Constructive, with Conditions

OVERVIEW Markets pulled back modestly during the first week of the new year, with U.S. equities generally lower across the board. Large-cap stocks led the decline, as the S&P 500 fell 1.03% and the NASDAQ dropped 1.52%. The Dow Jones Industrial Average...

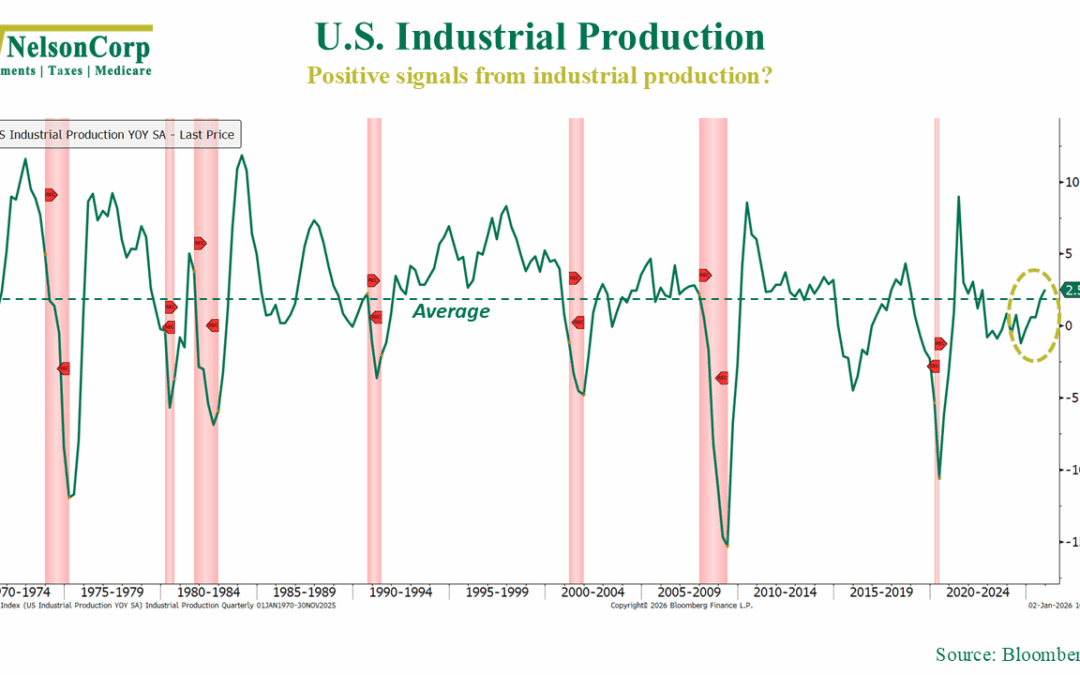

Signals From the Factory Floor

Heading into the new year, one question we get a lot is: How is the economy doing? Now, it can be hard to answer a question like that, because what one means by “the economy” can be different for different people. Are we talking about economic growth?...

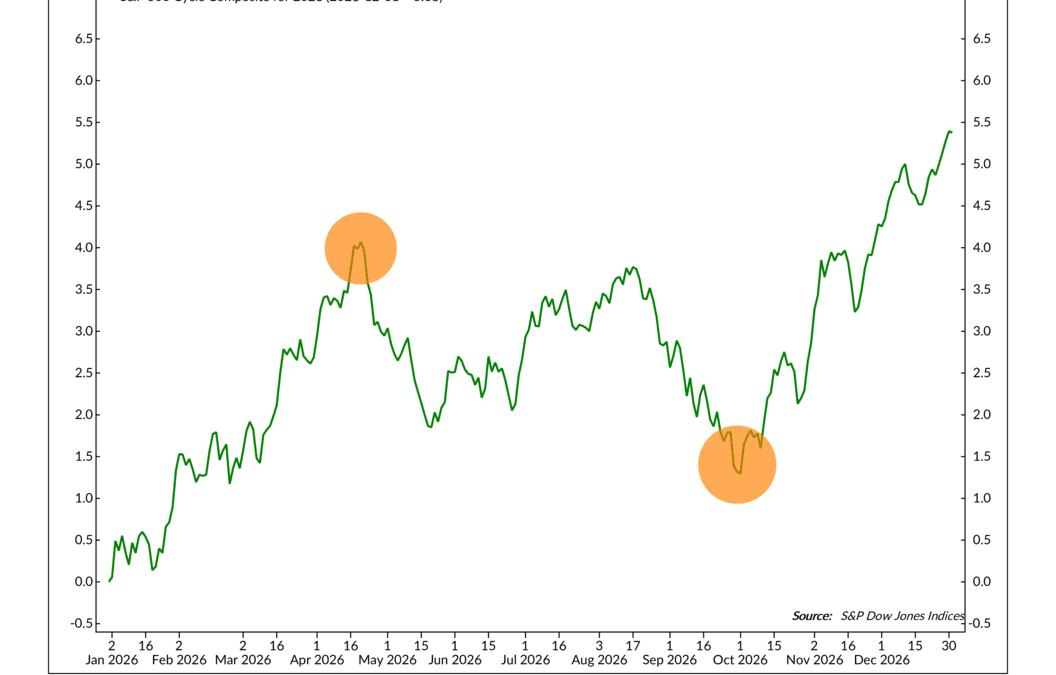

The 2026 Market Cycle

Today officially marks the first day of the new year, so let’s take a look at the NDR Cycle Composite for 2026 to see what the new year has in store for us. Now, this is one of the tools we use to help set expectations, not to make predictions. It’s based...

Mom-and-Pop Stress Test

Unfortunately, the data continues to show struggles for small businesses. John Nelson shares the numbers on Subchapter 5 bankruptcy filings and how they could become a warning for the broader economy.

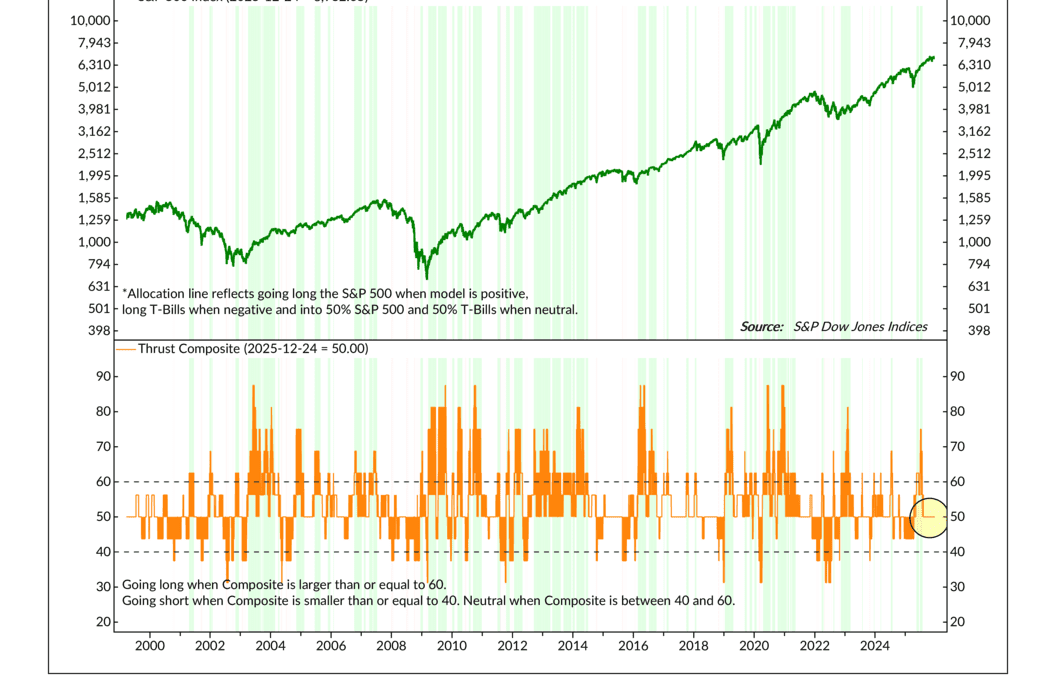

Not Overly Excited

OVERVIEW Markets finished the holiday-shortened week on a constructive note, with broad-based gains across most major asset classes. U.S. equities moved higher, led by large-cap stocks. The S&P 500 rose 1.40% on the week, while the NASDAQ added 1.22%. The...

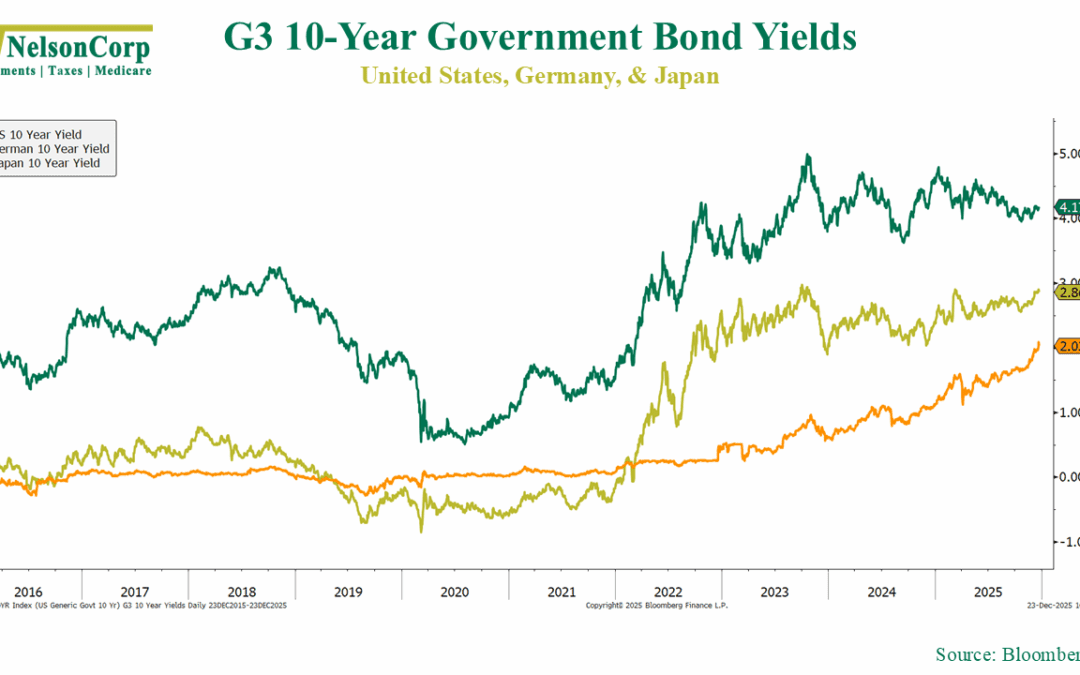

Higher for Longer

We got some encouraging economic news this week. In the third quarter, real GDP grew at a 4.3% annualized pace, the fastest growth in two years and well above expectations. That strength is welcome, but it also helps explain something else we’ve been living...

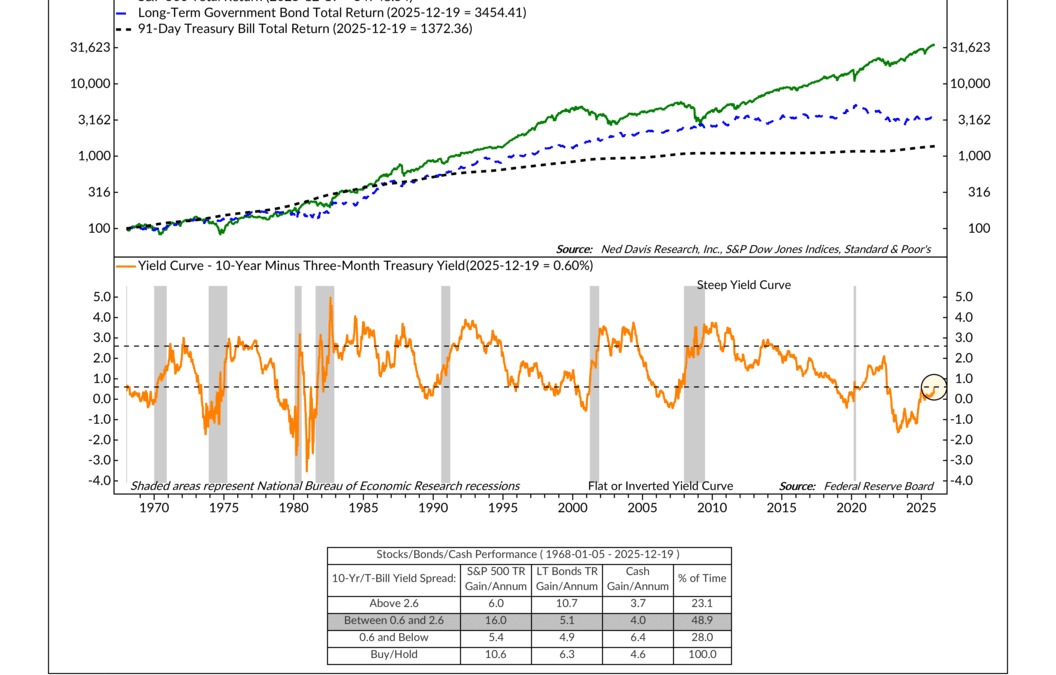

Reading the Yield Curve

For this week’s indicator, we’re looking at a simple but powerful signal from the bond market called the yield curve. Don’t let the name scare you off. At its core, this indicator just compares two interest rates: the yield on a 10-year U.S. Treasury bond and...

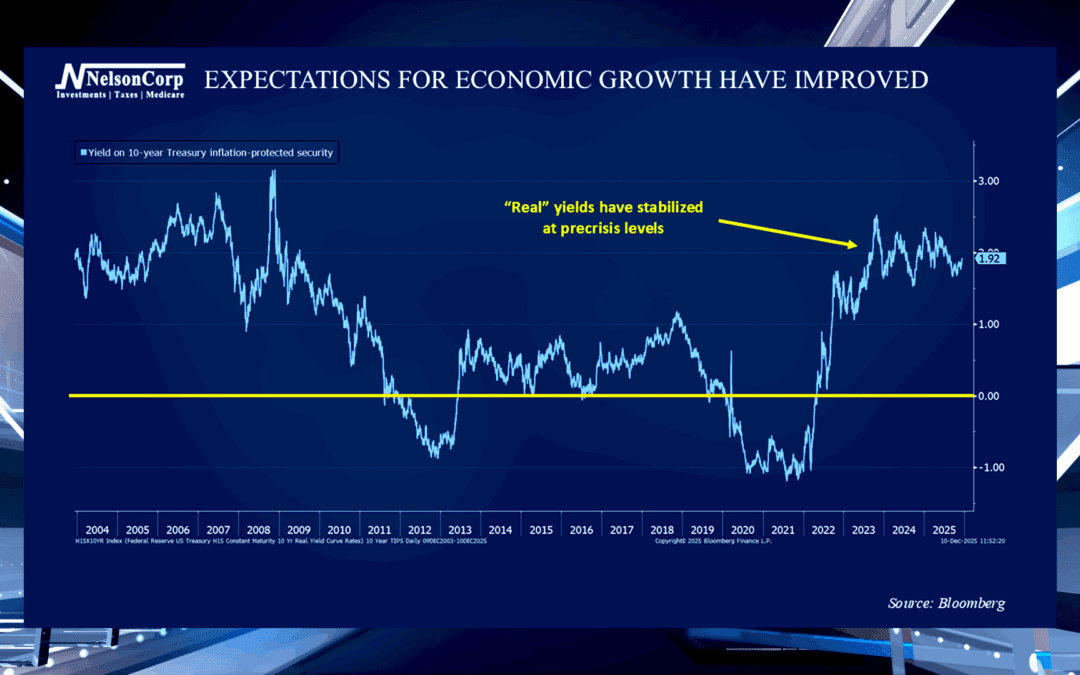

The Return of Real

There is plenty of talk about where the economy is currently heading. David Nelson names what he believes to be the most important indicator for investors to keep an eye on right now.

Rooted in Earnings

OVERVIEW Markets were mixed but generally quiet last week, with modest gains in several major indexes. Large-cap stocks edged higher, with the S&P 500 up 0.10% and the NASDAQ gaining 0.48%. The S&P 100 also rose 0.17%, suggesting some stabilization in...

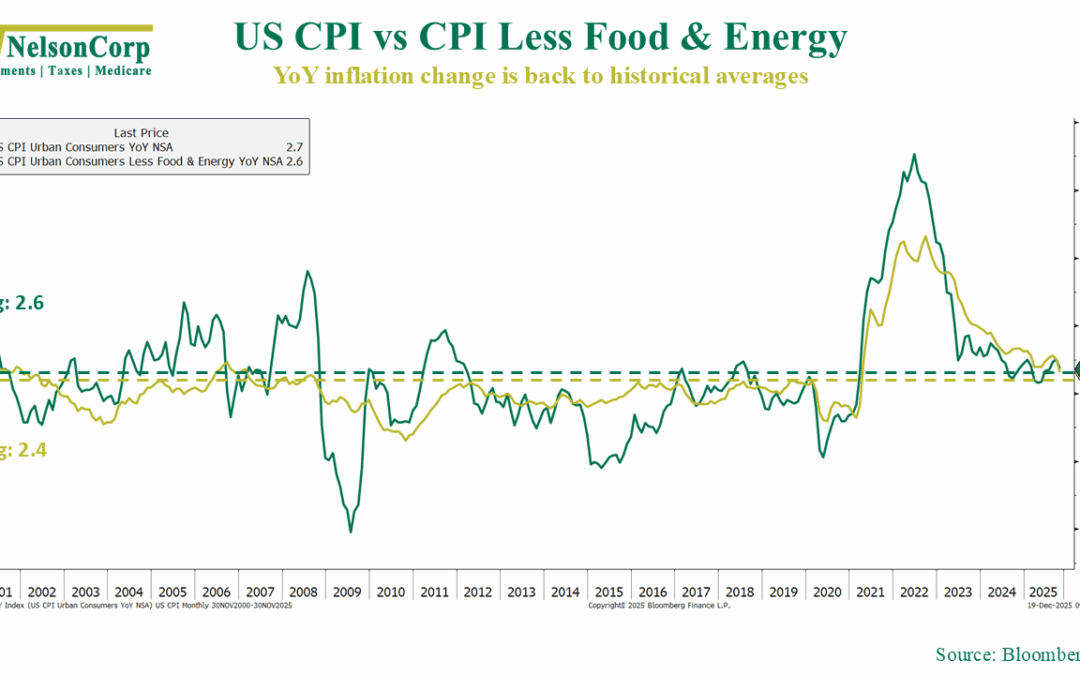

Grain of Salt

The big news in the finance world this week was the release of the November inflation numbers. On the surface, it was a good report. The headline Consumer Price Index (CPI) posted a 2.7% y/y gain, down from 3% in September. And if we back out food and energy...

880 13th Avenue North

Clinton, Iowa 52732

563-242-9042

5465 Utica Ridge Road

Davenport, Iowa 52807

563-823-0532

9079 East Tamarack Drive

Dubuque, Iowa 52003

800-248-9042

info@nelsoncorp.com

Fax: 563-242-9062

Securities offered through Registered Representatives of Cambridge Investment Research, Inc., a broker-dealer, member FINRA/SIPC. Advisory services through Cambridge Investment Research Advisors, Inc., a Registered Investment Advisor. Cambridge and NelsonCorp Wealth Management are not affiliated. This communication is strictly intended for individuals residing in the states of AZ, AR, CA, CO, CT, FL, GA, IA, IL, IN, ME, MI, MN, MO, NC, NJ, NY, SD, TN, TX, UT, WI, and WY. No offers may be made or accepted from any resident outside the specific states referenced. Investing involves risk. Depending on the different types of investments there may be varying degrees of risk. Clients and prospective clients should be prepared to bear investment loss including loss of original principal.

Cambridge’s Form CRS (Customer Relationship Summary)

The information being provided is strictly as a courtesy. When you link to any of these websites provided herein, NelsonCorp Wealth Management makes no representation as to the completeness or accuracy of information provided at these sites. Nor is the company liable for any direct or indirect technical or system issues or any consequences arising out of your access to or your use of third-party technologies, sites, information, and programs made available through this site.