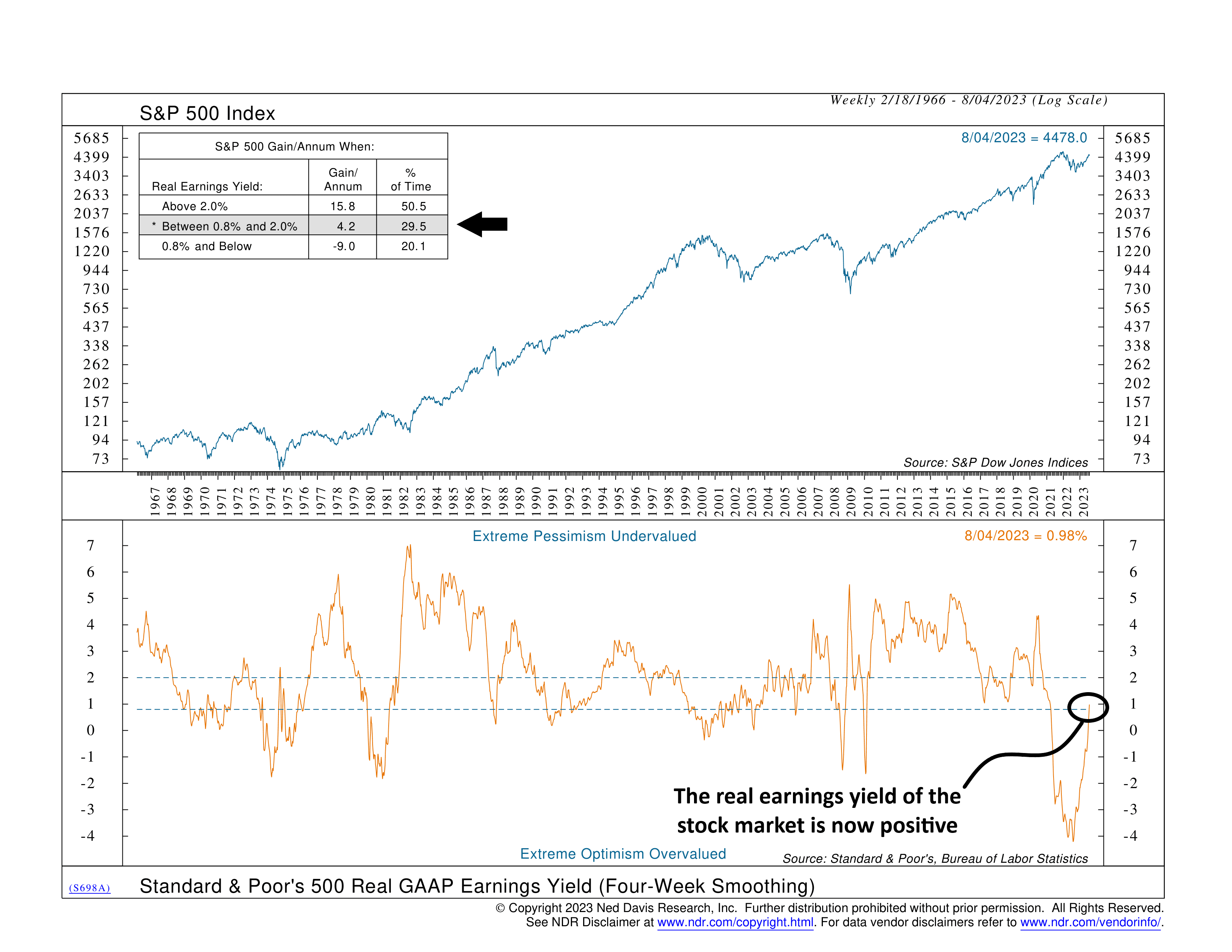

For example, by the end of 2021, the earnings yield of the S&P 500 had risen to about 4%. Not great—but not bad, either. However, the annualized inflation rate had already soared over 7%. So, the real earnings yield was more like -3%. As you can see on the chart, a real earnings yield of less than 0.8% has coincided with negative returns for the S&P 500 historically, and that’s indeed what we got over the next year.

Fast forward to today, though, and the script has flipped. The earnings yield of the market is about where it was at the end of 2021 (3.9% currently), but inflation has fallen to just 3% annually, resulting in a real earnings yield of about 1%. That puts the indicator in its middle (neutral) zone, where the S&P 500 has historically generated moderate but positive annualized returns.

So that’s some good news. But, to get into the most bullish environment for stocks, we’d need to see the real earnings yield climb to 2% or more. For that to happen, we need inflation to slow to just 2% or less annually while the market’s earnings yield stays above 4%.

Whether we get that point or not remains to be seen, but it will certainly be something investors will want to keep an eye on going forward.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.