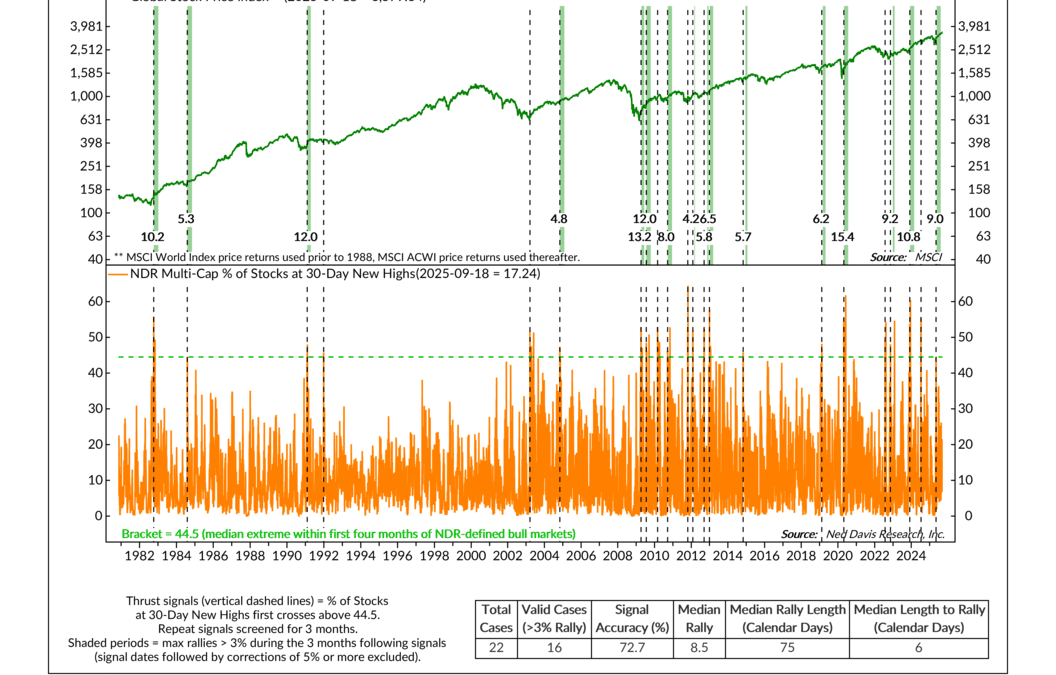

Strength in Numbers

Markets love confirmation. Sure, it’s one thing to see stock prices climb higher, but it’s another to see a broad swath of companies participating in the move. That’s what’s this week’s featured indicator is all about. It measures the percentage of global...

Financial Focus – September 17th, 2025

Medicare open enrollment is just around the corner, and Nate and Mike break down what you need to know before making any changes to your coverage. From common mistakes to planning tips, they share practical advice to help you navigate the process with confidence.

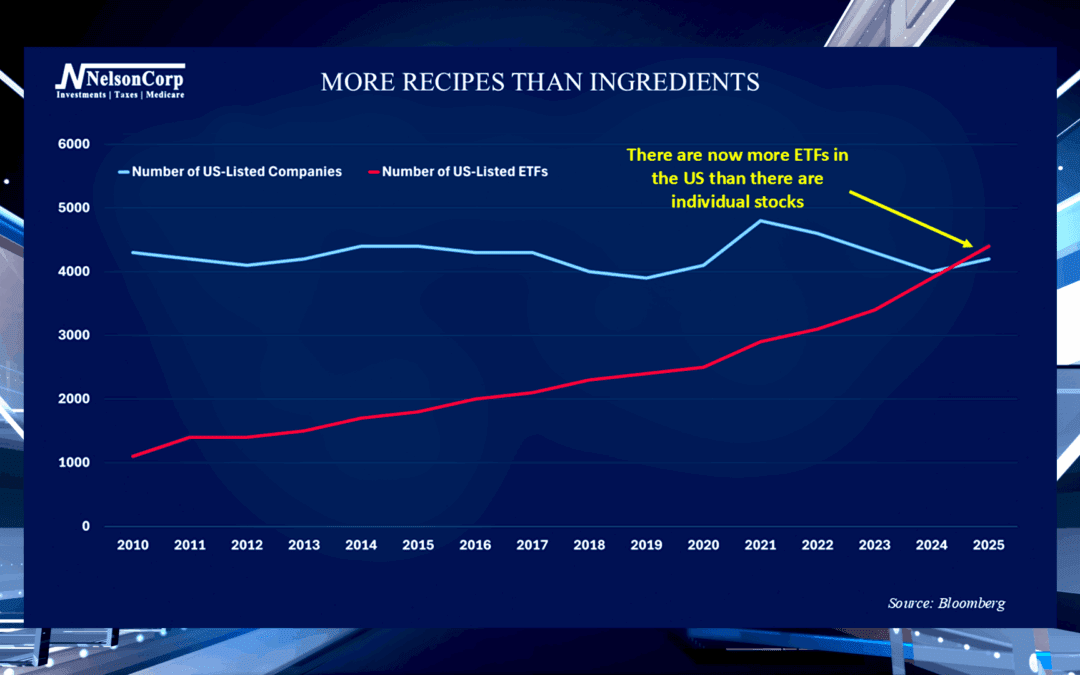

More Recipes than Ingredients

The investment marketplace keeps evolving with new products and strategies being introduced all the time. Nate Kreinbrink is here to discuss ETF’s and how this packaged investment option is trending.

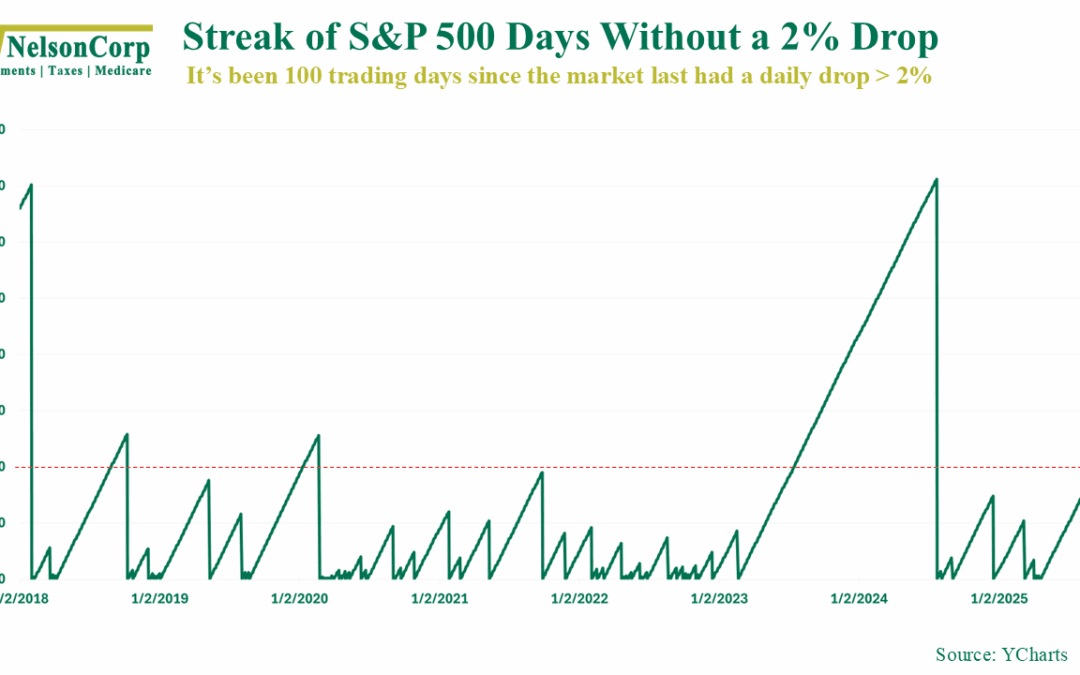

Head on a Swivel

OVERVIEW Markets finished the week with a mix of winners and laggards. The S&P 500 rose 1.59%, while the Dow added a smaller 0.95%. The NASDAQ led the major U.S. benchmarks with a 2.03% gain. Broad measures were also strong, with the Russell 3000 up 1.48%....

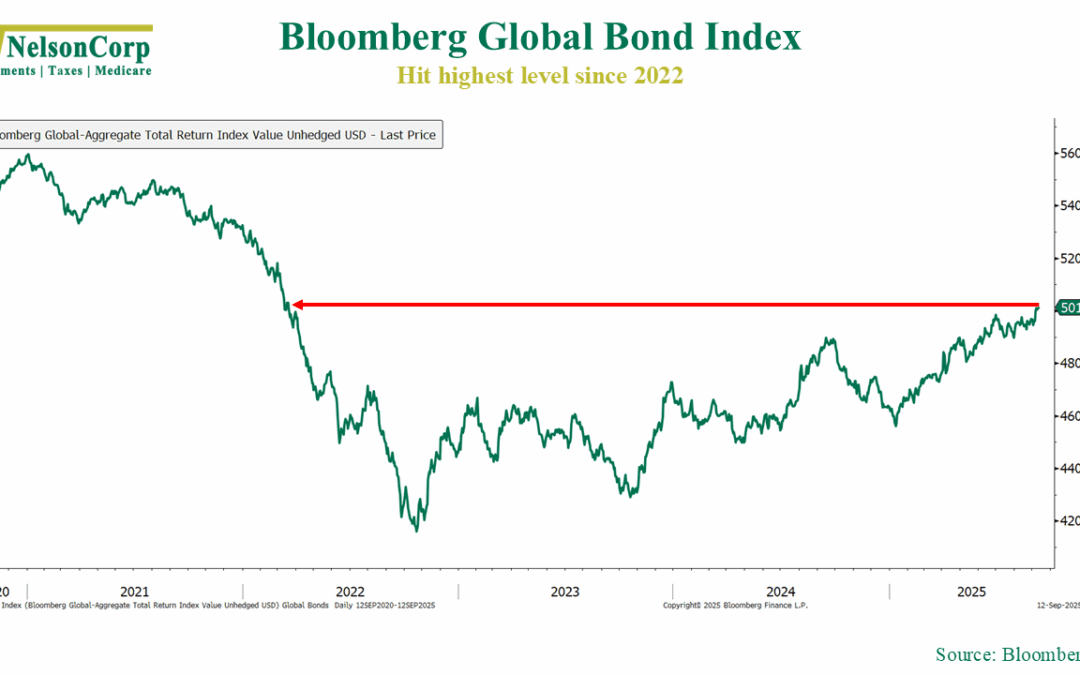

The Big Bond Bounce

Are bonds back? They’re certainly looking feisty again. As this week’s chart above shows, the Bloomberg GlobalAgg Index, which tracks returns on sovereign and corporate debt across developed and emerging markets, has surged more than 20% from its 2022 low—and...

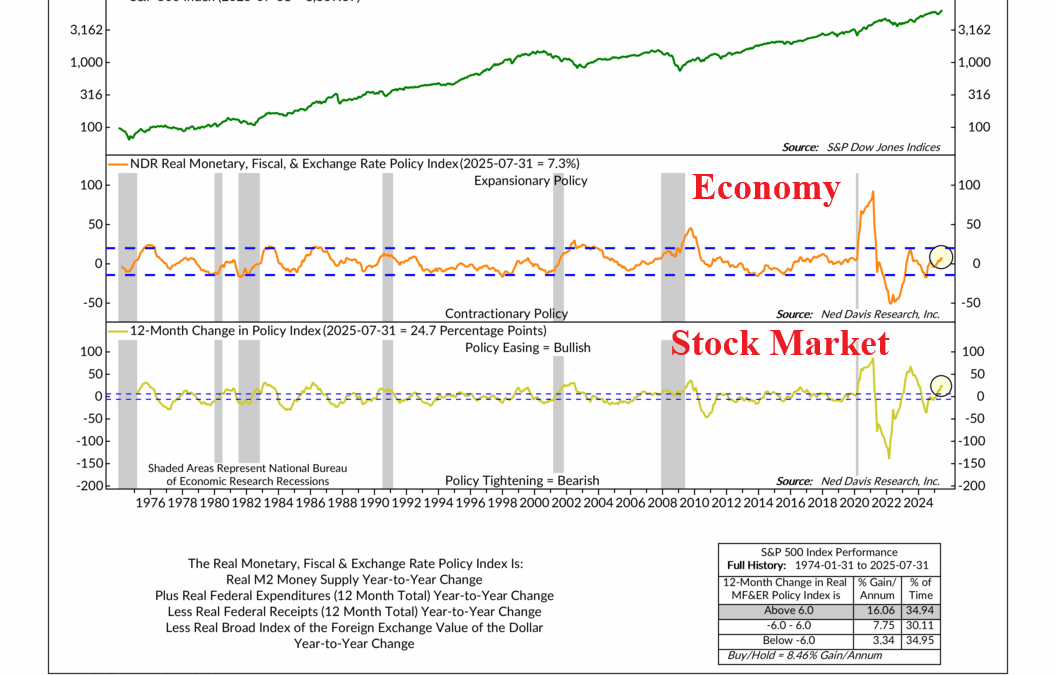

A Monetarist and Keynesian Walk Into a Bar

This week’s insight starts with a quick trip down economic history lane. For decades, two schools of thought have debated what really drives the economy. Monetarists believe the answer lies in the money supply. In times of economic weakness, increases in the...

Financial Focus – September 10th, 2025

This week’s Financial Focus dives into the often-overlooked role of insurance in a complete financial plan. From income replacement for young families to changing needs later in life, Nate Kreinbrink explains why the right coverage matters and how term and permanent policies fit into the bigger picture.

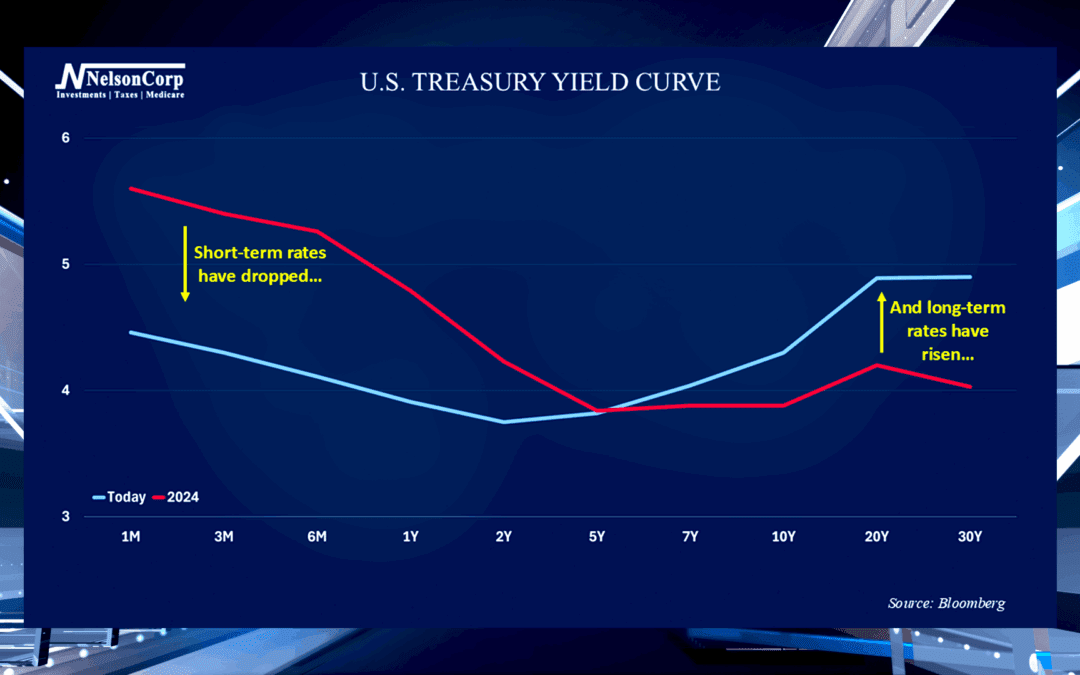

Teeter Totter

The financial markets seem to always be in a state of flux these days. David Nelson explains how the yield curve compares investments with different maturity dates and how the shape of the yield curve is a tool to forecast future interest rates.

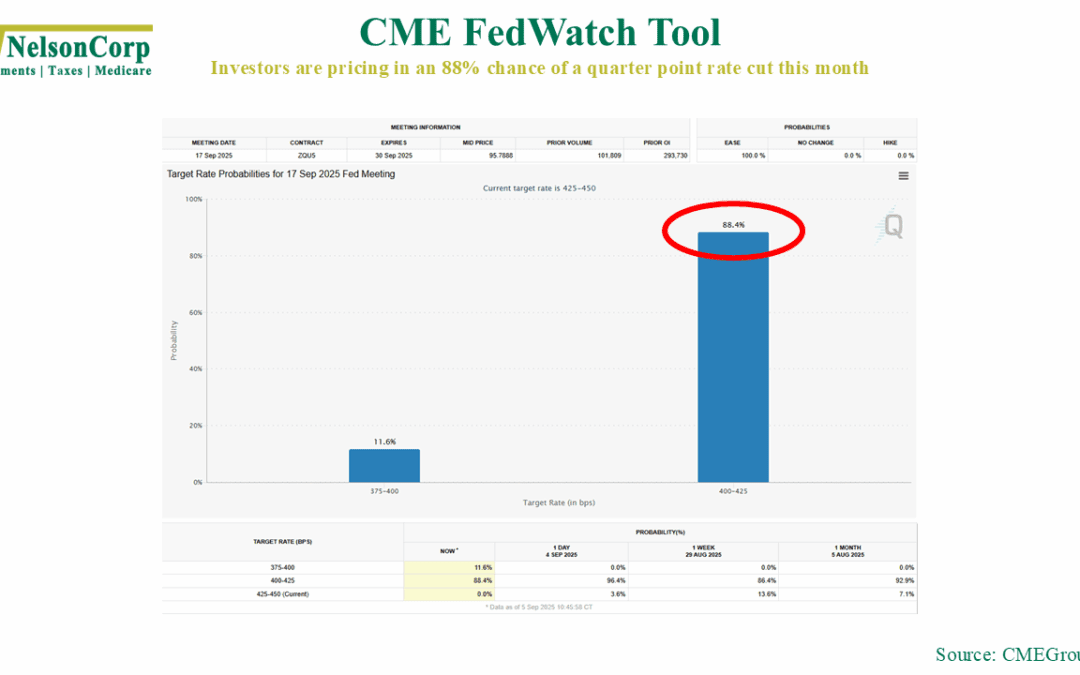

Adding Punch to the Punchbowl

OVERVIEW Markets turned in mixed results last week. The S&P 500 gained 0.33%, while the Dow Jones Industrial Average slipped 0.32%. The NASDAQ led among major U.S. indexes with a 1.14% advance. Broad measures like the Russell 3000 added 0.46%, with growth...

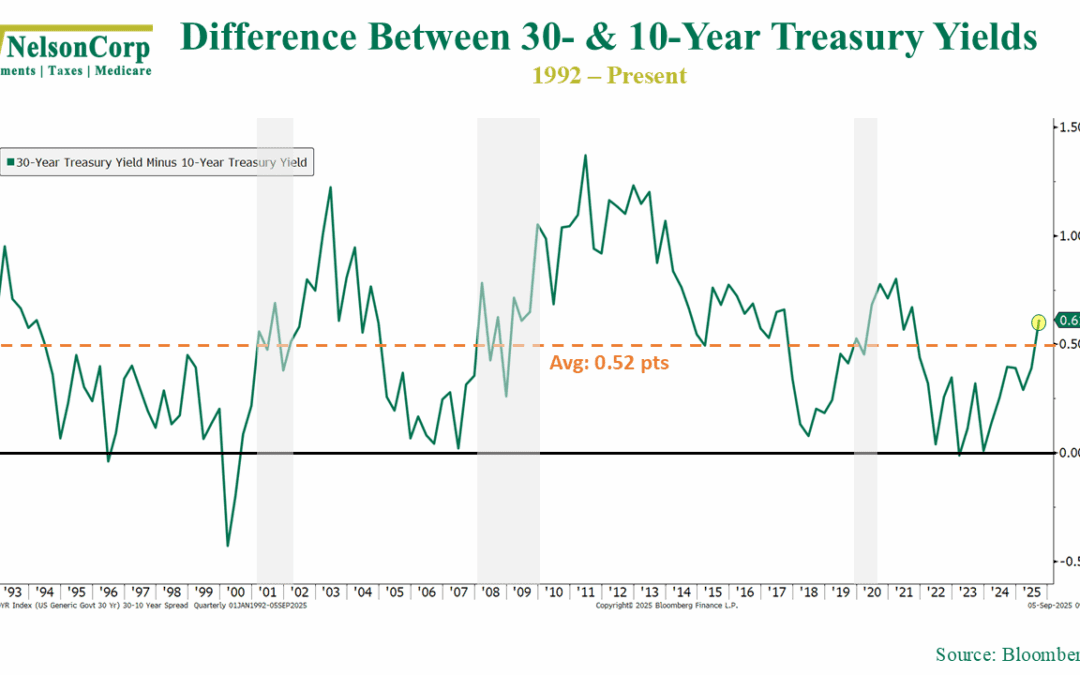

The Long and the Short of It

There’s been a bit of chatter lately about 30-year Treasury yields and the fact that they have been inching up towards 5%. As a reminder, the 30-year Treasury yield is the interest the U.S. government promises to pay you each year if you let them borrow your...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.