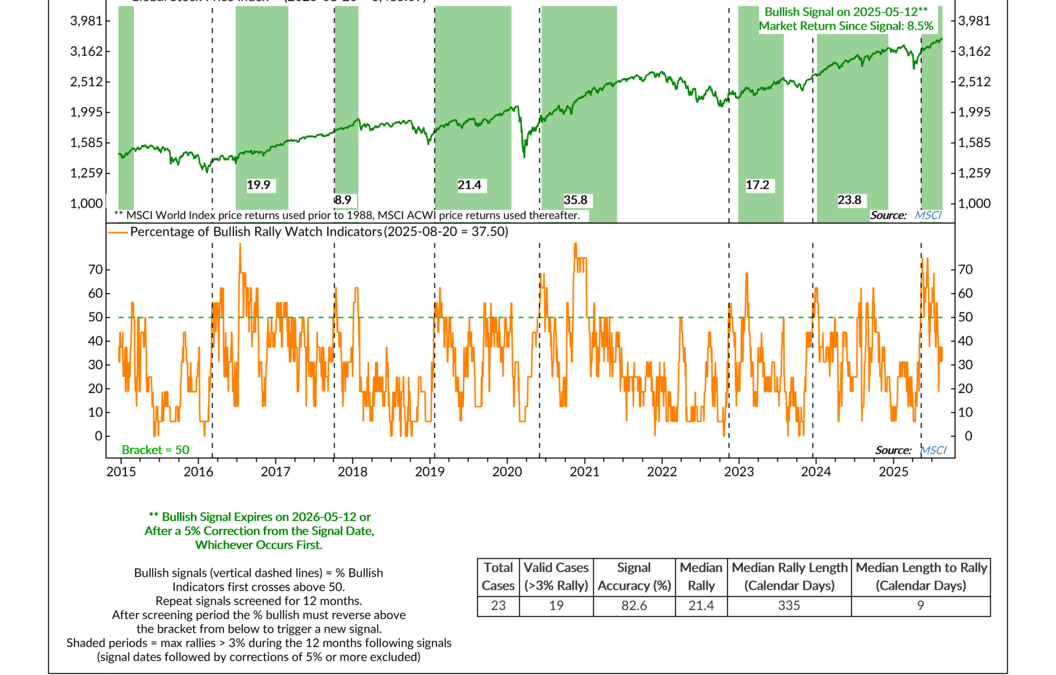

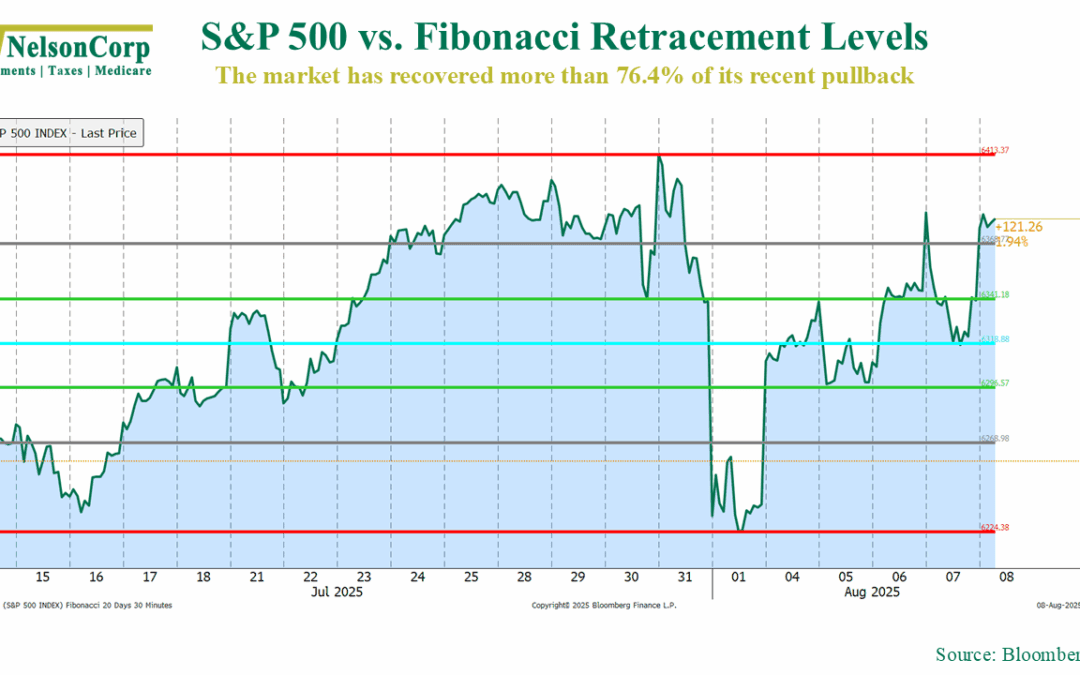

Really a Rally?

There are a lot of challenges in investing. But one that’s particularly tricky is knowing when a market rally is, well, a rally. Maybe it's the start of a new rally? Or maybe the current one is running out of steam? That’s where this week’s indicator comes into...

Financial Focus – August 20th, 2025

Announcer: It is time now on KROS for Financial Focus, brought to you by NelsonCorp Wealth Management. The opinions voiced in this show are for general information only and are not intended to provide specific advice or recommendations for any individual. Any indices...

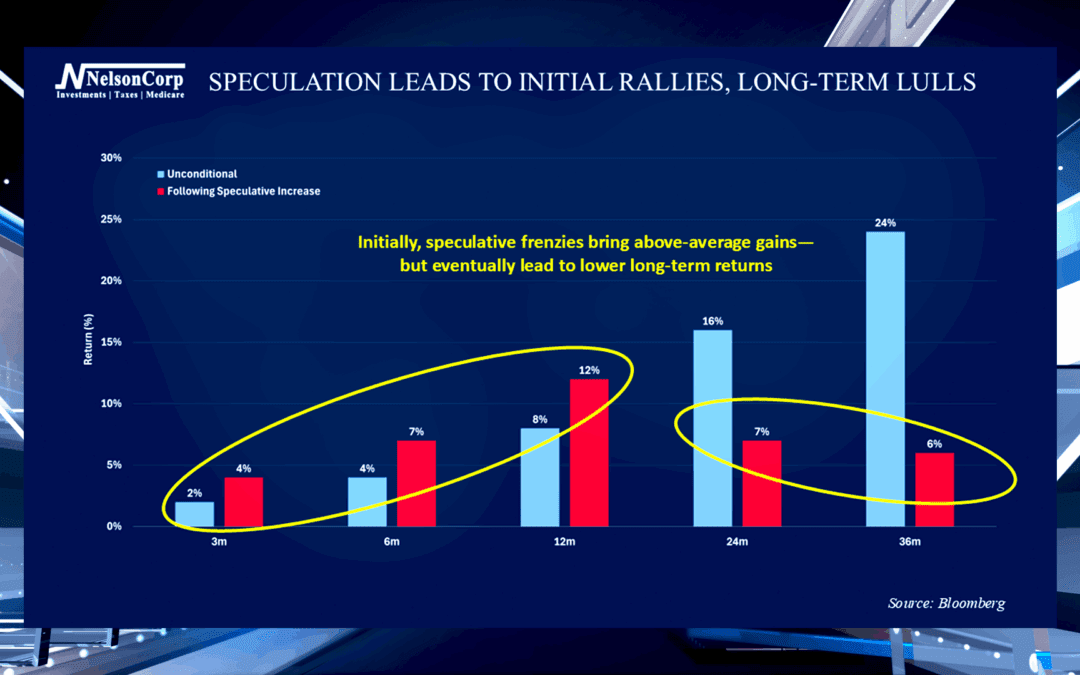

Fun Now, Pain Later

There has been a big jump in speculative trading that involves a higher degree of risk compared to traditional long-term investing. David Nelson joins us to share if these potential short-term gains usually provide a long-term advantage.

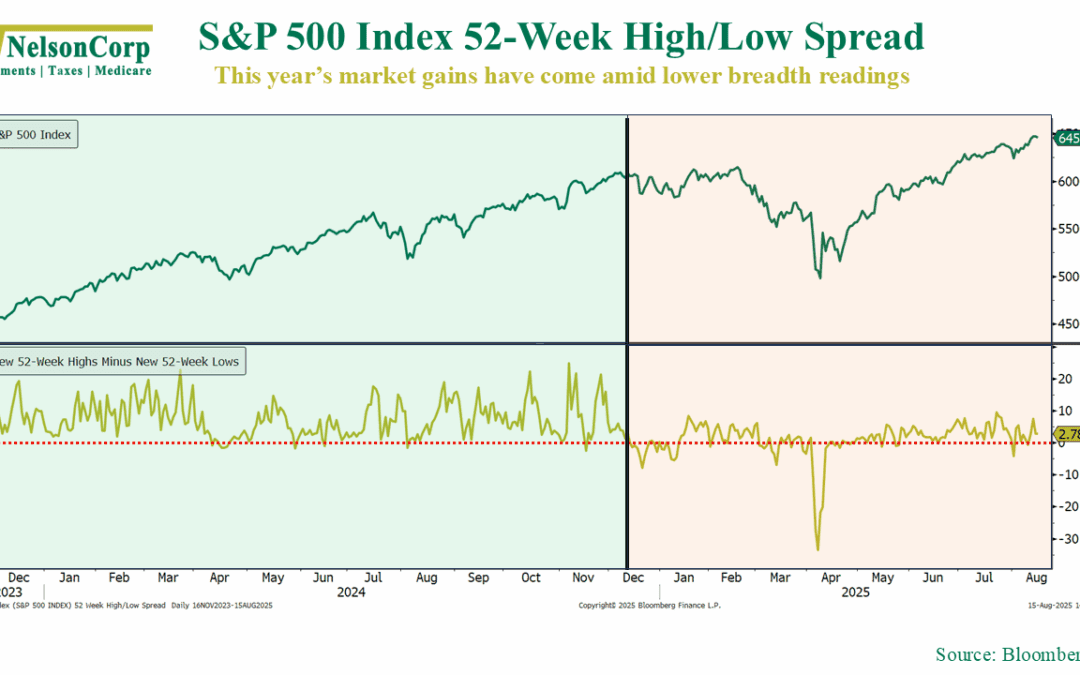

Can I Get a “Breadth” Mint?

OVERVIEW Markets posted broad gains last week, with strength across equities both in the U.S. and overseas. The S&P 500 rose 0.94%, while the Dow added 1.74%. The NASDAQ gained 0.81%. Small caps led the way, with the S&P 600 surging 3.15% after lagging...

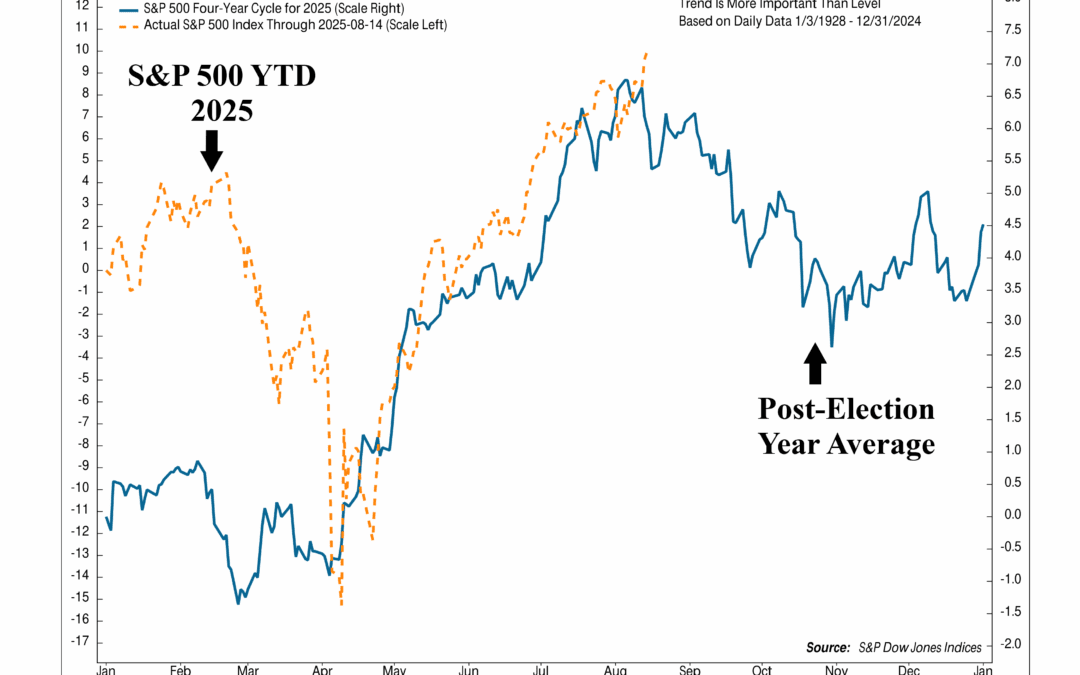

Setting Expectations

Despite all the headlines and big-picture drama this year, the stock market has been quietly following the historical, seasonal playbook pretty closely. As this week’s chart shows, the S&P 500’s path in 2025 has lined up closely with what typically happens...

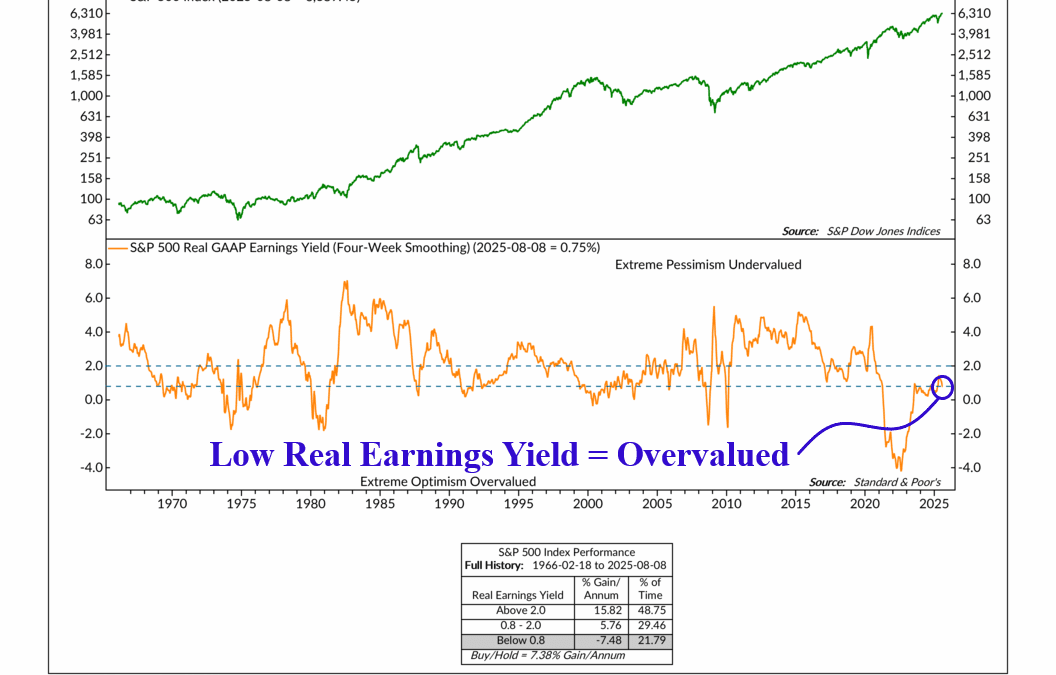

Relative to What?

Most people watch the stock market by looking at prices. Are they going up? Are they going down? But price is only one component. How do we know if that price is actually a good deal? That’s where this week’s featured indicator comes into play. It measures...

Financial Focus – August 13th, 2025

This week on Financial Focus, Nate and Andy break down the new tax law and why it’s not as straightforward as the headlines suggest. From Social Security deductions to overtime and tip rules, they explain what’s really changing and how smart planning can make a big difference.

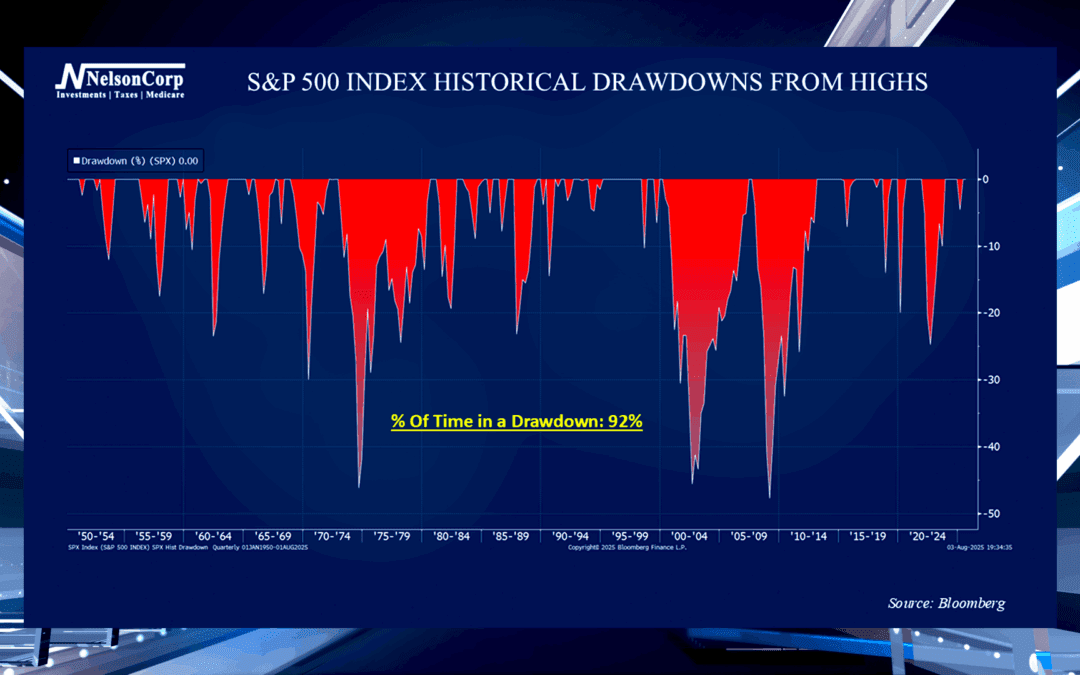

Danger of Drawdowns

David Nelson is here to discuss drawdowns and how they are a factor investors often overlook when it comes to stock market risk.

Measuring Tape

OVERVIEW Markets bounced back last week, with gains across most major asset classes. The S&P 500 rose 2.43%, while the Dow added 1.35%. The NASDAQ led the way with a 3.87% jump. Small- and mid-cap stocks also gained ground, with the S&P 400 up 0.63% and...

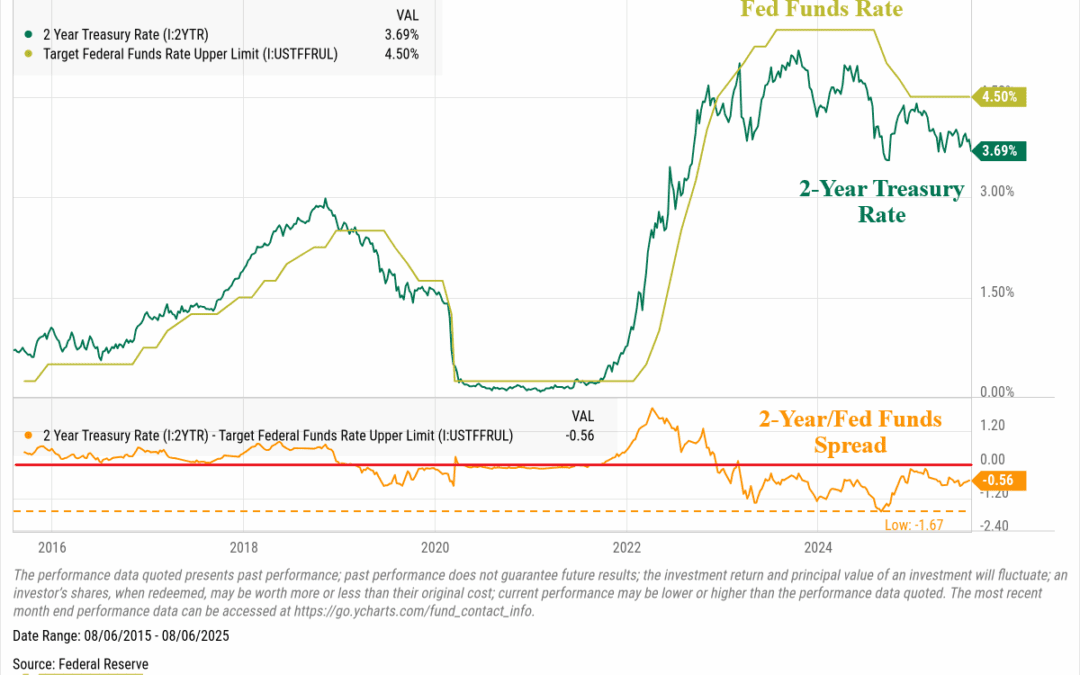

Pressure Cooker

The bond market is sending a clear message: it's time for the Fed to start thinking about rate cuts. The chart above compares the 2-Year Treasury yield with the Federal Funds Rate, and right now, the 2-Year is trading well below the Fed’s upper limit—by...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.