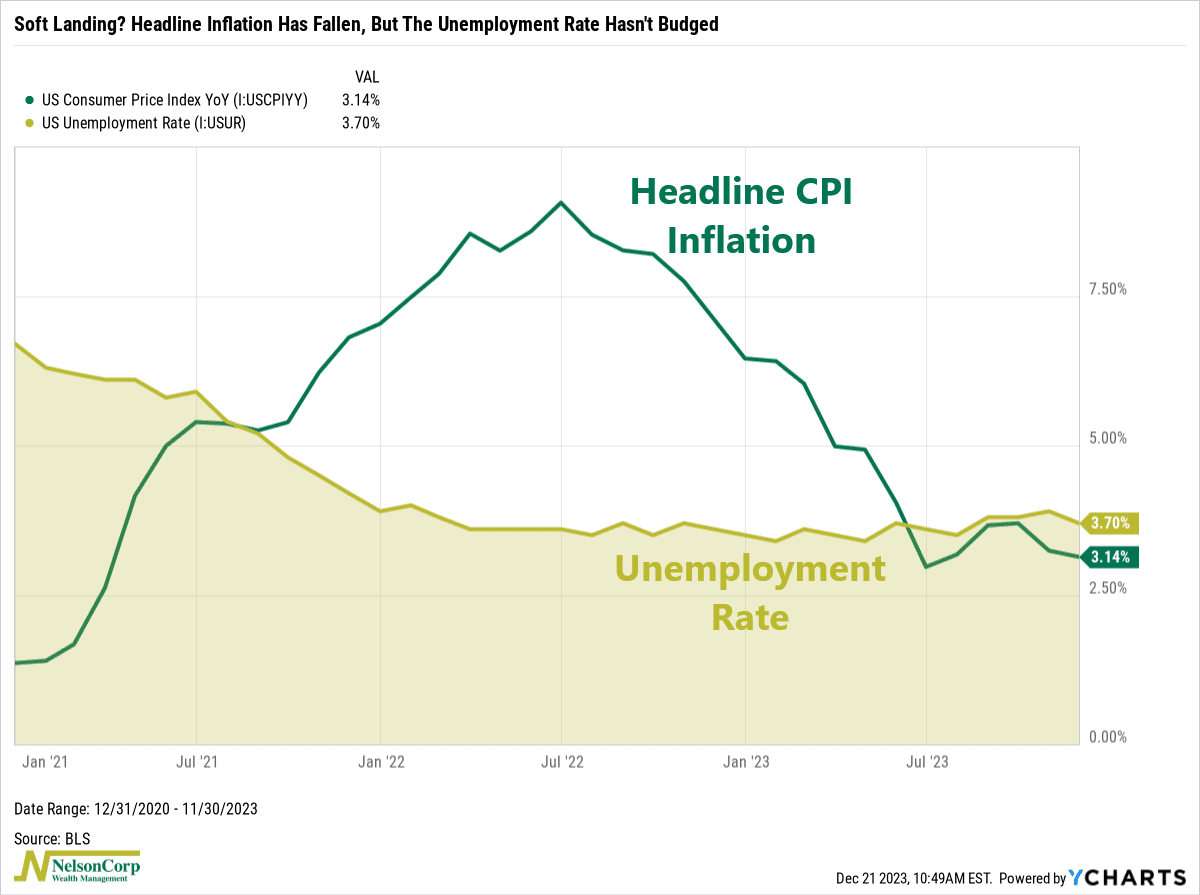

When the Federal Reserve began increasing interest rates in 2022, the big worry was that it would put a lot of people out of work. Initially, the Fed predicted that the unemployment rate would need to rise from 3.7% to 4.4% in 2023, equivalent to 1.2 million job losses, to squash inflation.

But that’s not what happened. Despite the Fed raising the Fed Funds rate to 5.5%, the unemployment rate (shown in the gold-shaded area) remained steady at 3.7% in November, the same as it was in the fall of 2022. Meanwhile, headline inflation (the green line) decreased from its peak of 9.06% in 2022 to just 3.14% today.

In a sense, you could say this has been what economists call a “soft landing.” The Fed raised rates to slow down specific parts of the economy, inflation fell, and the overall economy didn’t suffer much of a slowdown in growth or employment.

Of course, the Fed would still like to see inflation fall more from here, down to their 2% target. But so far, things have turned out better than expected—and that is likely a big reason financial assets have done as well as they have this year.

This is intended for informational purposes only and should not be used as the primary basis for an investment decision. Consult an advisor for your personal situation.

Indices mentioned are unmanaged, do not incur fees, and cannot be invested into directly.

Past performance does not guarantee future results.