Financial Focus – August 7th, 2024

Tune into this week’s episode of Financial Focus, where David Nelson discusses the recent volatility in the financial markets. He emphasizes the importance of staying disciplined, understanding what you own, and being cautious with investment decisions during uncertain times. He also notes that recessions are a natural part of the economic cycle and can present opportunities if approached wisely.

Shipping Surge

Inflation numbers have improved recently. David Nelson is here to explain why shipping costs are an important metric to watch when gauging inflation and how those costs could impact investors down the road.

Dog Days

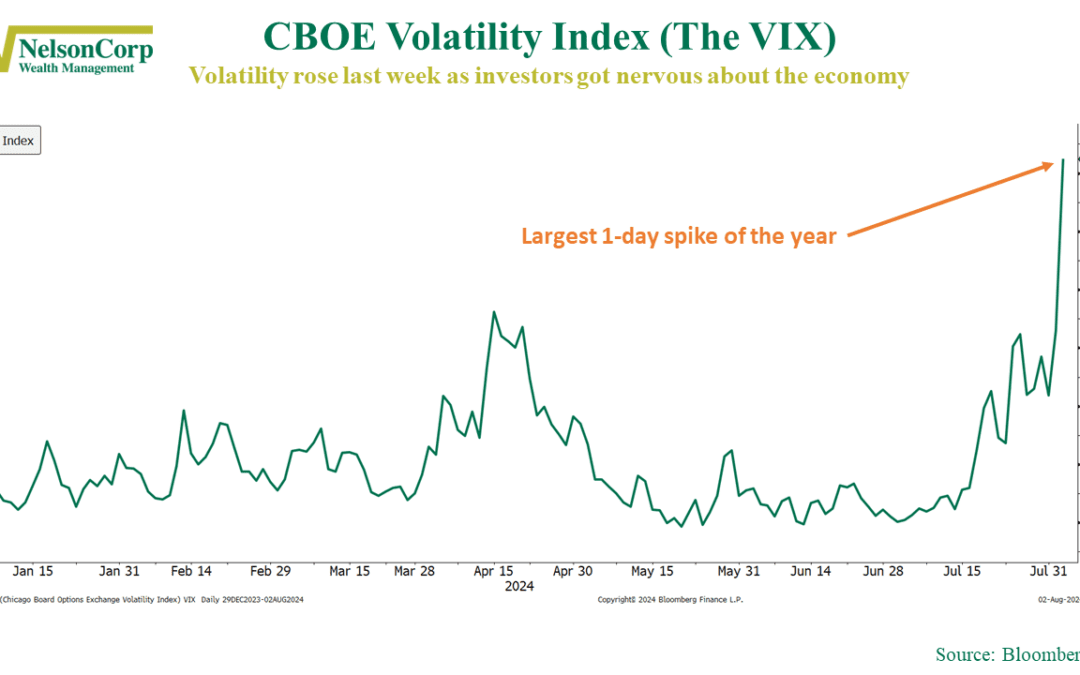

The stock market was hit with a heat wave last week in the form of rising volatility. In this week’s commentary, we delve into what’s got investors so nervous and where we think things might be headed from here.

Feeling the Blues

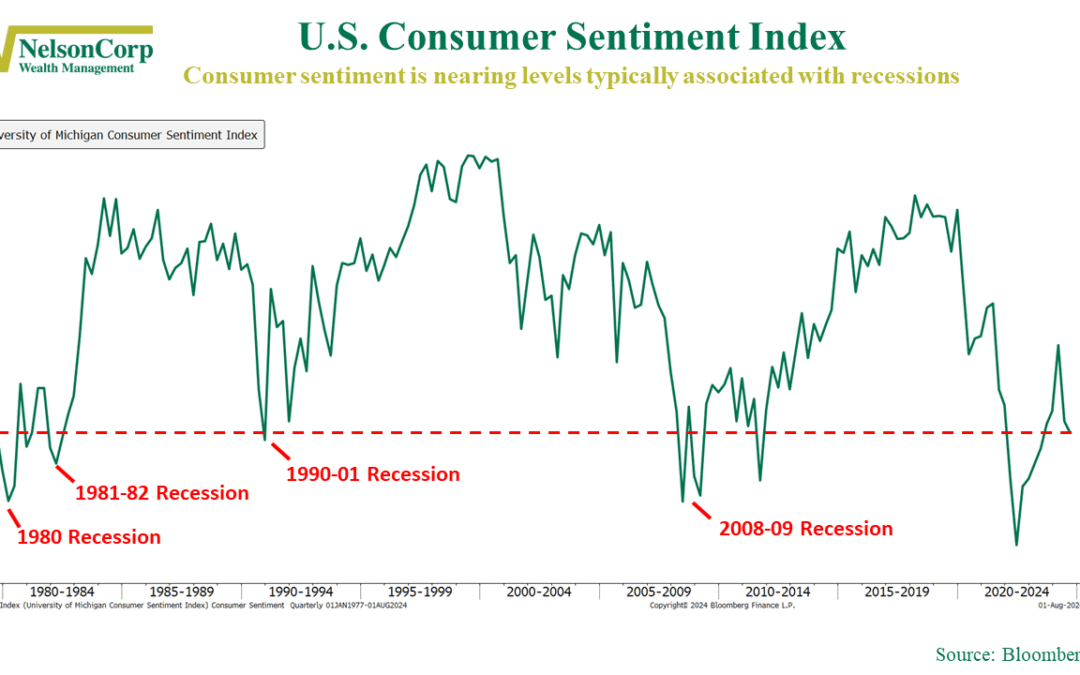

It’s weird. Given a relatively strong economy and stock market, you would think consumer confidence would be running hot right now. But that’s not the case. As our featured chart above shows, the University of Michigan Consumer Sentiment Index fell to its...

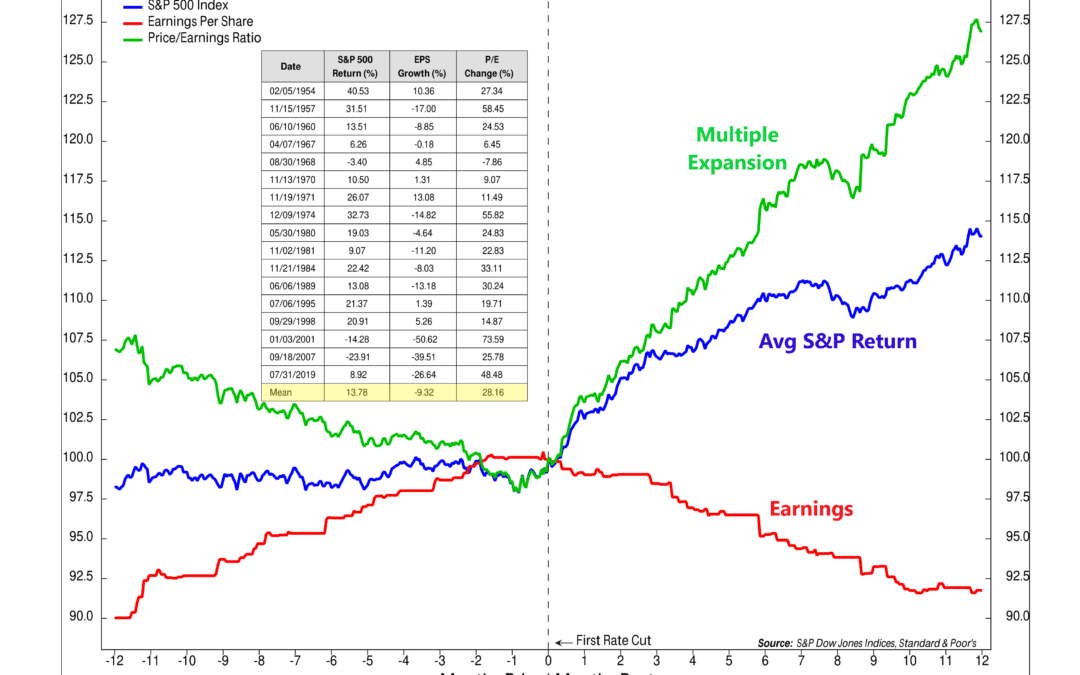

What Happens After the First Cut?

What happens to the stock market after the Federal Reserve first cuts interest rates? With the September FOMC meeting approaching and the Fed expected to make its first rate cut, this question is on many people's minds. Let's look at this week's indicator for...

Financial Focus – July 31st, 2024

Announcer:It's time now on KROS for Financial Focus, brought to you by NelsonCorp Wealth Management.The opinions voiced in this show are for general information only and are not intended to provide specific advice or recommendations for any individual. Any...

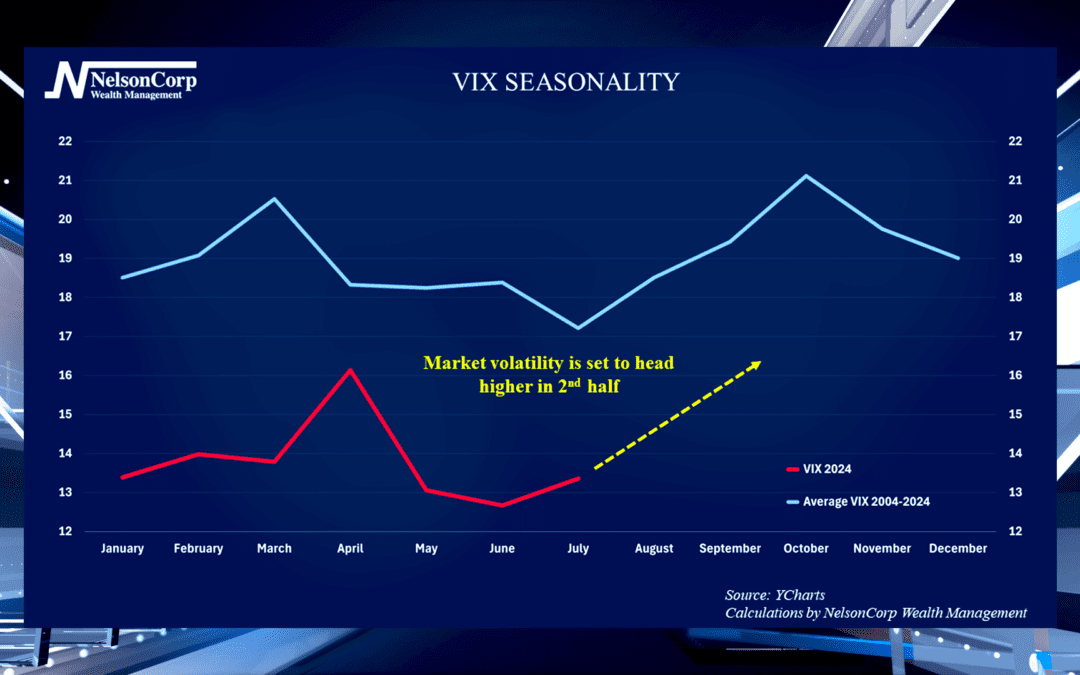

Volatility Season

Markets have been calm for the first half of 2024 compared to recent years. David Nelson joins us to discuss the Fear Index and encourages viewers to be prepared for potential increased volatility.

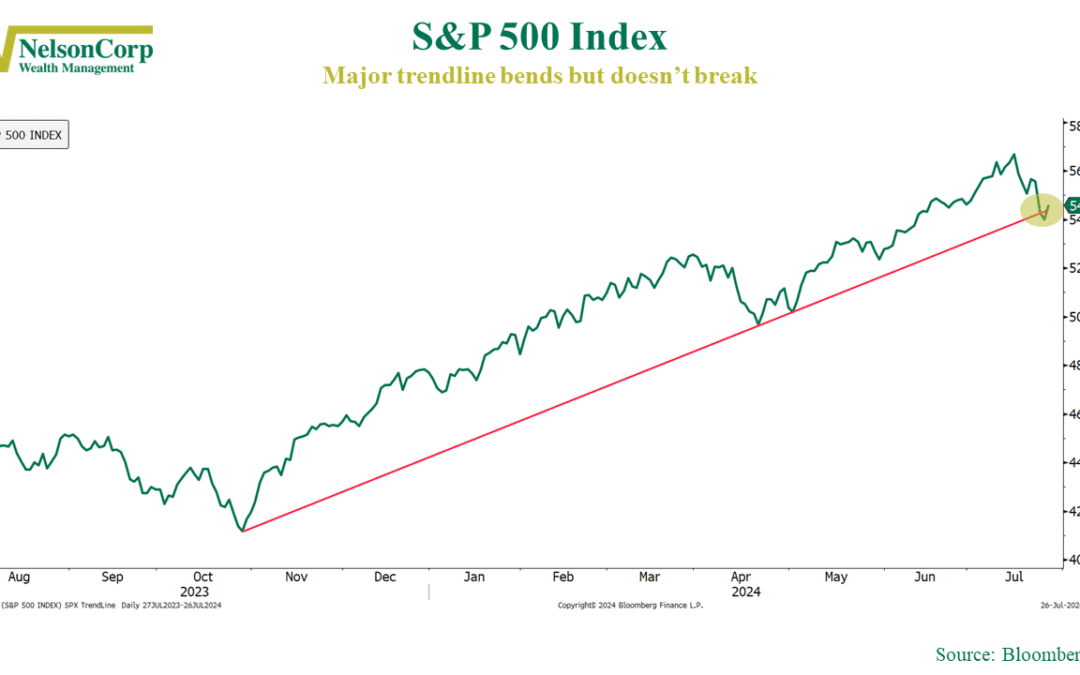

The Trend is Our Friend

The market took a hit last week, but it held strong. Check out this week’s commentary to see why the trend is still on our side.

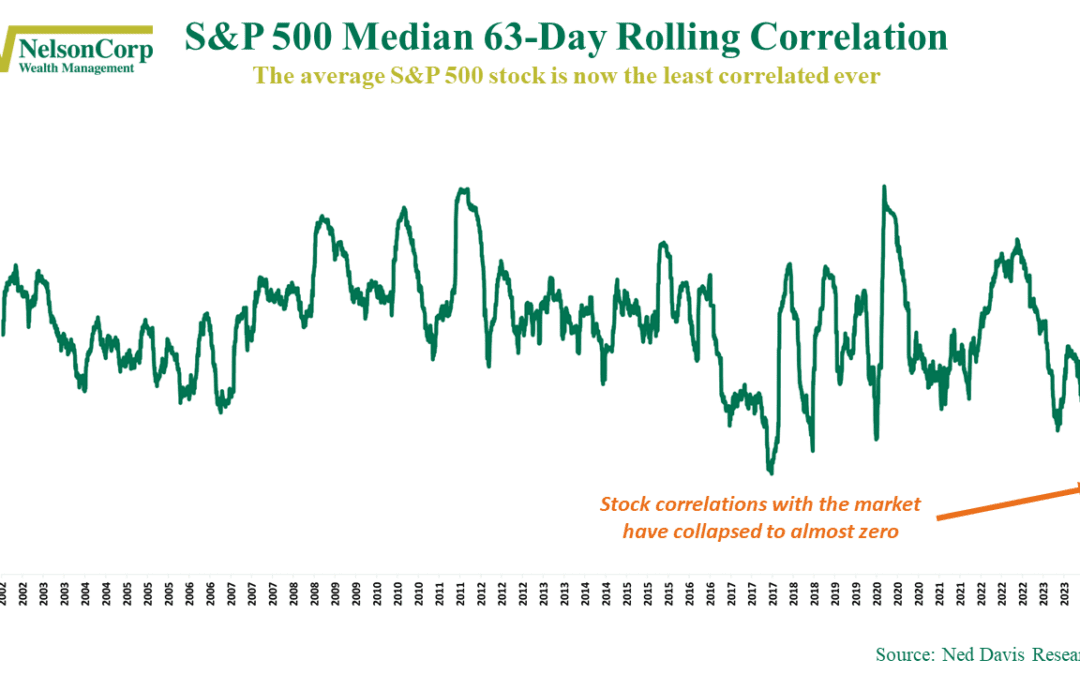

Marching to Their Own Beat

Gone are the days when stocks move in lockstep with the index. This week's chart shows that stocks in the S&P 500 are increasingly going their own way. Specifically, the chart shows the median 63-day correlation of S&P 500 stocks to the S&P 500...

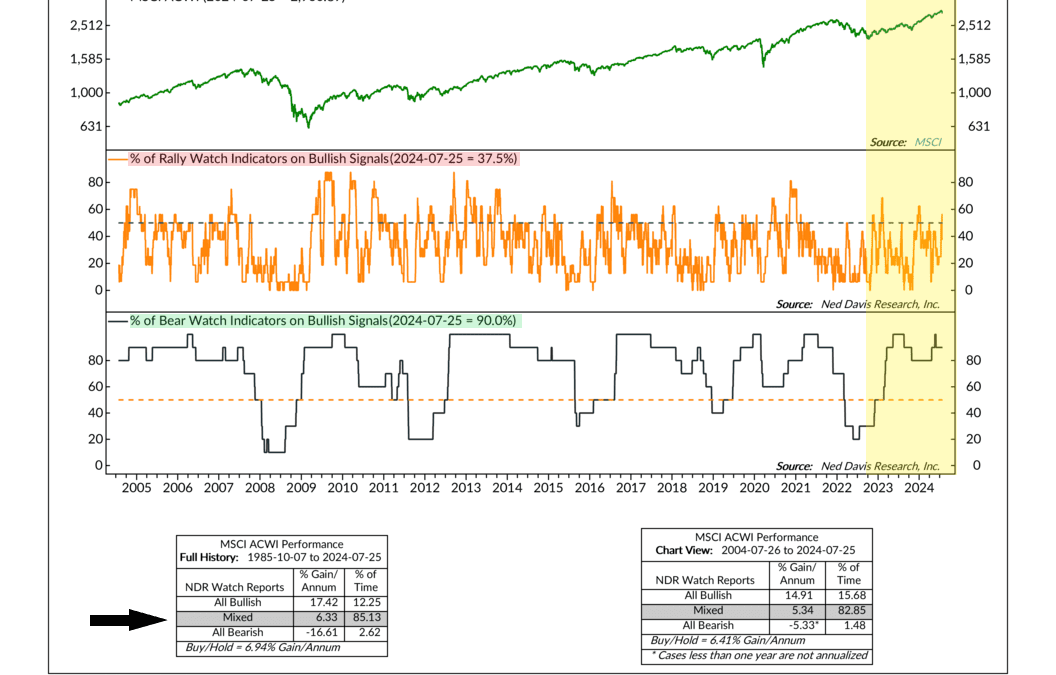

Watch Reports

In recent weeks, the stock market has shown some weakness. This naturally raises the question: will this trend continue? To help answer this, we use a composite indicator that combines two reports: the Rally Watch and the Bear Watch. The Rally Watch report...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, MA, ME, MI, MN, MO, NC, NE, NJ, NM, NV, NY, OH, OR, SD, TN, TX, UT, VA, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.