All In, Less to Win

There’s a well-known saying in science the correlation does not equal causation. We know this to be true. Just google “spurious correlations” and you’ll find endless examples of two completely unrelated data points that appear to move together. For example,...

Financial Focus – October 1st, 2025

Check out this week’s Financial Focus, where David Nelson talks about the market’s reaction to the government shutdown and why history shows resilience through the noise. He also explains why protecting against big losses is key to long-term success.

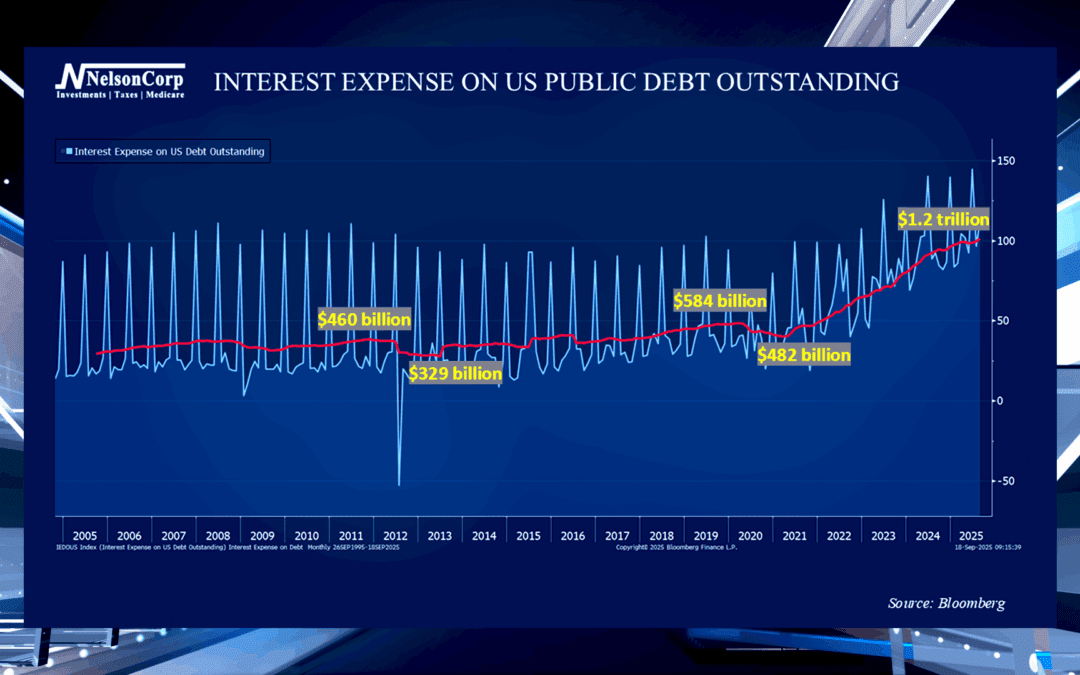

The Soaring Cost of Interest

National debt tends to grab many headlines. David Nelson explains why the amount of interest we are paying on this debt should also be drawing our country’s attention

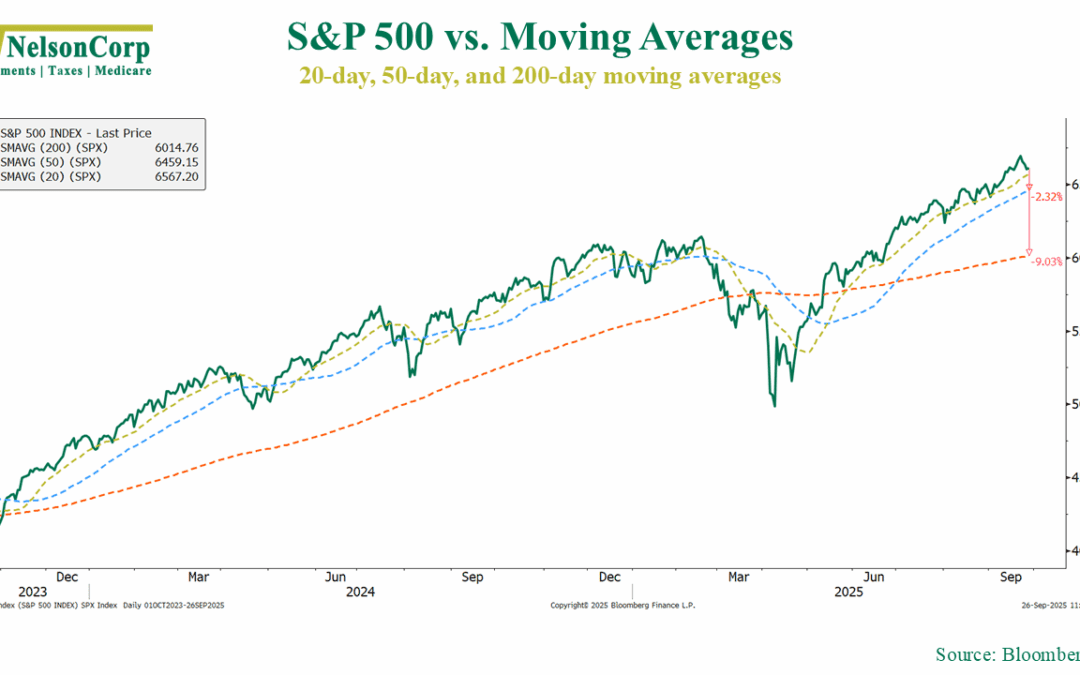

A Tired Stock Market

OVERVIEW Markets slipped last week, with losses across most major equity benchmarks. The S&P 500 fell 0.31%, while the Dow declined a more modest 0.15%. The NASDAQ lagged with a 0.65% drop. Broad measures were weaker too, as the Russell 3000 slid 0.40%....

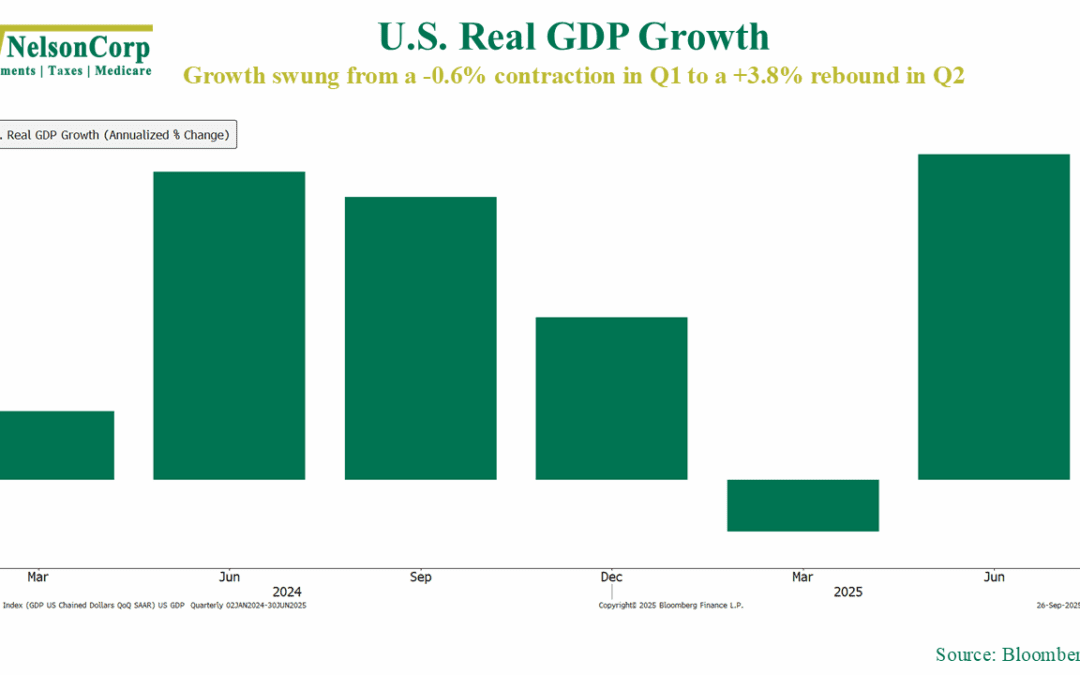

Growth Swing

The U.S. economy is looking pretty strong again—or at least it was last quarter. Real GDP growth was revised in the second quarter to 3.8%, a sharp rebound from the -0.6% decline in the previous quarter. As a reminder, real GDP is a measure of...

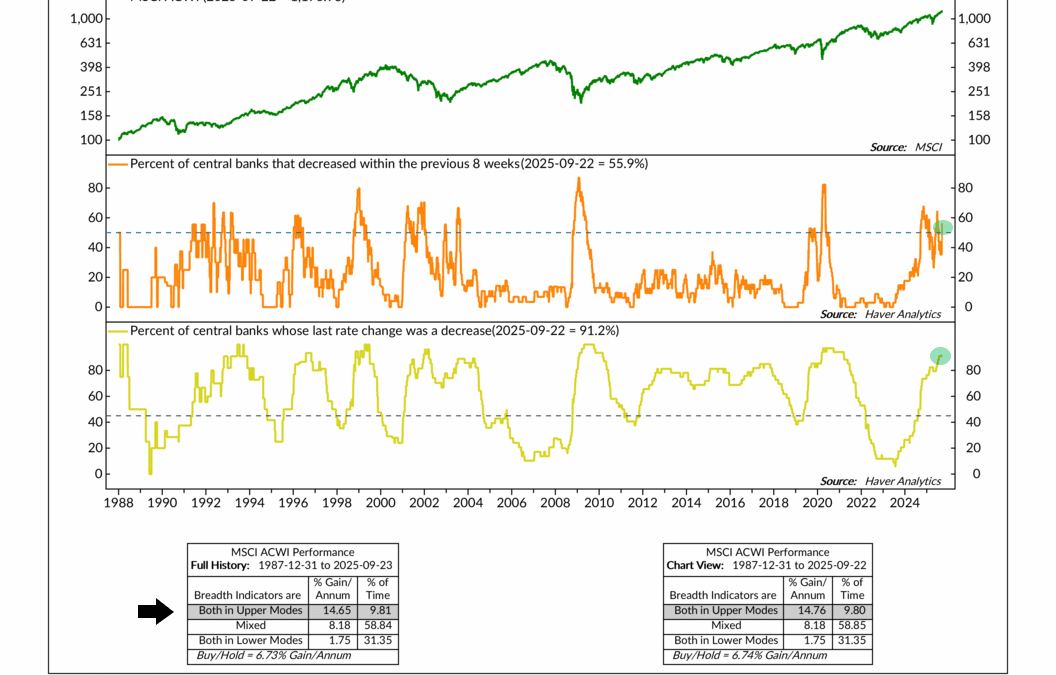

The Easing Effect

This week’s indicator is all about central banks. What are central banks? They’re like the “money boss” of a country. They decide how much money should be in circulation and set interest rates to help maintain price stability. It’s the setting of interest rates...

Financial Focus – September 24th, 2025

On this week’s Financial Focus, Nate and Andy tackle timely tax changes, including the IRS ending paper check transactions. They also share insights from the latest IRS Tax Forum and what it all means for taxpayers heading into year-end.

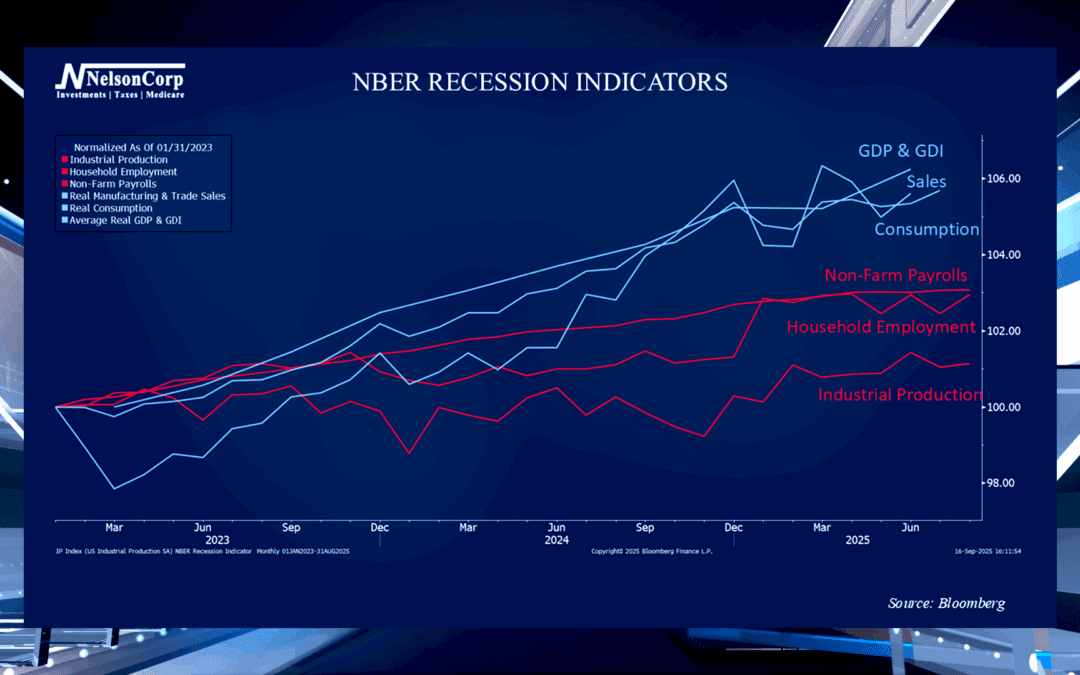

Recession Radar

Few topics draw more attention than the economy. David Nelson is here to break down the indicators that help us understand it best.

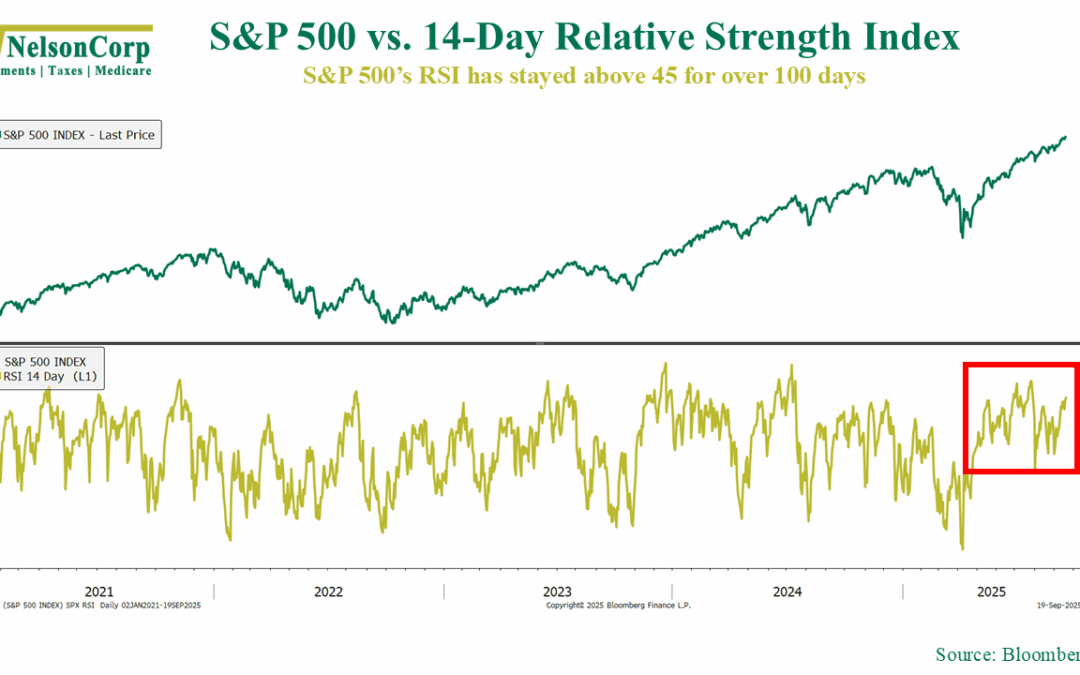

Exhaustion Signal?

OVERVIEW Markets finished the week broadly higher, with technology once again leading the way. The S&P 500 gained 1.22%, while the Dow added 1.05%. The NASDAQ outpaced both, rising 2.21%. Broad measures were also strong, as the Russell 3000 advanced 1.30%....

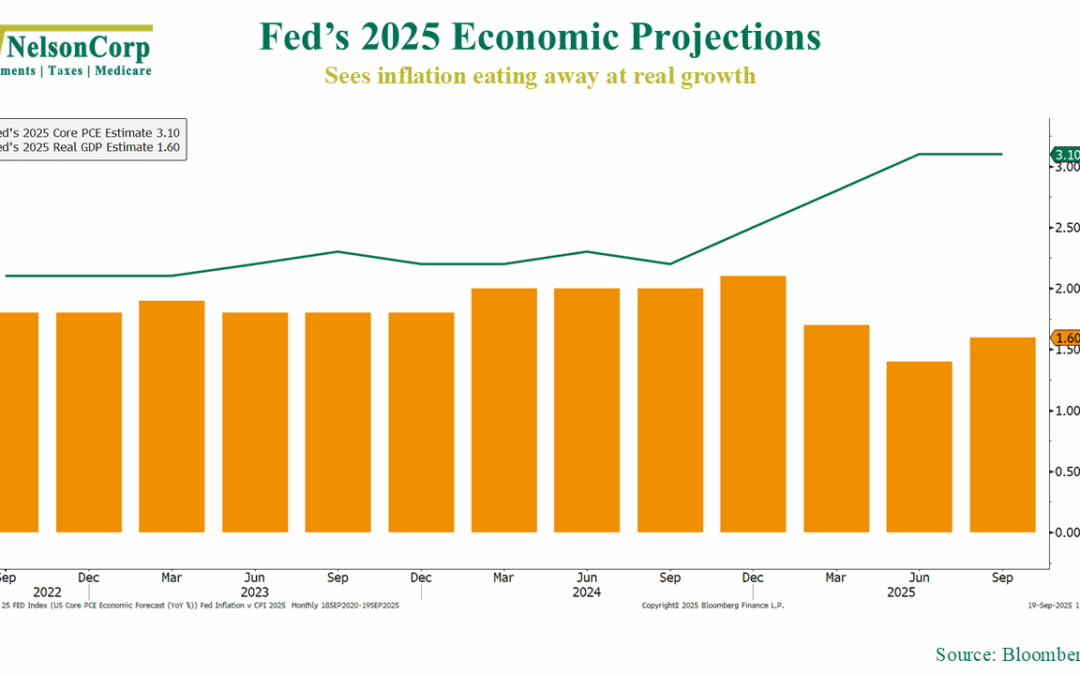

Stagflation-lite

Well, it didn’t come as a surprise, but the Fed went ahead and cut rates this week—their first move since last December. What was more interesting, though, were the new economic projections. This week’s chart shows the Fed’s outlook for 2025. The bars track...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.