Financial Focus – March 6th, 2024

Tune into this week’s episode of Financial Focus, where David Nelson discusses the impact of Caitlin Clark on the University of Iowa, as well as the current state of the stock market and the Federal Reserve’s role in driving the market.

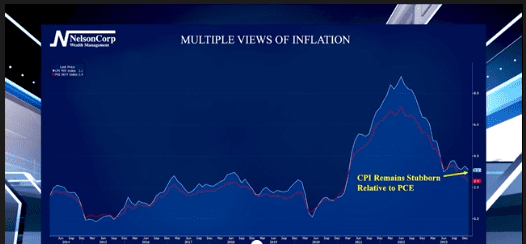

Which Inflation?

Everyone wants to know when the Fed may start cutting interest rates. David Nelson is here to share what he is watching to form his opinion and how viewers may use this information for their investments.

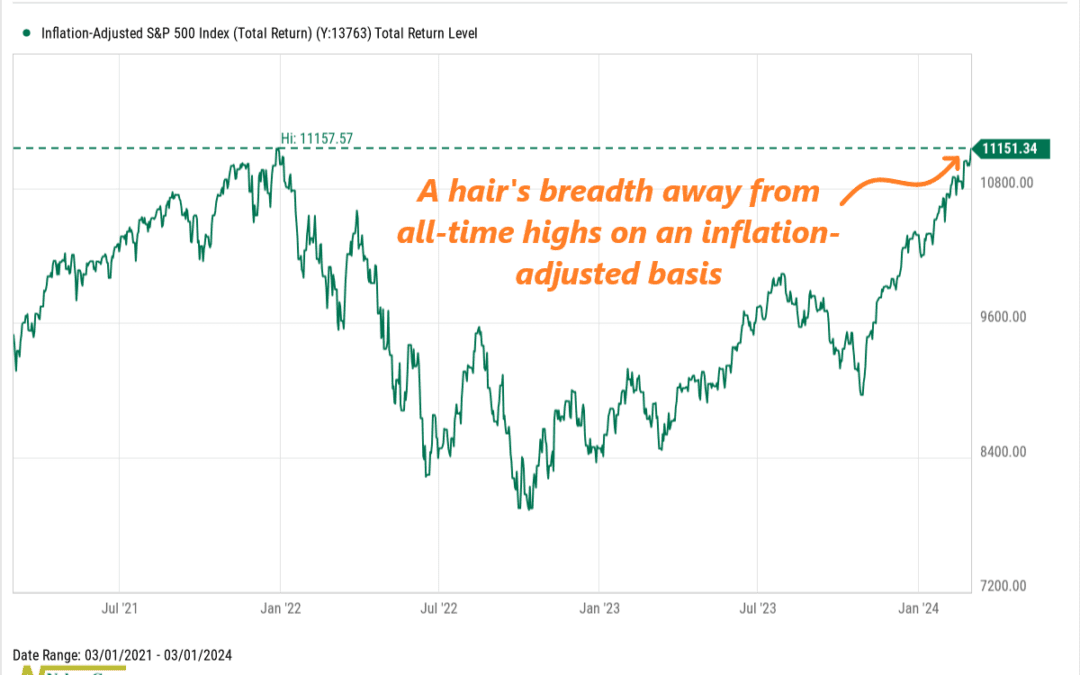

A Hair’s Breadth Away

This week, we delve into how the stock market is performing when adjusted for inflation, and explore the factors driving the increase in prices.

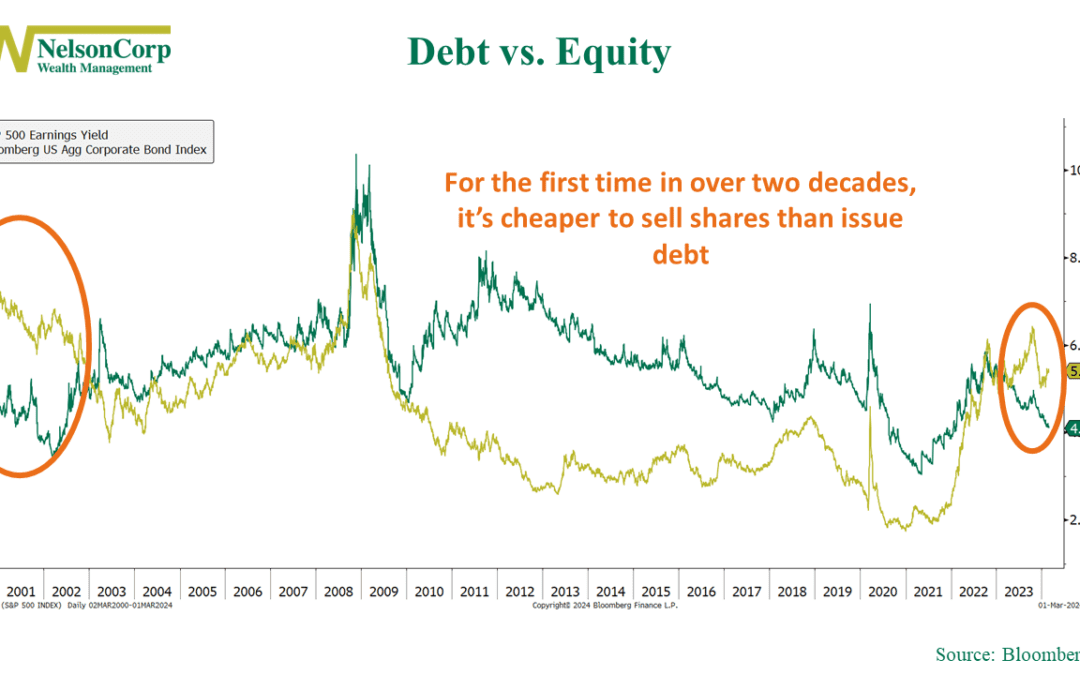

Equity Strikes Back

Let’s say you're a big company and need to raise some cash. You've generally got two options: borrow money or sell a piece of your company. Borrowing money has largely been the go-to choice for the past couple of decades. That’s because not only is the interest...

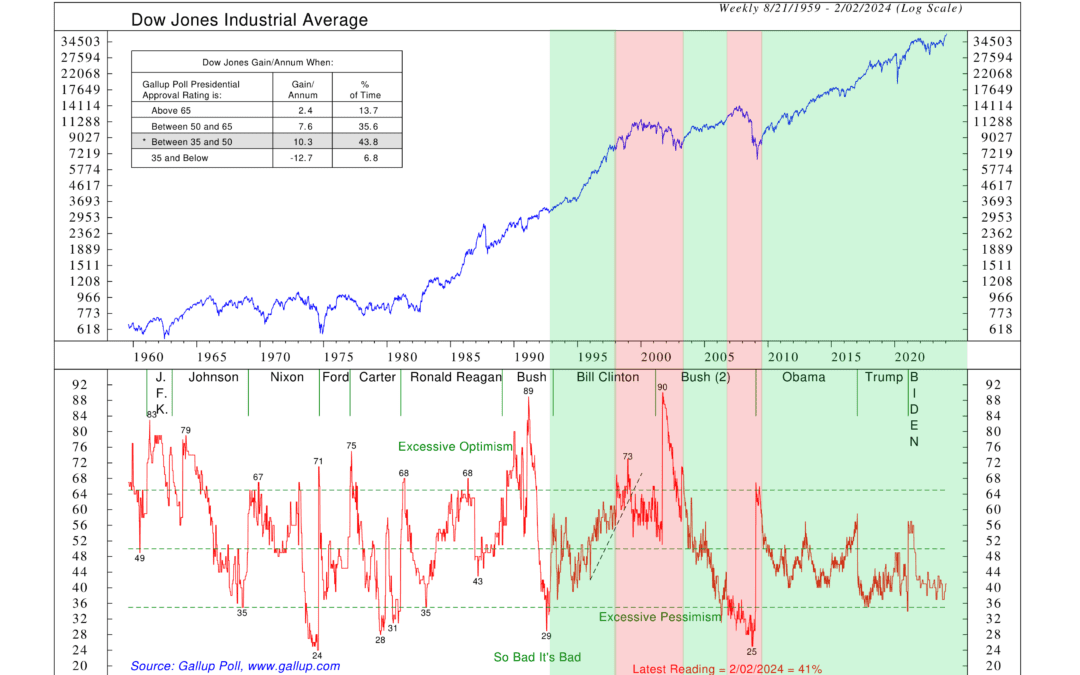

Presidential Gloom

It's an election year, and naturally, investors are wondering how it might impact their investments. Perhaps surprisingly, we find that the president's influence on markets isn't as significant as many believe. However, our data does suggest that sentiment...

Financial Focus – February 28th, 2024

In this episode of Financial Focus, Nate Kreinbrink and Mike Steigerwald emphasize the importance of bringing in tax documents early and making any necessary changes to withholding. They also remind listeners that they still have time to make prior year contributions to IRA or Roth accounts before the tax deadline.

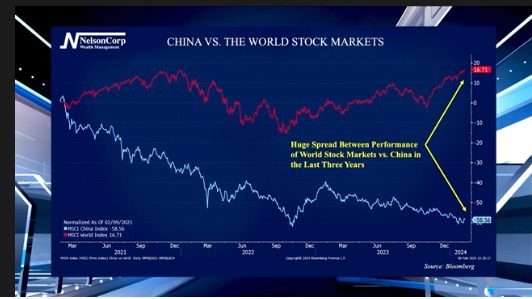

China vs World

While we have been fortunate to see strong returns in most financial markets recently, not everything is doing well. Nate Kreinbrink joins us to share some of the areas that he believes are worth watching.

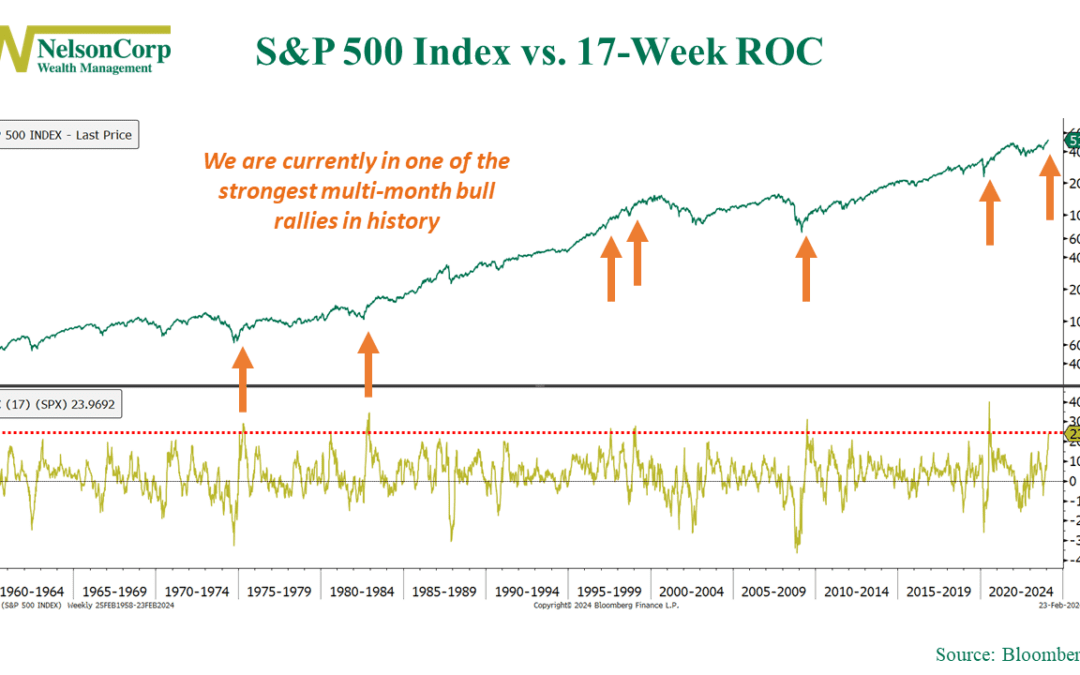

Not Too Shabby

The S&P 500 has been on a tremendous run the past few months, driven by a strong tech sector. Have things gotten out of hand, or is there still room to ride the wave? Check out our thoughts in this week’s commentary.

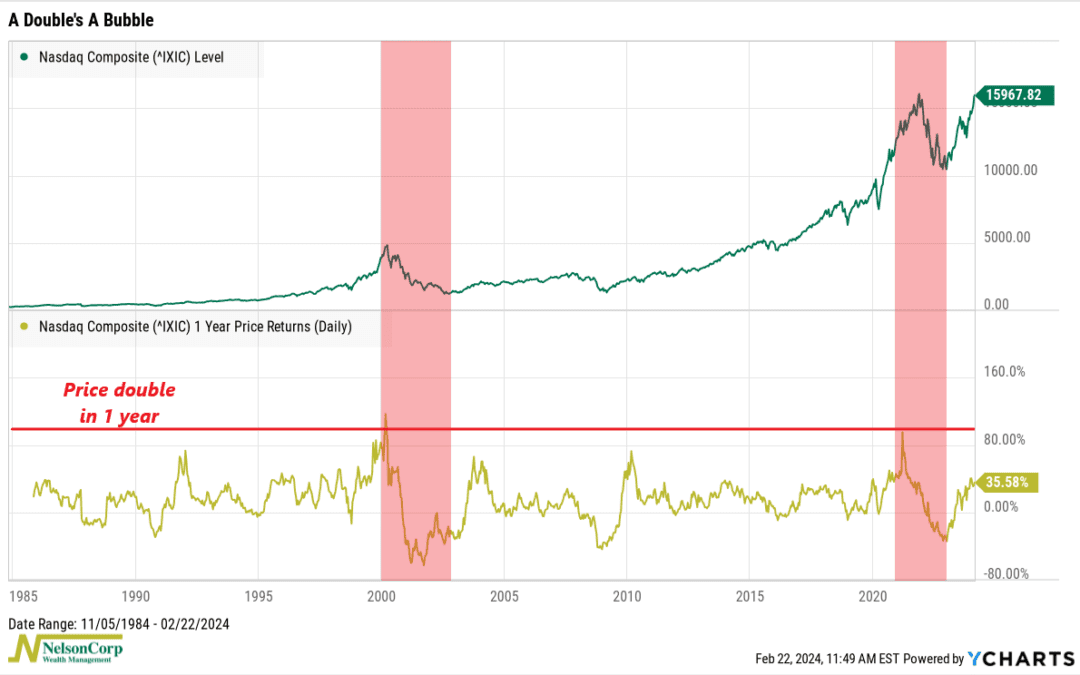

A Double’s a Bubble

The tech sector has been booming lately. Since the January 2023 low, the Nasdaq Composite—a good measure of tech stock performance—has gained roughly 55%. Naturally, that’s got investors asking: is the tech sector overvalued? One way to answer this is by...

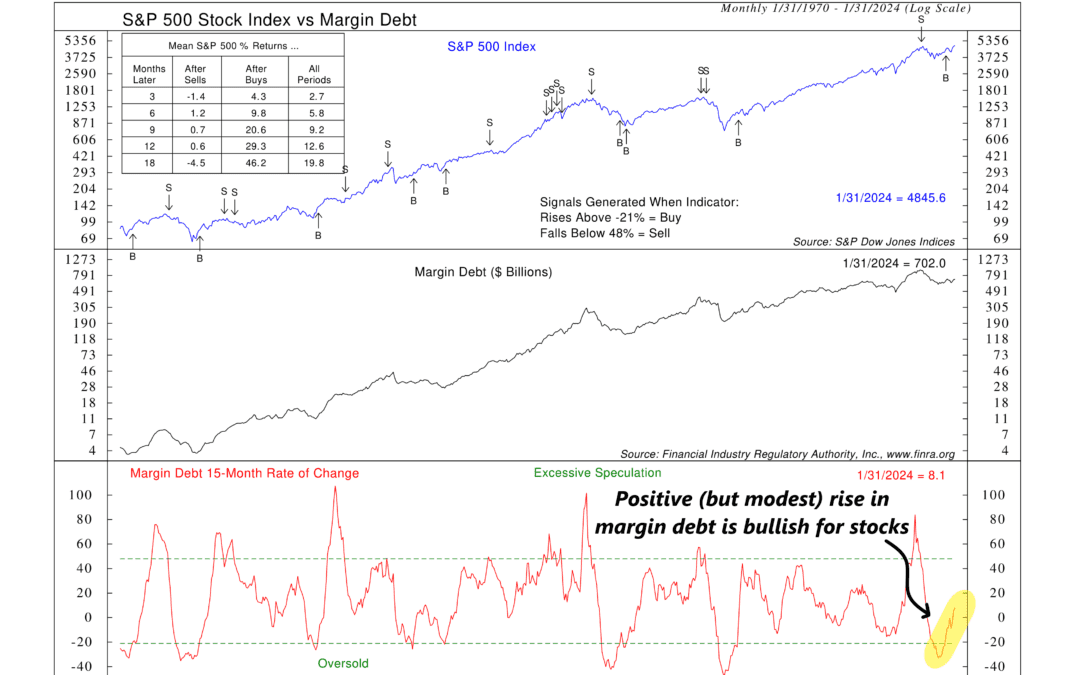

Buy Now, Pay Later

The focus of this week’s indicator is margin debt. What is margin debt? In simple terms, it’s money that an investor borrows to purchase stocks. Think of it like a credit card for the stock market. It allows investors to amplify their returns, but there's a...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.