This week’s indicator focuses on interest rates—and why rapid changes in interest rates can negatively affect the stock market.

When we talk about interest rates in the financial world, we often reference the 10-year Treasury rate, the rate at which the federal government borrows for a length of 10 years. This is generally a good benchmark for longer-term rates, so that is the rate our indicator uses.

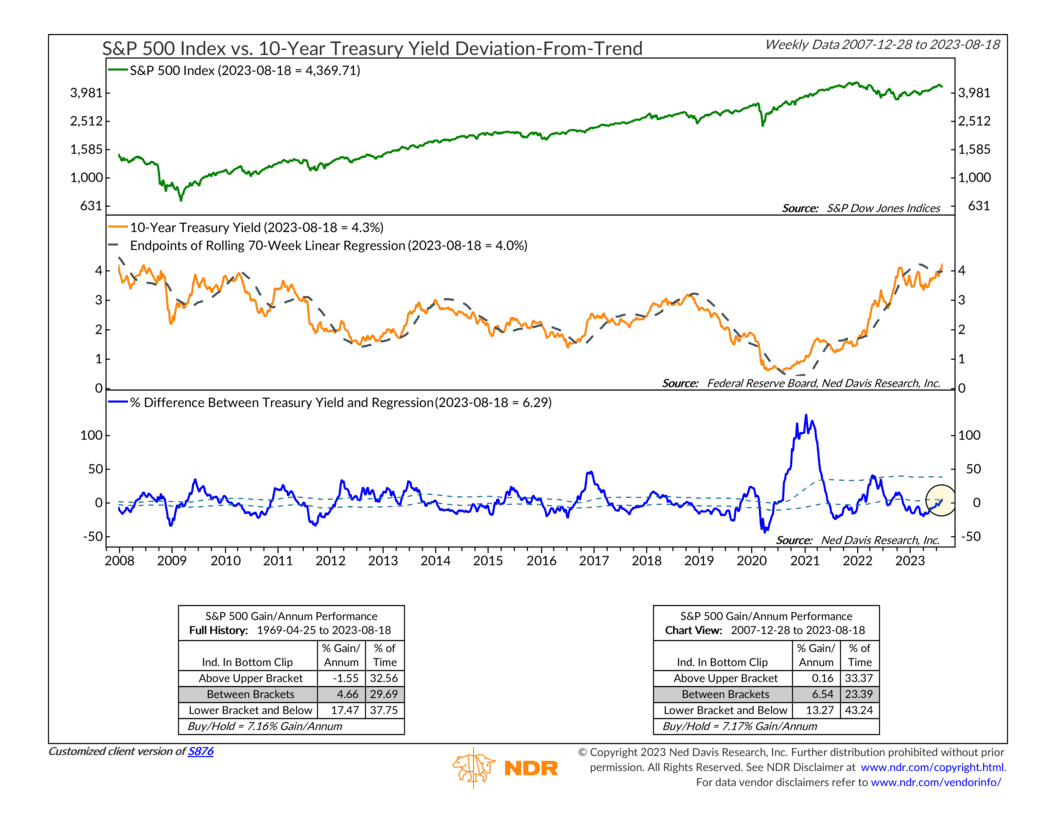

In the middle clip of the chart above, we show both the 10-year Treasury rate and a technical measure called a 70-week linear regression line. The linear regression line can be thought of as an estimate for the 10-year Treasury rate’s recent “trend.” In the bottom clip of the chart, we plot the percentage distance of the 10-year Treasury rate from this linear regression estimate, which gives us an indicator that essentially measures what we call “deviation from trend.”

Basically, when the indicator is above the upper dashed line in the bottom clip, it’s a sign that rates are rising rapidly, which has historically been a poor environment for stock returns. On the other hand, when the indicator is below the lower dashed line, it means rates are falling quickly, which is usually positive for stock returns.

Looking at the recent history of the indicator (the far-right side), we can see that the measure has been below the lower dashed line all year. In other words, the 10-year rate has been below trend, and that has been a bullish tailwind for stock prices.

Last week, however, the indicator finally broke above that lower barrier and is technically in neutral territory (between the dashed lines). Historically, expected returns for stocks drop to more average levels when this is the case.

So, the bottom line is that the rate at which interest rates are moving matters greatly for the stock market. When rates are climbing sharply from recent lows, it produces a riskier environment for stocks. The implication of our deviation-from-trend indicator’s current “neutral” reading suggests that stocks can still produce positive returns in this sort of environment but that they’ll likely be more muted than during the first half of the year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.