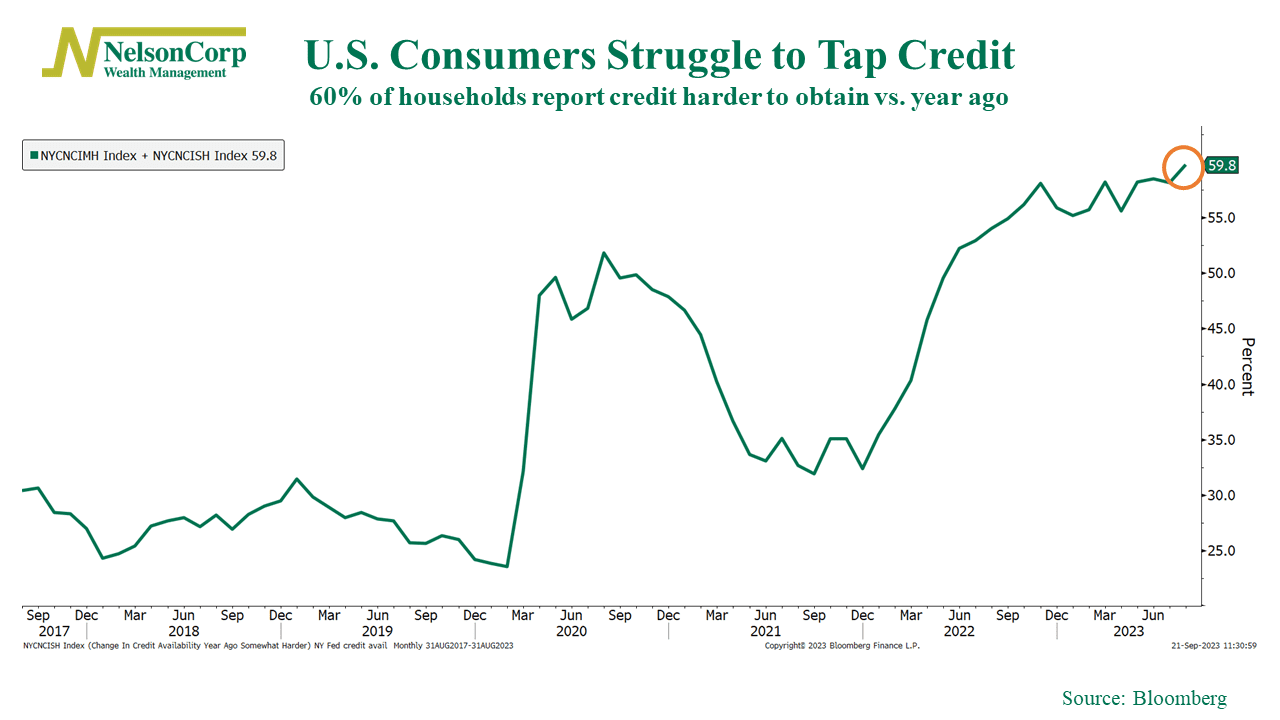

Americans love to spend money. That’s what we do. Resilient American consumers have helped support an economy this year that many believed would slow dramatically. However, as our featured chart this week shows, an important source of consumer spending is now starting to dry up.

The chart above features a survey by the New York Fed in which they asked people how hard it is to obtain credit relative to a year ago. Last month, it jumped to 60%, meaning three out of every five households surveyed find it harder to secure credit this year versus last.

This is concerning because it’s also happening while consumers are draining their excess pandemic savings—and student debt repayments are set to resume next month. With less credit available to help fund purchases, consumers might have no choice but to cut spending, which could put a big damper on economic growth.

The bottom line? Consumers tend to find a way to keep spending, one way or another. But eventually, there’s a tipping point, and consumers start to pull back their spending. We aren’t saying that is necessarily going to happen, but there is a risk out there that consumers will be forced to slow down their purchases with less credit available. That could hurt the economy and stock prices, which is why we try to be aware of these types of risks—and be prepared for them.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.