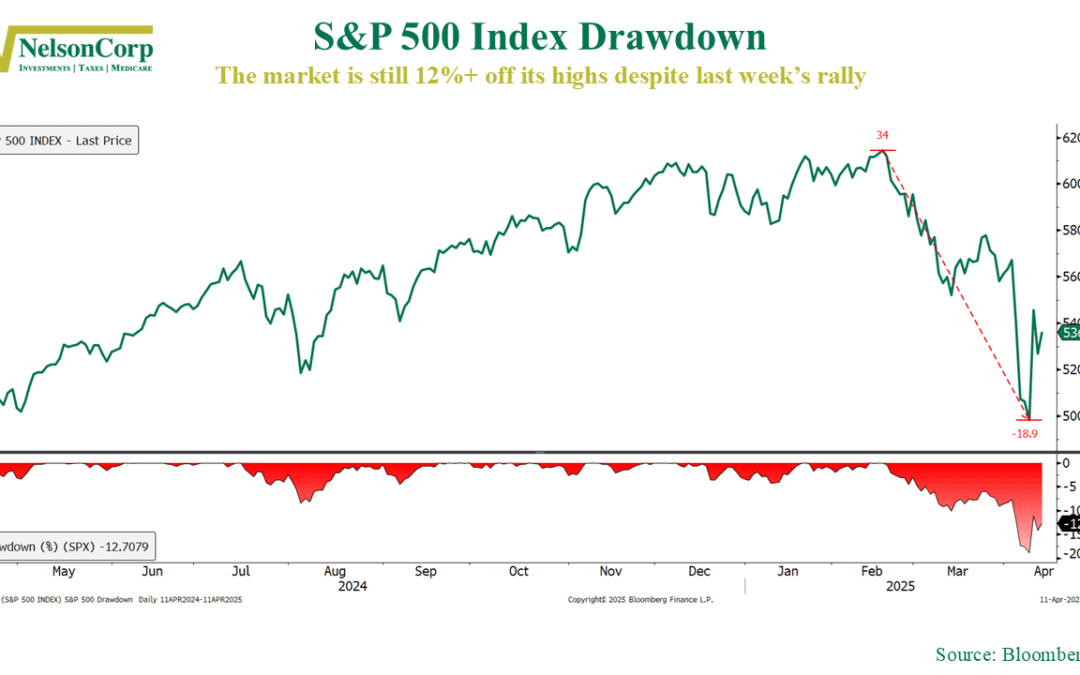

Fundamental Math

Stocks staged a wild comeback this week, but don’t let the rally fool you—valuations are still walking a tightrope. We break down what the fundamentals say about where the market could go from here, and why the real test may still lie ahead.

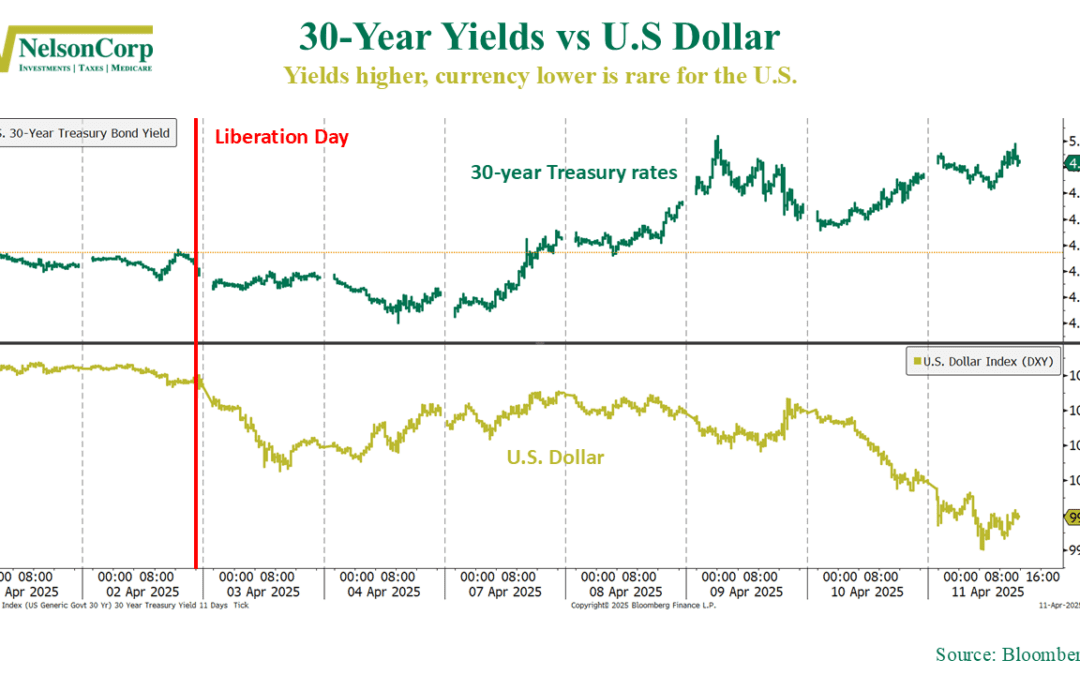

Vigilantes

It was another rollercoaster week in the markets. Volatility was high, and stock prices swung wildly. But beyond the headline-grabbing moves in equities, there was a deeper, more telling story unfolding under the surface—one that many non-market watchers likely...

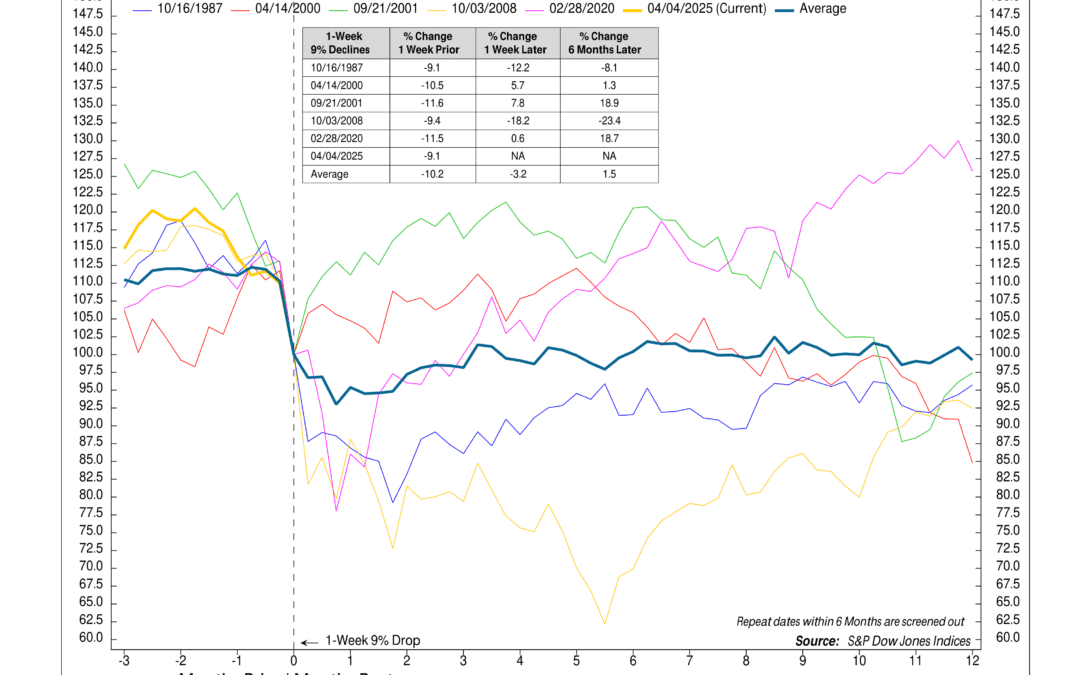

Stock Plunge

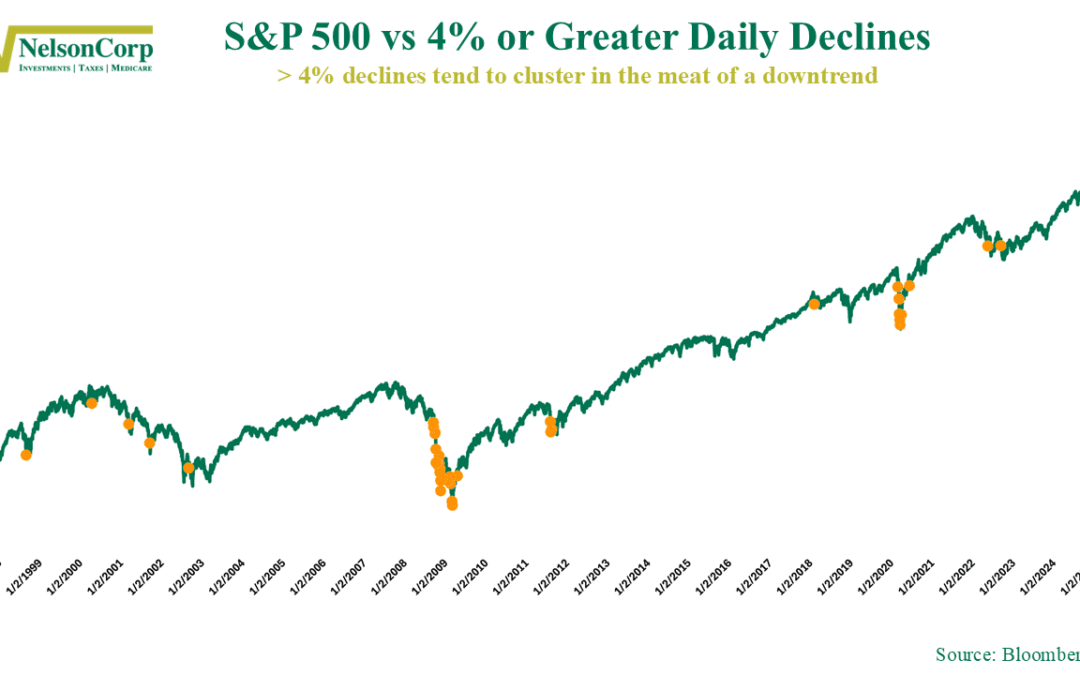

We’re doing something a little different this week. The chart we’re looking at isn’t one of our go-to indicators—it’s more of a historical curiosity. But with the market falling over 9% last week, it’s worth digging into how things have played out after similar...

Financial Focus – April 9th, 2025

This week’s Financial Focus highlights the fast-approaching tax deadline and why now is the perfect time to start planning ahead, not just looking back. Nate Kreinbrink also breaks down the key decisions around Social Security—one of the most important assets in retirement—and how timing can impact your long-term financial picture.

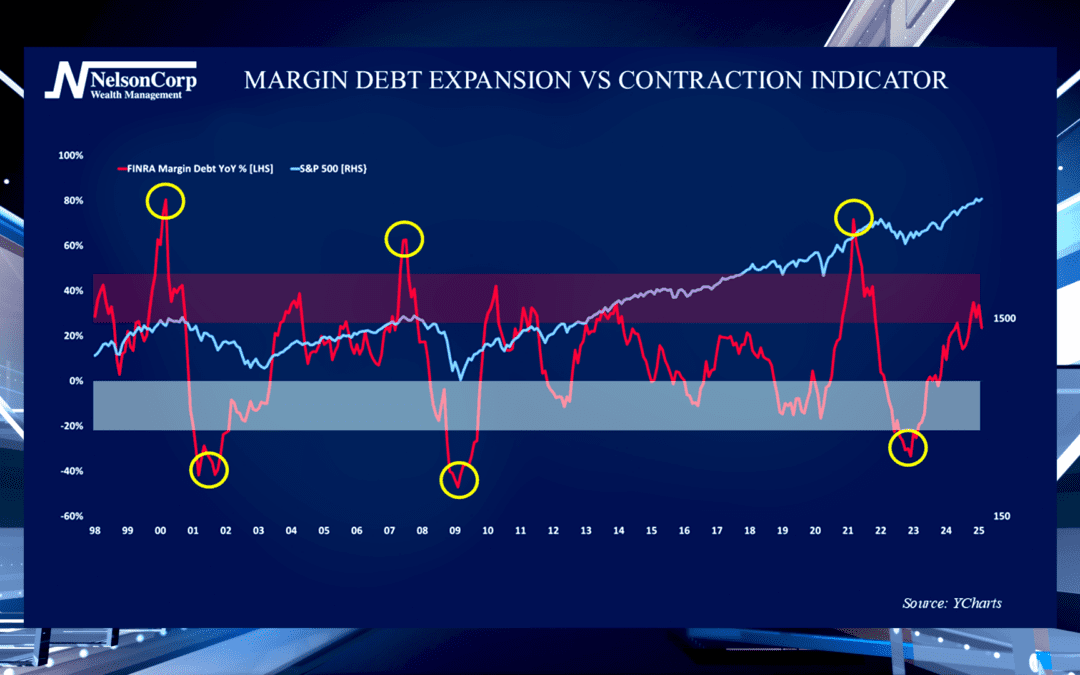

Margin Debt Warning

Margin debt is the amount of money investors borrow to buy stocks. David Nelson explains the historical trend of margin debt and why investors should continue to be cautious.

Risk Off

The S&P 500 got slammed to close the week, dropping over 4% on Thursday and then following that up with another bruising decline on Friday. The two back-to-back haymakers left markets reeling and investors wondering: Is this the bottom—or just the beginning?

Tariff Turbulence

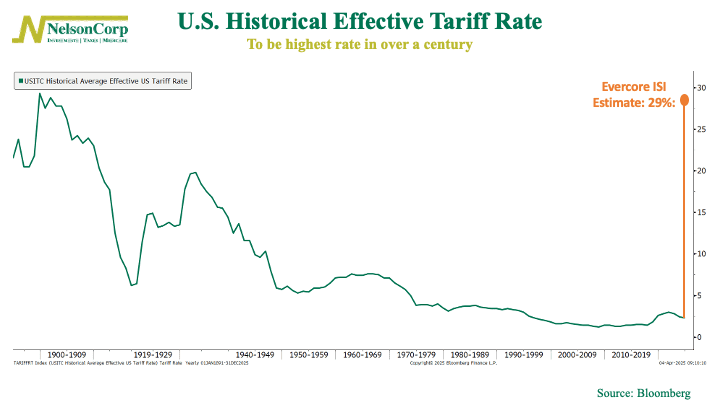

If you thought tariffs were a relic of early American economic policy, think again. Under President Trump's proposed "Liberation Day" policy, the U.S. is set to see its effective tariff rate hit 29%, the highest level in over a century. That’s according to an...

Weak Foundation

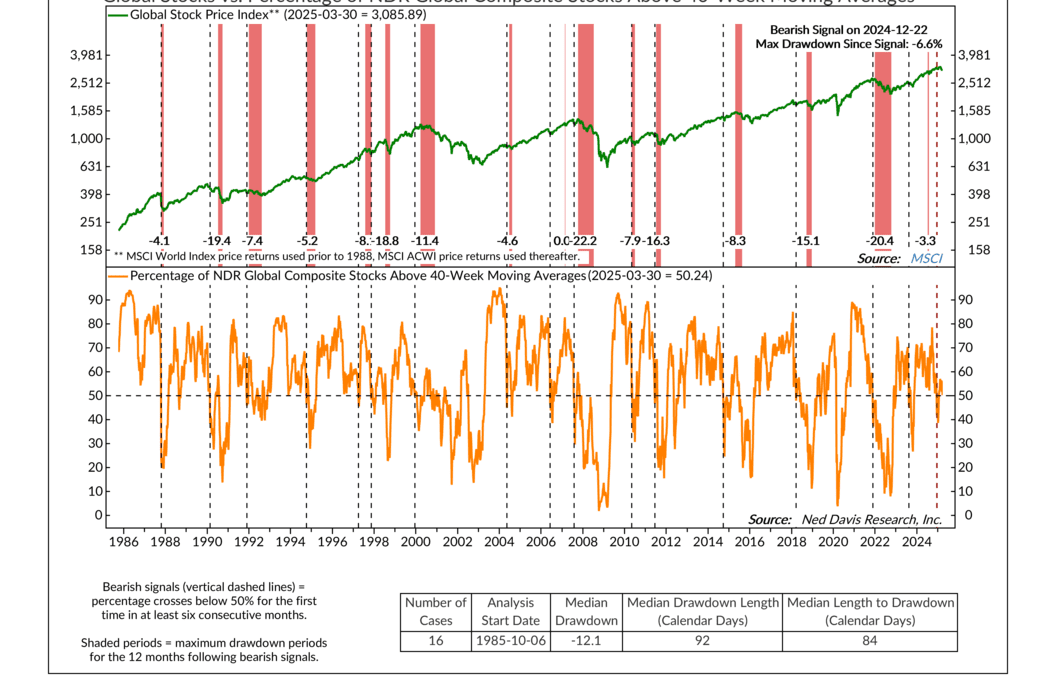

Global stocks are having a rough week. After a strong start to the year, markets have stumbled—hard. The selling pressure has been widespread, and it’s hitting many of the biggest names that have been propping things up. It’s starting to feel like a building...

Financial Focus – April 2nd, 2025

In this week’s Financial Focus, David Nelson reflects on the market’s recent volatility, recession risks, and the impact of tariffs and political uncertainty. David explains how his team is navigating the noise with defensive positioning and emphasizes the importance of focusing on fundamentals over headlines.

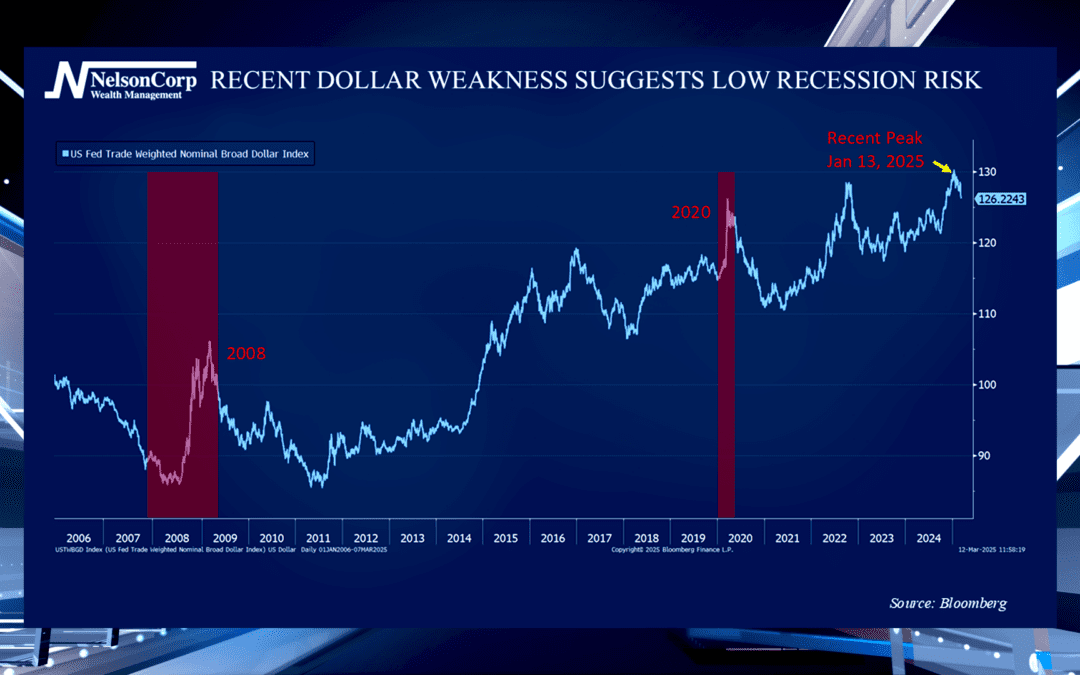

Dollar Dip

The US dollar had a strong finish in 2024 but has been weakening since late January. Nate Kreinbrink shows us how investors usually rush to the dollar for safety when the markets become nervous.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.