Our nickname for this week’s indicator is the “inflation leader.” Why? Because it tends to lead the broader measures of inflation—like the Producer Price Index and the Consumer Price Index—and can therefore warn us when inflationary pressures are building.

The official name is the Institute for Supply Management (ISM) Price Index. It’s a part of the larger ISM Index, a popular economic gauge that keeps tabs on how the manufacturing sector is doing. Essentially, it spills the beans on what purchasing managers are shelling out for the goods they’re buying. When their costs start skyrocketing, our indicator quickly detects the changes and lets us know.

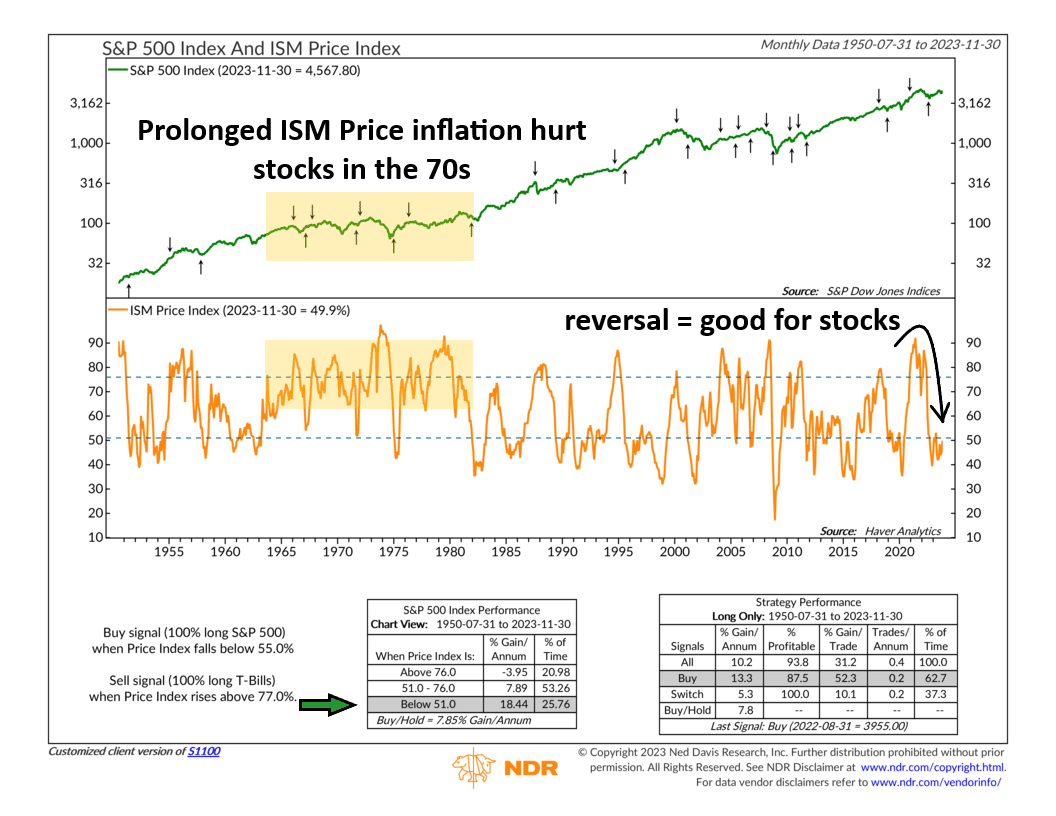

For example, at the start of 2021, the ISM Price Index (orange line, bottom clip) shot above 76 (that upper dashed line). This was a red flag, signaling high inflationary pressures. And guess what? A “sell” signal followed. That’s because inflation tends to send interest rates climbing, shaking up the stock market. True to form, the S&P 500 Index (the green line in the top clip) stumbled into 2022.

History has seen this drama play out before, like in the 1970s. The ISM Price Index remained elevated for more than a decade, repeatedly poking above that upper dashed line, and the stock market suffered as a result.

But things have turned out differently this time around. In August 2022, the ISM Price Index nosedived, dropped below 50, and stayed there. The indicator warned us that broader inflation would fall in the future—and it did, to the benefit of the stock market, which is now nearing all-time highs again.

The lesson? Nailing down inflation is a big deal for investors, given how detrimental it can be for the stock market. The ISM Price Index—our so-called inflation leader indicator—has an excellent track record of telling us where broader inflation is heading. That makes it an essential tool in our toolbox.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.

The S&P 500 Index, or Standard & Poor’s 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.