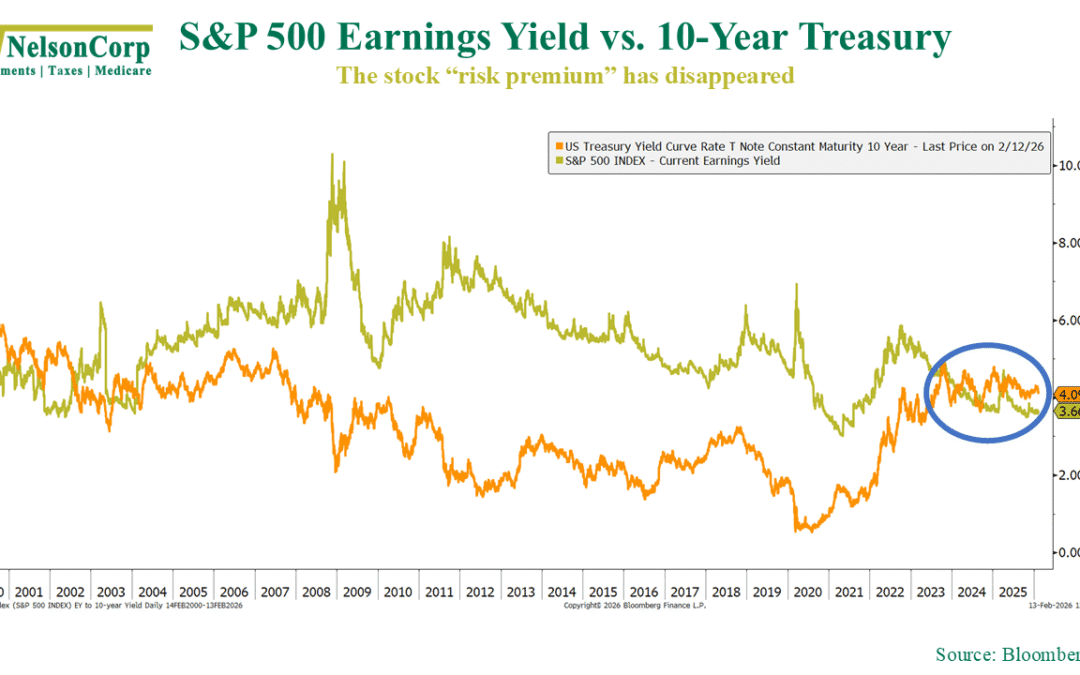

Risk Premium

OVERVIEW Markets leaned more risk-off last week, with pressure concentrated in large-cap growth. The S&P 500 fell 1.39%, the Dow Jones Industrials lost 1.23%, and the NASDAQ dropped 2.10%. The damage was most visible in mega-cap names, as the S&P 100...

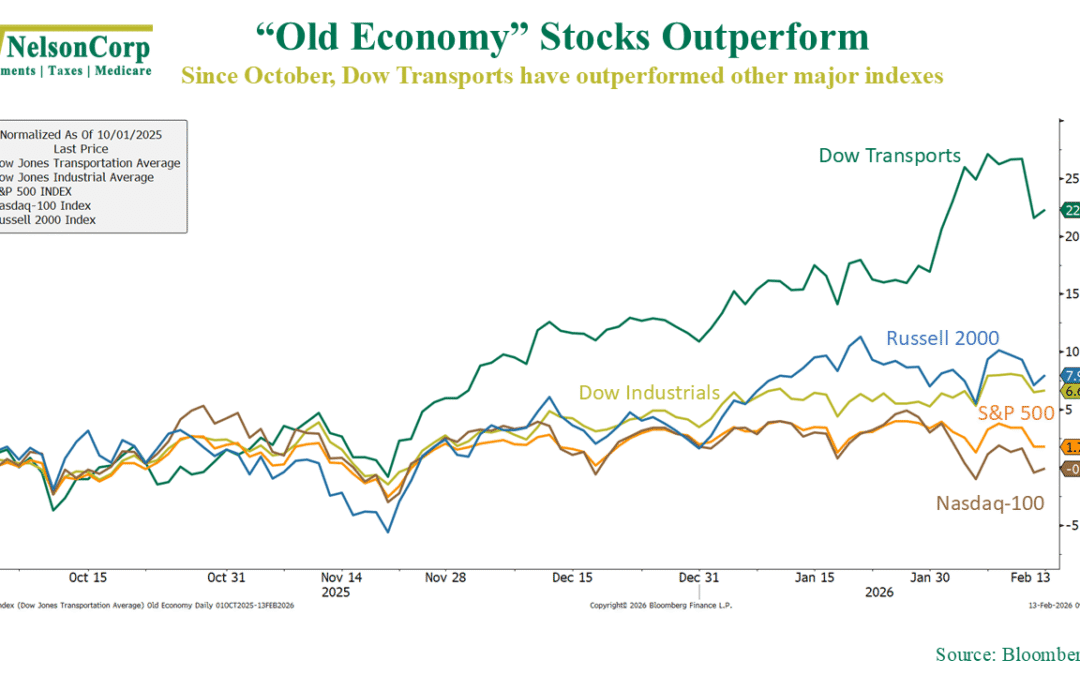

“Old Economy” Takes the Lead

Over the past few months, we’ve seen an interesting shift happening in markets. As this week’s chart shows, the so-called “old economy” stocks have taken the lead. Since early October, the Dow Jones Transportation Average has surged more than 20%, decisively...

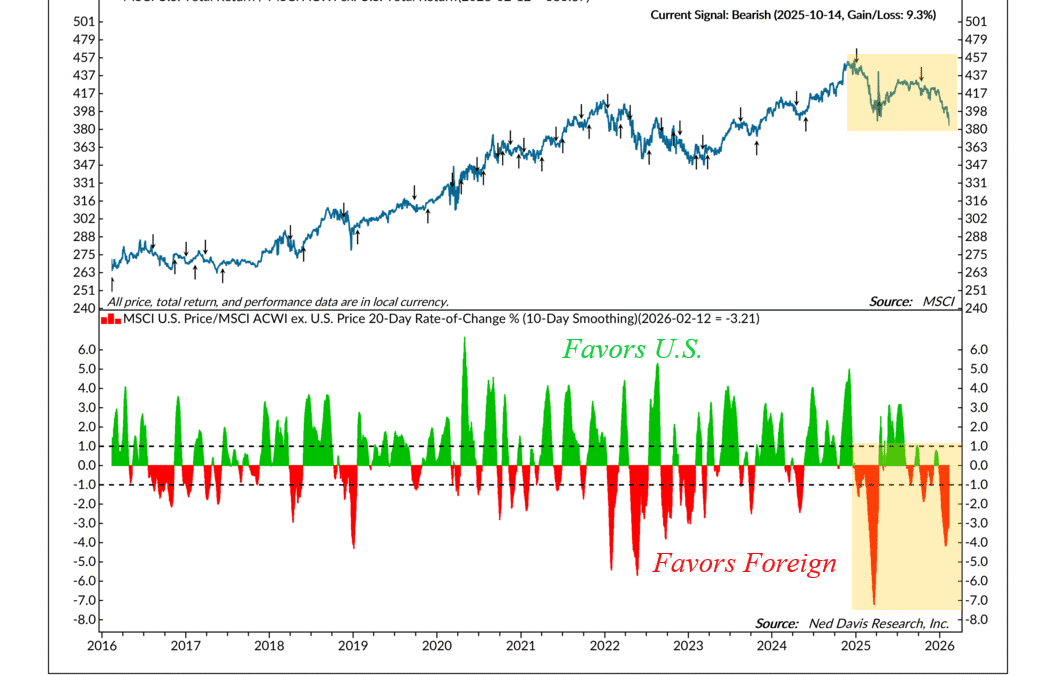

Stay Home or Go Global

I like to call this week’s featured indicator the “Stay Home or Go Global” indicator. This is because it measures the relative strength of the U.S. stock market versus the global stock market. Here’s the basic idea. The top portion of the chart shows the ratio...

Financial Focus – February 11th, 2026

On this week’s Financial Focus, Nate Kreinbrink walks through key tax season reminders and highlights important retirement contribution changes for 2026, including new IRA and 401(k) limits and updated catch-up rules. He also shares practical tips to help you stay organized, adjust withholdings if needed, and start the year on the right financial foot.

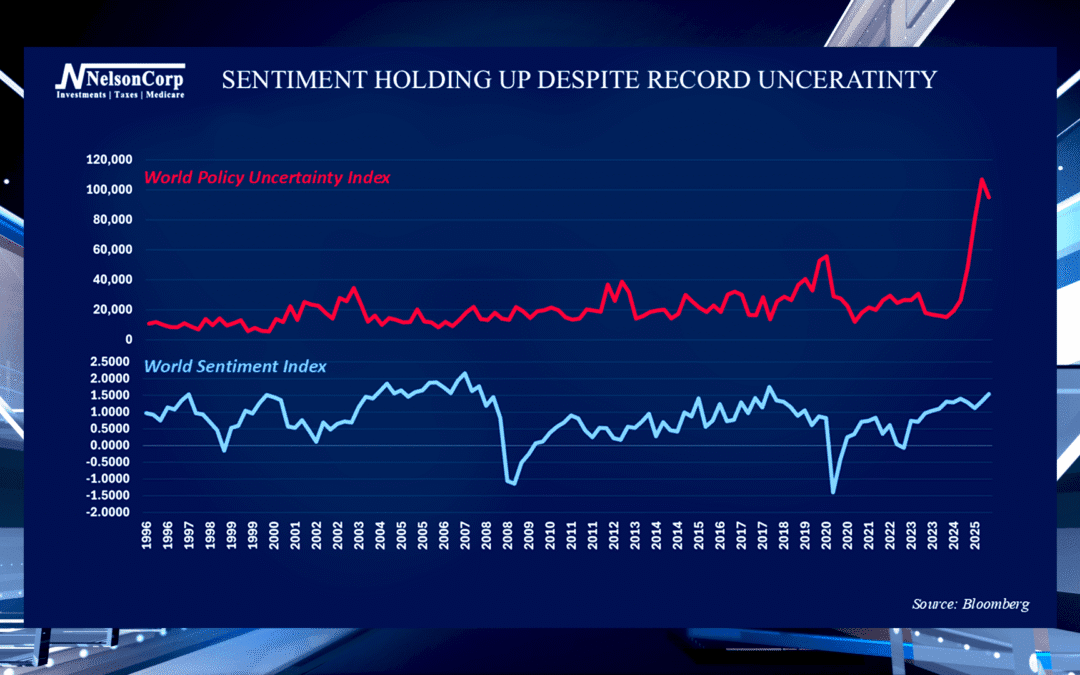

The Uncertainty Puzzle

While there is significant uncertainty in the world right now, political and economic, it does not always translate to the markets. James Nelson compares sentiment data and reminds us that headlines should not drive investment decisions.

Profit Taking

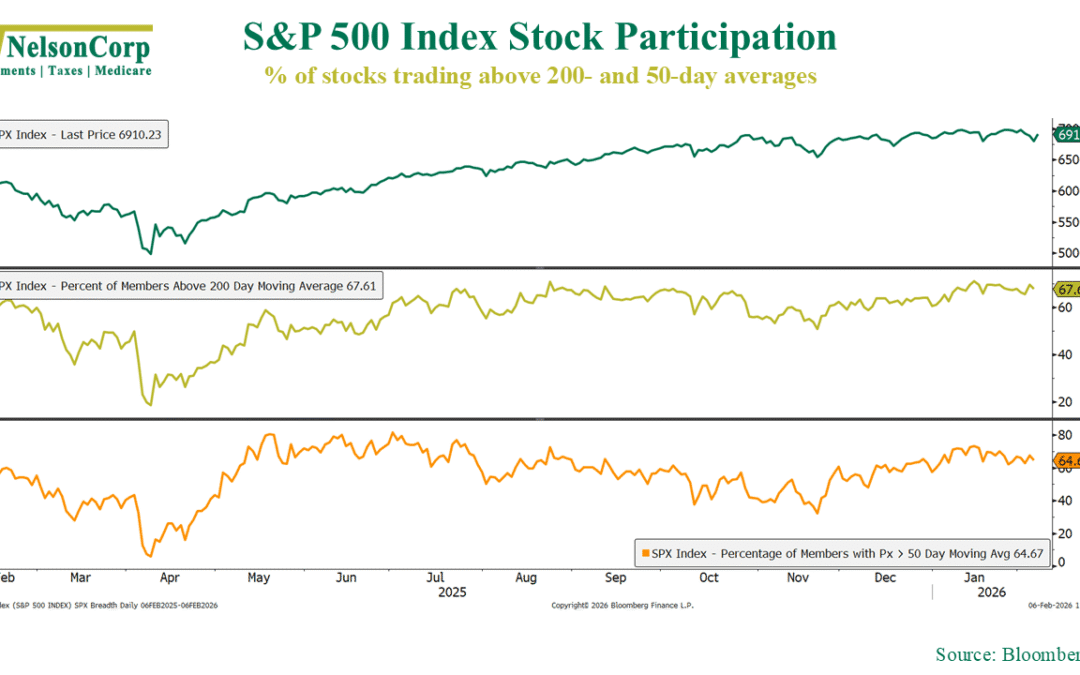

OVERVIEW Markets were mixed last week, with sharp rotation beneath the surface. The S&P 500 slipped 0.10%, while the Dow rose 2.50%. The NASDAQ fell 1.84% after a tech-led selloff earlier in the week, though a rebound on Friday helped stabilize sentiment....

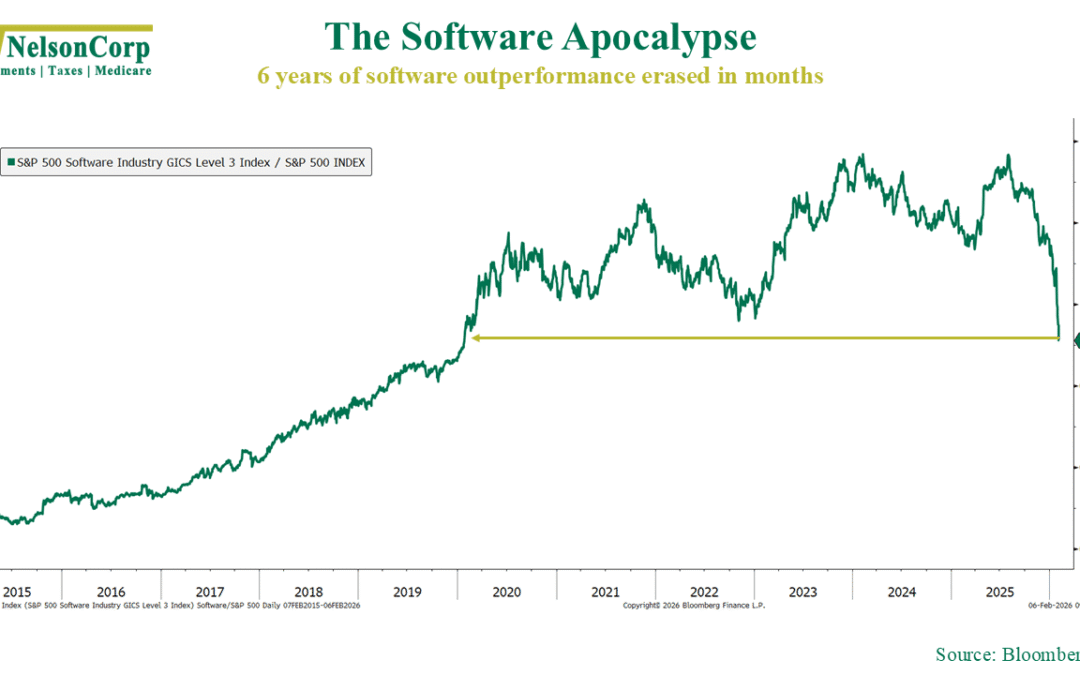

Vibe Coding Disruption

It was a rough week on Wall Street for technology stocks, and software took the brunt of it. This week’s chart shows the relative performance of the S&P 500 Software sector compared to the broader S&P 500. It’s a brutal picture. Nearly six years of...

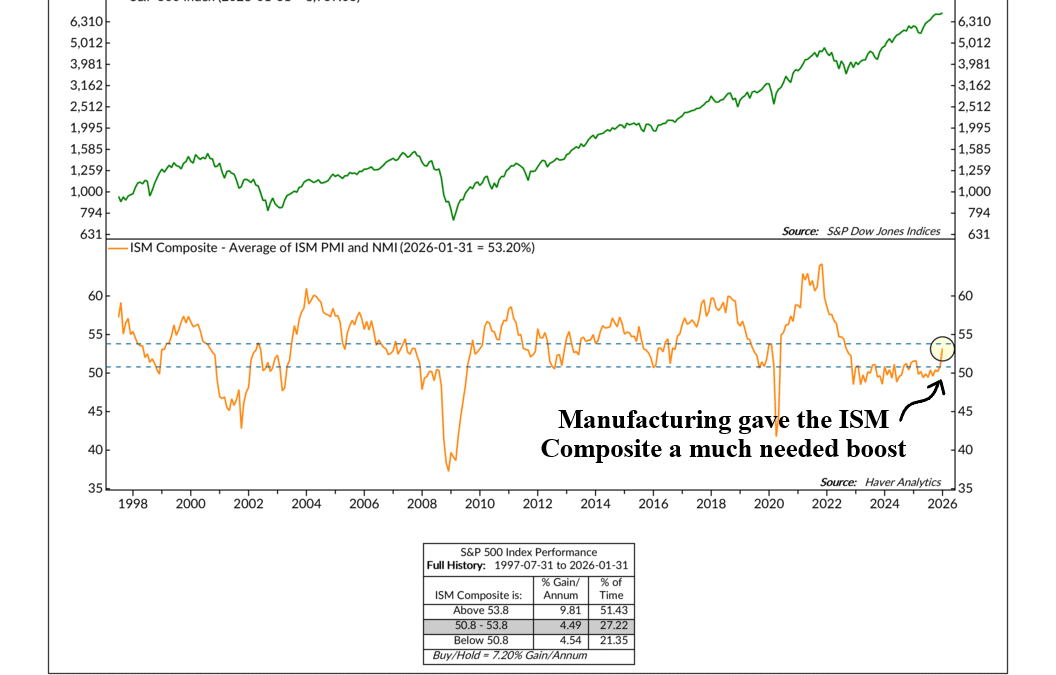

Manufacturing Momentum

The good news on Wall Street this week came from a place that has been stuck in the mud for a while: manufacturing. The latest Institute for Supply Management Manufacturing index jumped to 52.6, up from 47.9 previously. This was significant for a couple of...

Financial Focus – February 4th, 2026

Markets feel a lot more uncertain than they did just a month ago, and that shift in mood is starting to show up in how investors are thinking about risk. This week on Financial Focus, David Nelson explains why volatility stirs emotions, why hiding in cash can quietly hurt long-term plans, and how thoughtful portfolio management is meant to help investors stay steady when markets get choppy.

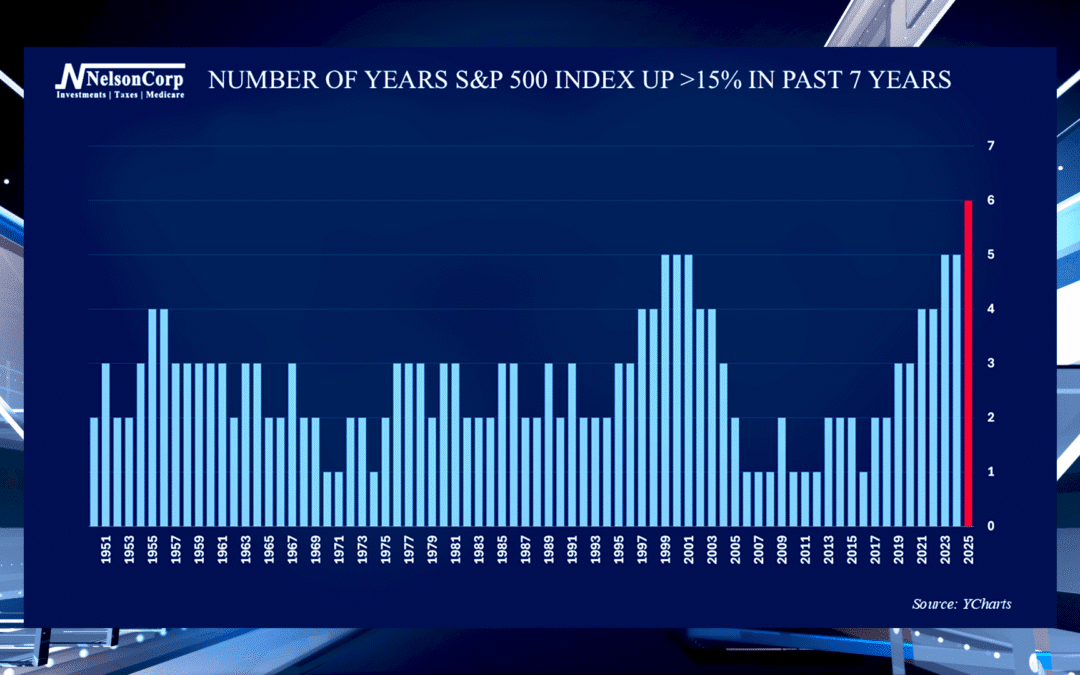

On A Heater

The stock market has continued a successful run the past several years. David Nelson shares the bigger picture by looking at historical patterns and what this current run means for investors.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.