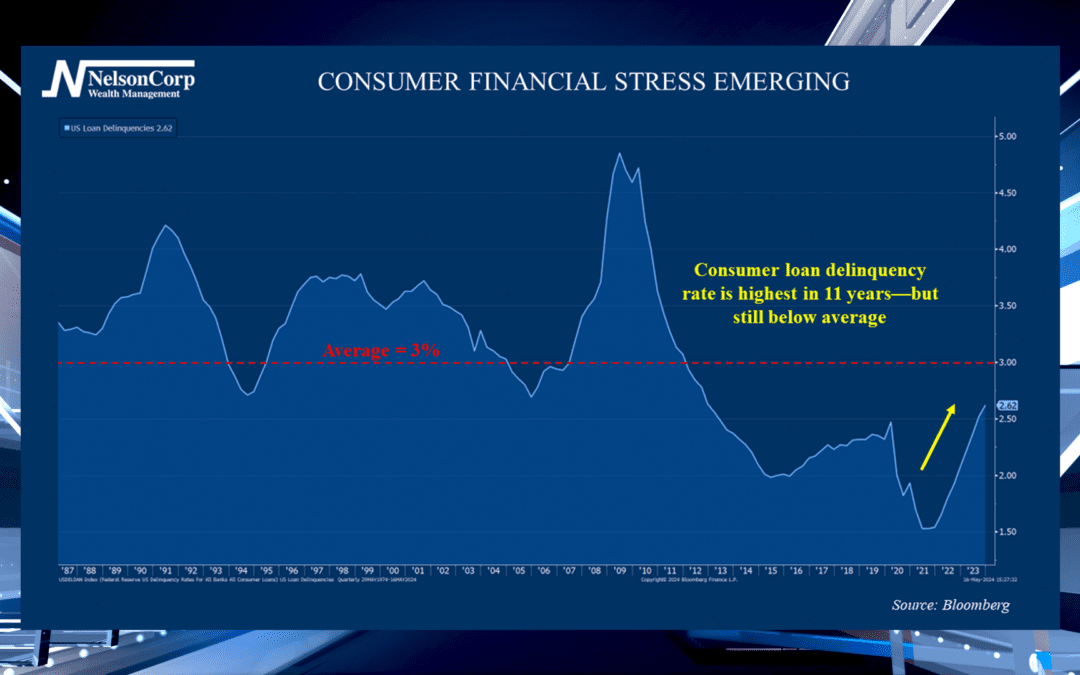

Consumer Stress

There has been concern lately about growing consumer frustration and stress in the economy. John Nelson joins us to shed some light on what is driving this trend and how it might affect the broader economy.

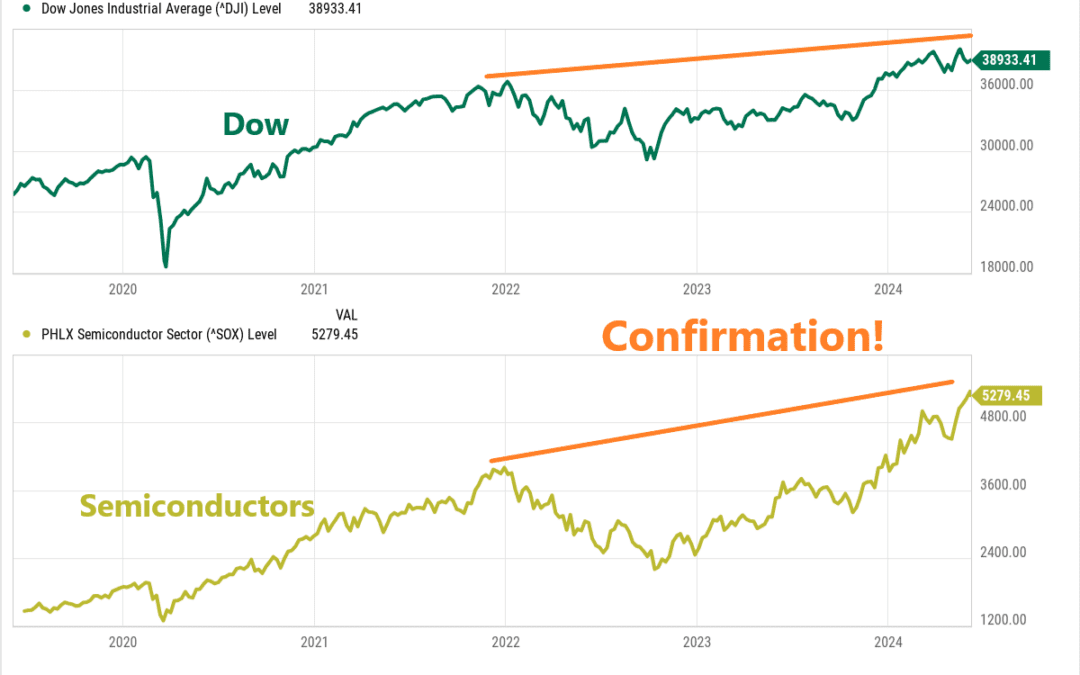

The Dow’s New Groove

Check out this week’s commentary where we give the famous Dow Theory a makeover, as well as discuss the risks associated with complacency in the stock market.

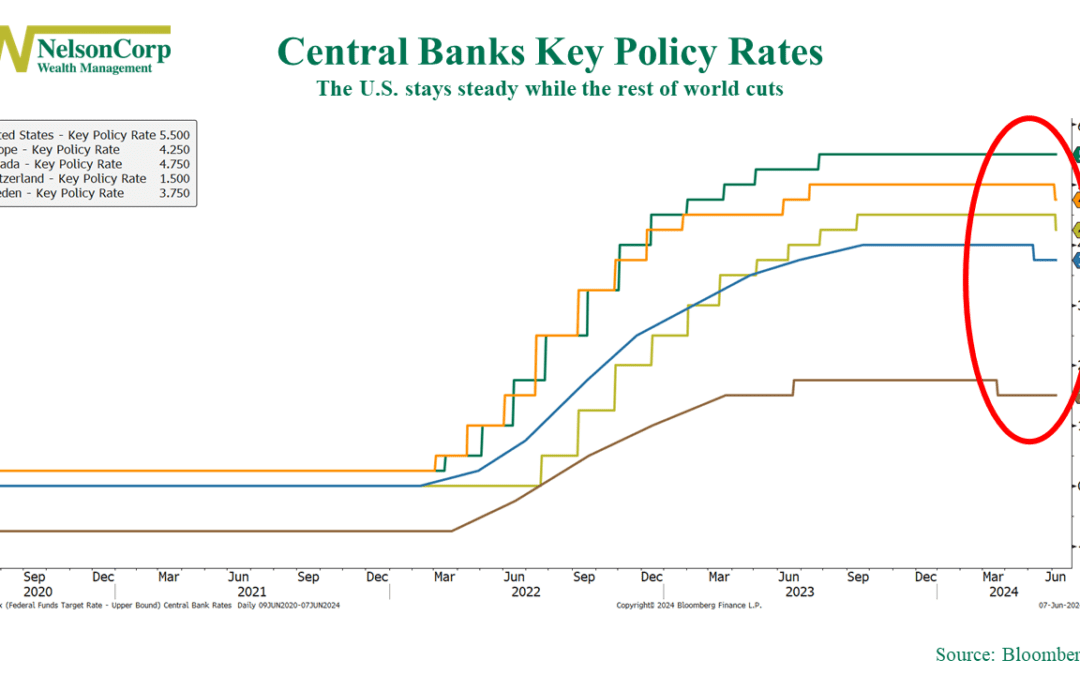

Bucking the Trend

Hikes are out, and cuts are in. That's the direction the world's Central Banks have been moving lately. This week, the European Central Bank and Canada joined Sweden and Switzerland in cutting their key policy interest rates. That makes four major Central Banks...

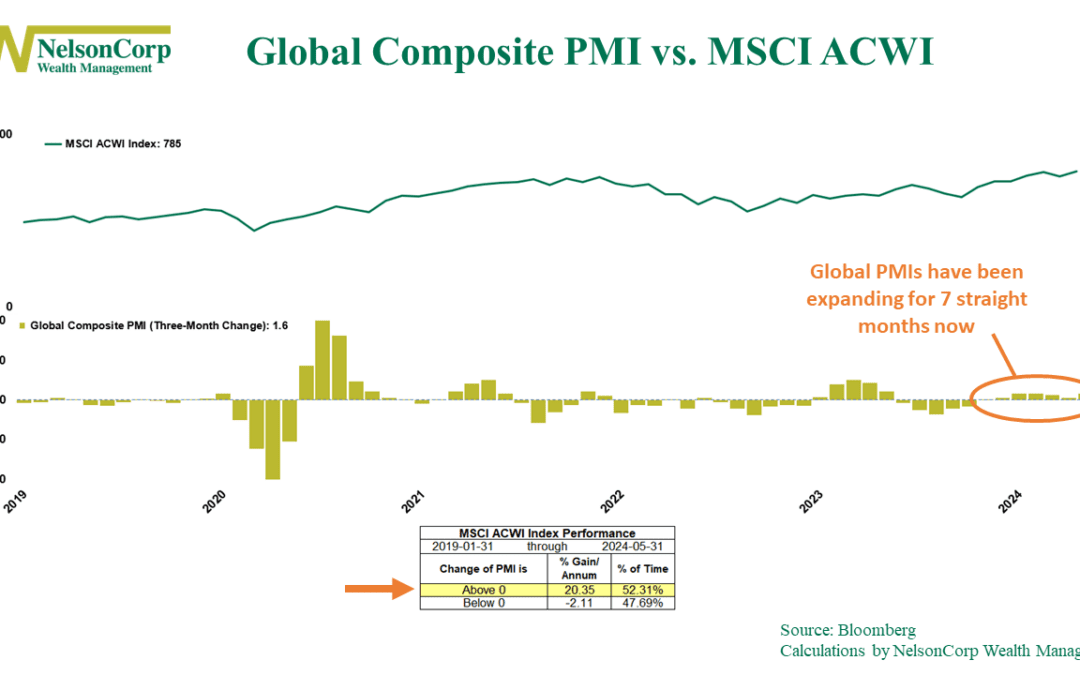

Global Growth Spurt

The global economy is still running strong. That’s the message from our two indicators on display this week. The first indicator, shown above, compares global stock market performance (top clip) to the 3-month change in the Global Composite PMI (bottom clip)....

Financial Focus – June 5th, 2024

In this week’s episode of Financial Focus, Gary Determan sits down with David Nelson to discuss the crucial factors driving global financial markets. They also delve into the pressing issue of social security here in the United States.

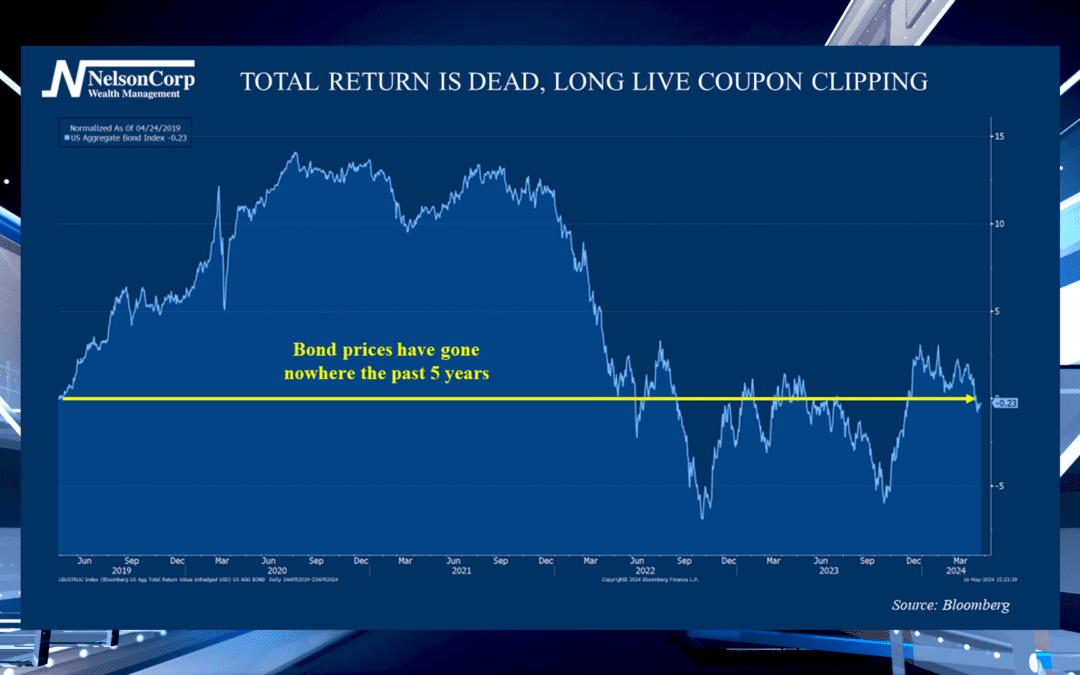

The Death of Total Return

Over the past few years, we’ve witnessed a significant shift in the bond market with total return strategies losing their luster. David Nelson is here to elaborate on what is driving this change and if there is anything investors should do to adapt their approach when investing.

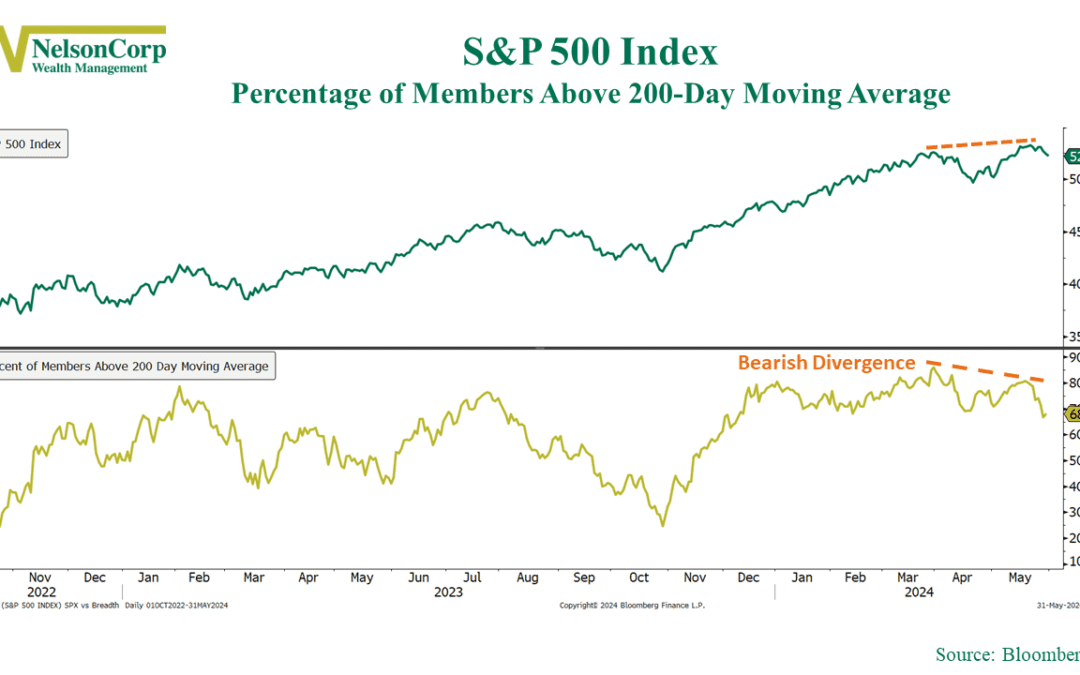

Divergences

The stock market has been showing some unusual patterns recently. In this week’s commentary, we take a closer look at these trends to explain what’s going on.

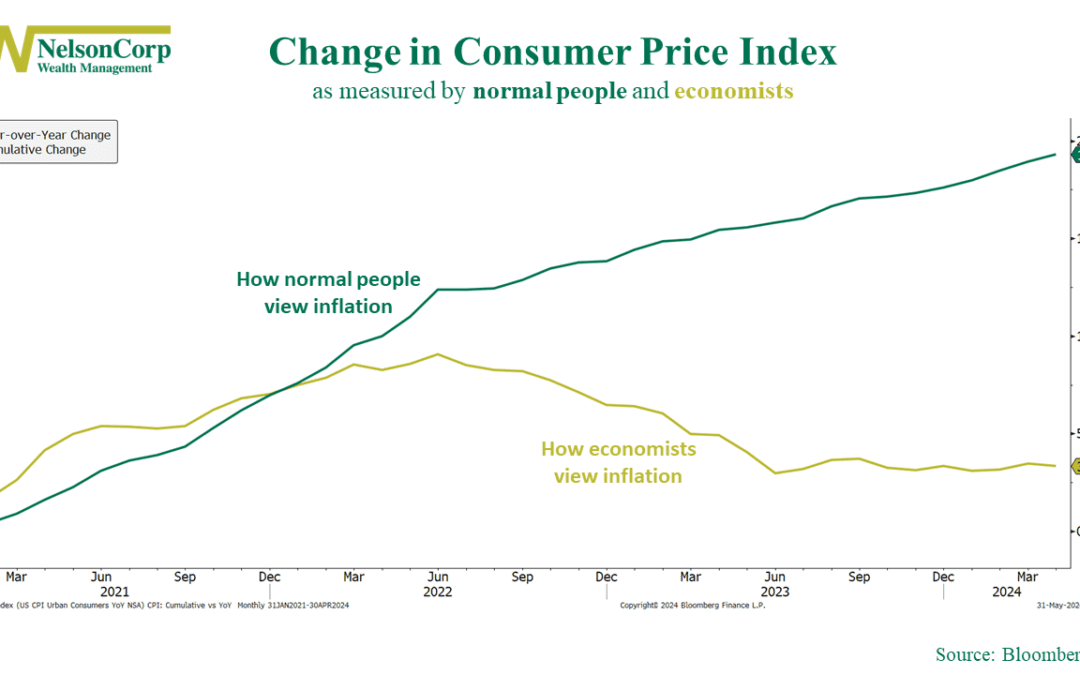

Economists vs Normal People

If you were to ask a random person on the street their thoughts on inflation, they’d likely say, “It’s ridiculously high right now.” But ask that same question to an economist, and you’d probably get a different answer. They’d say something like, “It’s come down...

Thrust Issues

When a bunch of stocks skyrocket at the same time, in a strong and sudden fashion, we call it a breadth thrust. It’s a good thing for the overall stock market, as it’s a sign of a healthy and robust environment. Typically, when the market is in the beginning...

Financial Focus – May 29th, 2024

Join us for this week’s episode of Financial Focus, where Nate Kreinbrink and Andy Fergurson discuss tax planning strategies to help manage and optimize your taxable income effectively.

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.