Financial Focus – February 7th, 2024

In this week’s episode of Financial Focus, Gary Determan talks with David Nelson about local basketball records, the importance of surrounding oneself with positive people, and the expansion of services offered by NelsonCorp Wealth Management.

Supply Chain Issues Redux

Inflation has certainly seemed to slow down over the past year. John Nelson joins us to share what he keeps his eye on when it comes to inflation data and how it can help viewers make more informed investment decisions.

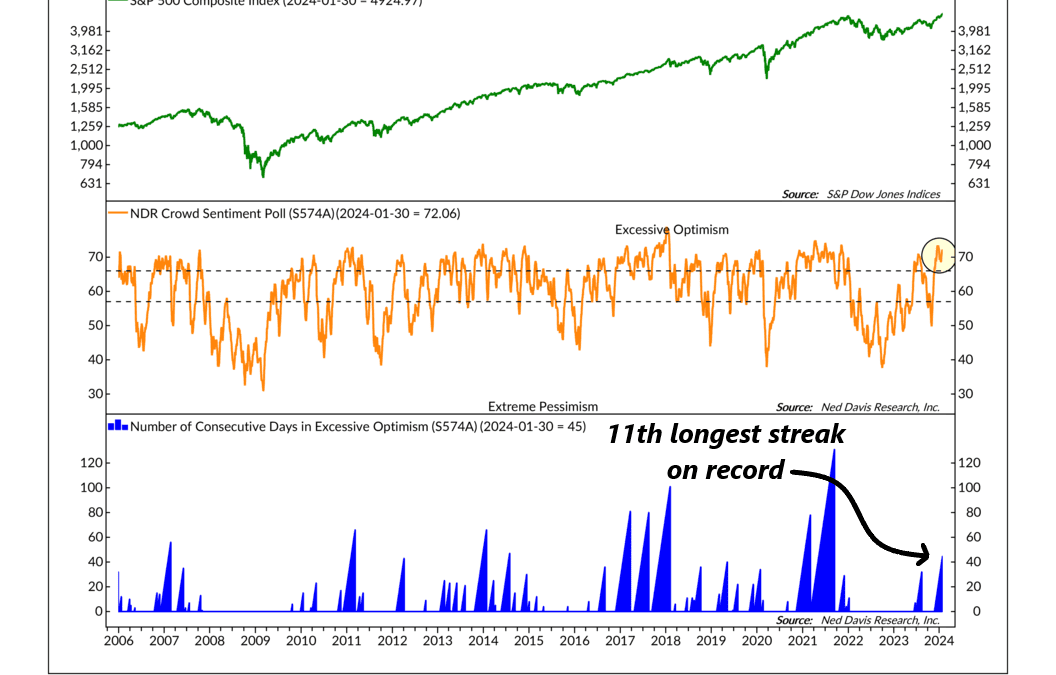

Optimistic Streak

Investors have been on an optimistic streak lately. In this week’s discussion, we take a look at how all this positivity might influence the long-term health of the ongoing bull market.

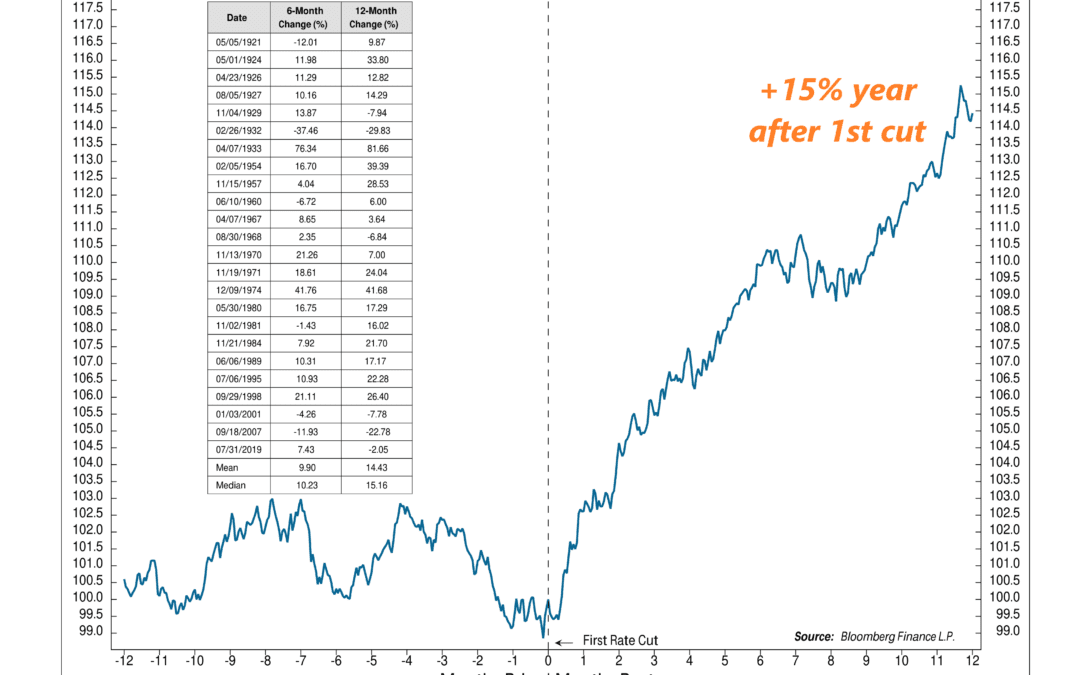

Cut Then What?

At this week’s FOMC meeting, the Fed threw cold water on the possibility of a rate cut in March. But investors anticipate that one is still coming—perhaps as soon as this summer. That raises an interesting question: how does the stock market typically respond...

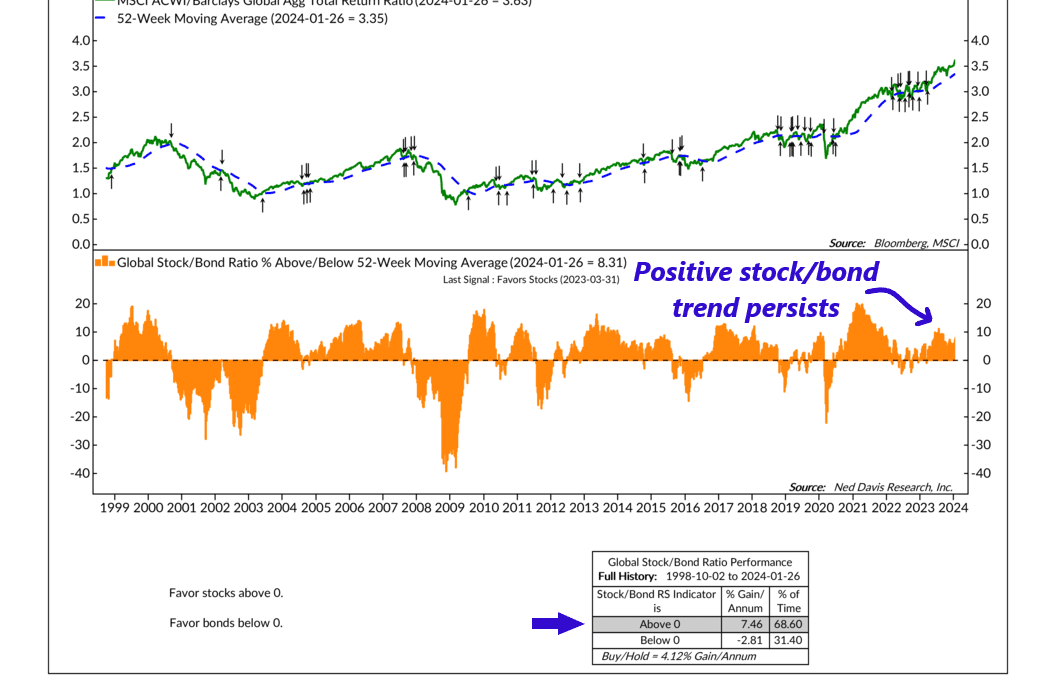

Relative Strength

For this week’s indicator, we're going to look at a technical concept called relative strength. What is relative strength? In simple terms, it measures how well one investment or asset is doing compared to another. It’s typically calculated by dividing the...

Financial Focus – January 31st, 2024

In this week’s Financial Focus, Nate Kreinbrink offers practical insights on what to do with your retirement plan when leaving a job.

Dollar Dynamics

Over the years, we have discussed how certain areas of the market perform better at specific times. David Nelson is here to elaborate on the drivers of that dynamic and why they are important to viewers’ portfolios.

Supporting Cast

For investors, the price movement of the stock market is often the star of the show. But in the week’s commentary, we discuss the “supporting cast” and how these indicators can help one better manage risk.

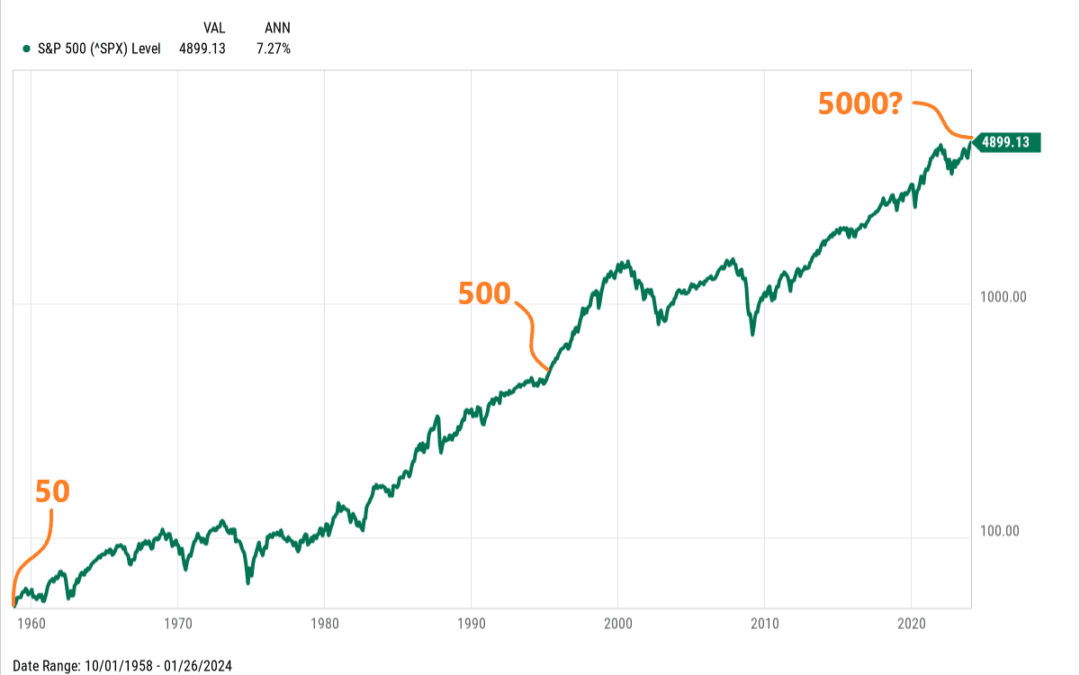

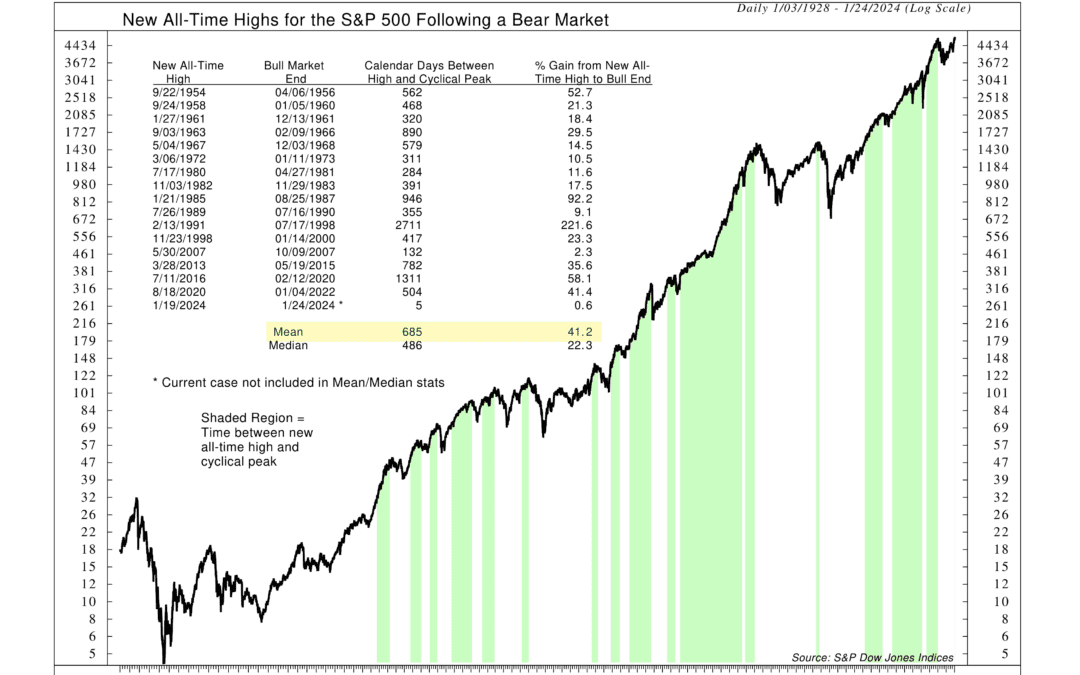

Beyond the Summit

The U.S. stock market has climbed its way back to new all-time highs. But now that we’re at the summit, what does it mean for stocks going forward? If history is any guide, the outlook is likely positive. This week’s featured chart illustrates the S&P 500...

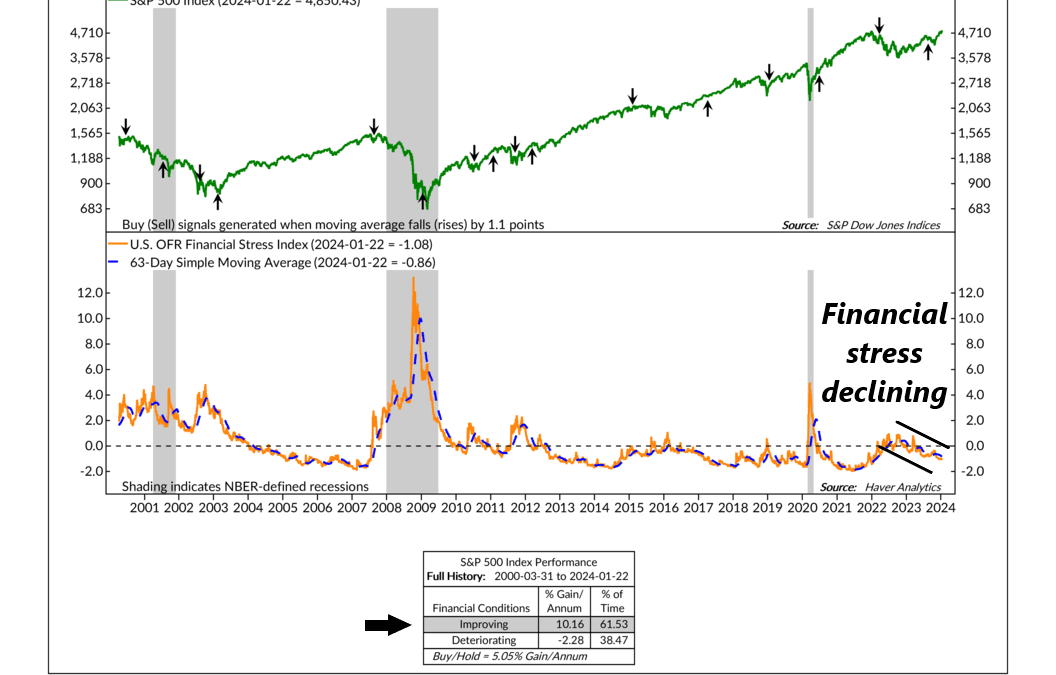

Stress Relief

The OFR Financial Stress Index (OFR FSI) is a neat little metric produced by the Office of Financial Research that measures the amount of stress in global financial markets. It combines roughly 33 market variables—from yield spreads to valuation measures—into...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, and WI. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.