by NelsonCorp Wealth Management | Feb 26, 2025 | Financial Focus

This week’s Financial Focus, hosted by Nate Kreinbrink and Mike VanZuiden, covers the complexities of Medicare enrollment and the importance of reviewing options regularly. They emphasize understanding enrollment periods, making informed decisions, and seeking professional guidance to navigate Medicare effectively.

by NelsonCorp Wealth Management | Feb 25, 2025 | 4 Your Money

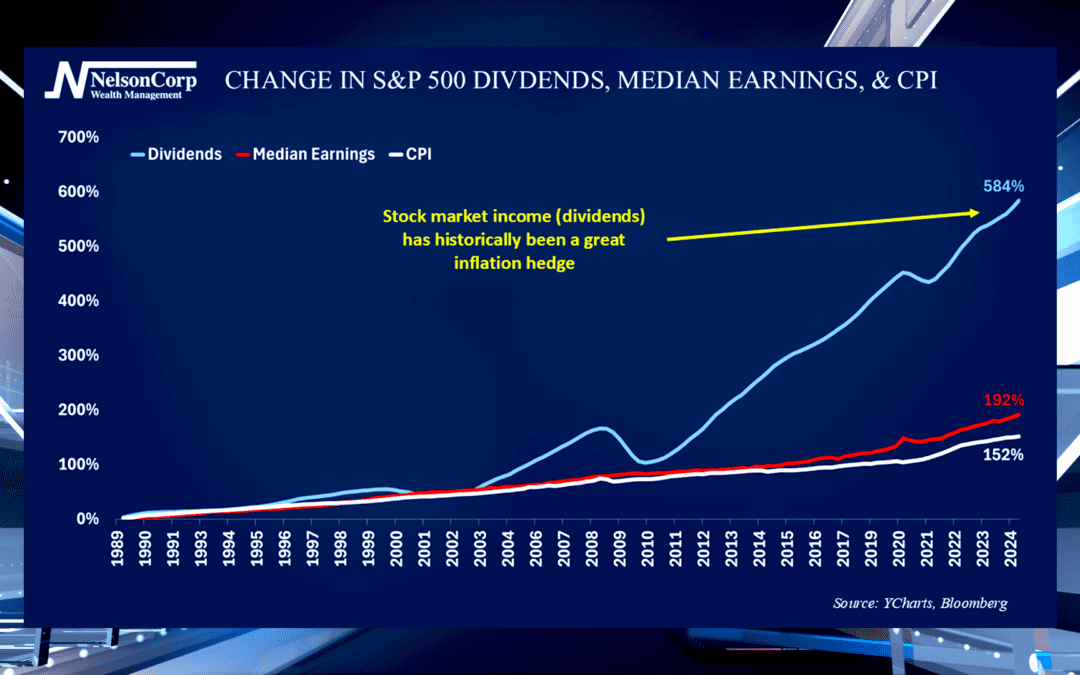

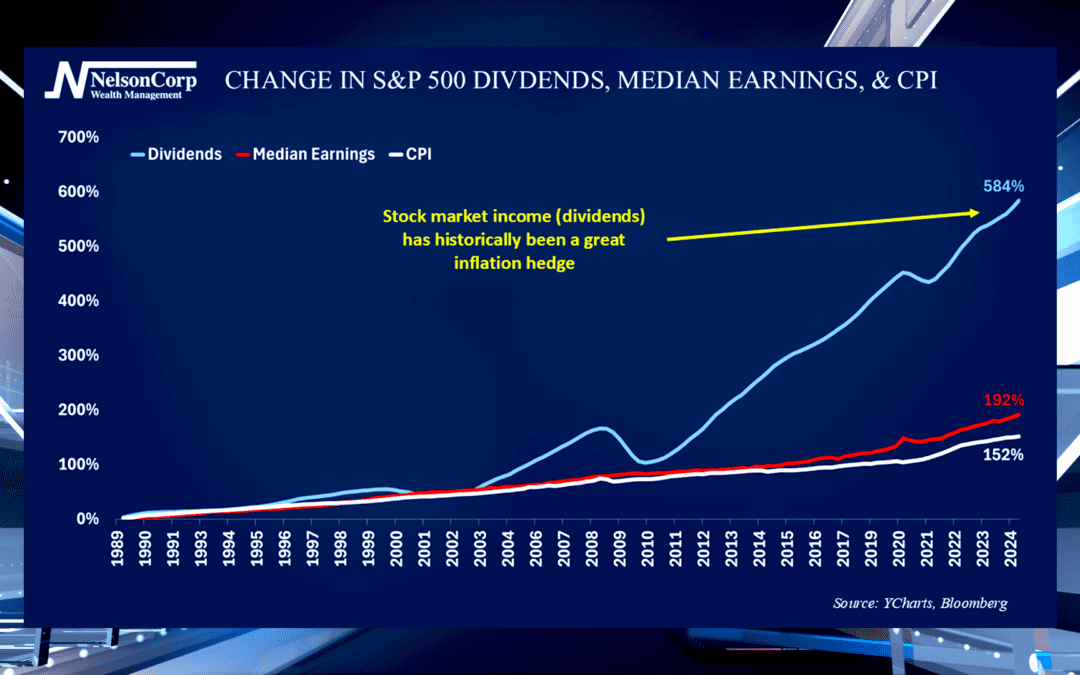

With inflation still a major concern, investors want to know how to protect their purchasing power. David Nelson joins us to explain why investors should not ignore their assets income potential.

by NelsonCorp Wealth Management | Feb 24, 2025 | Weekly Market Thoughts

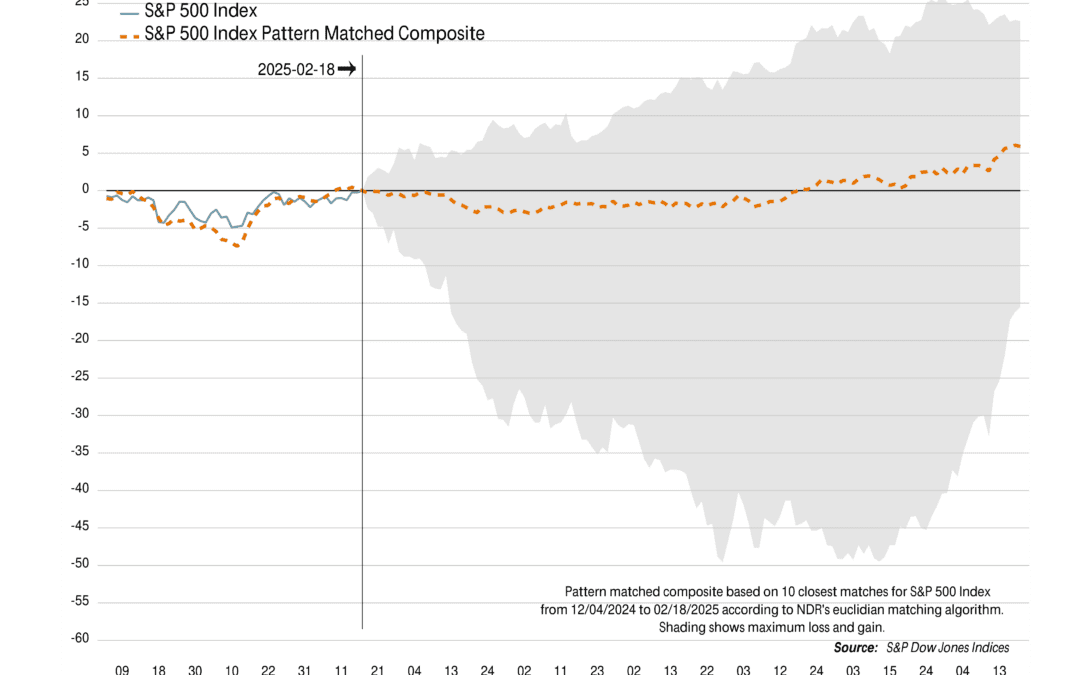

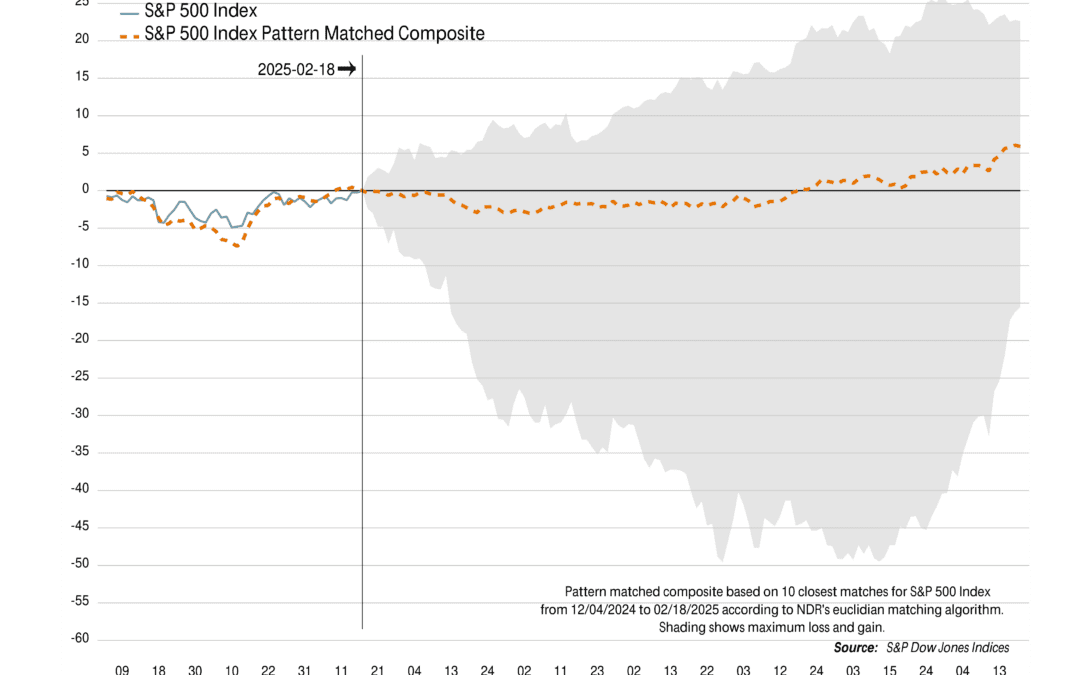

The market has been treading water, but the pressure is building for a big move. Will it be a breakout or a breakdown? History offers some clues—check out this week’s commentary to see what could be coming next!

by NelsonCorp Wealth Management | Feb 21, 2025 | Chart of the Week

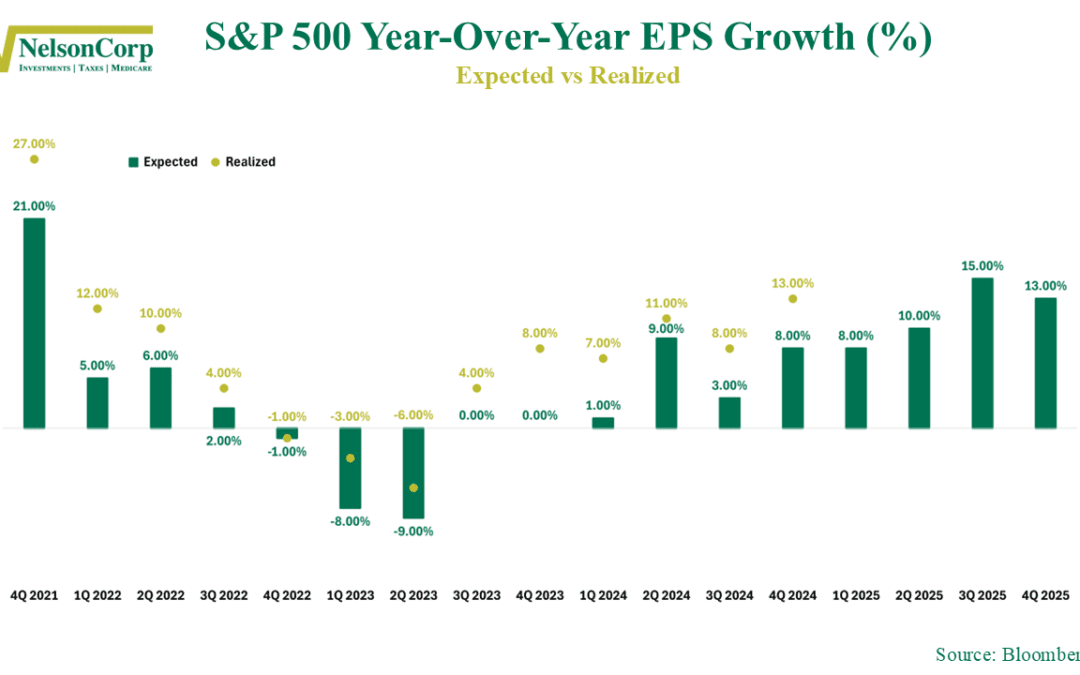

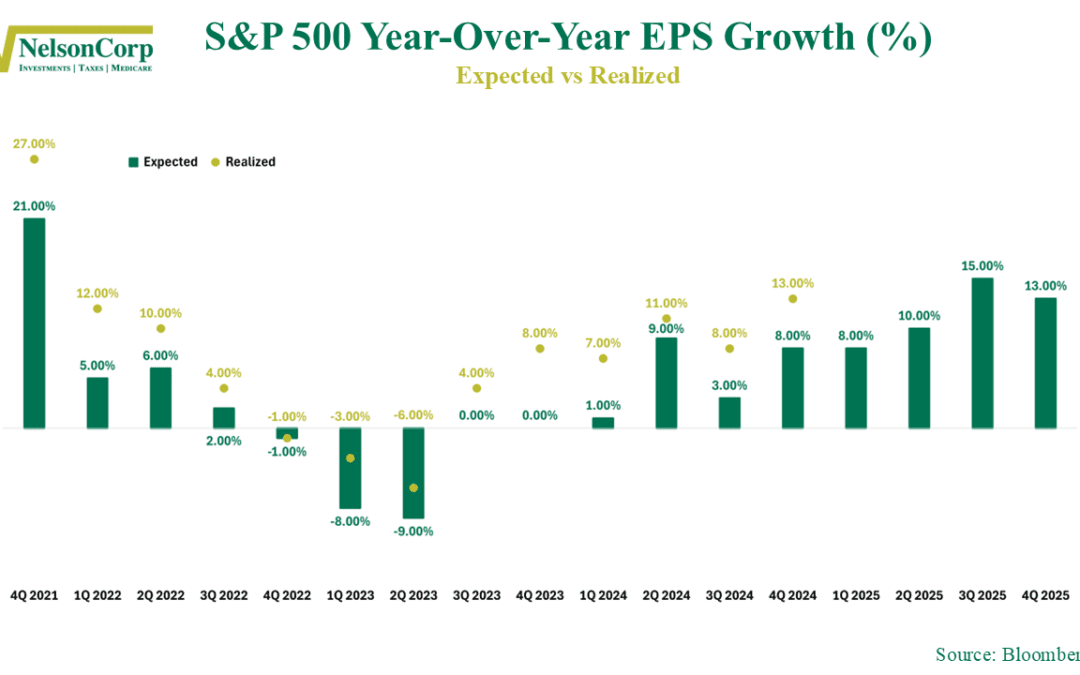

This week’s chart is all about earnings—expectations versus reality, to be exact. Each green bar represents the market’s forecast for S&P 500 year-over-year EPS (Earnings Per Share) growth, while each gold dot shows what actually happened. As you can see,...

by NelsonCorp Wealth Management | Feb 20, 2025 | Indicator Insights

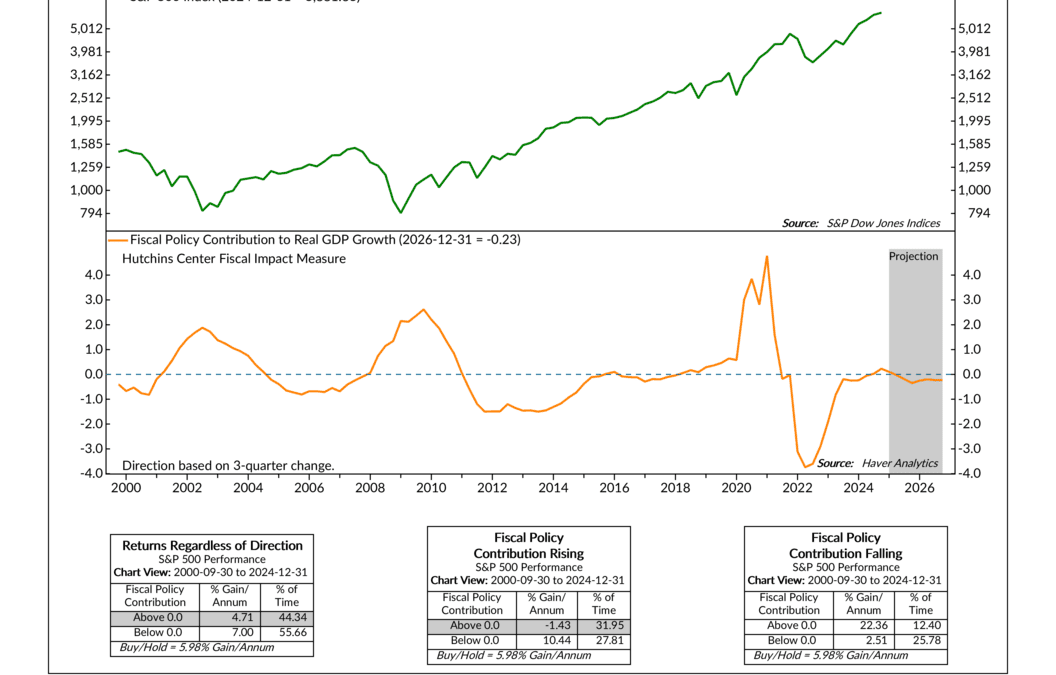

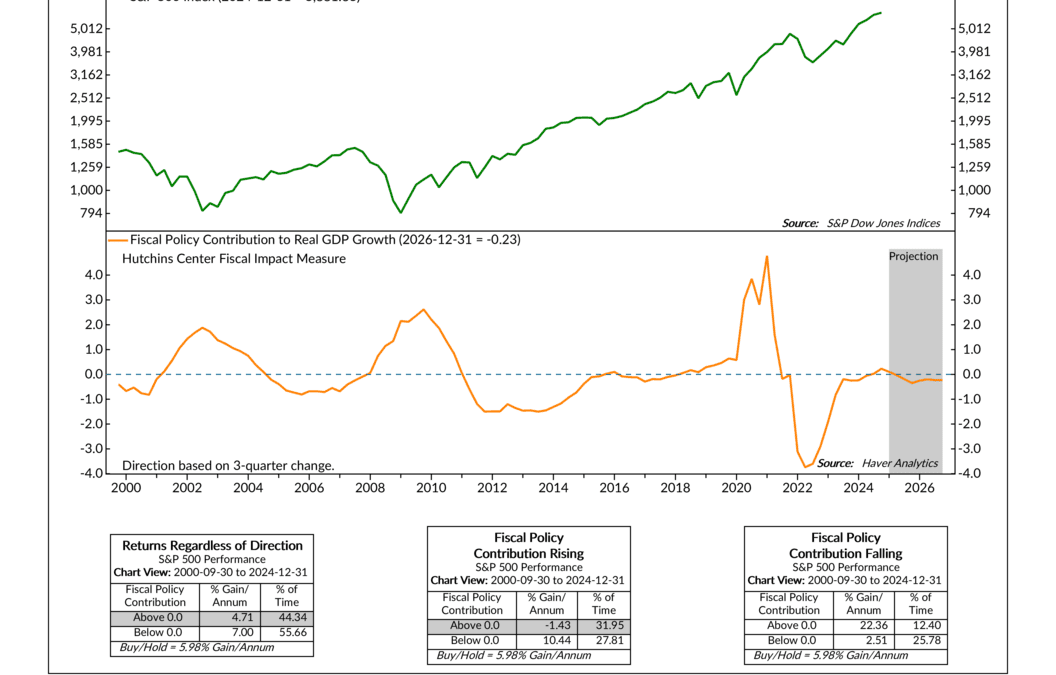

One of the biggest drivers of economic growth is government spending. But here’s the funny thing— as this week’s featured indicator reveals, that spending doesn’t always have the same effect on the stock market. The blue line at the top of the chart tracks the...