Financial Focus – February 21st, 2024

In this episode of Financial Focus, Nate Kreinbrink and Andy Fergurson discuss some of the common misconceptions and changes in tax filing.

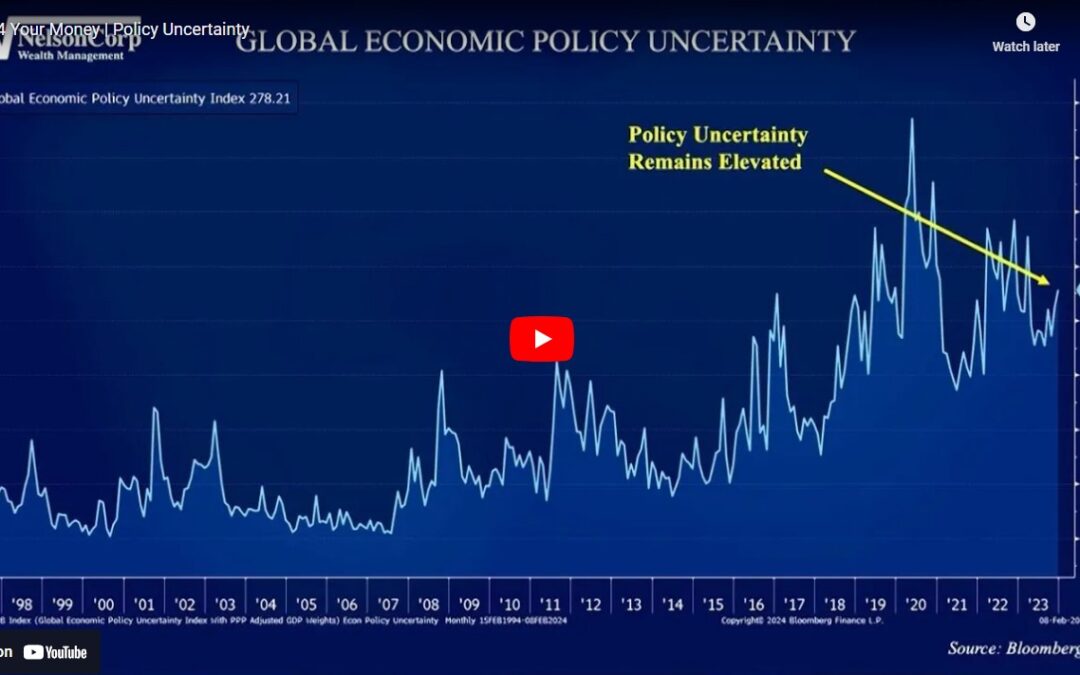

Policy Uncertainty

With 2024 featuring a presidential election, it is interesting to analyze how the markets have reacted during previous presidential election cycles. David Nelson is here to share how he thinks this year’s election might impact financial markets.

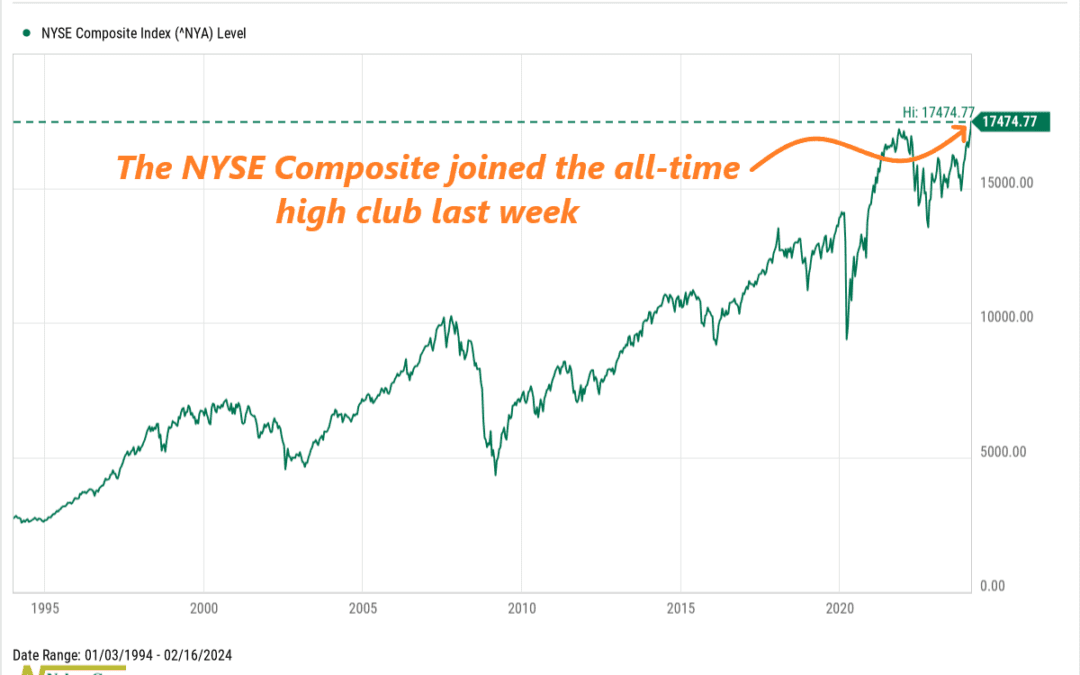

Strong and Persistent

Another stock market index joined the all-time high club last week. This week, we’ll discuss the market’s strength—and why overconfidence among investors could be a risk to its continued rise.

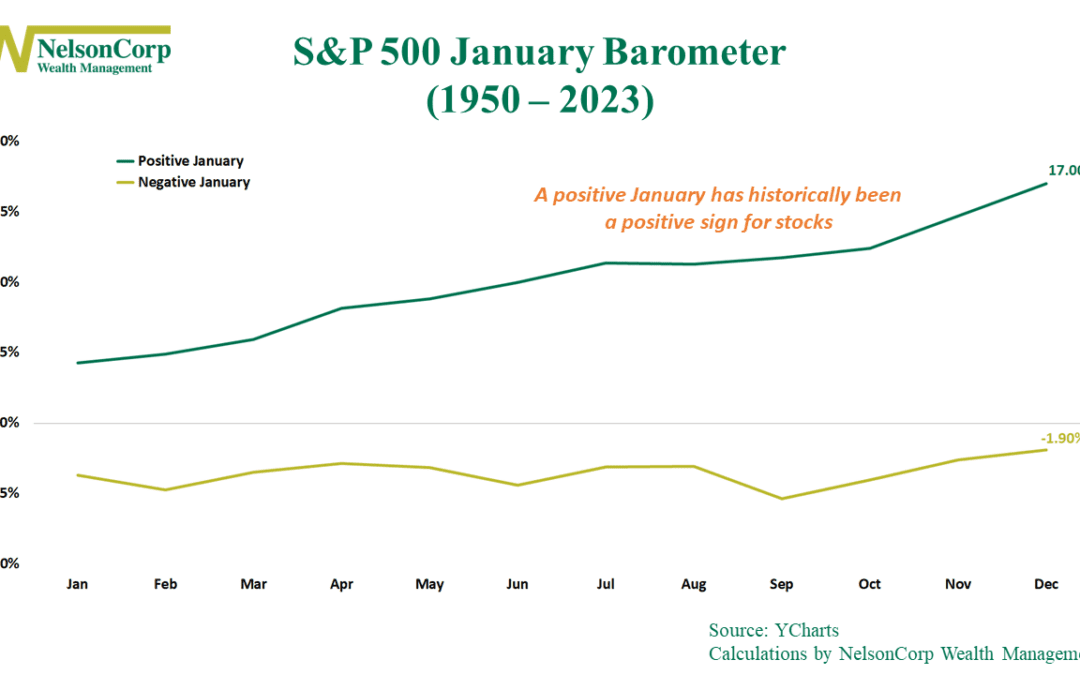

January Barometer

In 1972, Yale Hirsch, the author of the popular investment guide the "Stock Trader’s Almanac," uncovered a fascinating stock market pattern he dubbed the “January Barometer.” Simply put, he observed that how the S&P 500 Index performs in January tends to...

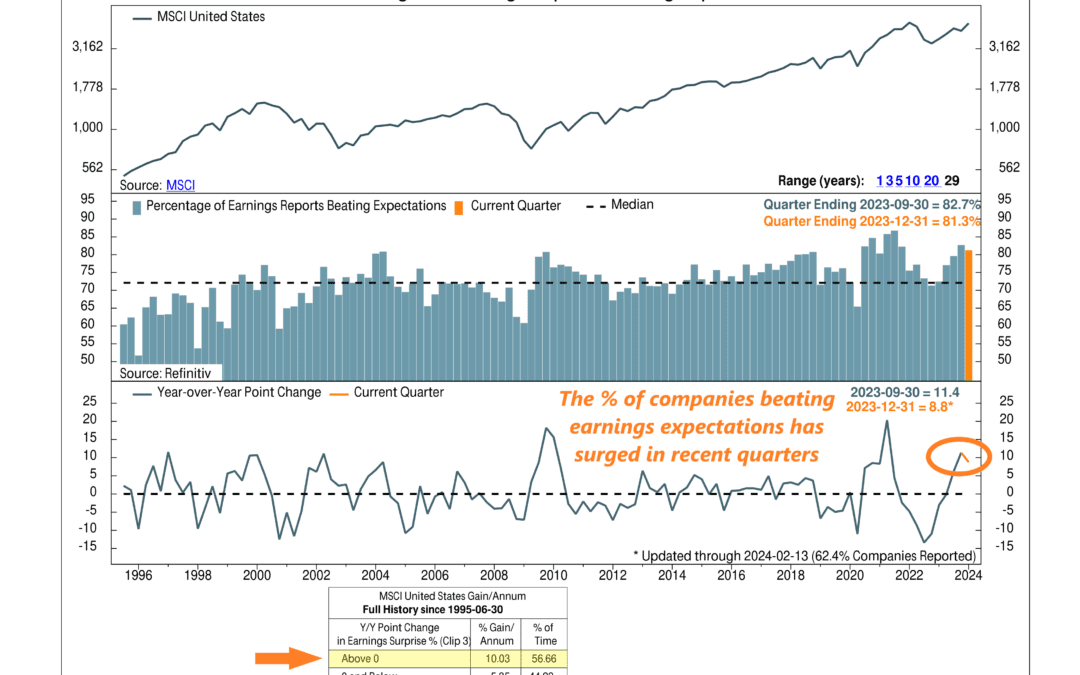

Earnings Breadth

This week’s indicator looks at the percentage of U.S. companies beating earnings expectations—or what is commonly called the “beat rate” on Wall Street. The key insight of the indicator is that when more companies beat earnings expectations in a quarter, it...

Financial Focus – February 14th, 2024

In this episode of Financial Focus, Nate Kreinbrink discusses the importance of tax planning and how it can impact an individual’s financial situation.

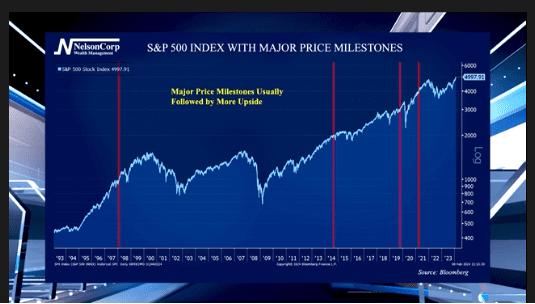

5,000

The U.S. stock market reached a major milestone recently. David Nelson joins us to explain what this milestone means for viewers’ investments.

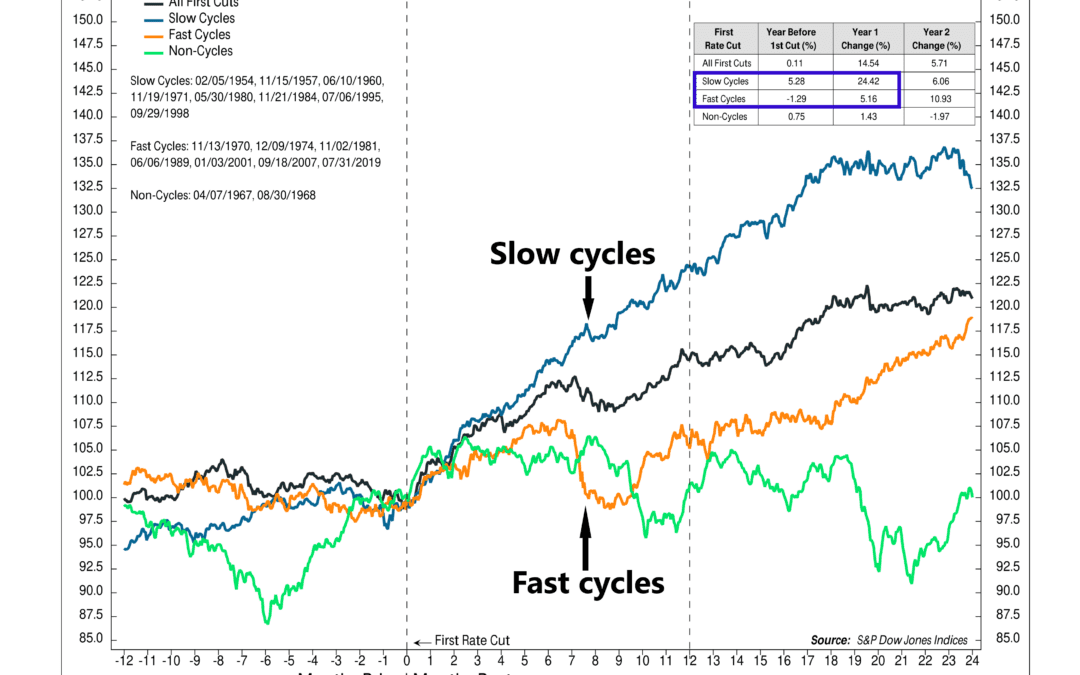

Take It Slow

Stocks continued to hit new all-time highs last week. In this week’s commentary, we discuss some of the factors driving the market higher, including why a “slower” Fed is a better Fed when it comes to its rate-cutting ambitions.

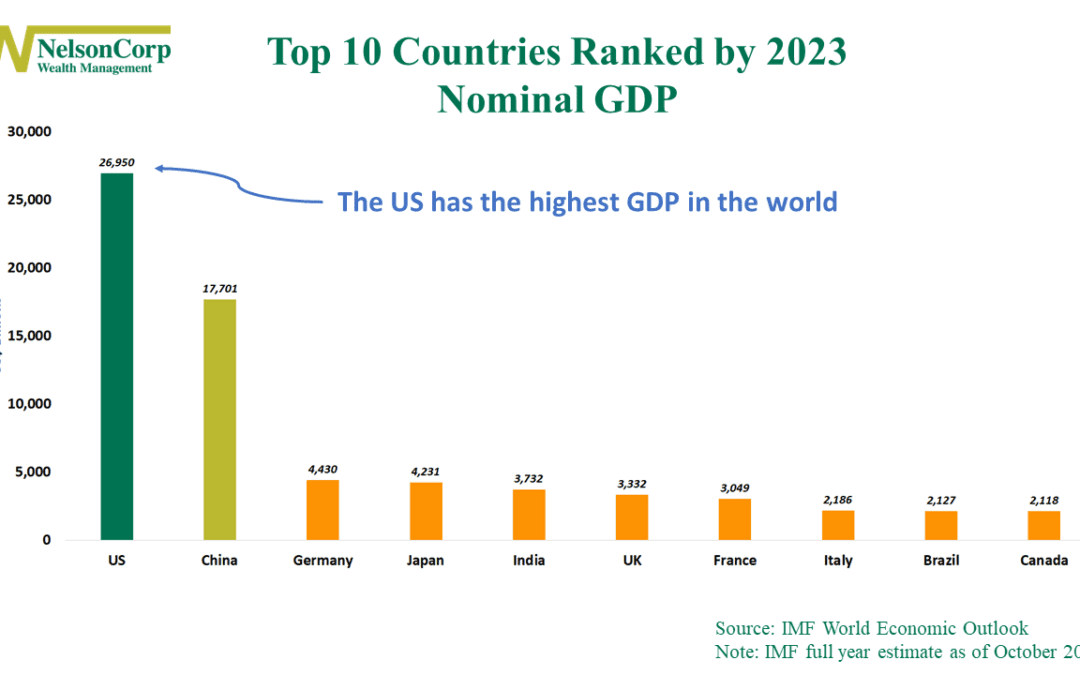

Top Dog

This week’s chart shows the top 10 countries in the world ranked by nominal GDP or economic growth. As you can see, the U.S. continues to dominate the rest of the world—and by a pretty wide margin. According to the latest IMF World Economic Outlook report, the...

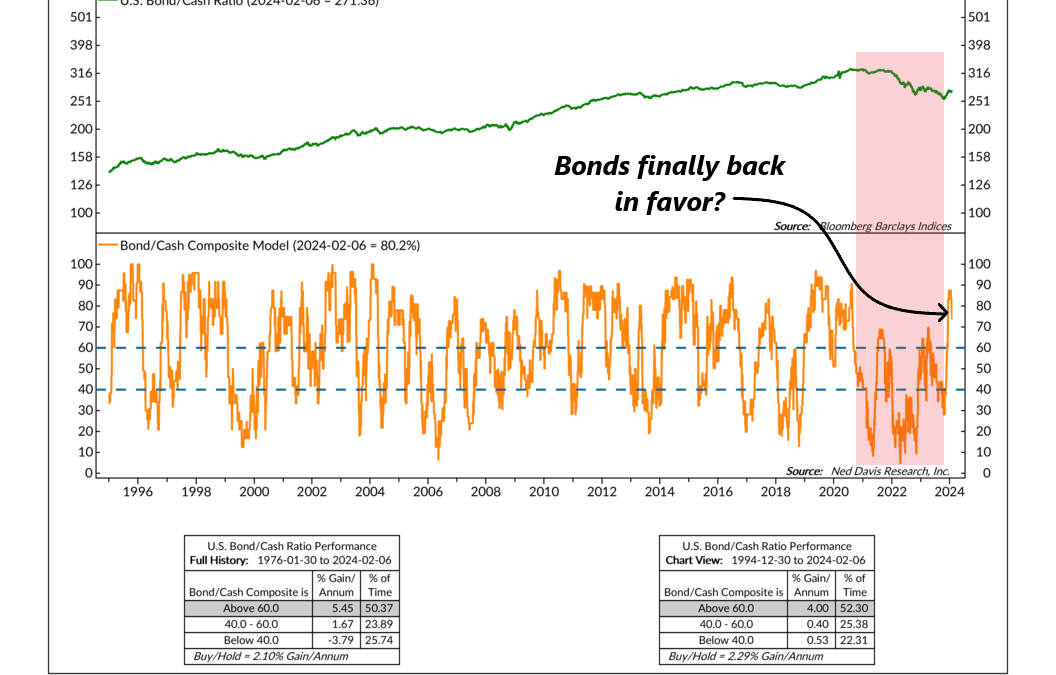

Bonds Are Back

Bonds have had a rough time the past few years. The Fed started raising cash rates in 2021 to tackle inflation, and bond returns suffered severely. But, according to this week’s featured indicator, things are starting to look up for bonds. The indicator is...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.