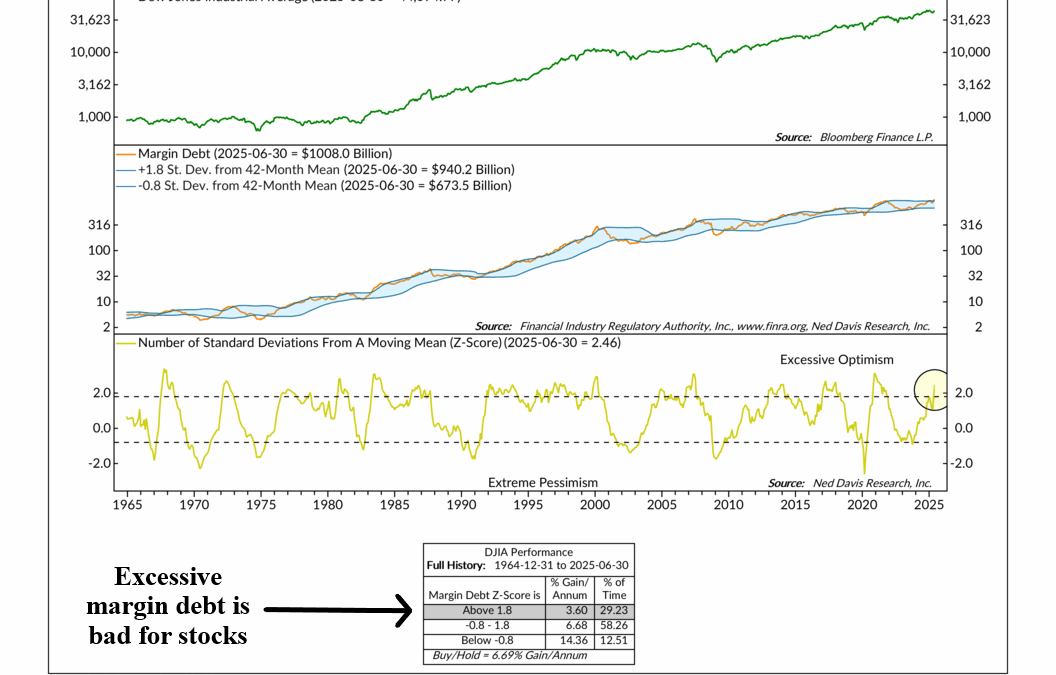

Put It on My Tab

Margin debt. What is it? Technically, it’s the total amount of money owed to brokerage firms by customers who’ve borrowed funds to buy financial securities. But in simple terms, it’s just money investors borrow to buy stocks. Why would someone do this? Because...

Financial Focus – August 6th, 2025

It’s never too early to start saving for retirement—and understanding your options now can pay off big later. This week’s Financial Focus covers the importance of getting started, choosing between Roth and traditional accounts, and making the most of your employer’s match.

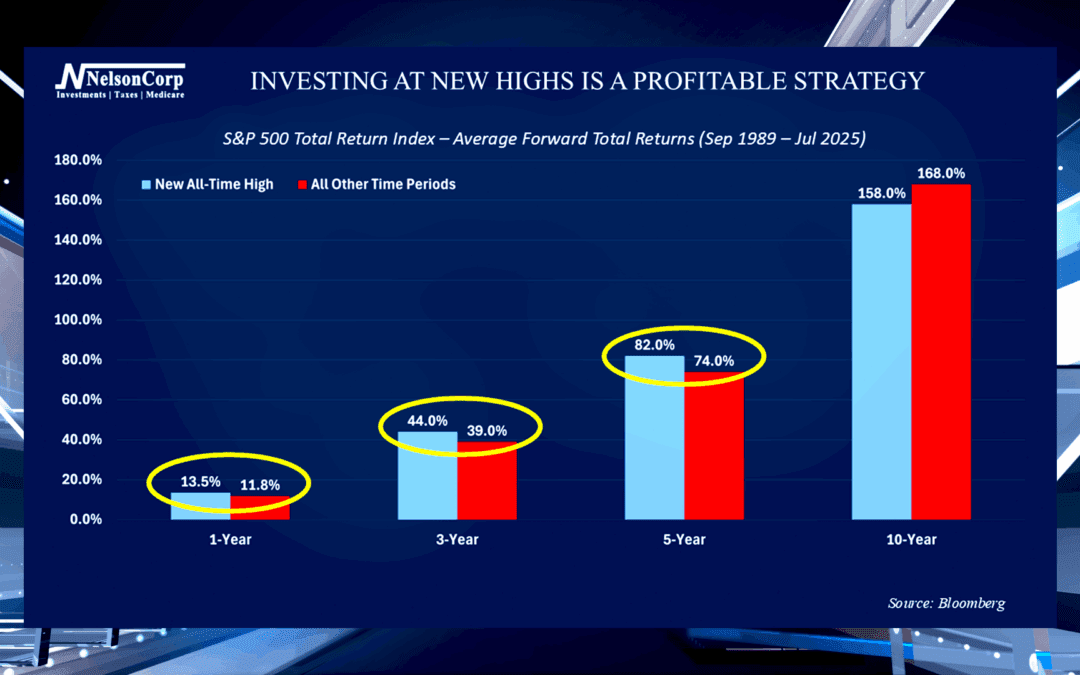

Don’t Fear the Peak

The stock market has been trending toward new record highs in recent weeks. Nate Kreinbrink explains the historical patterns that suggest investors should be encouraged by the all-time highs.

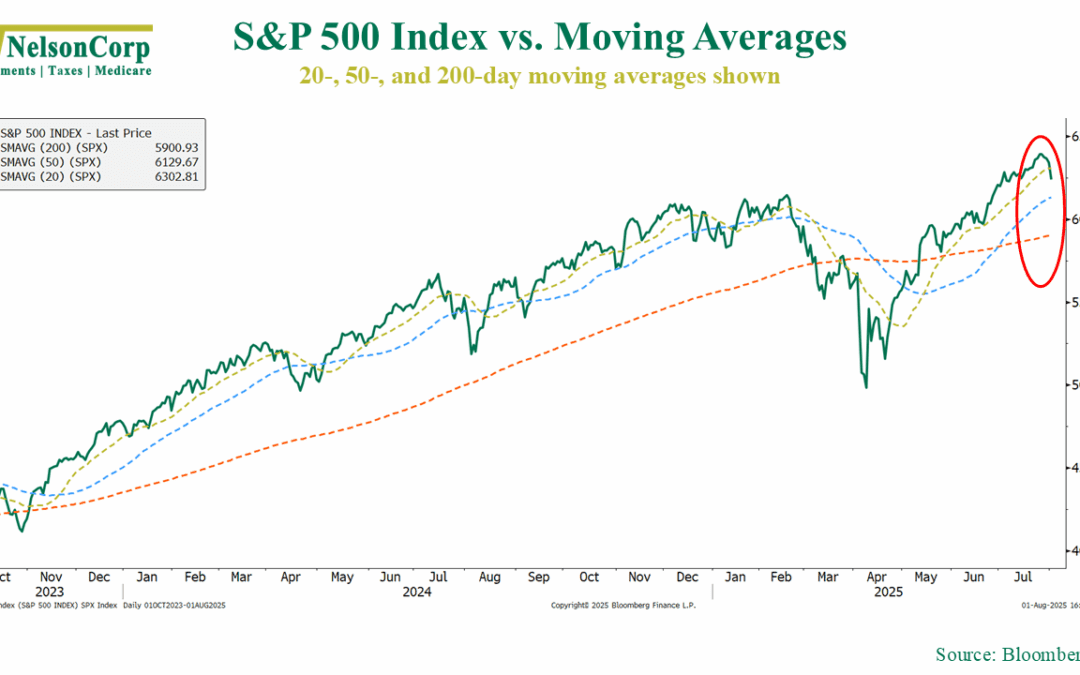

How’s The Market Doing?

“How’s the market doing?” It’s a question we get all the time, and this week’s commentary takes a closer look at the answer. From strong overall trends to a few warning signs under the surface, check it out for the full breakdown.

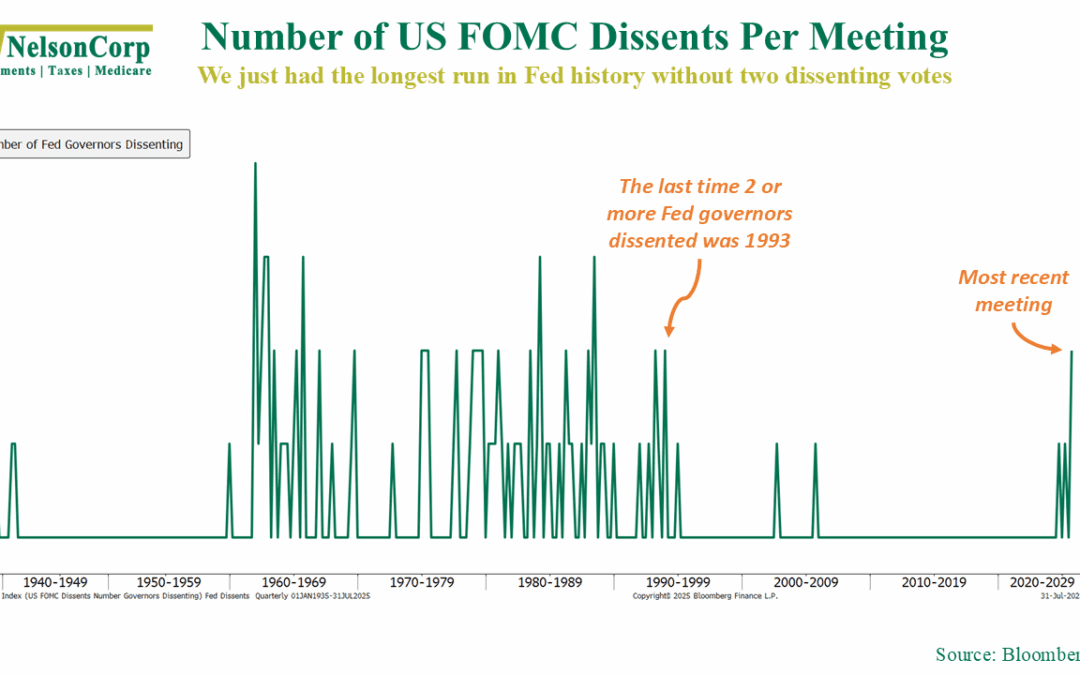

I Dissent!

Cracks are starting to show inside the Federal Reserve, with multiple members breaking from the pack for the first time in over 30 years. Check out this week’s chart for a peek at the shift starting to form inside the Fed.

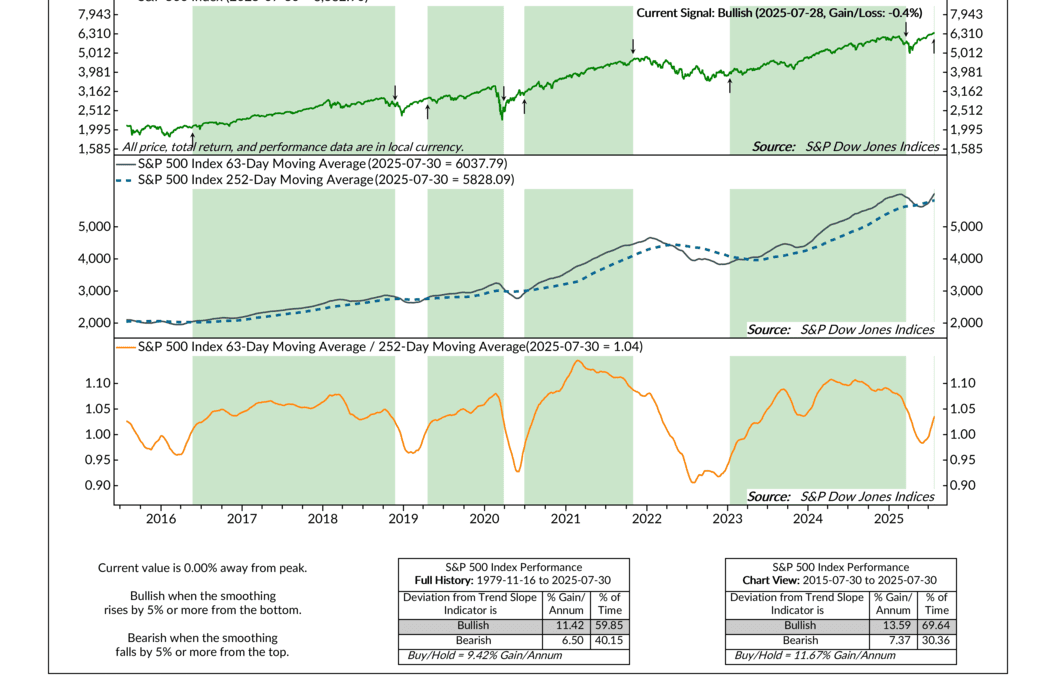

Hitting the Slopes

The market’s trend is back on track, and one of our favorite slope-based signals just turned bullish. Check out what that means—and why it could matter for your next move.

Financial Focus – July 30th, 2025

Check out this week’s Financial Focus for a wide-ranging conversation with David Nelson on face-to-face planning, interest rates, and staying level-headed in today’s market. From estate documents to tariff talk, it’s a practical reminder that smart investing starts with preparation—not panic.

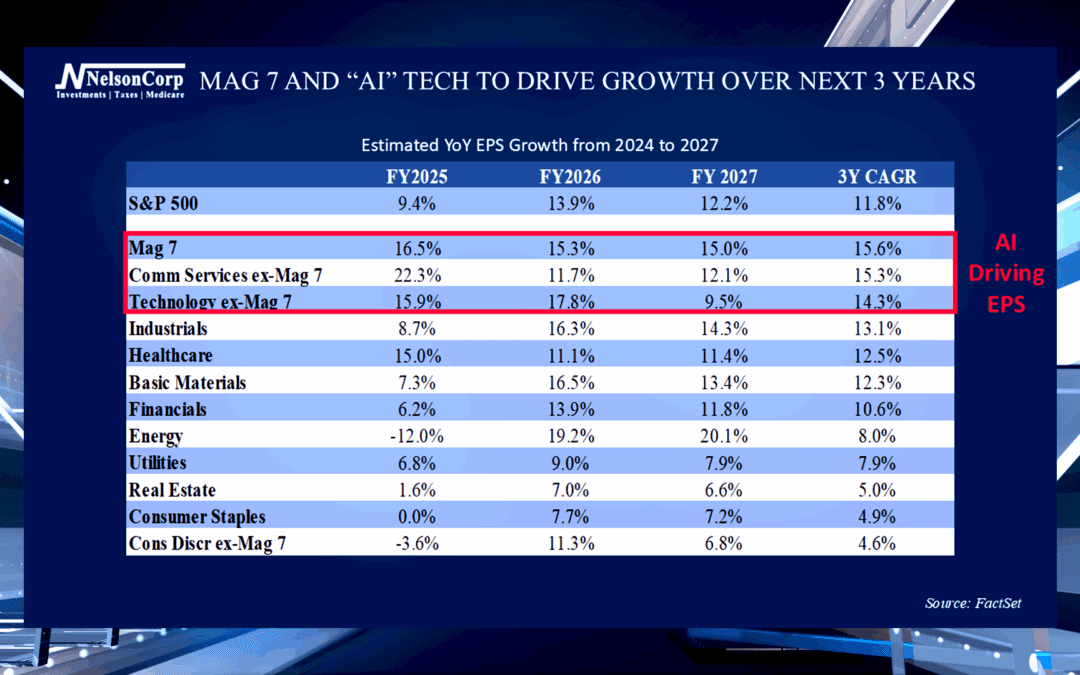

Powered by AI

AI has been a big buzzword in the financial world. John Nelson is here to share the stock market numbers that indicate AI’s growing importance is the real deal.

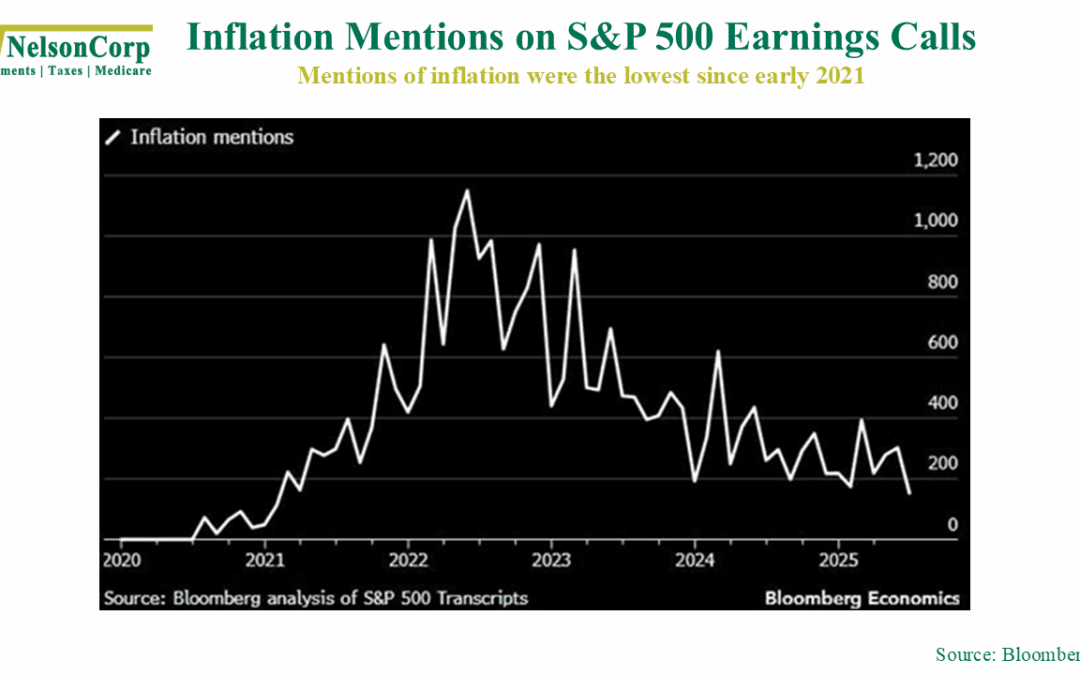

Inflation Talk

Mentions of inflation by S&P 500 companies just hit a four-year low, but should investors still be paying attention? This week’s commentary looks at a key inflation indicator that remains in bullish territory for stocks.

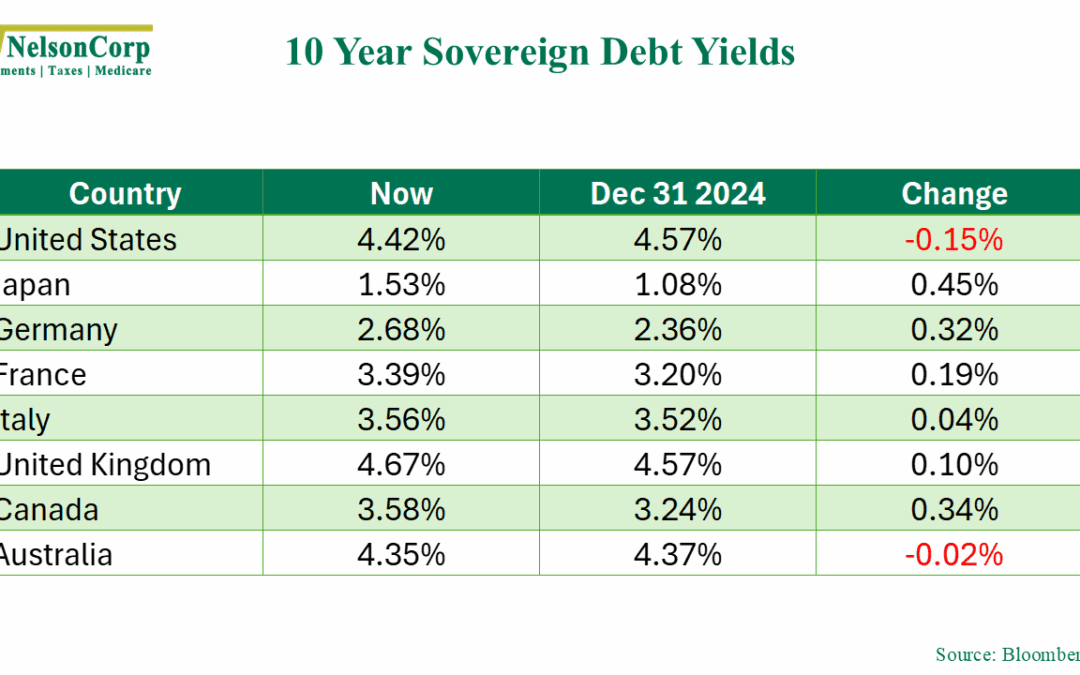

The World Reprices

Yields are up, but stocks don’t seem to care. This week’s chart unpacks the disconnect.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.