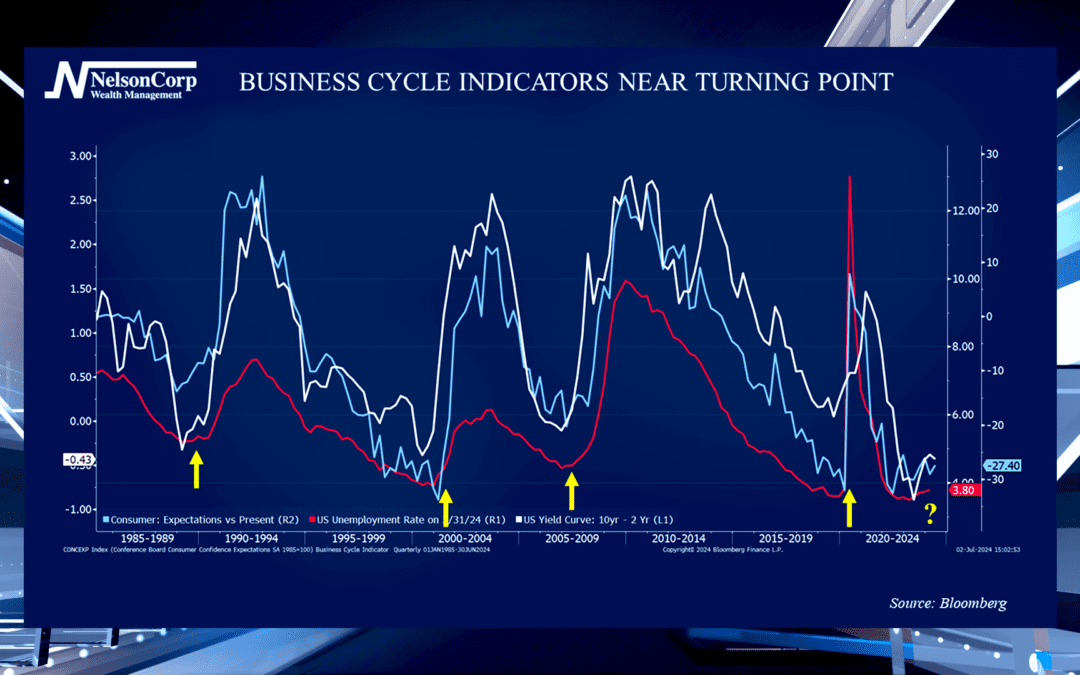

Long In The Tooth

We often hear how the business cycle is the economy’s heartbeat. David Nelson is here to explain the different stages of the business cycle and the tools used to determine the stage we are in now.

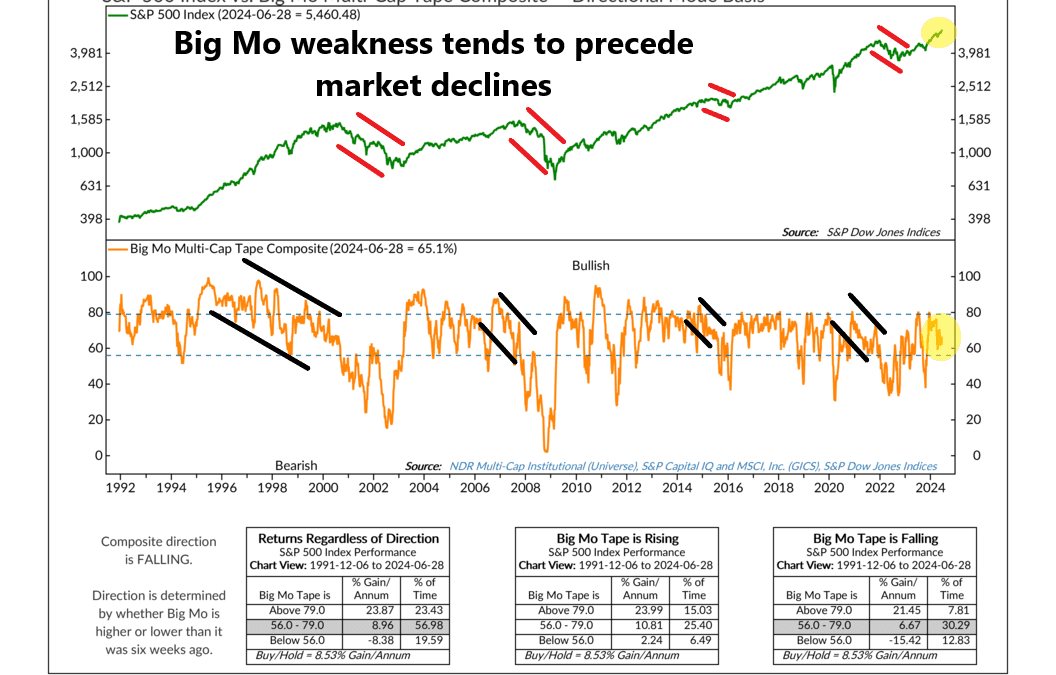

Big Mo Says No

The stock market says yes, but Big Mo says No. Check out this week’s commentary, where we explore a key indicator of market momentum and what its current reading means for the broader market.

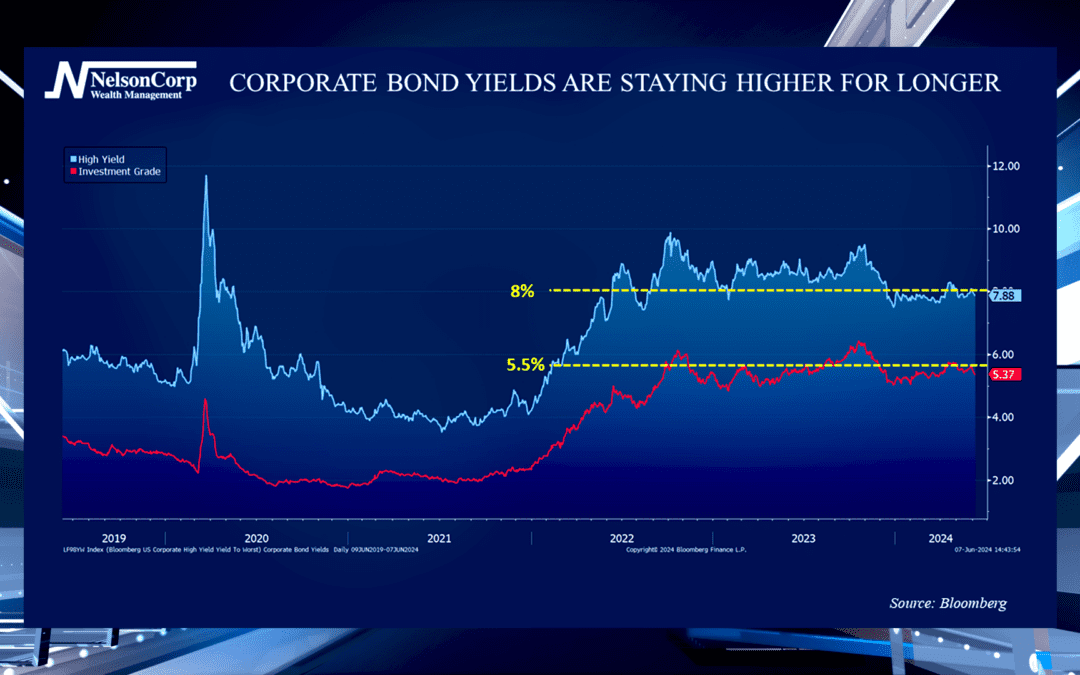

Higher For Longer

Rising interest rates have negatively impacted consumers in recent years. David Nelson joins us to explore how savers might use these changes to their benefit.

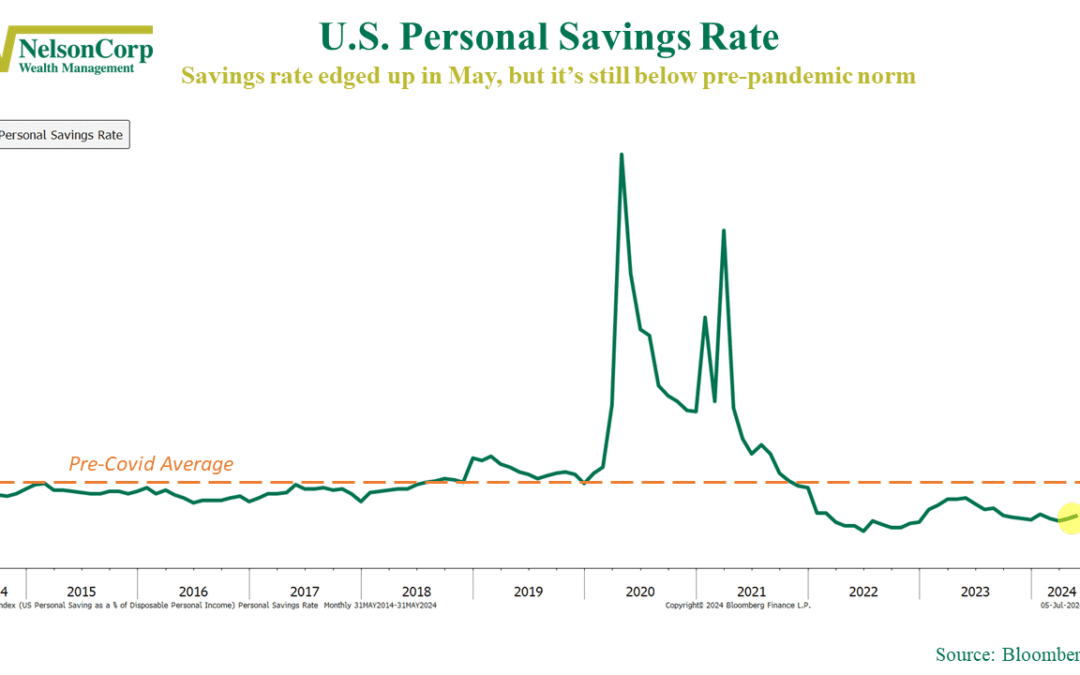

Piggy Bank

The latest savings rate data showed that the personal savings rate for U.S. households edged up to about 3.9% in May. On the bright side, this shows that Americans haven’t felt the need to cut back on spending in recent months and are actually socking away a...

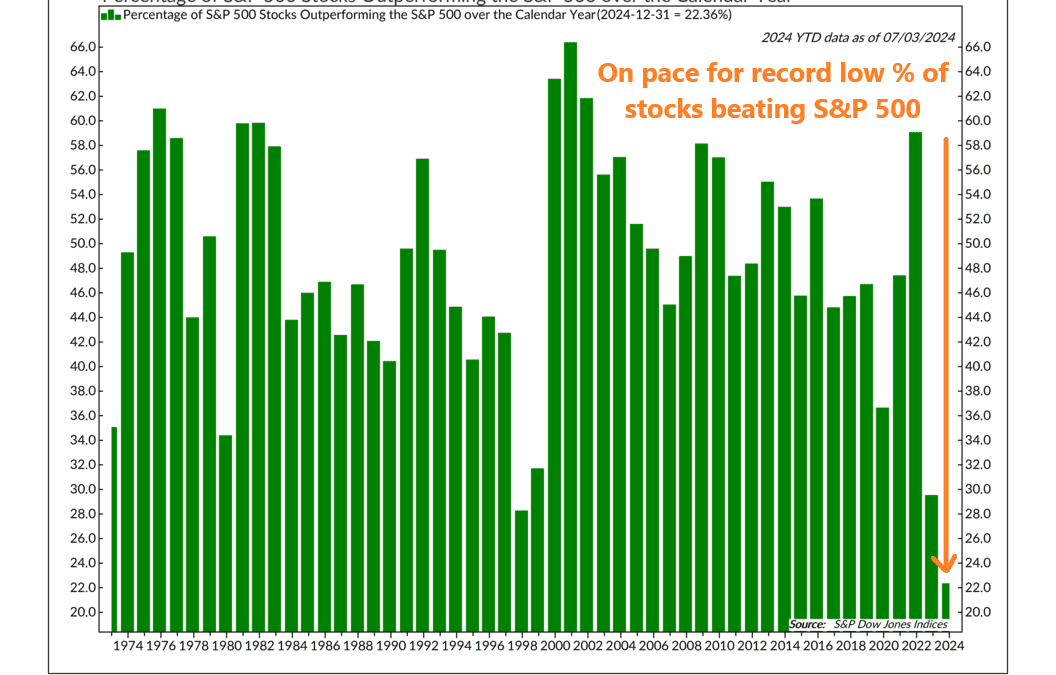

Narrow Participation

Participation is an important component of stock market returns. What do I mean by participation? Simply put, it refers to how many stocks within a market index—like the S&P 500—are joining in a rally. The more stocks trending upwards, the healthier the overall...

Financial Focus – July 3rd, 2024

Tune in to this week’s episode of Financial Focus, where Nate Kreinbrink and Andy Fergurson delve into the latest tax code changes and their impact on financial planning.

Measuring Pace

The stock market had a stellar first half of the year. In this week’s commentary, we look at how recent returns stack up with historical averages and whether this blistering pace can continue.

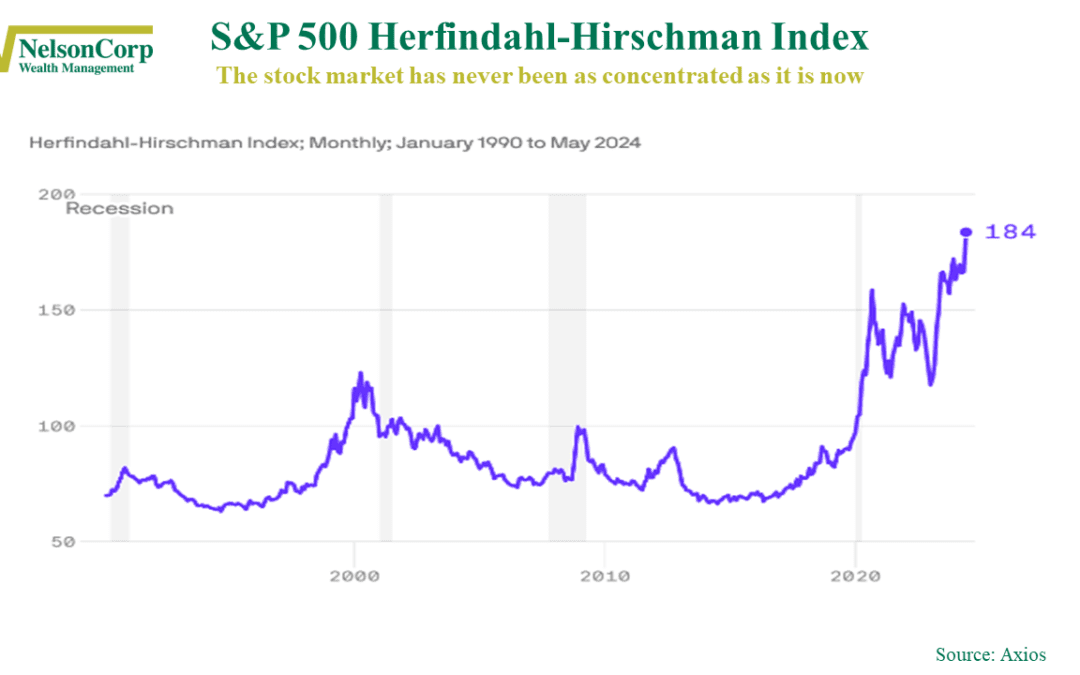

Concentration

My daughter loves strawberry milk, but when she makes it, she uses way too much strawberry syrup. You can barely taste the milk because it’s so concentrated. It kind of reminds me of today’s stock market. But instead of syrup, a few giant companies dominate the...

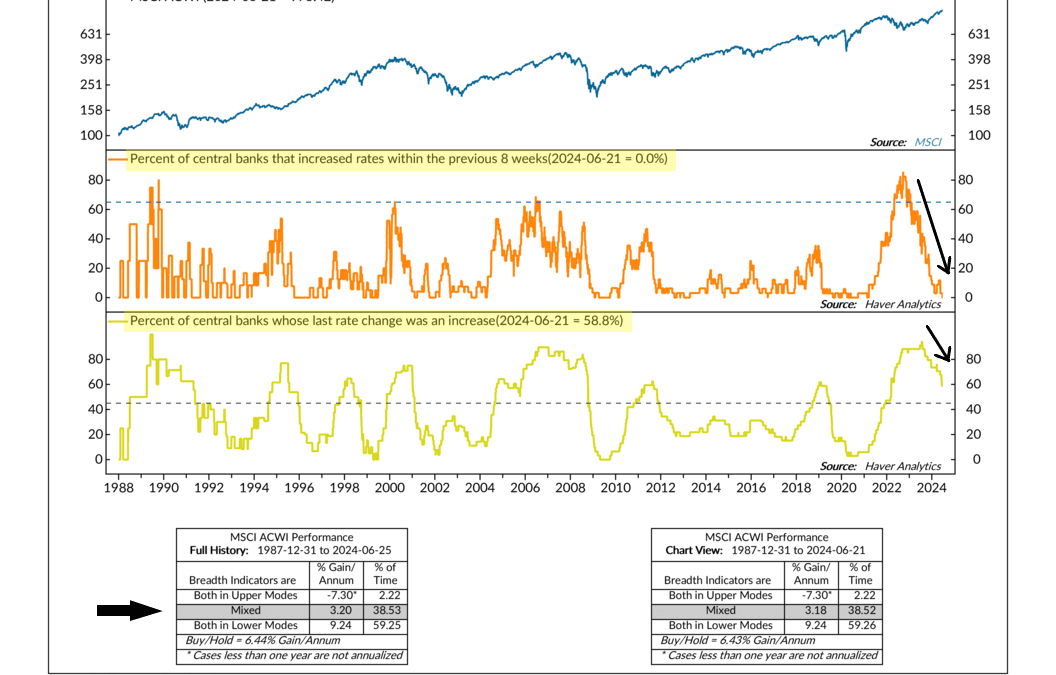

From Hawks to Doves

Central banks play a big role in financial markets. When they adjust interest rates—either cutting or raising them—it has a big impact on financial prices. In recent years, these interest rate movements have been a hot topic. So, for this week’s indicator,...

Financial Focus – June 26th, 2024

In this episode of Financial Focus, Nate Kreinbrink highlights the crucial role of financial planning at every life stage. He covers smart saving options, retirement strategies, scam avoidance, and the value of professional advice.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.