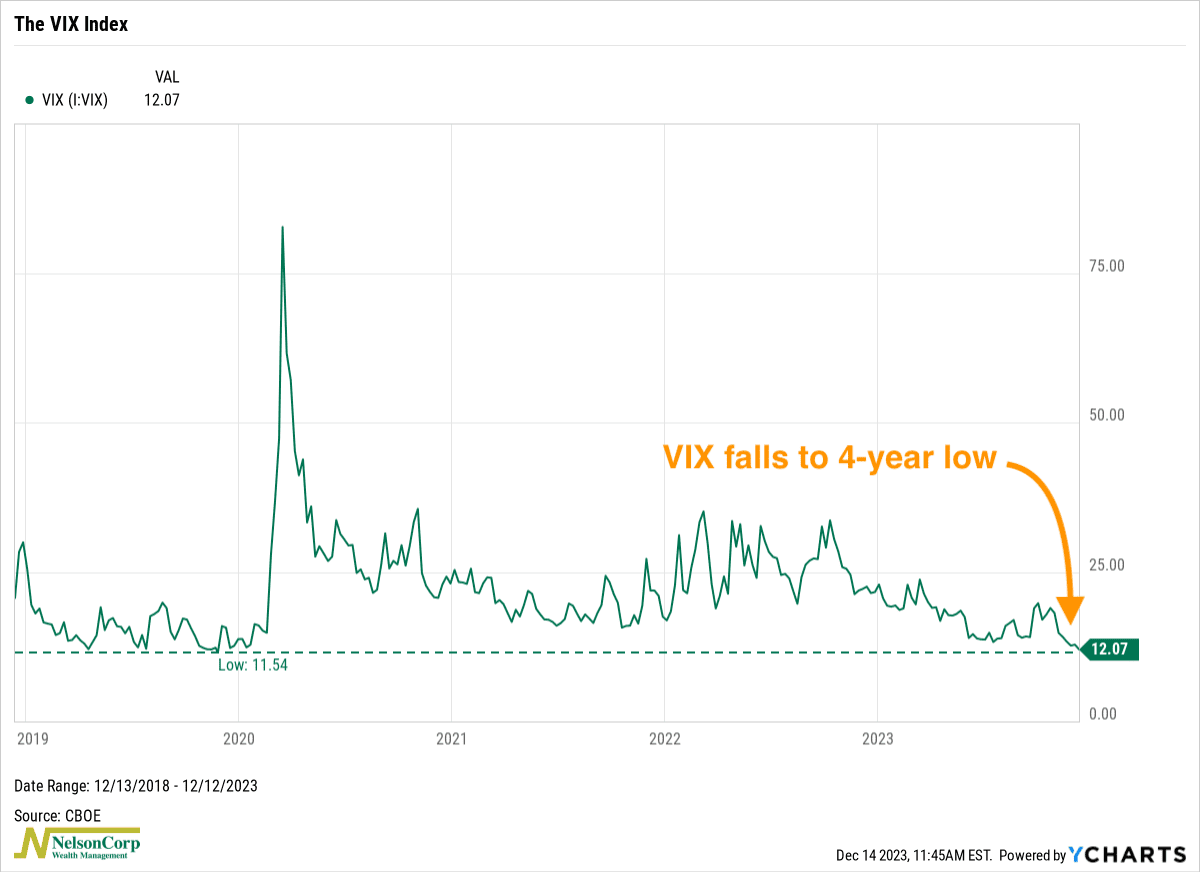

For this week’s chart, we highlight the VIX. No… not that ointment your mom rubbed on your chest when you were sick as a kid. But rather the VIX Index, a measure of market expectations for future stock market volatility.

When the VIX is high, it means traders and investors think the stock market will have big ups and downs, indicating more fear or uncertainty. On the other hand, when the VIX is low, it suggests people expect the market to be calm and stable.

That’s where we are now. The VIX Index dropped to its lowest point in four years this week, going below 12.1. (For reference, the average long-term VIX is about 20). This low VIX reading tells us that traders expect the stock market to move around just 3.5% over the next month.

What’s also interesting is that this low VIX supports the idea that the stock market is on an upswing. That’s because, to paraphrase the investor George Soros, volatility tends to contract or fall once an uptrend is established.

And right now, all signs are pointing to a stock market that’s on the rise.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.